The Asian stock market is currently experiencing a dynamic transformation influenced by various macroeconomic factors, technological advancements, and shifting investor sentiments. As global economies recover from the pandemic, Asian markets are becoming increasingly attractive to both local and international investors. This article explores the emerging trends in the Asian stock market, providing a comprehensive analysis of current market conditions, implementation strategies for investors, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| AI and Technology Sector Growth | The rise of artificial intelligence (AI) has significantly boosted technology stocks in Asia, particularly in Taiwan and Japan. Companies like Taiwan Semiconductor Manufacturing Corp have seen substantial gains due to increased demand for AI-related products. |

| China's Economic Recovery | China's stock market has rebounded as government measures to support economic growth take effect. The MSCI China index has shown a notable increase, driven by improved investor sentiment and government policies. |

| India's Manufacturing Sector | India continues to attract investments in its manufacturing sector, supported by government initiatives aimed at enhancing production capabilities. This trend is expected to bolster the Indian stock market in the long term. |

| Monetary Policy Influences | The monetary policies of major central banks, particularly the U.S. Federal Reserve, are impacting Asian markets. Anticipated rate cuts in the U.S. are expected to increase risk appetite among Asian investors. |

| Regulatory Changes | Regulatory updates across Asia are focusing on enhancing market transparency and investor protection, which may lead to increased foreign investment in regional markets. |

| Sustainability Investments | There is a growing trend towards sustainable and responsible investing in Asia, with more funds being allocated to green technologies and sustainable practices. |

Market Analysis and Trends

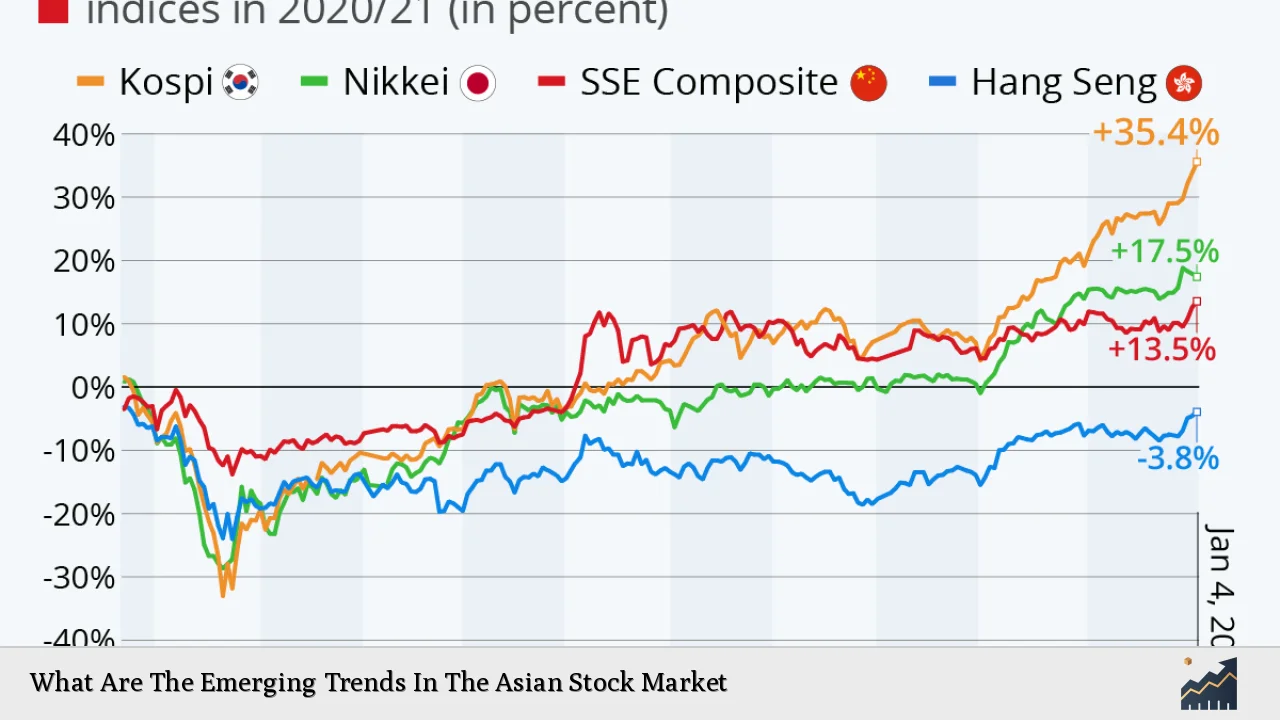

Emerging trends in the Asian stock market reflect a complex interplay of local economic conditions and global influences. Key observations include:

- AI and Technology Sector Growth: The first half of 2024 has seen Taiwan emerge as a leader in the Asia-Pacific stock market, primarily due to its robust technology sector driven by AI optimism. The Taiwan Weighted Index surged by 28%, with major companies like TSMC experiencing significant stock price increases. Japan's Nikkei 225 also reached all-time highs with an 18% gain during this period.

