The emergence of cryptocurrencies has significantly transformed the landscape of global remittances, offering innovative solutions to longstanding challenges faced by traditional remittance systems. With the rapid adoption of digital currencies, particularly in regions with high migrant populations, cryptocurrencies are increasingly recognized for their potential to enhance the efficiency, accessibility, and affordability of cross-border money transfers. This article explores the multifaceted impacts of cryptocurrency on global remittances, backed by current market statistics and trends.

| Key Concept | Description/Impact |

|---|---|

| High Transaction Costs | Traditional remittance methods often incur high fees due to multiple intermediaries. Cryptocurrencies reduce these costs significantly by facilitating direct peer-to-peer transactions. |

| Transaction Speed | Cryptocurrency transactions can be completed in minutes, compared to several days for conventional methods, allowing for quicker access to funds for recipients. |

| Financial Inclusion | Cryptocurrencies provide access to financial services for unbanked populations, enabling anyone with internet access to send and receive money globally. |

| Security and Transparency | The blockchain technology underlying cryptocurrencies ensures secure transactions with an immutable record, reducing fraud and enhancing trust. |

| Stablecoins | Stablecoins offer a less volatile alternative for remittances, pegged to fiat currencies, which helps mitigate the risks associated with cryptocurrency price fluctuations. |

| CBDCs (Central Bank Digital Currencies) | CBDCs are being explored as a government-backed solution to improve remittance efficiency while maintaining regulatory oversight and stability. |

Market Analysis and Trends

The global remittance market is a critical component of the world economy, with flows estimated at approximately $857 billion in 2023, reflecting a modest growth rate of 1.6% from the previous year. Despite this growth, traditional remittance channels remain costly; the average fee for sending $200 internationally stands at around 6.4%. In contrast, cryptocurrencies promise lower transaction fees, often less than 1%, making them an attractive alternative.

Recent studies indicate that remittances using cryptocurrencies have surged dramatically. For instance, a report noted a staggering 900% increase in crypto-based remittances in certain regions over the past year. Countries like Mexico and El Salvador are leading this trend, where cryptocurrency platforms facilitate significant volumes of cross-border transactions.

Key Trends

- Increased Adoption: As of 2024, there are approximately 560 million cryptocurrency users worldwide, many of whom utilize digital currencies for remittance purposes.

- Technological Integration: The rise of mobile wallets and blockchain technology is streamlining remittance processes. These innovations enhance user experience by providing faster and cheaper transfer options.

- Regulatory Developments: Governments are beginning to explore Central Bank Digital Currencies (CBDCs) as a means to modernize payment systems while ensuring regulatory compliance.

Implementation Strategies

To effectively leverage cryptocurrencies for remittances, several strategies can be employed:

- Utilizing Stablecoins: Migrants can use stablecoins like USDC or Tether for sending money home without the volatility associated with traditional cryptocurrencies like Bitcoin or Ethereum.

- Peer-to-Peer Platforms: Individuals can utilize platforms that facilitate direct crypto transfers without intermediaries, significantly reducing costs and time.

- Education and Awareness: Increasing awareness about how to use cryptocurrencies for remittances is crucial. Educational initiatives can help migrants understand the benefits and risks involved.

Risk Considerations

While cryptocurrencies present numerous advantages for remittances, they also come with inherent risks:

- Volatility: Non-stablecoin cryptocurrencies can experience significant price fluctuations, which may affect the value received by recipients.

- Regulatory Risks: The evolving regulatory landscape surrounding cryptocurrencies poses challenges. Users must stay informed about legal requirements in both sending and receiving countries.

- Security Concerns: Although blockchain technology is generally secure, users must be cautious of scams and phishing attempts prevalent in the crypto space.

Regulatory Aspects

The regulatory environment surrounding cryptocurrencies varies widely across countries. Some nations have embraced digital currencies as part of their financial systems, while others remain skeptical or outright prohibitive. Key considerations include:

- Compliance Requirements: Users must adhere to local regulations regarding cryptocurrency transactions to avoid legal repercussions.

- Cross-Border Regulations: Different jurisdictions may have varying rules governing cross-border payments, which can complicate crypto-based remittances.

- CBDC Initiatives: Many countries are exploring CBDCs as a regulated alternative to decentralized cryptocurrencies. These initiatives aim to combine the benefits of digital currencies with government oversight.

