The decentralized finance (DeFi) sector is rapidly evolving, presenting unique challenges and opportunities for regulators worldwide. As DeFi continues to gain traction, the need for clear regulatory frameworks has become increasingly critical. This article explores the current global trends in DeFi regulation, examining market dynamics, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Market Growth | The DeFi market is projected to grow from USD 46.61 billion in 2024 to USD 78.47 billion by 2029, indicating a CAGR of 10.98%. |

| Regulatory Focus | Regulators are intensifying their scrutiny of DeFi platforms to address risks related to anti-money laundering (AML) and consumer protection. |

| International Coordination | Efforts are underway among jurisdictions to create harmonized regulations that can effectively govern the decentralized nature of DeFi. |

| Technological Integration | DeFi platforms are increasingly incorporating compliance technologies such as blockchain analytics to meet regulatory requirements. |

| Consumer Protection | Regulatory bodies are focusing on enhancing consumer protection measures within DeFi, addressing issues like fraud and systemic risks. |

Market Analysis and Trends

The DeFi market is experiencing significant growth, with projections indicating it will reach USD 531.5 billion by 2032, up from USD 17.1 billion in 2023. This rapid expansion is driven by the increasing adoption of blockchain technology across various sectors, which enhances transparency and security in financial transactions.

Key Market Statistics:

- Total Value Locked (TVL): As of late 2024, the TVL in DeFi protocols has rebounded to approximately $190 billion.

- Daily Trading Volume: The daily trading volume within DeFi has surged to around $14 billion.

- Regional Growth: North America is identified as the fastest-growing region in the DeFi sector, while Asia Pacific holds the largest market share.

These statistics underscore the growing importance of DeFi in the global financial landscape and highlight the urgency for effective regulatory frameworks.

Implementation Strategies

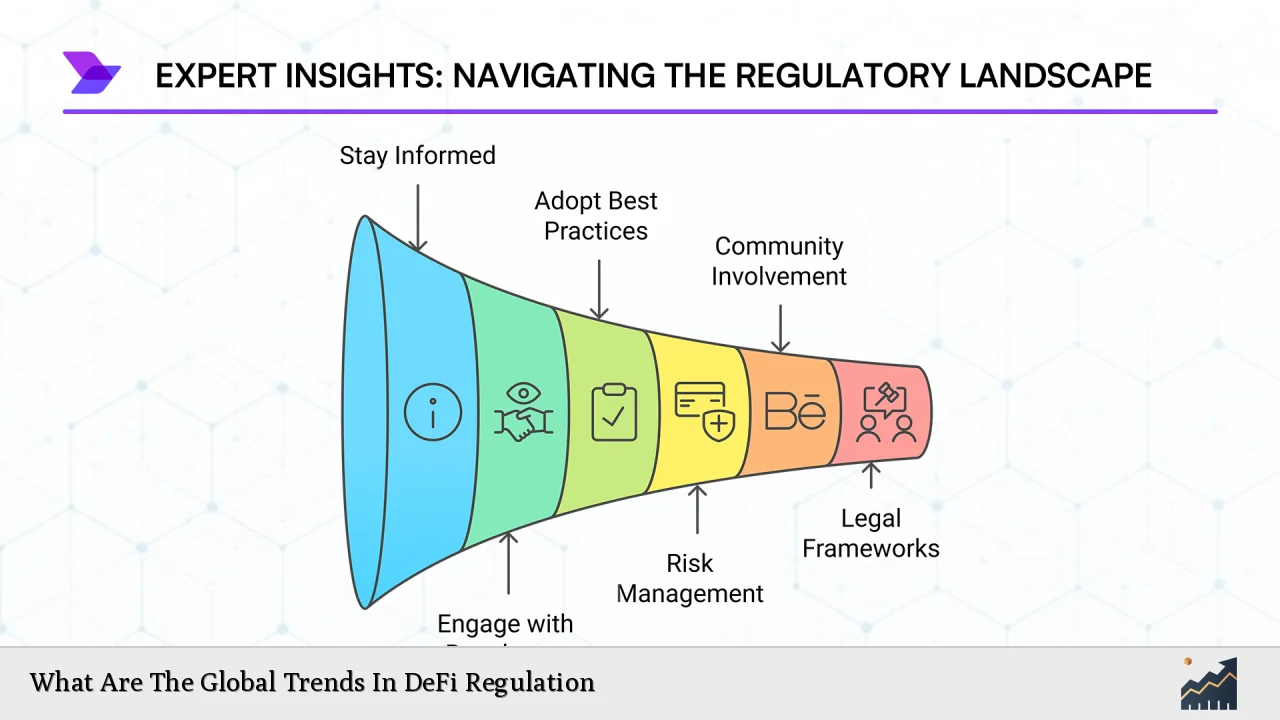

As regulators seek to address the complexities of DeFi, several strategies are emerging:

