The cryptocurrency market has witnessed a significant rise in exchange hacks, leading to substantial financial losses and a shift in investor sentiment. These incidents not only affect the targeted exchanges but also have broader implications for exchange-based tokens and the overall market. As hackers exploit vulnerabilities in centralized exchanges, the repercussions are felt across the ecosystem, impacting token prices, investor confidence, and regulatory scrutiny.

| Key Concept | Description/Impact |

|---|---|

| Market Volatility | Exchange hacks often trigger immediate sell-offs, leading to sharp declines in the prices of affected tokens and increased volatility across the market. |

| Loss of Trust | Repeated hacks undermine confidence in exchanges, causing users to withdraw funds and seek alternatives, which can lead to liquidity issues for those exchanges. |

| Regulatory Response | High-profile hacks prompt regulatory bodies to impose stricter compliance measures on exchanges, potentially stifling innovation while aiming to enhance security. |

| Security Enhancements | Following hacks, exchanges often invest heavily in security upgrades, which can increase operational costs and affect profitability. |

| Token Value Fluctuations | The value of exchange-based tokens can be severely impacted by hacks, as perceived security risks lead to decreased demand and price drops. |

| Market Dynamics Shift | Hacks can shift market dynamics by increasing interest in decentralized finance (DeFi) alternatives, as users seek platforms with perceived lower risks. |

Market Analysis and Trends

The cryptocurrency landscape is characterized by rapid changes and evolving threats. In 2024 alone, hackers stole approximately $1.38 billion from various platforms, marking a significant increase from previous years. Notably, centralized exchanges remain prime targets due to their substantial holdings of cryptocurrencies. In 2023, over $1.7 billion was stolen from these platforms, highlighting ongoing vulnerabilities within the sector.

Current Market Statistics

- Total Crypto Hacks in 2024: $1.38 billion stolen by June 2024.

- Total Crypto Hacks in 2023: Over $1.7 billion lost.

- Impact on Token Prices: Following major hacks, tokens associated with the affected exchanges typically see price drops ranging from 10% to over 30% within days.

The trend indicates that as cryptocurrency prices rise, so does the incentive for hackers to target exchanges. This correlation suggests that market conditions play a crucial role in determining the frequency and scale of hacks.

Implementation Strategies

To mitigate the impacts of exchange hacks on tokens and maintain investor confidence, several strategies can be implemented:

- Enhanced Security Protocols: Exchanges should adopt multi-signature wallets and conduct regular security audits to identify vulnerabilities.

