The landscape of stablecoin regulation is rapidly evolving as governments and financial authorities worldwide seek to establish frameworks that ensure consumer protection, mitigate systemic risks, and promote innovation in the digital asset space. As stablecoins gain traction as a viable alternative to traditional currencies, understanding the regulatory trends shaping their future is crucial for investors, financial professionals, and policymakers alike. This article delves into the current market analysis, implementation strategies, risk considerations, regulatory aspects, and future outlook concerning stablecoin regulation globally.

| Key Concept | Description/Impact |

|---|---|

| Market Growth | The stablecoin market has seen consistent growth, with a market capitalization reaching approximately $150 billion by late 2024, reflecting increasing adoption in various sectors. |

| Regulatory Frameworks | Regions like the EU and Singapore are implementing comprehensive regulations (e.g., MiCA) to oversee stablecoin operations, ensuring issuer accountability and consumer protection. |

| Cross-Border Challenges | Stablecoins pose unique challenges for cross-border transactions and financial stability, prompting international cooperation among regulators to address these issues. |

| Consumer Protection | Regulations are focusing on safeguarding consumer rights, requiring issuers to maintain adequate reserves and ensure transparency in operations. |

| Technological Innovation | Stablecoins are increasingly integrated into payment systems and smart contracts, driving innovation while necessitating regulatory oversight to prevent misuse. |

| Risk Management | The potential for runs on stablecoins and loss of confidence underscores the need for robust risk management frameworks among issuers. |

Market Analysis and Trends

The stablecoin market has experienced significant growth over the past few years. As of late 2024, the total market capitalization of stablecoins has surpassed $150 billion, accounting for approximately 6.93% of the total cryptocurrency market. This growth is attributed to several factors:

- Increased Adoption: Stablecoins are being adopted for various use cases including remittances, trading pairs in cryptocurrency exchanges, and as a means of payment in e-commerce.

- Diverse Collateralization: While many stablecoins are pegged to fiat currencies like the US dollar, there is a growing trend toward collateralization with other assets such as gold or even baskets of cryptocurrencies to mitigate risks associated with single-asset backing.

- Integration into Financial Systems: Major companies like Visa and PayPal are integrating stablecoins into their payment systems, enhancing transaction speed and reducing costs.

These trends indicate a robust demand for stablecoins as they provide a bridge between traditional finance and the burgeoning world of digital assets.

Implementation Strategies

As regulatory frameworks develop globally, stablecoin issuers must adopt strategies to comply with these new regulations. Key implementation strategies include:

- Establishing Clear Compliance Protocols: Issuers should develop internal compliance mechanisms to adhere to KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements mandated by regulators.

- Maintaining Adequate Reserves: Regulations like the EU’s Markets in Crypto-Assets (MiCA) require stablecoin issuers to hold sufficient reserves to back their tokens fully. This necessitates transparent reporting practices.

- Engaging with Regulators: Active engagement with regulatory bodies can help issuers stay ahead of compliance requirements and participate in shaping future regulations.

- Adopting Technology Solutions: Leveraging blockchain technology can enhance transparency and traceability in transactions, aligning with regulatory expectations.

Risk Considerations

Investing in or utilizing stablecoins comes with inherent risks that must be managed effectively:

- Liquidity Risks: The ability of issuers to convert reserves into liquid assets is crucial for maintaining the peg. Regulatory frameworks often require stringent liquidity standards.

- Market Confidence: Stablecoins can face sudden loss of confidence leading to “runs” on the issuer. Regulatory measures aim to bolster trust through transparency and reserve requirements.

- Regulatory Compliance Risks: Non-compliance with evolving regulations can lead to significant penalties or operational restrictions for issuers.

- Technological Vulnerabilities: As stablecoins become more integrated into financial systems, they may become targets for cyberattacks or fraud.

