Decentralized Finance (DeFi) represents a significant shift in the financial landscape, utilizing blockchain technology to provide financial services without intermediaries. While DeFi offers numerous benefits, including increased accessibility and transparency, it also raises substantial environmental concerns. This article explores the environmental impacts of DeFi, analyzing market trends, implementation strategies, risks, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

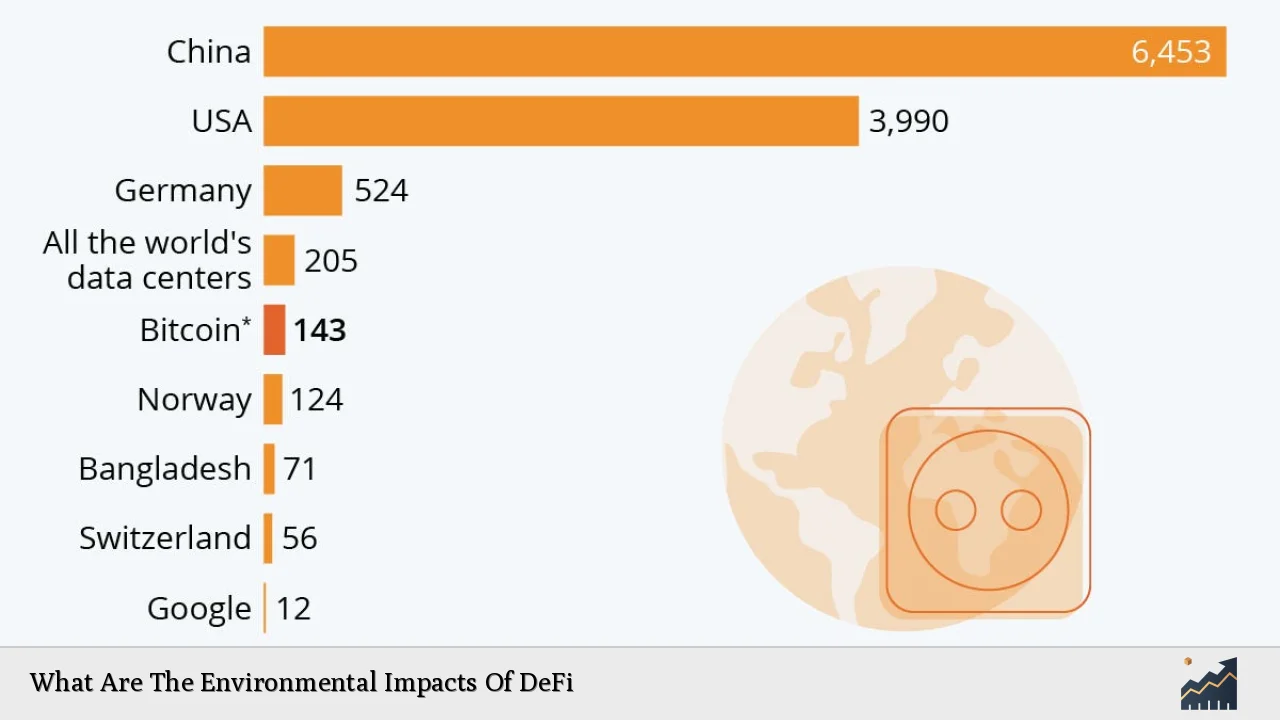

| Energy Consumption | Many DeFi platforms utilize energy-intensive Proof-of-Work (PoW) consensus mechanisms that contribute significantly to carbon emissions. |

| Carbon Footprint | DeFi activities can generate substantial carbon emissions, comparable to those from traditional industries, raising concerns about their overall sustainability. |

| Renewable Energy Use | Some DeFi projects are exploring the use of renewable energy sources to mitigate their environmental impact. |

| Tokenization of Carbon Credits | DeFi can facilitate carbon credit trading through tokenization, promoting transparency and accessibility in emissions reduction efforts. |

| Consensus Mechanism Transition | The shift from PoW to Proof-of-Stake (PoS) mechanisms is crucial for reducing energy consumption and enhancing sustainability in DeFi. |

| Regulatory Challenges | The lack of clear regulations can hinder the adoption of sustainable practices within the DeFi space. |

| Sustainable Finance Initiatives | Emerging projects aim to integrate Environmental, Social, and Governance (ESG) principles into DeFi protocols to promote responsible finance. |

Market Analysis and Trends

The DeFi market has experienced rapid growth, with total value locked (TVL) in DeFi protocols reaching approximately $40 billion in late 2023. However, this growth has been accompanied by increasing scrutiny regarding its environmental footprint.

