The rise of stablecoins has transformed the cryptocurrency landscape, offering a bridge between traditional finance and digital assets. However, their increasing adoption raises significant ethical considerations that must be addressed by investors, regulators, and users alike. This article delves into the ethical implications of stablecoin usage, examining market trends, implementation strategies, risk factors, regulatory aspects, and future outlooks to provide a comprehensive analysis.

| Key Concept | Description/Impact |

|---|---|

| Value Stability | Stablecoins are designed to maintain a stable value relative to fiat currencies, which can help mitigate the volatility associated with other cryptocurrencies. |

| Transparency and Trust | The ethical obligation for issuers to provide transparent information regarding reserves and backing assets is crucial for maintaining user trust. |

| Regulatory Compliance | Stablecoins must navigate complex regulatory landscapes to ensure compliance, which raises ethical questions about evading regulations or exploiting loopholes. |

| Financial Inclusion | Stablecoins can enhance financial inclusion by providing access to financial services for unbanked populations, but this potential must be balanced against risks of exploitation. |

| Environmental Impact | The energy consumption associated with blockchain technology raises ethical concerns regarding sustainability and environmental responsibility. |

| Market Manipulation Risks | The potential for market manipulation through the issuance and redemption of stablecoins poses ethical challenges for maintaining fair market practices. |

| User Security and Fraud Risks | Ensuring user security against fraud and cyber threats is an ethical imperative for stablecoin platforms to protect users’ investments. |

| Tax Evasion Concerns | The use of stablecoins for tax evasion raises ethical questions about compliance with tax laws and the broader implications for public finance. |

Market Analysis and Trends

The stablecoin market has witnessed significant growth, with the total market capitalization reaching approximately $171.63 billion by August 2024. This represents a resurgence following the decline experienced during the collapse of algorithmic stablecoins like Terra’s UST in 2022. The leading stablecoins—Tether (USDT), USD Coin (USDC), and DAI—account for over 94% of this market share.

Key trends include:

- Increased Adoption: Stablecoins are being increasingly integrated into payment systems, particularly for cross-border transactions, reducing costs and enhancing transaction speed.

- Diverse Backing Assets: Beyond fiat currencies, stablecoins are now backed by various assets including gold and stocks, reflecting a diversification strategy among issuers.

- Regulatory Developments: Stricter regulations are emerging globally as governments seek to address risks associated with stablecoin usage while fostering innovation.

