The Asian cryptocurrency markets are experiencing a remarkable transformation, characterized by rapid adoption, innovative technologies, and evolving regulatory landscapes. As the region embraces digital assets, several key trends are emerging that reflect both the unique cultural dynamics and the technological advancements shaping the future of finance. This article delves into these trends, providing a comprehensive analysis of market developments, implementation strategies, associated risks, regulatory considerations, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Rapid Adoption | The Asia-Pacific region leads globally in cryptocurrency adoption, with countries like Indonesia and India witnessing exponential growth in transactions and user engagement. |

| Institutional Investment | Institutional players are increasingly entering the cryptocurrency space, with funds being established to manage digital assets as part of broader investment strategies. |

| Regulatory Developments | Countries are establishing clearer regulatory frameworks to govern cryptocurrency operations, enhancing investor protection while fostering innovation. |

| Technological Innovation | Blockchain technology is being leveraged for various applications beyond currency, including supply chain management and decentralized finance (DeFi). |

| Demographic Shifts | A young demographic is driving crypto investments, particularly among individuals aged 18-39, who are more open to adopting new financial technologies. |

| Payment Solutions | Emerging payment systems integrating cryptocurrencies into everyday transactions are gaining traction, enhancing accessibility for merchants and consumers alike. |

| Market Volatility | The cryptocurrency market remains highly volatile, influenced by global economic conditions and regulatory news, which investors must navigate carefully. |

Market Analysis and Trends

The Asia-Pacific region has become a powerhouse for cryptocurrency activity. According to the 2024 Global Crypto Adoption Index, Central & Southern Asia and Oceania lead the world in crypto adoption, with significant activity observed in countries like Indonesia, India, and Thailand. For instance:

- Indonesia reported over $30 billion in cryptocurrency transactions from January to October 2024, marking a staggering 350% increase compared to the previous year. This surge is driven by a combination of high smartphone penetration and a growing interest in digital assets among younger generations.

- India is also making strides in cryptocurrency adoption. The country has seen an influx of retail investors exploring various digital assets as traditional banking infrastructure remains less accessible.

Key Market Statistics

- Ownership Rates: As of 2024, approximately 6.8% of the global population owns cryptocurrencies, with over 560 million users worldwide.

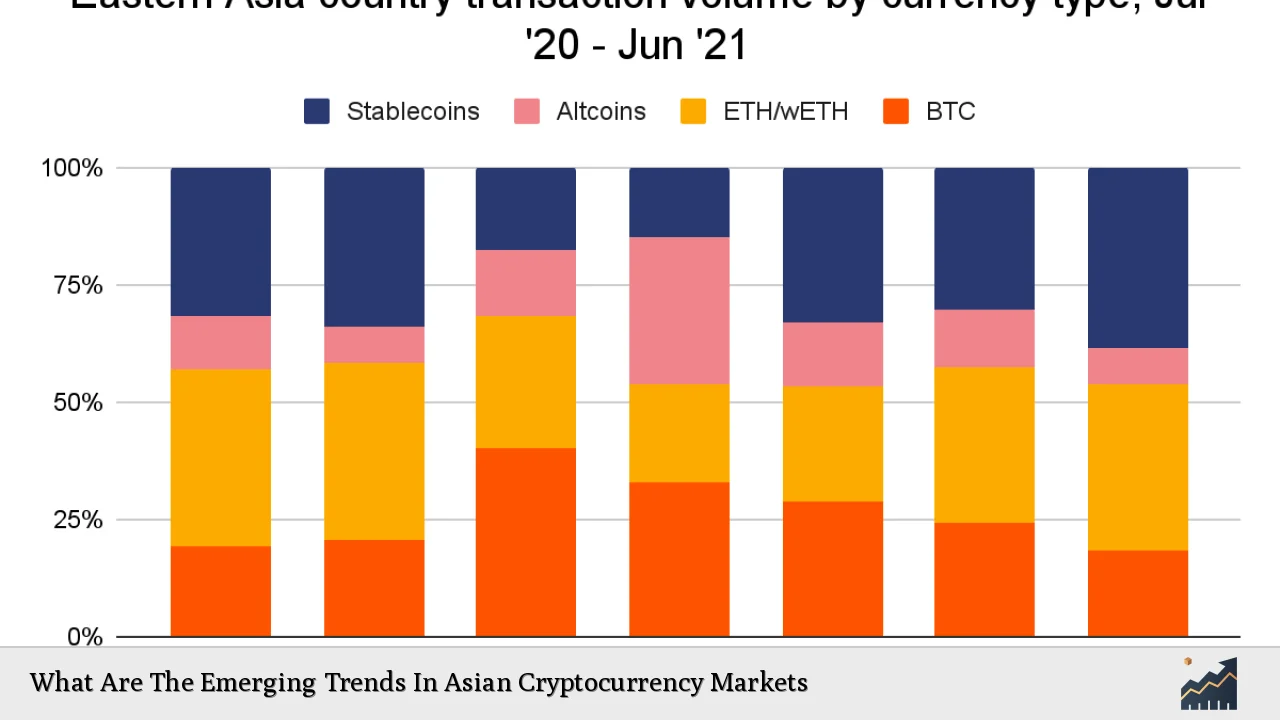

- Transaction Value: Eastern Asia accounts for around 8.9% of global cryptocurrency transaction value, with South Korea leading the region.

