Layer 1 (L1) blockchains serve as the foundational infrastructure for various decentralized applications (dApps) and cryptocurrencies. They are integral to the blockchain ecosystem, directly handling transactions and providing essential security and decentralization. As we look towards the future, several trends and predictions emerge regarding the evolution and impact of Layer 1 technologies.

| Key Concept | Description/Impact |

|---|---|

| Market Growth | Layer 1 blockchains are projected to experience significant growth, with estimates suggesting a potential market increase of 50-100% from 2024 to 2025. |

| Technological Advancements | Emerging technologies like sharding and improved consensus mechanisms (e.g., Proof of Stake) will enhance scalability and transaction speeds. |

| Interoperability | The future will see increased focus on interoperability between different L1 blockchains, allowing seamless interactions across networks. |

| Regulatory Landscape | Regulatory clarity will be crucial for institutional investment, impacting how Layer 1 protocols develop and operate. |

| Decentralized Finance (DeFi) Growth | L1 blockchains will continue to underpin DeFi applications, driving demand for robust infrastructure that supports high transaction volumes. |

| Environmental Sustainability | With growing scrutiny on energy consumption, L1s adopting eco-friendly consensus mechanisms will gain a competitive edge. |

Market Analysis and Trends

The market for Layer 1 blockchains has witnessed extraordinary growth in recent months, with a collective market capitalization exceeding $2.8 trillion as of late 2024. This surge represents an astonishing increase of approximately 7,000% since January 2024, driven by heightened interest from both retail and institutional investors. Bitcoin remains the dominant player, accounting for nearly 70% of this market share, followed closely by Ethereum, which is vital for decentralized applications due to its robust smart contract capabilities.

Current statistics indicate that Ethereum leads in Total Value Locked (TVL), significantly outpacing competitors like Solana and Avalanche. As of Q4 2024, Ethereum’s TVL stood at approximately $69 billion compared to Solana’s $6 billion. This disparity highlights Ethereum’s stronghold in DeFi applications, which require substantial liquidity to function effectively.

Key Trends

- Increased Adoption: The integration of Layer 1 technologies into mainstream financial systems is expected to rise as more traditional financial institutions explore blockchain solutions.

- Emerging Projects: New entrants like Mantra and Sui are gaining traction with innovative features that address scalability and transaction efficiency.

- Focus on Security: As the number of blockchain attacks increases, Layer 1 protocols are prioritizing security enhancements to protect user assets.

Implementation Strategies

Investors looking to capitalize on Layer 1 blockchain technologies should consider several strategic approaches:

- Diversification Across Protocols: Investing in a mix of established L1s like Bitcoin and Ethereum alongside emerging projects can mitigate risks associated with market volatility.

- Monitoring Regulatory Developments: Staying informed about regulatory changes can provide insights into potential impacts on specific blockchains or the broader market.

- Engagement with Ecosystem Development: Participating in governance or staking mechanisms can offer investors additional returns while contributing to the network’s growth.

- Focus on Use Cases: Evaluating projects based on their real-world applications—such as supply chain management or decentralized finance—can help identify those with the most potential for adoption.

Risk Considerations

While Layer 1 blockchains present substantial opportunities, they also come with inherent risks:

- Market Volatility: The cryptocurrency market is notoriously volatile; investments can fluctuate dramatically in short periods.

- Regulatory Risks: Changes in government policies regarding cryptocurrencies can significantly affect market dynamics and specific projects’ viability.

- Technological Challenges: Issues related to scalability, security breaches, or network congestion can hinder performance and user adoption.

- Competition from Layer 2 Solutions: As Layer 2 solutions gain traction by addressing scalability issues more efficiently, traditional Layer 1 blockchains may face pressure to innovate continuously.

Regulatory Aspects

The regulatory landscape surrounding cryptocurrencies is evolving rapidly. In many jurisdictions, regulators are working to establish clearer frameworks that govern how cryptocurrencies operate. This clarity is essential for fostering institutional investment in Layer 1 technologies.

Key regulatory considerations include:

- Classification of Cryptocurrencies: Determining whether cryptocurrencies are classified as securities or commodities can have profound implications for their legal status and how they are traded.

- Energy Consumption Regulations: With increasing scrutiny over the environmental impact of blockchain technologies, especially those using Proof-of-Work consensus mechanisms like Bitcoin, regulations may push for greener alternatives.

- Tax Implications: Understanding tax obligations related to cryptocurrency transactions is crucial for investors operating within legal frameworks.

Future Outlook

The future of Layer 1 blockchain technology appears promising but will depend heavily on several factors:

- Technological Innovations: Continued advancements in consensus algorithms and scalability solutions will be critical in maintaining competitive advantages among L1 protocols.

- Integration with Traditional Finance: As more financial institutions adopt blockchain technology for various applications—from payments to asset tokenization—the demand for robust L1 infrastructures will grow.

