Investment decisions are crucial for economic growth, business expansion, and individual wealth accumulation. Understanding the determinants of investment is essential for investors, policymakers, and finance professionals alike. The four main determinants of investment are interest rates, expected returns, financial conditions, and overall economic growth. Each of these factors plays a significant role in shaping investment behavior and can influence the broader economy.

| Key Concept | Description/Impact |

|---|---|

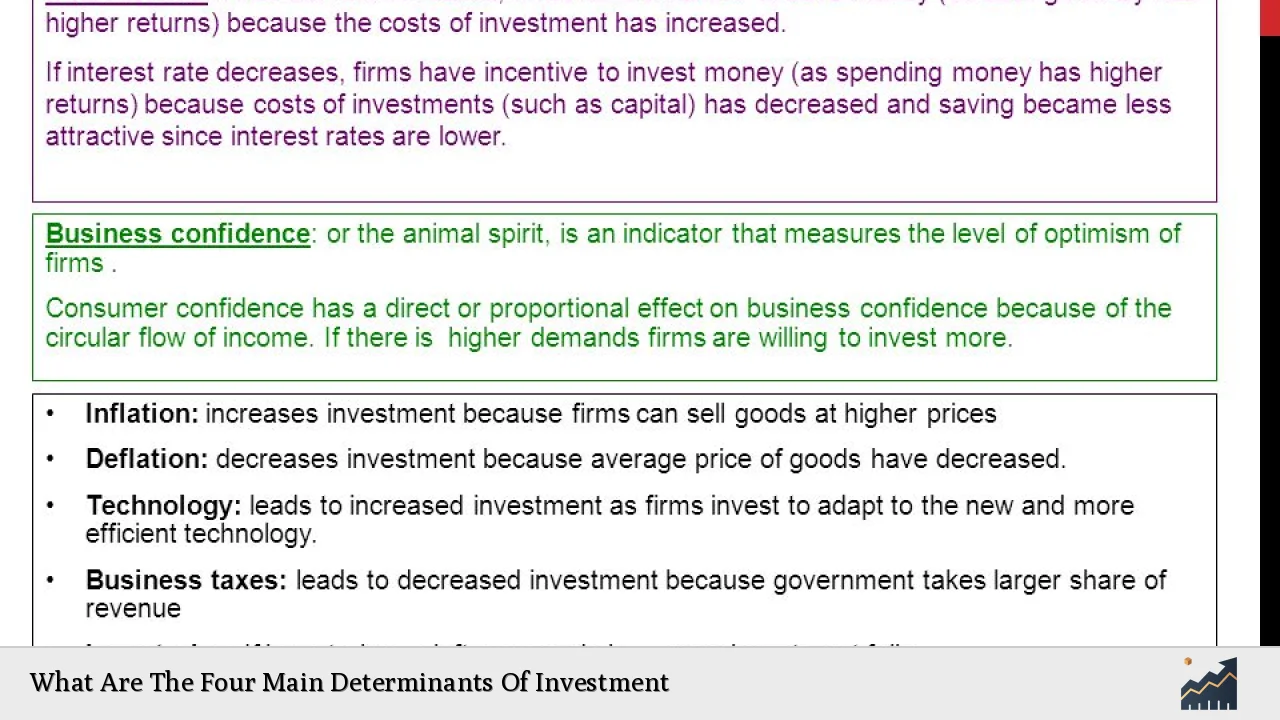

| Interest Rates | Interest rates represent the cost of borrowing money. High interest rates can deter investment as they increase the cost of financing, while low rates generally encourage borrowing and investment. |

| Expected Returns | The anticipated profitability of an investment influences decision-making. Higher expected returns make investments more appealing, while low or uncertain returns can lead to hesitation. |

| Financial Conditions | The current financial health of a business, including its debt levels and cash flow, affects its ability to invest. Stable financial conditions promote investment, whereas high debt can restrict it. |

| Overall Economic Growth | Economic growth signals increased demand for goods and services, prompting businesses to invest in capacity expansion. Conversely, economic downturns often lead to reduced investment due to uncertainty. |

Market Analysis and Trends

Understanding the current market landscape is vital for analyzing investment determinants. As of late 2024, global equity markets have seen significant fluctuations influenced by various economic indicators.

- Interest Rates: Central banks globally have been adjusting interest rates in response to inflationary pressures. For instance, the Federal Reserve has raised rates multiple times over the past two years to combat inflation, which has resulted in higher borrowing costs for businesses.