Regulatory Aspects

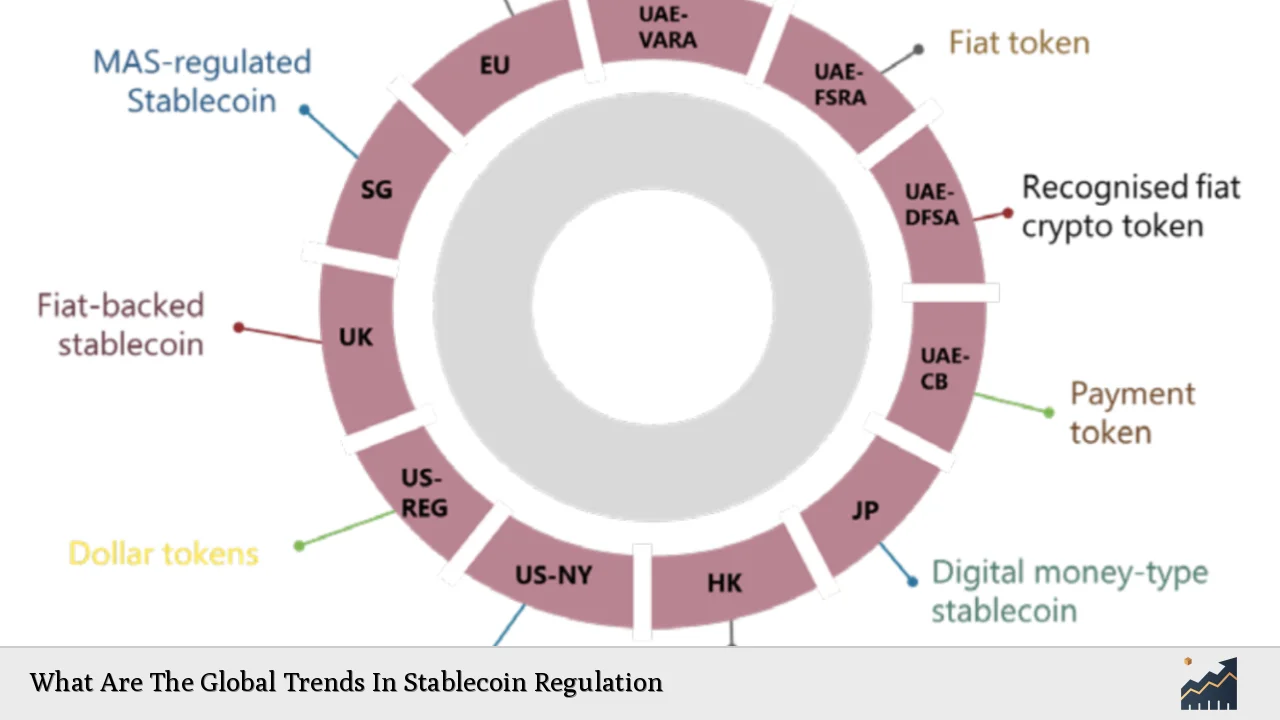

The regulatory landscape for stablecoins is becoming increasingly complex as various jurisdictions implement tailored frameworks:

- European Union (EU): The MiCA regulation represents a significant step forward in establishing a comprehensive framework for stablecoin issuance within the EU. It includes provisions for reserve requirements and consumer protection measures that will take effect by mid-2024.

- United States: Currently lacking a cohesive federal framework specifically addressing stablecoins, several states have enacted their own regulations. However, national legislation remains stalled amid political debates.

- Asia-Pacific Region: Countries like Singapore and Hong Kong are progressing towards establishing clear guidelines for stablecoin operations. Singapore’s Monetary Authority has already set forth a regulatory framework that emphasizes consumer protection and financial stability.

International collaboration among regulators is essential to address cross-border challenges posed by stablecoins. Organizations such as the Financial Stability Board (FSB) are actively working towards harmonizing regulations across jurisdictions.

Future Outlook

The future of stablecoin regulation appears poised for further evolution as adoption continues to rise:

- Increased Regulatory Scrutiny: As more users engage with stablecoins, regulators will likely intensify scrutiny over issuers’ practices to ensure compliance with established laws.

- Emergence of New Standards: The development of global standards for stablecoin regulation may emerge from ongoing discussions among international regulatory bodies aimed at preventing regulatory arbitrage.

- Technological Advancements: Innovations in blockchain technology may lead to more secure and efficient ways of issuing and managing stablecoins, which could influence future regulatory approaches.

- Consumer Demand for Stability: As economic uncertainties persist globally, consumer demand for reliable digital currencies will likely drive further adoption of regulated stablecoin solutions.

In conclusion, while challenges remain in creating a cohesive global regulatory framework for stablecoins, the trends indicate a movement toward greater oversight that balances innovation with necessary protections for consumers and the financial system at large.

Frequently Asked Questions About What Are The Global Trends In Stablecoin Regulation

- What is a stablecoin?

A stablecoin is a type of cryptocurrency designed to maintain a stable value by pegging it to a reserve asset such as fiat currency or commodities. - Why is regulation important for stablecoins?

Regulation helps ensure consumer protection, promotes market stability, prevents fraud, and addresses systemic risks associated with digital assets. - What are some key regulations affecting stablecoins globally?

The EU’s MiCA regulation is one of the most comprehensive frameworks introduced recently; other countries like Singapore have also established specific guidelines. - How do reserve requirements impact stablecoin issuers?

Reserve requirements mandate that issuers hold sufficient assets backing their tokens, which enhances consumer trust but may limit operational flexibility. - What risks do investors face when using stablecoins?

Investors face liquidity risks, market confidence issues, compliance challenges, and potential technological vulnerabilities. - How can issuers prepare for changing regulations?

Issuers should establish compliance protocols, maintain transparent operations regarding reserves, engage with regulators proactively, and adopt advanced technology solutions. - What role do international organizations play in stabilizing global regulations?

Organizations like the FSB work towards harmonizing regulations across jurisdictions to prevent inconsistencies that could lead to regulatory arbitrage. - What does the future hold for stablecoin regulation?

The outlook suggests increased scrutiny from regulators, potential emergence of global standards, ongoing technological advancements, and sustained consumer demand.

This comprehensive overview highlights the dynamic nature of global trends in stablecoin regulation while addressing key concerns relevant to investors and finance professionals.