- Investment Growth: The compound annual growth rate (CAGR) for cryptocurrency ownership has reached an impressive 99%, far exceeding traditional payment methods.

These statistics underscore the robust growth trajectory of cryptocurrencies in Asia and highlight the region’s pivotal role in shaping global trends.

Implementation Strategies

Investors looking to capitalize on emerging trends in Asian cryptocurrency markets can adopt several strategies:

- Diversification: Investors should consider diversifying their portfolios across various cryptocurrencies to mitigate risk while maximizing potential returns.

- Education and Research: Staying informed about market developments and regulatory changes is crucial. Engaging with educational resources can help investors make informed decisions.

- Utilizing Technology: Leveraging trading platforms that offer advanced analytics and tools can provide investors with insights into market movements and trading opportunities.

- Institutional Partnerships: Collaborating with institutional investors or funds can provide access to larger capital pools and professional management expertise.

Risk Considerations

While the opportunities in Asian cryptocurrency markets are significant, they come with inherent risks:

- Market Volatility: Cryptocurrencies are known for their price volatility. Investors must be prepared for rapid fluctuations that can result in substantial gains or losses.

- Regulatory Risks: The evolving regulatory landscape poses challenges. Changes in government policies or regulations can impact market dynamics significantly.

- Security Concerns: Cybersecurity threats remain a concern for cryptocurrency exchanges and wallets. Investors should prioritize security measures to protect their assets.

- Lack of Consumer Protections: Unlike traditional financial systems, many regions lack comprehensive consumer protections for cryptocurrency investments.

Regulatory Aspects

Regulatory frameworks across Asia are evolving to keep pace with the rapid growth of cryptocurrencies. Notable developments include:

- Hong Kong’s Stablecoin Bill: In late 2024, Hong Kong introduced a draft bill aimed at regulating stablecoin issuers. This move aligns with global efforts to establish clearer guidelines for digital currencies.

- India’s Regulatory Framework: The Indian government is actively working on regulations that could provide clarity on taxation and compliance for cryptocurrency transactions.

- Southeast Asian Initiatives: Countries like Singapore are fostering innovation through supportive regulations while ensuring investor protection mechanisms are in place.

These regulatory advancements indicate a growing recognition of cryptocurrencies as legitimate financial instruments within Asia’s economic landscape.

Future Outlook

The future of Asian cryptocurrency markets appears promising:

- Continued Growth: As digital literacy increases and financial inclusion improves through cryptocurrencies, more individuals will likely engage with these assets.

- Technological Advancements: Innovations such as decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain applications will continue to evolve, attracting investment from various sectors.

- Institutional Adoption: More institutions are expected to diversify their portfolios by including cryptocurrencies as part of their asset management strategies.

- Global Influence: Asia’s leadership in crypto development may influence global standards and practices as other regions look to emulate its successes.

Frequently Asked Questions About Emerging Trends In Asian Cryptocurrency Markets

- What factors contribute to the rapid adoption of cryptocurrencies in Asia?

The combination of high smartphone penetration rates, a young demographic interested in technology, and an evolving financial landscape drives adoption. - How does regulation affect cryptocurrency investments?

Regulations can provide clarity and security for investors but may also impose restrictions that affect market dynamics. - What types of cryptocurrencies are most popular in Asia?

Bitcoin remains the most popular cryptocurrency; however, altcoins like Ethereum and local tokens also see significant trading volumes. - What risks should investors be aware of?

Investors should consider market volatility, regulatory changes, cybersecurity threats, and lack of consumer protections when investing. - How can investors stay informed about market trends?

Engaging with financial news platforms, attending webinars, and following industry experts on social media can help investors stay updated. - What role do institutions play in the crypto market?

Institutions provide liquidity and credibility to the market by investing large sums into cryptocurrencies and developing related financial products. - Are there any specific investment strategies recommended for new investors?

Diversification across different cryptocurrencies and continuous education about market trends are essential strategies for new investors. - What is the outlook for cryptocurrencies in Asia over the next five years?

The outlook is positive with expected growth driven by technological advancements and increasing acceptance among retail and institutional investors.

In conclusion, the Asian cryptocurrency markets are poised for significant growth driven by technological innovation, increasing adoption rates among younger demographics, supportive regulatory frameworks, and expanding institutional interest. Investors must navigate this dynamic landscape carefully while remaining informed about ongoing developments.