- Expected Returns: The technology sector has attracted substantial investments, particularly in areas related to artificial intelligence (AI). As of mid-2024, technology equities reached an all-time high, reflecting strong investor confidence in future returns from this sector.

- Financial Conditions: The overall financial health of corporations has improved post-pandemic, with many companies reporting robust cash flows. This trend supports higher levels of capital expenditure and investment activity.

- Economic Growth: Global economic growth is projected to remain modest but stable. The International Monetary Fund (IMF) forecasts a GDP growth rate of approximately 3% for 2024, which is expected to drive investment as consumer demand increases.

Implementation Strategies

To effectively respond to these determinants, investors can adopt several strategies:

- Monitor Interest Rate Trends: Investors should keep abreast of central bank policies regarding interest rates as they directly impact borrowing costs and investment viability.

- Evaluate Expected Returns: Conduct thorough market analyses to assess potential returns on investments. Utilizing tools such as discounted cash flow (DCF) analysis can provide insights into expected profitability.

- Strengthen Financial Health: Businesses should focus on maintaining healthy balance sheets with manageable debt levels to enhance their capacity for future investments.

- Adapt to Economic Conditions: Investors must remain agile and responsive to changes in economic conditions. This includes reallocating assets based on economic forecasts and market trends.

Risk Considerations

Investing inherently involves risks that must be carefully evaluated:

- Interest Rate Risk: Fluctuations in interest rates can significantly affect the cost of capital and the attractiveness of various investments.

- Market Risk: Economic downturns can lead to reduced consumer spending and lower expected returns on investments.

- Credit Risk: Companies with high debt levels may face challenges in securing additional financing, impacting their ability to invest.

- Regulatory Risk: Changes in regulations can affect financial conditions and overall market dynamics.

Regulatory Aspects

Regulatory frameworks play a crucial role in shaping investment environments:

- Capital Requirements: Investment firms are subject to stringent capital requirements designed to ensure stability and protect investors. For example, the European Union has implemented regulations that require firms to maintain adequate capital buffers relative to their risk exposure.

- Market Transparency: Regulations aimed at enhancing market transparency help build investor confidence. This includes requirements for firms to disclose financial information regularly.

- Investment Protection Laws: Various jurisdictions have established laws that protect investors against fraud and mismanagement, thereby fostering a more secure investment climate.

Future Outlook

The future landscape for investments will likely be shaped by several key trends:

- Technological Advancements: Continued innovation in technology will drive new investment opportunities, particularly in sectors like renewable energy and AI.

- Sustainable Investing: There is increasing momentum towards environmental, social, and governance (ESG) criteria influencing investment decisions. Investors are more frequently considering sustainability as a determinant of long-term success.

- Global Economic Shifts: Emerging markets are expected to play a larger role in global investments as they recover from pandemic-related setbacks and attract foreign direct investments (FDI).

In conclusion, understanding the four main determinants of investment—interest rates, expected returns, financial conditions, and overall economic growth—is essential for making informed decisions in today’s complex financial landscape.

Frequently Asked Questions About What Are The Four Main Determinants Of Investment

- What are the four main determinants of investment?

The four main determinants are interest rates, expected returns, financial conditions, and overall economic growth. - How do interest rates affect investment?

High interest rates increase borrowing costs which can deter businesses from investing; conversely, low rates encourage borrowing. - What role do expected returns play in investment decisions?

If expected returns are high, businesses are more likely to invest; low or uncertain returns may lead them to delay or avoid investments. - Why are financial conditions important for investment?

A company’s current financial health impacts its ability to secure financing for new projects; stable cash flow supports greater investment activity. - How does overall economic growth influence investments?

A growing economy typically leads to increased demand for products and services, prompting businesses to invest more heavily. - What risks should investors consider when making decisions?

Investors should consider interest rate risk, market risk, credit risk, and regulatory risk when evaluating potential investments. - How do regulatory aspects impact investment?

Regulations ensure market stability by imposing capital requirements on firms and promoting transparency through mandatory disclosures. - What is the future outlook for investments?

The future will likely see increased technological advancements driving new opportunities along with a growing emphasis on sustainable investing practices.

This comprehensive overview provides insights into the determinants of investment while addressing current trends and future considerations relevant for individual investors and finance professionals alike.