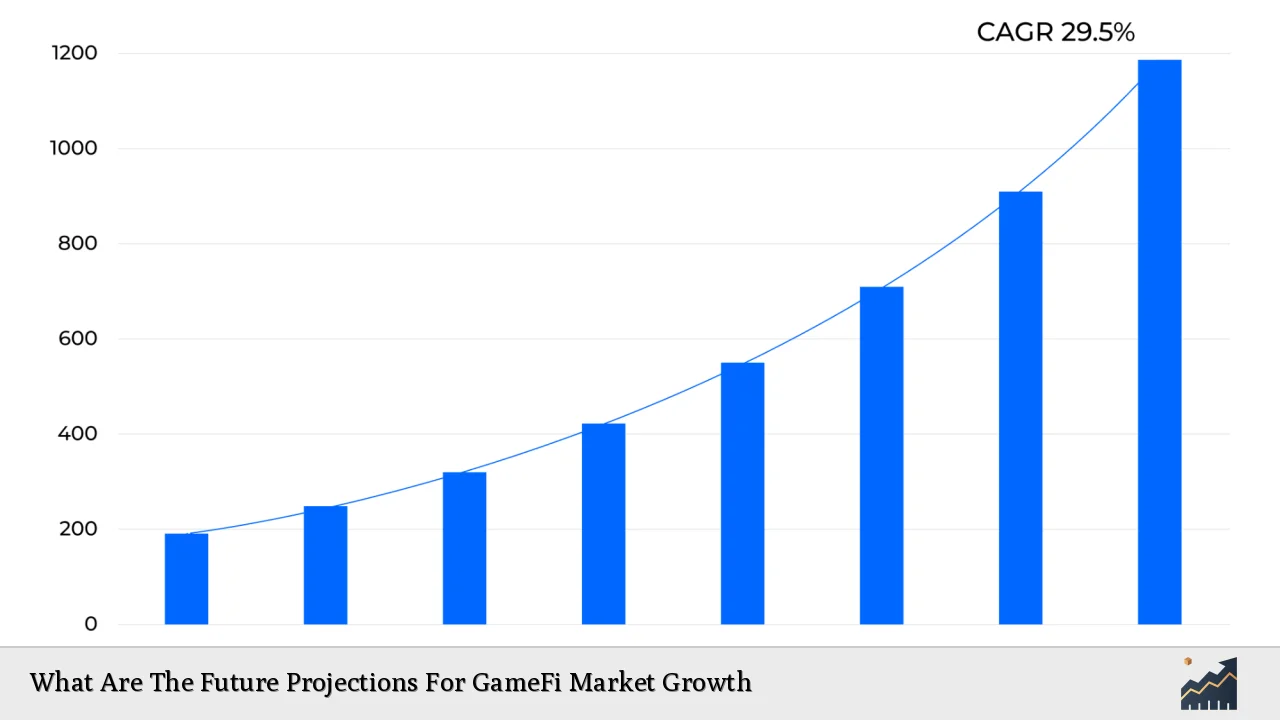

The GameFi market, which merges gaming with decentralized finance (DeFi), is experiencing rapid growth and transformation. As of 2023, the global GameFi market was valued at approximately $9.6 billion and is projected to reach between $19.58 billion and $126.17 billion by 2032, depending on various market analyses. This growth is driven by a compound annual growth rate (CAGR) ranging from 25.4% to 29.5% over the next several years. The GameFi sector is not only attracting traditional gamers but also a broader audience of tech enthusiasts and investors, creating a unique ecosystem that combines entertainment with financial opportunities.

| Key Concept | Description/Impact |

|---|---|

| Market Size | The GameFi market is expected to grow from $9.6 billion in 2023 to approximately $19.58 billion in 2024, with projections reaching up to $126.17 billion by 2032. |

| User Growth | Active GameFi players are anticipated to increase from around 20 million in 2023 to over 50 million by the end of 2024. |

| Investment Surge | Venture capital investments in GameFi could exceed $2 billion in 2024, reflecting strong investor confidence. |

| Technological Advancements | 80% of GameFi platforms are expected to adopt Layer 2 solutions for enhanced scalability by 2024. |

| Regulatory Developments | By the end of 2024, at least 20 major countries are predicted to establish regulatory frameworks specific to GameFi. |

| Metaverse Integration | 35% of all Metaverse platforms are projected to incorporate GameFi elements by the end of 2024. |

Market Analysis and Trends

The GameFi market is currently characterized by several key trends that indicate its potential for substantial growth:

- User Base Expansion: The number of active users in the GameFi sector is expected to rise dramatically, with estimates suggesting an increase from approximately 20 million in 2023 to over 50 million by the end of 2024. This surge is attributed to the unique blend of gaming and earning opportunities that GameFi offers.

