Kleva is a decentralized finance (DeFi) protocol that operates on the Klaytn blockchain, primarily focusing on leveraged yield farming. As with many DeFi platforms, users must be aware of various fees that can impact their overall investment returns. Understanding these fees is crucial for individual investors and finance professionals looking to optimize their strategies in the rapidly evolving cryptocurrency landscape.

| Key Concept | Description/Impact |

|---|---|

| Transaction Fees | Transaction fees are charged for every interaction with the Kleva protocol, including deposits, withdrawals, and trades. These fees can vary based on network congestion and are typically paid in KLAY or KLEVA tokens. |

| Liquidity Provider Fees | Users who provide liquidity to the platform may incur fees associated with the liquidity pools. These fees are often a percentage of the trading volume generated by the pool. |

| Withdrawal Fees | Kleva may impose withdrawal fees when users decide to take their funds out of the protocol. These fees can vary based on the amount being withdrawn and the specific tokens involved. |

| Slippage Costs | When executing trades, users may experience slippage, which is the difference between the expected price of a trade and the actual price. This can lead to additional costs, especially in volatile markets. |

| Gas Fees | Gas fees are required for executing transactions on the Klaytn blockchain. These fees fluctuate based on network demand and can significantly affect transaction costs during peak times. |

| Performance Fees | If users engage in yield farming or staking within Kleva, performance fees may be applied based on the profits generated from these activities. |

Market Analysis and Trends

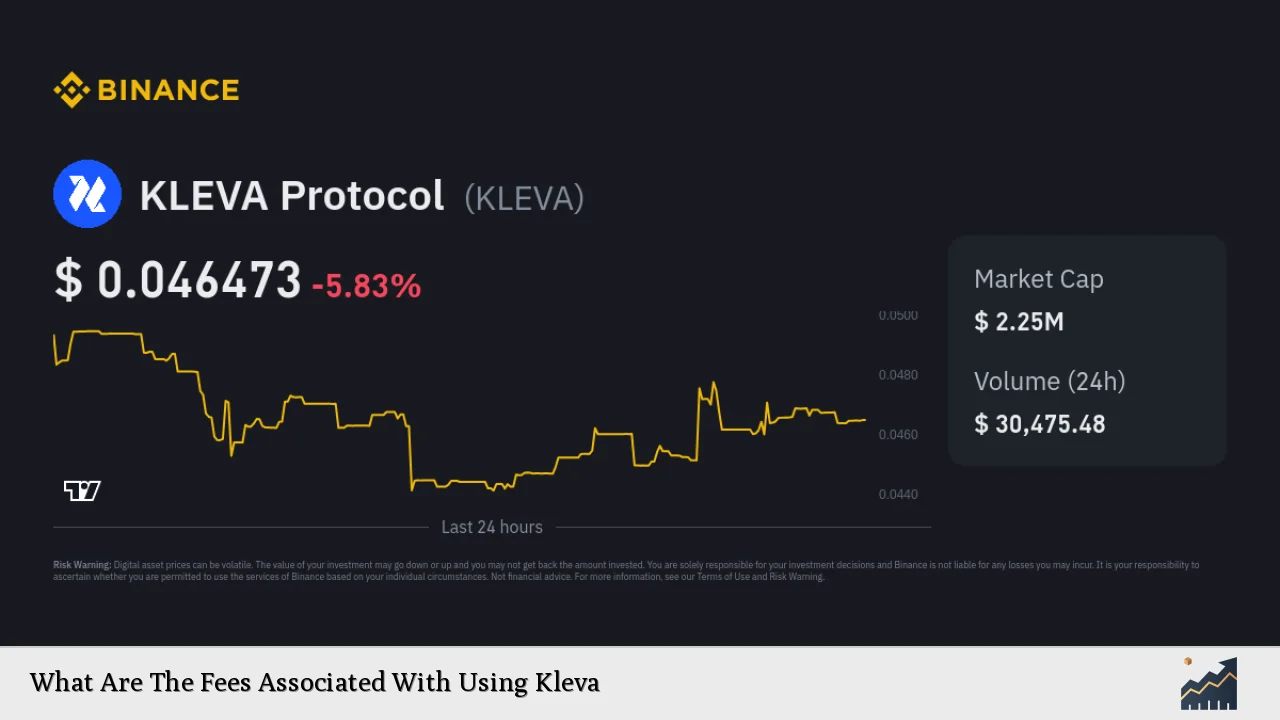

The cryptocurrency market has witnessed significant growth over recent years, with DeFi protocols like Kleva gaining traction among investors seeking higher returns through innovative financial products. As of December 2024, Kleva’s market cap stands at approximately $2.63 million, with a trading volume fluctuating around $95,000 daily. The KLEVA token has experienced volatility, with a 52-week price range between $0.16 and $0.45, indicating both potential for growth and risk for investors.