Current Market Statistics

- Energy Consumption: Mining cryptocurrencies associated with DeFi generates between 25 to 50 megatons of CO2 annually in the U.S. alone.

- Projected Growth: The global DeFi market is expected to reach $418.7 million by 2024 but may face challenges due to regulatory uncertainties and environmental concerns.

Key Trends

- Shift to PoS: Major platforms like Ethereum have transitioned from PoW to PoS, significantly reducing their energy consumption and carbon footprint.

- Tokenization of Carbon Credits: Platforms are emerging that focus on trading carbon credits using blockchain technology, enhancing transparency and accountability.

Implementation Strategies

To mitigate the environmental impacts of DeFi, several strategies can be adopted:

- Adopting Energy-Efficient Consensus Mechanisms: Transitioning from PoW to PoS or other less energy-intensive mechanisms is essential for reducing the carbon footprint of blockchain networks.

- Utilizing Renewable Energy: Encouraging DeFi projects to source energy from renewable sources can help offset their environmental impact.

- Carbon Credit Trading: Implementing systems that allow for the tokenization of carbon credits can facilitate more efficient trading and accountability.

Risk Considerations

While there are opportunities for sustainable practices within DeFi, several risks must be considered:

- High Energy Consumption: The reliance on PoW systems leads to significant energy use and associated carbon emissions.

- Market Volatility: The nascent nature of DeFi markets can lead to instability, affecting investments in sustainable initiatives.

- Regulatory Risks: Uncertainty surrounding regulations may deter investment in environmentally friendly practices within the sector.

Regulatory Aspects

The regulatory landscape for DeFi is still evolving. Key considerations include:

- Need for Clear Guidelines: Establishing regulations that promote sustainable practices while ensuring consumer protection is vital for the growth of eco-friendly DeFi solutions.

- Incorporating ESG Principles: Regulators should encourage the integration of ESG factors into DeFi operations to foster responsible finance.

- Global Cooperation: International collaboration is necessary to address the cross-border nature of cryptocurrencies and ensure consistent regulatory approaches.

Future Outlook

The future of DeFi will likely hinge on its ability to address environmental concerns effectively. Key predictions include:

- Increased Adoption of Sustainable Practices: As awareness grows about the environmental impacts of blockchain technology, more projects will prioritize sustainability.

- Technological Innovations: Advances in blockchain technology may lead to more efficient systems that reduce energy consumption without compromising security or decentralization.

- Greater Regulatory Clarity: As governments and regulatory bodies develop clearer frameworks for cryptocurrencies and DeFi, it will encourage investment in sustainable initiatives.

Frequently Asked Questions About Environmental Impacts Of DeFi

- What is the primary environmental concern associated with DeFi?

The primary concern is the high energy consumption linked to Proof-of-Work consensus mechanisms used by many blockchain networks. - How does transitioning to Proof-of-Stake reduce environmental impact?

Proof-of-Stake eliminates the need for energy-intensive mining processes, significantly lowering carbon emissions associated with transaction validation. - Can DeFi contribute positively to environmental sustainability?

Yes, through initiatives like tokenizing carbon credits and promoting renewable energy usage within blockchain operations. - What role do regulations play in promoting sustainable practices in DeFi?

Regulations can establish guidelines that encourage environmentally responsible practices while ensuring consumer protection. - How significant is the carbon footprint of cryptocurrency mining?

Cryptocurrency mining contributes an estimated 25-50 megatons of CO2 annually in the U.S., comparable to emissions from traditional industries. - What are some examples of sustainable finance initiatives within DeFi?

Projects like CarbonSwap focus on offsetting carbon emissions through decentralized exchanges that prioritize sustainability. - Is there a market demand for environmentally friendly DeFi solutions?

The growing awareness of climate change has led to increased demand for sustainable financial products among consumers and investors alike. - What technological advancements could improve the sustainability of DeFi?

Innovations such as layer-2 solutions and improved consensus algorithms could enhance efficiency while reducing environmental impact.

As Decentralized Finance continues to evolve, addressing its environmental impacts will be crucial for its long-term viability. By prioritizing sustainable practices and fostering regulatory clarity, stakeholders can work towards a greener future in finance.