- China's Economic Recovery: After a challenging 2023 marked by economic headwinds, China's stock market has rebounded sharply. The MSCI China index reported a 13.6% increase over three months as domestic positioning improved and government support bolstered investor confidence. However, challenges remain in sectors like real estate that require careful monitoring.

- India's Manufacturing Sector: India has positioned itself as an attractive destination for manufacturing investments. The government's initiatives to boost production capabilities have led to positive earnings growth forecasts for Indian equities, although recent election results have created some volatility.

- Monetary Policy Influences: Central banks across Asia are closely watching U.S. monetary policy shifts. The Fed's anticipated rate cuts are expected to enhance liquidity and risk appetite in Asian markets.

- Regulatory Changes: Regulatory bodies across Asia are implementing new frameworks aimed at improving market integrity and investor protection. For instance, Indonesia has introduced regulations for margin financing that emphasize risk management practices.

- Sustainability Investments: There is a marked shift towards sustainable investing in Asia, with increasing allocations towards green technologies and renewable energy projects as investors become more conscious of environmental impacts.

Implementation Strategies

Investors looking to capitalize on these trends can consider various strategies:

- Diversification Across Sectors: Given the volatility in specific markets like China and India, diversifying investments across different sectors (technology, manufacturing, renewable energy) can mitigate risks while capturing growth.

- Focus on AI-Driven Stocks: With technology stocks leading the charge in many Asian markets, focusing on companies involved in AI development can provide significant upside potential.

- Monitor Regulatory Changes: Keeping abreast of regulatory developments can help investors identify emerging opportunities or risks associated with compliance requirements.

- Sustainable Investment Practices: Incorporating environmental, social, and governance (ESG) criteria into investment decisions can not only align with global trends but also attract capital from ESG-focused funds.

Risk Considerations

Investing in the Asian stock market comes with inherent risks that must be managed:

- Market Volatility: Rapid changes in investor sentiment can lead to significant price fluctuations. Investors should be prepared for short-term volatility while maintaining a long-term perspective.

- Geopolitical Risks: Tensions between countries can impact market stability. Investors should consider geopolitical developments when making investment decisions.

- Economic Slowdowns: Potential economic slowdowns in major economies like China could adversely affect regional markets. Continuous monitoring of economic indicators is crucial.

- Regulatory Risks: Changes in regulations can impact profitability for certain sectors or companies. Investors should stay informed about regulatory environments in their target markets.

Regulatory Aspects

The regulatory landscape across Asia is evolving to enhance transparency and protect investors:

- Enhanced Regulations: Countries like India and Indonesia are updating their financial regulations to improve market integrity and investor confidence. For example, India's SEBI has revised guidelines for alternative investment funds to enhance due diligence practices.

- Focus on Risk Management: Regulatory bodies are emphasizing risk management frameworks for financial institutions to ensure stability within the markets.

- Sustainability Regulations: Governments are increasingly implementing regulations that promote sustainable business practices, which could affect investment strategies moving forward.

Future Outlook

Looking ahead, several factors will shape the future of the Asian stock market:

- Continued Growth of Technology Stocks: As AI technology continues to evolve and expand into various sectors, technology stocks are likely to remain at the forefront of market growth.

- China's Long-Term Recovery Path: While recent gains are promising, China's long-term recovery will depend on effective management of its real estate sector and overall economic reforms.

- India’s Manufacturing Potential: India's focus on boosting its manufacturing capabilities presents significant long-term investment opportunities as global supply chains adapt post-pandemic.

- Impact of Global Monetary Policies: The actions of central banks worldwide will continue to influence liquidity conditions in Asia. Investors should remain vigilant regarding changes in interest rates that could affect capital flows into the region.

Frequently Asked Questions About What Are The Emerging Trends In The Asian Stock Market

- What are the main drivers behind the recent growth in Asian stock markets?

Key drivers include advancements in technology (especially AI), government support for economic recovery in China, and strong performance from India's manufacturing sector. - How should investors approach investing in volatile markets?

Diversification across sectors and maintaining a long-term investment horizon can help mitigate risks associated with volatility. - What role do central banks play in shaping market trends?

Central banks influence liquidity conditions through monetary policy decisions; anticipated rate cuts from major banks can boost investor confidence and risk appetite. - Are there specific sectors that show more promise than others?

The technology sector, particularly AI-related stocks, along with renewable energy investments show significant promise due to current trends. - How do regulatory changes affect investment strategies?

Investors must adapt their strategies based on new regulations that impact market dynamics; staying informed about these changes is essential. - What risks should investors be aware of when investing in Asia?

Investors should be cautious of market volatility, geopolitical tensions, economic slowdowns, and regulatory changes that could impact their investments. - What is the outlook for sustainable investing in Asia?

The trend towards sustainability is growing rapidly; investors focusing on ESG criteria may benefit from increased capital flows into sustainable projects. - How does geopolitical tension affect Asian markets?

Tensions between countries can create uncertainty leading to volatility; investors should monitor geopolitical developments closely when making decisions.

In summary, the Asian stock market presents numerous opportunities driven by technological advancements and supportive government policies. However, investors must navigate various risks while adapting their strategies according to evolving market conditions and regulatory landscapes.