Cryptocurrency mining, particularly for Bitcoin and other proof-of-work cryptocurrencies, has garnered significant attention due to its substantial environmental consequences. As the demand for digital currencies continues to rise, so does the energy consumption associated with their mining. This process not only consumes vast amounts of electricity but also contributes significantly to greenhouse gas emissions, electronic waste, and other environmental issues. Understanding these impacts is crucial for investors, policymakers, and the general public as they navigate the complexities of the cryptocurrency landscape.

| Key Concept | Description/Impact |

|---|---|

| Energy Consumption | Cryptocurrency mining consumes an estimated 150 terawatt-hours (TWh) of electricity annually, comparable to the energy use of entire countries like Argentina. |

| Carbon Emissions | Bitcoin mining alone is responsible for approximately 68 million metric tons of CO2 emissions per year, equivalent to the annual emissions of Singapore. |

| Electronic Waste | The average lifespan of mining hardware is about 1.3 years, leading to significant electronic waste that is often not recycled properly. |

| Water Usage | Cooling systems for mining operations require substantial water resources, potentially straining local water supplies. |

| Health Impacts | Communities near mining operations report health issues linked to air pollution and noise from mining activities. |

| Renewable Energy Potential | While 39% of Bitcoin mining is powered by renewable energy sources, a significant portion still relies on fossil fuels, highlighting the need for a transition to greener practices. |

Market Analysis and Trends

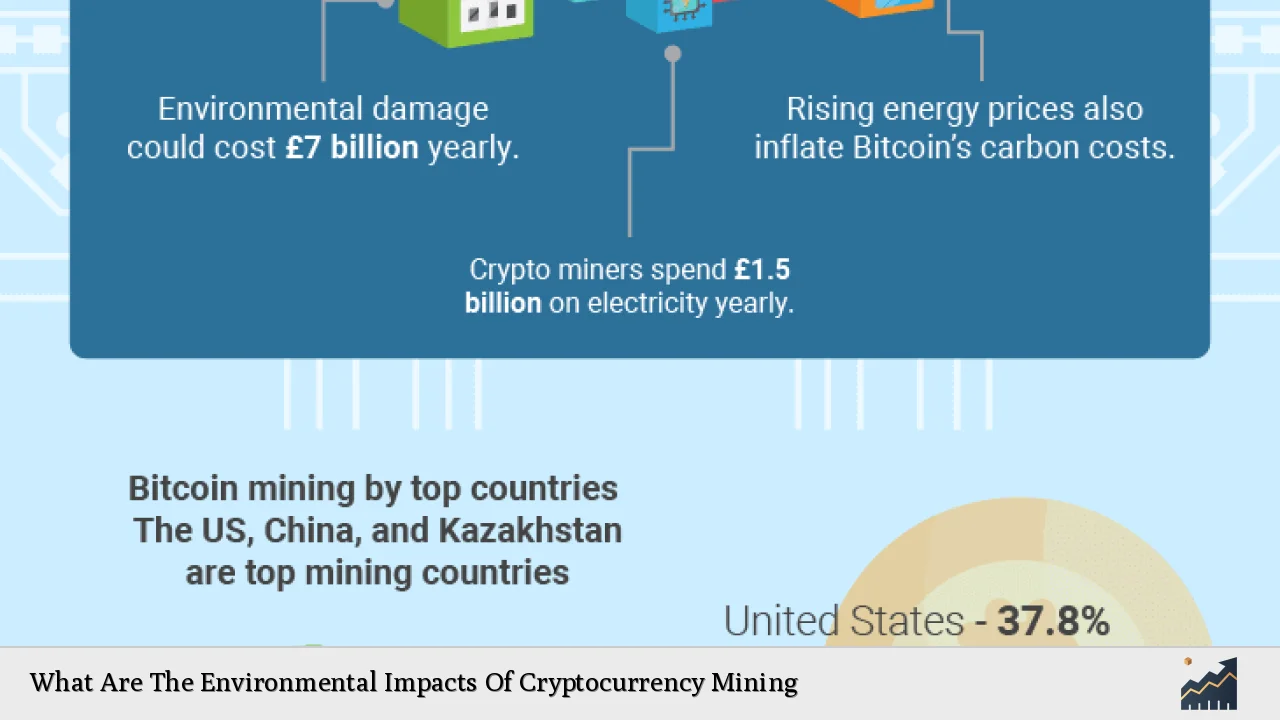

The cryptocurrency market has experienced explosive growth over the past decade, with Bitcoin leading the charge. As of late 2024, Bitcoin’s market capitalization hovers around $450 billion, reflecting its dominance in the digital currency space. However, this growth comes at a cost; the environmental implications of mining operations are increasingly scrutinized by investors and regulators alike.

