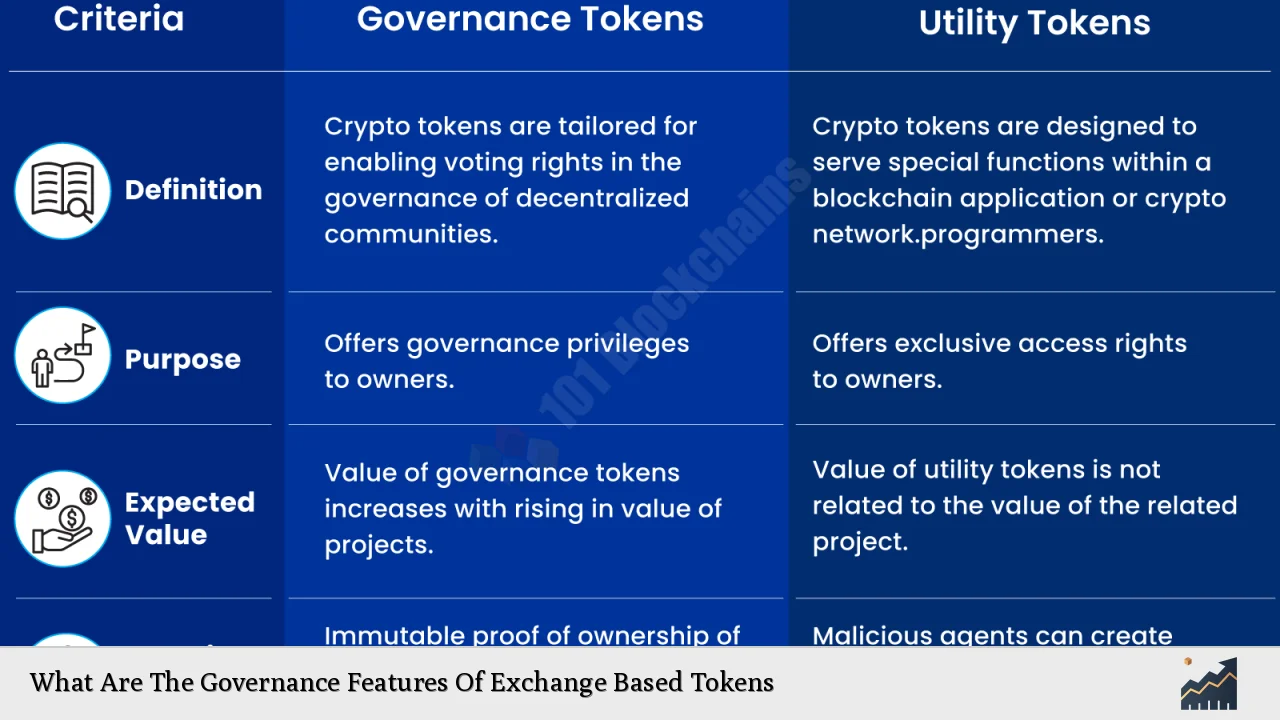

Exchange-based tokens, often referred to as governance tokens, are integral to the operation of decentralized finance (DeFi) platforms and cryptocurrency exchanges. These tokens empower holders with voting rights that influence the governance and operational decisions of the platform. As the cryptocurrency landscape evolves, understanding the governance features of these tokens becomes essential for investors and finance professionals alike.

| Key Concept | Description/Impact |

|---|---|

| Voting Rights | Holders of governance tokens can vote on proposals affecting protocol upgrades, fee structures, and other critical decisions. This decentralizes power from a central authority to the community. |

| Decentralized Governance | Governance tokens facilitate a collective decision-making process, enabling all token holders to participate in shaping the future of the platform. |

| Incentivization Mechanisms | Many platforms offer rewards for participation in governance activities, such as staking tokens or receiving a share of transaction fees, which encourages active engagement. |

| Transparency and Accountability | All governance actions are recorded on the blockchain, ensuring that decisions are transparent and can be audited by any member of the community. |

| Community Engagement | Governance tokens foster a sense of ownership among users, leading to increased participation and investment in the platform’s success. |

| Risk Management Features | Token holders can vote on risk parameters and collateral requirements, which helps mitigate financial risks associated with trading and lending protocols. |

| Emerging Trends | The rise of specialized governance tokens and cross-protocol governance models is reshaping how decisions are made within decentralized ecosystems. |

Market Analysis and Trends

The market for exchange-based tokens has seen significant growth over recent years. As of late 2024, the combined market capitalization of governance tokens across various platforms has surged, reflecting a growing trend towards decentralized governance.

- Market Capitalization: The total market capitalization for governance tokens reached approximately $100 billion in early 2024, driven by increased adoption in DeFi projects.