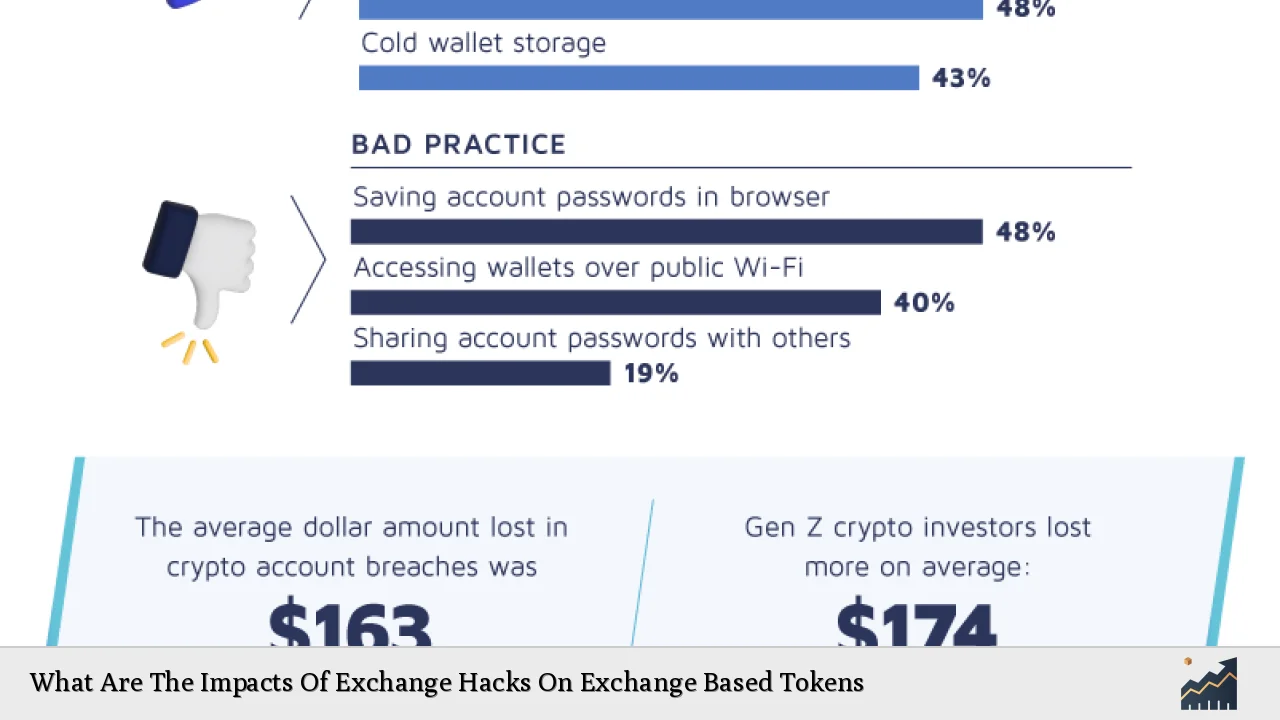

- User Education: Providing users with information on securing their accounts can reduce phishing attacks and other social engineering tactics.

- Insurance Policies: Implementing insurance for user funds can help restore trust following a breach.

- Decentralization Initiatives: Encouraging users to engage with decentralized platforms can reduce reliance on centralized exchanges.

Risk Considerations

Investors must be aware of several risks associated with exchange-based tokens:

- Liquidity Risks: Following a hack, liquidity may dry up as users withdraw funds en masse.

- Price Volatility: Tokens may experience extreme price fluctuations post-hack due to panic selling or loss of confidence.

- Regulatory Risks: Increased scrutiny from regulators can lead to compliance costs that impact profitability for exchanges.

- Technological Risks: As exchanges upgrade their security measures, potential technical issues may arise that could disrupt trading or access to funds.

Regulatory Aspects

Regulatory bodies are increasingly focused on enhancing security measures within the cryptocurrency sector. High-profile hacks have led to calls for:

- Stricter Compliance Requirements: Exchanges may face more rigorous regulations regarding fund storage and user data protection.

- Transparency Mandates: Regulators may require exchanges to disclose security practices and incident responses publicly.

- International Cooperation: Given the global nature of cryptocurrency trading, international regulatory frameworks are necessary to address cross-border hacking incidents effectively.

Future Outlook

The future of exchange-based tokens will likely be shaped by ongoing developments in security practices and regulatory landscapes. Key trends include:

- Increased Adoption of DeFi Solutions: As trust in centralized exchanges wanes, decentralized finance platforms may gain traction among investors seeking safer alternatives.

- Technological Innovations: Advances in blockchain technology could lead to more secure trading environments that reduce the risk of hacks.

- Evolving Regulatory Frameworks: As governments adapt to the growing cryptocurrency sector, regulations will continue to evolve, potentially impacting how exchanges operate and how tokens are traded.

In conclusion, while exchange hacks pose significant challenges for exchange-based tokens and the broader cryptocurrency market, proactive measures can mitigate these risks. Investors should remain vigilant and informed about market trends and security practices as they navigate this dynamic landscape.

Frequently Asked Questions About What Are The Impacts Of Exchange Hacks On Exchange Based Tokens

- What are exchange-based tokens?

Exchange-based tokens are digital assets issued by cryptocurrency exchanges that often provide benefits such as reduced trading fees or voting rights within the platform. - How do exchange hacks affect token prices?

Exchange hacks typically lead to immediate sell-offs as investors lose confidence, resulting in significant price drops for affected tokens. - What measures can exchanges take to prevent hacks?

Exchanges can implement multi-signature wallets, conduct regular security audits, educate users about phishing threats, and invest in advanced cybersecurity measures. - Are decentralized exchanges safer than centralized ones?

Decentralized exchanges often have lower risks related to hacking since they do not hold user funds directly; however, they come with their own set of risks such as smart contract vulnerabilities. - What role do regulators play after a hack?

Regulators may impose stricter compliance requirements on affected exchanges and increase oversight of their operations to protect investors. - How can investors protect themselves from losses due to hacks?

Investors should diversify their holdings across multiple platforms, use hardware wallets for storage when not actively trading, and stay informed about security practices. - What is the long-term impact of repeated hacks on the crypto market?

The long-term impact includes potential shifts toward decentralized finance solutions and increased regulatory scrutiny that could reshape how exchanges operate. - How do high-profile hacks influence investor sentiment?

High-profile hacks typically lead to negative sentiment in the market, causing panic selling and decreased trading volumes across various cryptocurrencies.

This comprehensive analysis highlights the multifaceted impacts of exchange hacks on exchange-based tokens while providing actionable insights for investors navigating this volatile environment.