Recent studies indicate that Bitcoin mining consumes more electricity than some countries, with estimates suggesting it uses about 0.4% of global electricity consumption. This trend raises concerns about sustainability and climate change as cryptocurrencies become more mainstream.

The shift towards renewable energy in cryptocurrency mining is gaining traction. Reports show that while fossil fuels dominate energy sources for mining (67% as of 2021), there is a growing movement towards utilizing surplus renewable energy from wind and solar farms. This transition could mitigate some environmental impacts while promoting sustainable practices within the industry.

Implementation Strategies

To address the environmental challenges posed by cryptocurrency mining, several strategies can be employed:

- Transition to Renewable Energy: Miners can invest in renewable energy sources such as solar or wind power. This shift not only reduces carbon emissions but also stabilizes energy costs in the long run.

- Adoption of Less Energy-Intensive Protocols: Cryptocurrencies like Ethereum have transitioned to proof-of-stake mechanisms, which consume significantly less energy compared to traditional proof-of-work systems.

- Enhanced Regulatory Frameworks: Governments can implement regulations that incentivize sustainable practices in cryptocurrency mining. This includes carbon taxes or subsidies for using renewable energy.

- Community Engagement: Miners should engage with local communities to address concerns related to health and environmental impacts. Transparency in operations can build trust and promote responsible practices.

Risk Considerations

Investors must consider several risks associated with the environmental impacts of cryptocurrency mining:

- Regulatory Risks: As governments worldwide become more aware of the environmental consequences of cryptocurrency mining, stricter regulations may be enacted. This could affect the profitability of mining operations and lead to increased compliance costs.

- Reputational Risks: Companies involved in cryptocurrency mining may face backlash from consumers and investors concerned about sustainability practices. Poor environmental performance can damage a company’s reputation and impact its market value.

- Market Volatility: The cryptocurrency market is notoriously volatile. Environmental concerns could lead to shifts in investor sentiment, impacting prices and market stability.

Regulatory Aspects

Regulatory bodies are increasingly scrutinizing cryptocurrency mining due to its environmental footprint. In recent years:

- New York State has denied air permits for certain Bitcoin mining operations due to their substantial greenhouse gas emissions, setting a precedent for future regulatory actions.

- The European Union is considering implementing stricter regulations on cryptocurrencies, particularly focusing on their environmental impacts.

- Various countries are exploring carbon taxes specifically targeting cryptocurrency miners to encourage greener practices.

These regulatory developments highlight the growing recognition of the need for sustainable practices within the cryptocurrency industry.

Future Outlook

The future of cryptocurrency mining will likely be shaped by technological advancements and regulatory pressures aimed at reducing its environmental impact. Key trends include:

- Increased Use of Renewable Energy: As renewable technologies become more affordable and accessible, a larger share of cryptocurrency mining operations may transition away from fossil fuels.

- Technological Innovations: Advances in blockchain technology may lead to more energy-efficient consensus mechanisms that reduce overall energy consumption.

- Greater Accountability: Investors are demanding transparency regarding the environmental impact of their investments. Companies that fail to adopt sustainable practices may face challenges attracting investment.

- Global Collaborations: International cooperation may emerge to establish standards and best practices for sustainable cryptocurrency mining globally.

Frequently Asked Questions About What Are The Environmental Impacts Of Cryptocurrency Mining

- What is cryptocurrency mining?

Cryptocurrency mining is the process by which transactions are verified and added to a blockchain ledger. It typically involves solving complex mathematical problems using powerful computers. - How much energy does Bitcoin mining consume?

Bitcoin mining consumes approximately 150 TWh annually, which is more than some countries’ total energy consumption. - What are the main environmental impacts of cryptocurrency mining?

The primary impacts include high carbon emissions, significant electricity consumption, electronic waste generation, and water usage for cooling systems. - Can cryptocurrency mining be sustainable?

Yes, transitioning to renewable energy sources and adopting less energy-intensive protocols can make cryptocurrency mining more sustainable. - What role do regulations play in mitigating environmental impacts?

Regulations can enforce standards that promote sustainable practices within the industry and incentivize miners to adopt greener technologies. - How does Bitcoin’s carbon footprint compare to other industries?

The carbon footprint from Bitcoin mining is comparable to major polluting industries like beef production and crude oil extraction. - What are some potential health impacts associated with crypto mining?

Communities near crypto-mining operations may experience health issues related to air pollution from emissions and noise pollution from machinery. - What steps can investors take regarding environmentally friendly cryptocurrencies?

Investors can prioritize cryptocurrencies that utilize proof-of-stake mechanisms or those that demonstrate commitments to sustainability through renewable energy use.

In conclusion, while cryptocurrency offers innovative financial opportunities, its environmental impacts cannot be overlooked. Investors must be aware of these challenges as they navigate this evolving landscape. Sustainable practices will be essential for ensuring that cryptocurrencies contribute positively rather than detrimentally to our planet’s future.