Implementation Strategies

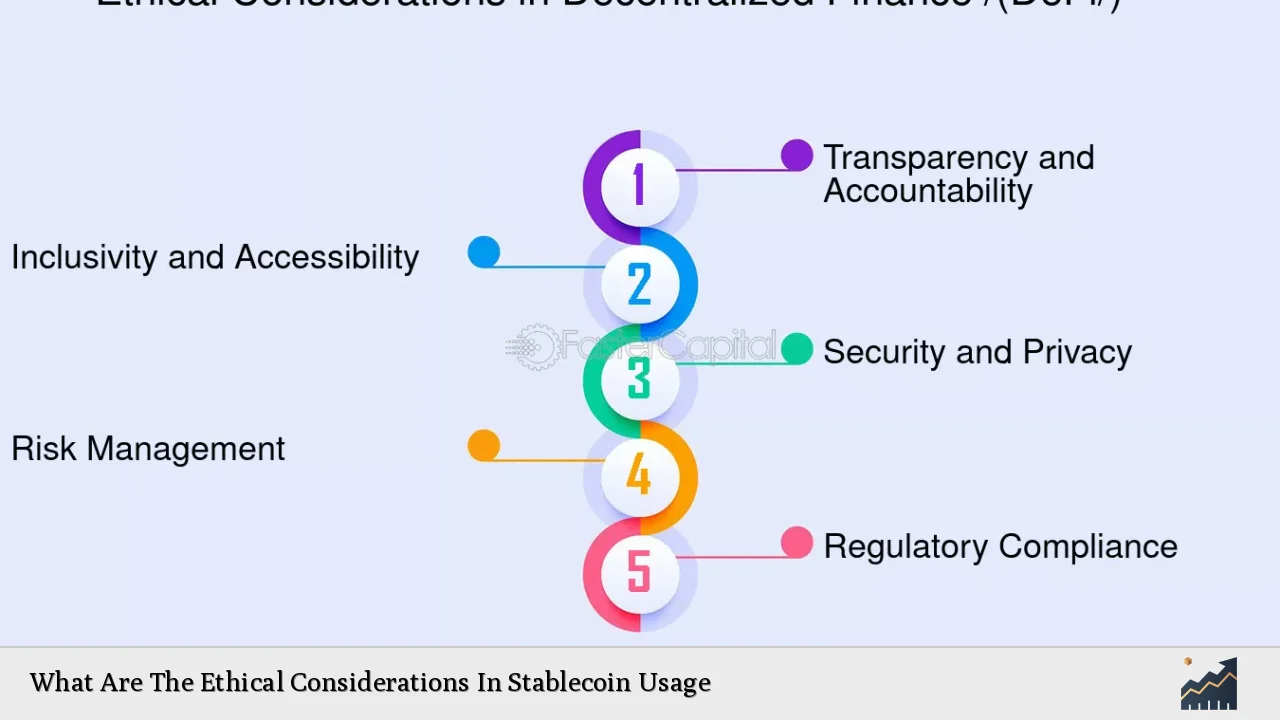

To ethically implement stablecoin solutions, stakeholders should consider the following strategies:

- Establish Clear Governance Frameworks: Issuers must develop robust governance frameworks that ensure transparency in reserve management and compliance with regulatory standards.

- Enhance User Education: Providing educational resources to users about the risks and benefits of stablecoin usage can empower informed decision-making.

- Integrate Security Measures: Implementing advanced cybersecurity protocols is essential to protect users from fraud and hacking attempts.

- Promote Financial Inclusion Initiatives: Collaborating with NGOs and financial institutions can help leverage stablecoin technology to improve access for unbanked populations.

Risk Considerations

While stablecoins offer numerous benefits, several ethical risks must be acknowledged:

- Market Volatility: Although designed for stability, external economic factors can still lead to fluctuations in value that impact users unpredictably.

- Regulatory Risks: The evolving regulatory landscape poses challenges for compliance, which can lead to ethical dilemmas if companies attempt to circumvent regulations.

- Reputation Risks: Any failure in transparency or security can severely damage an issuer’s reputation, leading to loss of user trust.

- Exploitation by Bad Actors: The anonymity features of some stablecoins may attract illicit activities such as money laundering or tax evasion.

Regulatory Aspects

Regulatory bodies worldwide are increasingly scrutinizing stablecoins due to their potential impact on financial stability. Key considerations include:

- Comprehensive Regulatory Frameworks: There is a call for global standards that address risks associated with stablecoin issuance and use while promoting innovation.

- Consumer Protection Measures: Regulations must ensure that users are protected from fraud and that they have clear avenues for recourse in case of issues.

- Cross-Border Coordination: Given the global nature of cryptocurrency markets, international cooperation is essential to prevent regulatory arbitrage.

Future Outlook

The future of stablecoins appears promising but requires careful navigation of ethical considerations:

- Technological Advancements: Innovations such as Central Bank Digital Currencies (CBDCs) may influence how stablecoins operate within the broader financial ecosystem.

- Increased Regulatory Clarity: As regulations become clearer, issuers may find it easier to operate within legal frameworks while maintaining ethical standards.

- Focus on Sustainability: The industry may need to address environmental concerns associated with blockchain technology through more sustainable practices.

Frequently Asked Questions About What Are The Ethical Considerations In Stablecoin Usage

- What are the main ethical concerns regarding stablecoin usage?

Key concerns include transparency in reserves, regulatory compliance, market manipulation risks, user security, and potential exploitation for tax evasion. - How do stablecoins promote financial inclusion?

Stablecoins can provide access to financial services for unbanked populations by enabling low-cost transactions and savings mechanisms without traditional banking barriers. - What role do regulations play in ensuring ethical use of stablecoins?

Regulations help establish standards for transparency, consumer protection, and accountability among issuers to mitigate risks associated with stablecoin usage. - Can stablecoins be used ethically?

Yes, if issuers adhere to transparent practices, comply with regulations, prioritize user security, and actively work against exploitation. - What measures can users take to protect themselves when using stablecoins?

Users should conduct thorough research on issuers, utilize secure wallets, enable two-factor authentication, and stay informed about regulatory changes affecting their investments. - Are there any environmental concerns linked to stablecoins?

The energy consumption associated with blockchain networks used by some stablecoins raises ethical questions about sustainability and environmental impact. - How do market fluctuations affect the ethics of using stablecoins?

While designed for stability, external economic conditions can lead to value fluctuations that challenge the ethical obligation of issuers to maintain consistent value. - What is the future outlook for ethical considerations in the stablecoin market?

The future will likely see increased regulatory clarity and technological advancements that could enhance ethical practices within the industry while addressing emerging challenges.

In conclusion, while stablecoins present unique opportunities within the financial ecosystem, they also pose significant ethical challenges that require careful consideration from all stakeholders involved. Addressing these concerns proactively will be essential in fostering a responsible and sustainable future for digital currencies.