Future Outlook

The future of cryptocurrency in global remittances appears promising but requires careful navigation through its challenges:

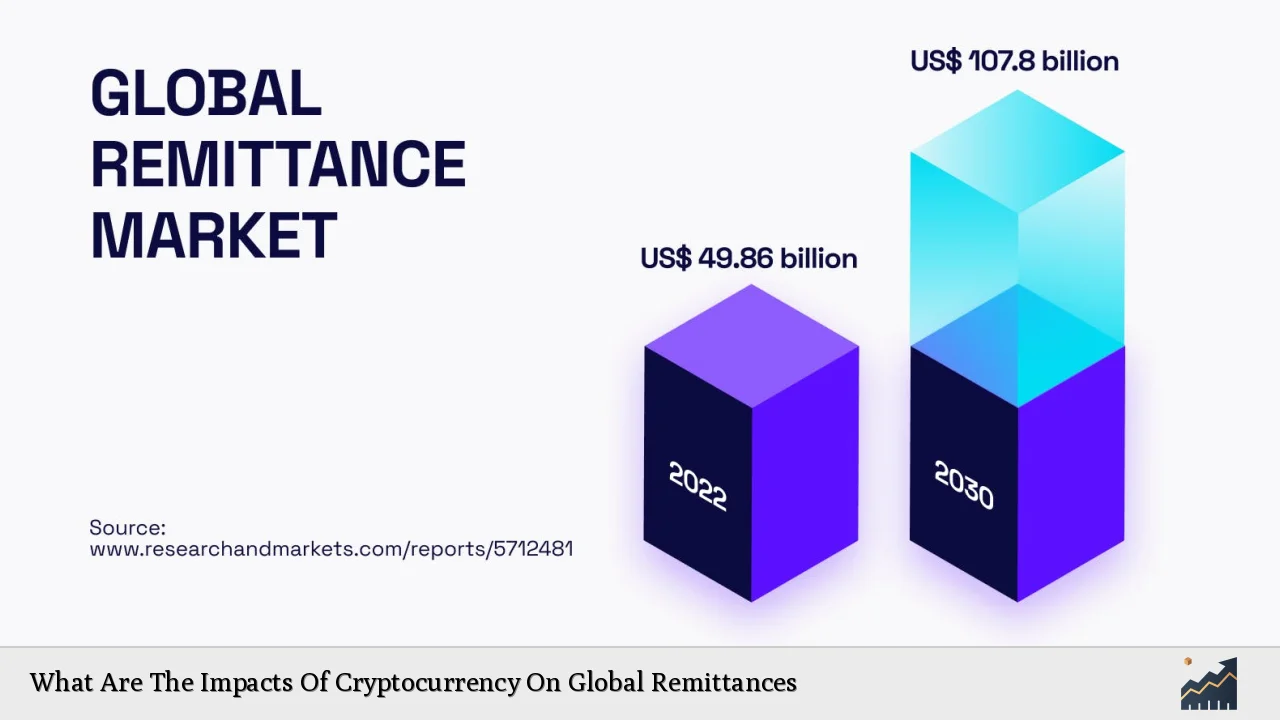

- Market Growth: The global remittance market is projected to continue growing, potentially reaching over $107 billion by 2030. Cryptocurrencies will likely capture a larger share as their adoption increases.

- Technological Advancements: Continued innovation in blockchain technology and mobile payment solutions will enhance the efficiency and security of crypto transactions.

- Increased Financial Inclusion: As more individuals gain access to digital wallets and internet connectivity, cryptocurrencies could play a pivotal role in promoting financial inclusion globally.

Frequently Asked Questions About Cryptocurrency’s Impact on Global Remittances

- How do cryptocurrencies reduce transaction costs for remittances?

Cryptocurrencies eliminate intermediaries by enabling direct peer-to-peer transactions, significantly lowering fees compared to traditional methods. - What are stablecoins and how do they benefit remittance senders?

Stablecoins are digital currencies pegged to fiat currencies that minimize volatility risks associated with other cryptocurrencies, making them suitable for remittances. - Are there risks associated with using cryptocurrency for remittances?

Yes, risks include price volatility of non-stablecoins, regulatory uncertainties, and potential security threats such as scams. - How fast can cryptocurrency transactions be completed?

Cryptocurrency transactions can often be completed within minutes or even seconds compared to several days required by traditional methods. - What role do CBDCs play in the future of remittances?

CBDCs may provide a regulated alternative that combines the benefits of digital currencies with government oversight, enhancing security and trust. - Which regions are seeing the highest adoption of cryptocurrency for remittances?

Latin America has shown significant growth in crypto-based remittances due to high transaction costs associated with traditional methods. - Can using cryptocurrency help unbanked individuals send money?

Yes, cryptocurrencies allow unbanked individuals with internet access to participate in global financial systems without needing traditional banking services. - What is the expected growth rate for cryptocurrency use in remittances?

The use of cryptocurrency for remittances is expected to grow significantly as awareness increases and technological advancements continue.

The transformative potential of cryptocurrencies on global remittances cannot be overstated. As technological advancements continue and regulatory frameworks evolve, digital currencies are poised to redefine how individuals send money across borders—making it faster, cheaper, and more accessible than ever before.