Recent trends show that investors are increasingly interested in DeFi platforms due to their ability to offer higher yields compared to traditional finance options. Additionally, as regulatory scrutiny increases globally, platforms that prioritize transparency and security will likely gain a competitive edge.

Implementation Strategies

To effectively utilize Kleva for investment purposes, investors should consider the following strategies:

- Diversification: Spread investments across multiple DeFi protocols to mitigate risk.

- Liquidity Provisioning: Engage in liquidity pools to earn transaction fees while contributing to market stability.

- Yield Farming: Take advantage of yield farming opportunities within Kleva to maximize returns on investment.

- Monitoring Fees: Regularly assess transaction and withdrawal fees to ensure they do not erode profits.

- Risk Management: Implement stop-loss orders and other risk management techniques to protect against market downturns.

Risk Considerations

Investing in DeFi protocols like Kleva carries inherent risks that should be carefully evaluated:

- Market Volatility: Cryptocurrency prices can fluctuate dramatically, leading to potential losses.

- Smart Contract Risks: Bugs or vulnerabilities in smart contracts can result in loss of funds.

- Regulatory Risks: Changes in regulations could impact the operation of DeFi platforms.

- Liquidity Risks: In times of high volatility, liquidity may dry up, making it difficult to execute trades without incurring significant slippage.

Regulatory Aspects

The regulatory landscape for cryptocurrencies and DeFi protocols is evolving rapidly. In many jurisdictions, DeFi platforms face scrutiny regarding compliance with anti-money laundering (AML) and know your customer (KYC) regulations. Investors should stay informed about regulatory developments that could affect their investments in Kleva and other DeFi protocols.

In the United States, for example, the SEC has indicated that it may classify certain tokens as securities, which could impose additional compliance burdens on platforms like Kleva. Investors should consider consulting with financial advisors or legal experts to navigate these complexities effectively.

Future Outlook

Looking ahead, the future of Kleva appears promising as DeFi continues to attract interest from both retail and institutional investors. The potential for higher yields compared to traditional finance options will likely drive further adoption of platforms like Kleva.

However, investors should remain vigilant about market conditions and regulatory changes that could impact their investments. As technology evolves and new financial products emerge within the DeFi space, adaptability will be key for successful investment strategies.

Frequently Asked Questions About What Are The Fees Associated With Using Kleva

- What types of fees can I expect when using Kleva?

Users can expect transaction fees, liquidity provider fees, withdrawal fees, slippage costs, gas fees, and performance fees depending on their activities within the platform. - How do transaction fees affect my investment?

Transaction fees can reduce overall returns by taking a portion of profits from trades or yield farming activities. - Are there any hidden costs when withdrawing funds?

Withdrawal fees may apply depending on the specific tokens being withdrawn; it’s important to check these before initiating a withdrawal. - What is slippage and how does it impact trading?

Slippage occurs when there is a difference between expected trade prices and actual execution prices; this can lead to higher costs during volatile market conditions. - How do gas fees influence my transactions?

Gas fees are necessary for executing transactions on blockchain networks; they can vary significantly based on network congestion. - Can I minimize my costs when using Kleva?

Yes, by monitoring market conditions and choosing optimal times for transactions, users can reduce costs associated with trading. - What should I do if I encounter high fees?

If you encounter high fees consistently, consider exploring alternative platforms or adjusting your trading strategies to minimize costs. - Is it advisable to consult a financial advisor before investing in Kleva?

Yes, consulting a financial advisor can provide personalized insights into managing risks associated with investing in cryptocurrencies.

This comprehensive analysis provides individual investors and finance professionals with critical insights into the fee structure associated with using Kleva. By understanding these aspects thoroughly, users can make informed decisions that align with their investment goals while navigating the complexities of decentralized finance effectively.