- Global Adoption Trends: The expansion of blockchain technology into developing markets could provide new opportunities for growth as these regions seek efficient financial solutions.

Overall, while challenges remain—particularly regarding scalability and regulatory acceptance—the outlook for Layer 1 blockchains is buoyed by their foundational role in the evolving digital economy.

Frequently Asked Questions About What Are The Future Predictions For Layer 1 L1 Blockchain Technology

- What is a Layer 1 blockchain?

A Layer 1 blockchain is a base-level protocol that operates independently without relying on other networks. It processes transactions directly on its own platform. - How do Layer 1 blockchains differ from Layer 2 solutions?

Layer 2 solutions build on top of Layer 1 blockchains to improve scalability and transaction speed without altering the underlying protocol. - What are some examples of popular Layer 1 blockchains?

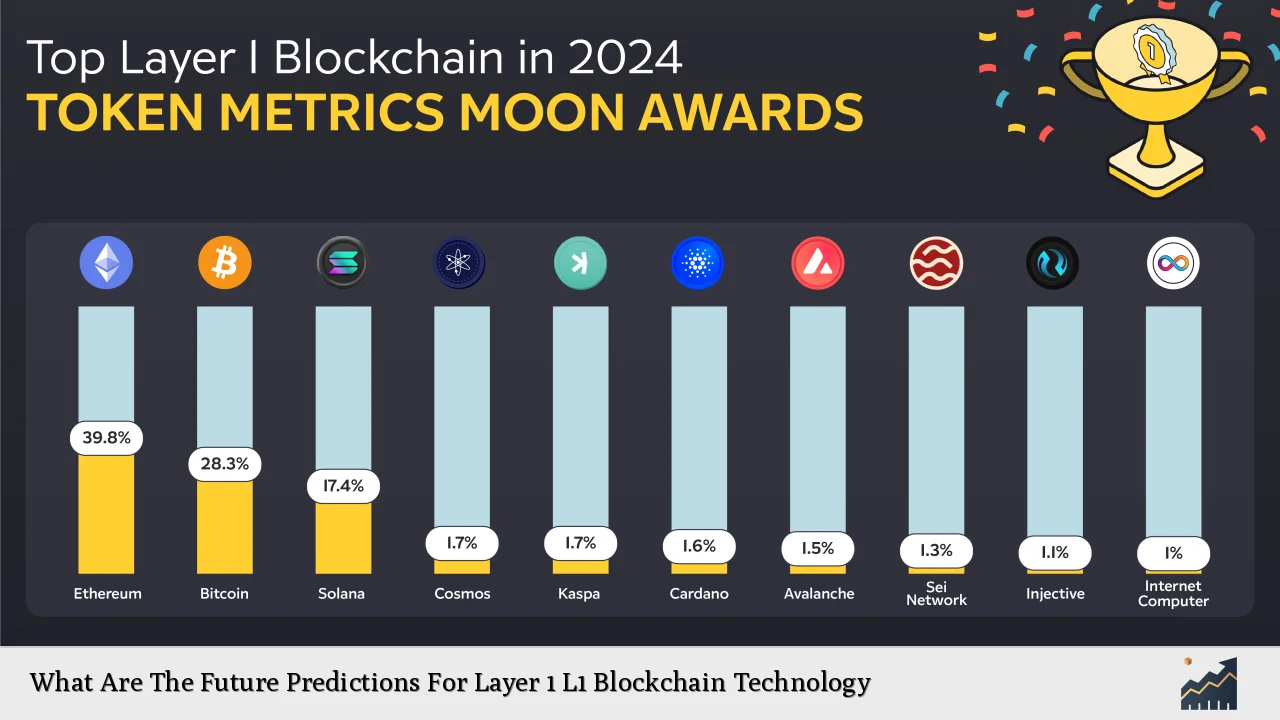

Notable examples include Bitcoin, Ethereum, Solana, Cardano, and Avalanche. - What factors influence the future growth of Layer 1 blockchains?

Key factors include technological advancements, regulatory developments, market demand for decentralized applications, and competition from other blockchain layers. - How does regulatory uncertainty impact Layer 1 investments?

Regulatory uncertainty can lead to volatility in prices and affect investor confidence; clear regulations could enhance institutional adoption. - What role do environmental concerns play in the future of Layer 1 blockchains?

As sustainability becomes increasingly important, L1s that adopt energy-efficient consensus mechanisms may gain a competitive edge over those that do not. - Can Layer 1 blockchains support decentralized finance (DeFi) applications?

Yes, many DeFi applications are built on top of Layer 1 blockchains due to their ability to handle secure transactions efficiently. - What is the significance of Total Value Locked (TVL) in evaluating L1s?

Total Value Locked indicates the amount of assets staked or locked within a protocol; higher TVL often signifies greater trust and usage within the ecosystem.

In conclusion, while there are numerous opportunities within the realm of Layer 1 blockchain technology, investors should remain cognizant of potential risks and challenges as they navigate this rapidly evolving landscape.