- Harmonization of Regulations: Countries such as the EU, Singapore, and Switzerland are developing cohesive regulatory frameworks that balance innovation with consumer protection. The EU's Markets in Crypto-Assets (MiCA) regulation is a prime example of this approach.

- Engagement with Industry Stakeholders: Regulatory bodies like the U.S. Commodity Futures Trading Commission (CFTC) are advocating for ongoing dialogue with industry participants to better understand DeFi's operational nuances.

- Use of Compliance Technologies: DeFi platforms are adopting advanced compliance solutions, including Know Your Customer (KYC) and AML measures, to align with regulatory expectations while maintaining their decentralized ethos.

Risk Considerations

The decentralized nature of DeFi introduces unique risks that regulators must address:

- Fraud and Security Risks: The open-source nature of many DeFi platforms makes them susceptible to hacks and scams. Regulatory measures must focus on safeguarding users against these threats.

- Regulatory Arbitrage: The lack of centralized entities complicates enforcement efforts. Regulators face challenges in identifying responsible parties within decentralized ecosystems.

- Consumer Protection: Ensuring that investors are protected from potential malfeasance and systemic risks is paramount. Regulators are exploring ways to enhance transparency and accountability within DeFi protocols.

Regulatory Aspects

Global regulatory trends indicate a shift towards more structured oversight of DeFi:

- Increased Scrutiny: Regulatory bodies worldwide are ramping up enforcement actions against non-compliant DeFi projects. The SEC and CFTC have already initiated several investigations into major players in the space.

- International Cooperation: Organizations like the Financial Action Task Force (FATF) are urging countries to adopt coordinated approaches to tackle AML risks associated with DeFi.

- Framework Development: Countries such as Japan have implemented progressive licensing regimes for crypto exchanges and DeFi platforms, prioritizing risk mitigation without stifling innovation.

Future Outlook

The future of DeFi regulation appears poised for significant evolution:

- Balancing Innovation and Regulation: As regulators strive to create frameworks that foster innovation while ensuring consumer protection, a delicate balance will be necessary. Successful integration of compliance measures into decentralized platforms could enhance trust among users.

- Emerging Trends: Key trends expected to shape the future include multi-chain interoperability, real-world asset tokenization, and enhanced security protocols powered by AI technologies.

- Global Leadership: Countries that successfully navigate the regulatory landscape while promoting innovation may solidify their positions as leaders in the burgeoning DeFi sector.

Frequently Asked Questions About Global Trends In DeFi Regulation

- What is decentralized finance (DeFi)?

DeFi refers to financial services that operate on blockchain technology without traditional intermediaries like banks or brokers. - Why is regulation important for DeFi?

Regulation helps ensure consumer protection, mitigate fraud risks, and promote market stability in a rapidly evolving financial landscape. - How do different countries approach DeFi regulation?

Countries vary widely in their regulatory approaches; some prioritize innovation while others focus on strict compliance measures. - What challenges do regulators face with DeFi?

The decentralized nature of DeFi complicates enforcement efforts and raises questions about accountability and consumer protection. - What technologies are being used for compliance in DeFi?

DeFi platforms are increasingly utilizing blockchain analytics tools for KYC/AML compliance and risk management. - How can investors protect themselves in the DeFi space?

Investors should conduct thorough research on projects, be aware of potential risks, and consider using platforms that implement robust security measures. - What is the future outlook for DeFi regulation?

The future will likely see more structured oversight combined with efforts to foster innovation through adaptive regulatory frameworks. - Are there any notable regulatory developments expected soon?

Yes, ongoing discussions among international regulatory bodies suggest forthcoming guidelines aimed at harmonizing global approaches to DeFi regulation.

In conclusion, as the decentralized finance landscape continues to grow and evolve, so too must our understanding of its regulatory environment. By fostering collaboration between regulators and industry participants, we can create frameworks that not only protect consumers but also encourage innovation within this dynamic sector.