- User Engagement: Platforms that incorporate governance features report up to 20% higher user engagement compared to those without. This indicates that users value having a say in platform decisions.

- Participation Rates: Despite high engagement levels, participation in voting remains a challenge; only about 30% of token holders typically vote on proposals. This low turnout can skew decision-making processes.

- Emerging Models: New governance models are emerging, such as quadratic voting, which aims to give smaller holders more influence in decision-making processes.

Implementation Strategies

To effectively leverage exchange-based tokens for governance, platforms must adopt strategic implementation approaches:

- Clear Governance Structures: Establishing transparent processes for proposal submissions and voting is crucial. This includes defining how proposals can be made and what thresholds are needed for approval.

- Incentive Programs: Platforms should consider implementing reward systems that incentivize participation in governance activities through token rewards or reduced fees.

- Education Initiatives: Educating token holders about their rights and responsibilities can enhance participation rates. Providing resources on how to engage in governance effectively is essential.

- Feedback Mechanisms: Regularly soliciting feedback from the community can help refine governance processes and ensure they meet user needs.

Risk Considerations

While exchange-based tokens offer numerous advantages, they also come with inherent risks:

- Centralization Risks: Large holders (often referred to as “whales”) can disproportionately influence votes, potentially undermining true decentralization.

- Security Vulnerabilities: Governance mechanisms can be susceptible to attacks if a single entity accumulates enough tokens to manipulate outcomes. This was notably seen during incidents involving large exchanges where concentrated token holdings led to governance failures.

- Regulatory Scrutiny: As governments worldwide increase their focus on cryptocurrencies, compliance with existing regulations becomes critical. Projects must ensure that their governance structures do not inadvertently classify tokens as securities under local laws.

Regulatory Aspects

The regulatory landscape surrounding exchange-based tokens is evolving rapidly:

- Compliance Frameworks: Regulatory bodies like the SEC have begun issuing guidelines that affect how governance tokens are treated under securities laws. Projects must navigate these frameworks carefully to avoid legal pitfalls.

- International Variability: Regulations differ significantly across jurisdictions. For instance, while some countries embrace crypto innovations, others impose stringent restrictions that could impact token functionality and market access.

- KYC/AML Requirements: As regulatory scrutiny increases, platforms may need to implement Know Your Customer (KYC) and Anti-Money Laundering (AML) measures within their governance frameworks to remain compliant.

Future Outlook

The future of exchange-based tokens appears promising but will require adaptation:

- Enhanced Interoperability: As blockchain technology matures, interoperability between different platforms will likely improve. This could lead to cross-platform governance models where token holders can influence multiple projects simultaneously.

- Innovative Governance Models: Future developments may include reputation-based voting systems or dynamic voting rights that adjust based on user engagement levels or length of token holding.

- Integration with Traditional Finance: There is potential for hybrid models that combine decentralized governance with traditional financial systems. This could facilitate broader acceptance and integration into mainstream finance.

- Sustainability Focus: Long-term sustainability will depend on community engagement and clear governance structures that adapt to changing market conditions while ensuring transparency and accountability.

Frequently Asked Questions About What Are The Governance Features Of Exchange Based Tokens

- What are exchange-based tokens?

Exchange-based tokens are digital assets issued by cryptocurrency exchanges that provide holders with voting rights on various platform decisions. - How do governance features work?

Governance features allow token holders to propose changes, vote on important issues like fee structures or protocol upgrades, thus decentralizing control. - What are the risks associated with holding these tokens?

The primary risks include centralization of voting power among large holders, potential security vulnerabilities from concentrated ownership, and regulatory challenges. - How can I participate in governance?

You can participate by acquiring governance tokens through exchanges or direct purchases and then engaging in voting processes as outlined by the specific platform. - Are there incentives for participating in governance?

Yes, many platforms offer incentives such as rewards in additional tokens or reduced transaction fees for active participants in governance activities. - What role do regulations play?

Regulations impact how exchanges operate their token systems; compliance with securities laws is crucial to avoid legal issues. - What is the future outlook for exchange-based tokens?

The future may see enhanced interoperability between platforms, innovative voting mechanisms, and greater integration with traditional finance systems. - How do I assess the value of exchange-based tokens?

The value can be assessed based on factors like market demand, utility within the ecosystem, participation rates in governance activities, and overall market trends.

Exchange-based tokens represent a significant shift towards decentralized decision-making within cryptocurrency platforms. Their effective implementation hinges on clear structures that promote transparency while addressing inherent risks associated with centralized power dynamics. As this sector continues to evolve, staying informed about regulatory developments and emerging trends will be crucial for investors and finance professionals alike.