- Market Penetration: Analysts predict that GameFi could capture up to 10% of the global gaming market by 2024, up from about 3% in 2023. This growth reflects increasing awareness and accessibility among players.

- Investment Dynamics: Venture capital funding for GameFi projects is projected to exceed $2 billion in 2024, significantly up from $1.2 billion in 2023. This influx of capital underscores the confidence investors have in the future of this sector.

- Technological Innovations: The adoption of Layer 2 solutions for scalability is expected to be widespread among GameFi platforms, enhancing user experience and operational efficiency.

- Economic Models: By 2024, around 60% of GameFi projects are anticipated to refine their tokenomics to ensure sustainability and long-term player engagement.

Implementation Strategies

To capitalize on the growing opportunities within the GameFi market, stakeholders should consider the following strategies:

- Diversification of Offerings: Developers should focus on creating diverse game genres that appeal to various demographics beyond traditional gamers, including casual players and investors.

- Community Engagement: Building strong community ties through participatory governance models can enhance user loyalty and project sustainability.

- Strategic Partnerships: Collaborating with established gaming companies can provide valuable resources and expertise, facilitating smoother entry into the market.

- Focus on User Experience: Prioritizing user-friendly interfaces and engaging gameplay mechanics will be crucial for attracting and retaining players.

Risk Considerations

Despite its promising outlook, several risks could impact the growth trajectory of the GameFi market:

- Market Volatility: The cryptocurrency market’s inherent volatility can affect player investments and overall market stability.

- Regulatory Uncertainty: As governments begin to implement regulations specific to GameFi, compliance challenges may arise, potentially hindering innovation.

- Technological Risks: Rapid technological changes may render existing platforms obsolete if developers fail to adapt quickly.

- User Retention Challenges: Maintaining player interest amid a growing number of competing platforms will require continuous innovation and engagement strategies.

Regulatory Aspects

As the GameFi industry expands, regulatory clarity will become increasingly important:

- Emerging Frameworks: By the end of 2024, it is expected that at least 20 major countries will have established regulatory frameworks for GameFi, providing clearer guidelines for operations within this space.

- Compliance Requirements: Stakeholders must stay informed about evolving regulations regarding cryptocurrency transactions, data protection laws, and consumer rights.

- Global Perspectives: Different regions may adopt varying regulatory approaches; thus, understanding local laws will be essential for successful international operations.

Future Outlook

The future of the GameFi market appears bright, driven by several key factors:

- Continuous User Growth: With projections indicating that active players could surpass 50 million by late 2024, sustained engagement strategies will be vital for long-term success.

- Increased Mainstream Adoption: As awareness grows and accessibility improves, more individuals are likely to enter the GameFi ecosystem.

- Integration with Traditional Gaming: The entry of traditional gaming giants into the GameFi space may further legitimize this sector and drive innovation.

- Economic Sustainability Models: The refinement of tokenomics within projects will play a critical role in ensuring long-term viability and profitability.

Frequently Asked Questions About What Are The Future Projections For GameFi Market Growth

- What is the current size of the GameFi market?

The global GameFi market was valued at approximately $9.6 billion in 2023. - How fast is the GameFi market expected to grow?

The market is projected to grow at a CAGR ranging from 25.4% to 29.5%, reaching between $19.58 billion and $126.17 billion by 2032. - What factors are driving growth in the GameFi sector?

Key drivers include increased user adoption, significant venture capital investment, technological advancements, and integration with mainstream gaming. - What are some risks associated with investing in GameFi?

The primary risks include market volatility, regulatory uncertainty, technological changes, and challenges related to user retention. - How important are regulations for the future of GameFi?

Regulations will provide necessary clarity for operations within the sector and help protect consumers as well as investors. - What role does community engagement play in GameFi?

A strong community can enhance user loyalty and participation in governance models, contributing significantly to project sustainability. - How does technological advancement impact GameFi?

Technological innovations improve scalability and user experience while enabling new gameplay mechanics that attract a broader audience. - Will traditional gaming companies enter the GameFi space?

Yes, many traditional gaming giants are exploring or entering the GameFi sector, which could accelerate its growth further.

The future projections for the GameFi market indicate a dynamic landscape characterized by rapid growth driven by technological innovations, increased investment interest, regulatory developments, and evolving user demographics. Stakeholders must navigate these changes strategically while remaining adaptable to sustain success in this burgeoning industry.