Government policies play a crucial role in shaping the dynamics of the stock market. These policies can influence investor sentiment, affect corporate profitability, and ultimately determine the overall performance of stock indices. Understanding the effects of government actions—ranging from fiscal and monetary policies to regulatory measures—can provide valuable insights for investors and finance professionals alike. This analysis delves into how various government policies impact the stock market, supported by current data and trends.

| Key Concept | Description/Impact |

|---|---|

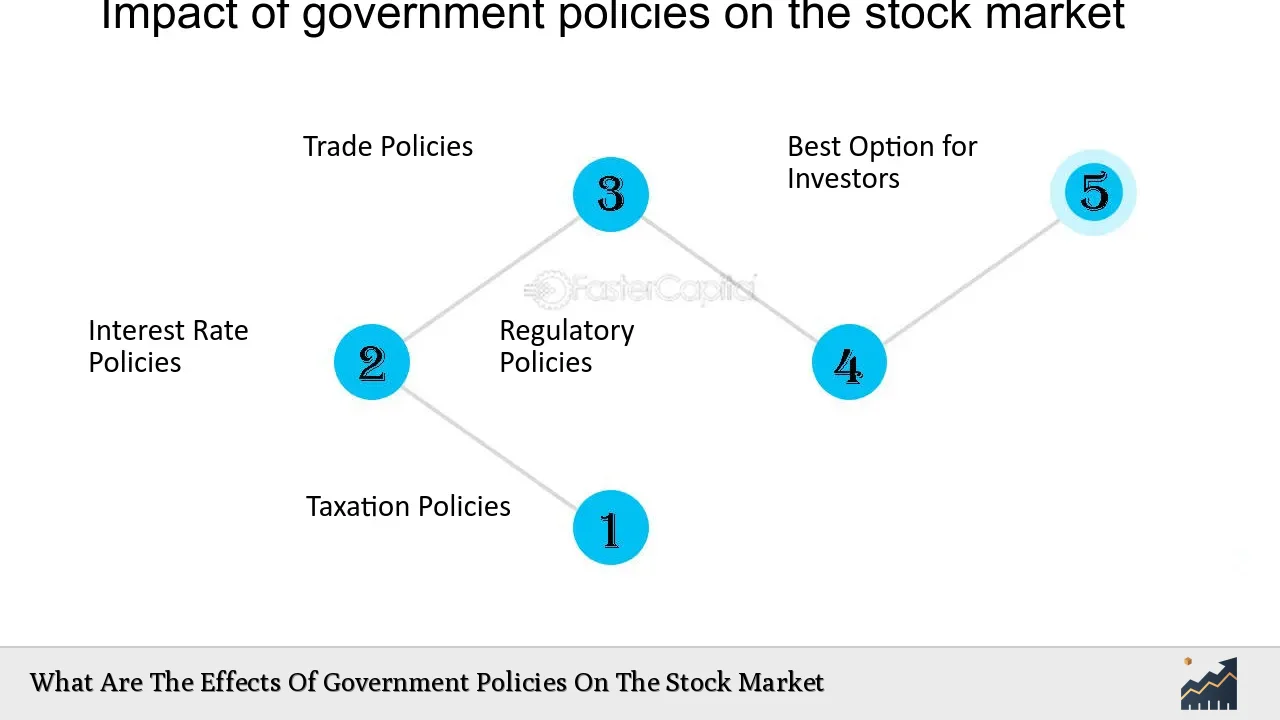

| Monetary Policy | Central banks, like the Federal Reserve, adjust interest rates to control inflation and stabilize the economy. Lowering rates typically boosts stock prices by making borrowing cheaper and increasing consumer spending. |

| Fiscal Policy | Government spending and tax policies directly influence economic growth. Expansionary fiscal policy (increased spending or tax cuts) can stimulate demand, leading to higher corporate earnings and stock prices. |

| Regulatory Environment | Regulations can either promote stability or create uncertainty in markets. For instance, stricter regulations can increase operational costs for companies but may enhance investor confidence in the long term. |

| Trade Policies | Tariffs and trade agreements can significantly impact specific sectors. For example, tariffs on imports can protect domestic industries but may lead to higher prices for consumers and retaliatory measures from other countries. |

| Political Stability | Political events, such as elections or changes in government, can lead to market volatility. Investors often react to perceived risks associated with political instability or uncertainty regarding future policies. |

| Economic Indicators | Government reports on employment, inflation, and GDP growth influence market expectations. Positive indicators typically boost investor confidence, while negative reports can lead to sell-offs. |

| Market Interventions | Direct government interventions, such as bailouts during financial crises, aim to stabilize markets but can also lead to moral hazard where companies take excessive risks expecting future bailouts. |

| Tax Policies | Changes in tax rates affect corporate profits and investor behavior. Higher taxes on capital gains may deter investment in stocks, while tax incentives can encourage investment in specific sectors. |

Market Analysis and Trends

The stock market is highly sensitive to government policies. Recent trends indicate that fiscal stimulus measures during economic downturns have historically led to significant market recoveries. For instance, during the COVID-19 pandemic, aggressive monetary easing by central banks worldwide resulted in a sharp rebound in stock prices after initial declines. The S&P 500 index dropped approximately 35% in March 2020 but rebounded by nearly 29% by June of the same year due to government interventions aimed at stabilizing the economy.

Current statistics reveal that as of December 2024, the S&P 500 has increased by approximately 27% since the beginning of the year, reflecting optimism around economic recovery and effective government policies. Additionally, small-cap stocks have outperformed large-cap stocks recently due to expectations that they will benefit more from pro-business policies introduced by new administrations.

Implementation Strategies

Investors should consider several strategies when navigating a market influenced by government policies:

- Diversification: Spread investments across various sectors to mitigate risks associated with specific policy changes.

- Monitoring Economic Indicators: Keep an eye on key economic indicators such as unemployment rates, inflation data, and GDP growth forecasts to gauge potential market movements.

- Understanding Regulatory Changes: Stay informed about new regulations that could impact specific industries or sectors.

- Long-term Perspective: Focus on long-term investment strategies rather than reacting impulsively to short-term policy announcements.

Risk Considerations

Investing in a market influenced by government actions carries inherent risks:

- Policy Uncertainty: Changes in administration or unexpected policy shifts can lead to volatility.

- Interest Rate Fluctuations: Sudden changes in interest rates can impact borrowing costs for companies and consumers alike.

- Market Reactions: The stock market often reacts irrationally to news; understanding this behavior is crucial for risk management.

- Global Factors: International trade policies and geopolitical events can also influence domestic markets.

Regulatory Aspects

Regulatory bodies like the Securities and Exchange Commission (SEC) play a vital role in maintaining market integrity. Regulations aimed at protecting investors can enhance confidence but may also impose additional costs on companies. For instance:

- The Sarbanes-Oxley Act introduced post-Enron scandals increased transparency requirements for public companies but also raised compliance costs.

- Stricter environmental regulations may lead companies to invest more in sustainable practices but could also affect their profitability in the short term.

Understanding these regulatory frameworks is essential for investors looking to navigate potential impacts on stock performance.

Future Outlook

Looking ahead, several factors will shape the relationship between government policies and the stock market:

- Continued Monetary Easing: If inflation remains under control, central banks may continue with gradual interest rate cuts, supporting equity markets.

- Infrastructure Spending: Increased government spending on infrastructure could benefit construction-related stocks and stimulate economic growth.

- Tax Reforms: Potential changes in tax legislation could significantly impact corporate earnings and investor behavior.

Investors should remain vigilant about upcoming elections and legislative sessions that could introduce significant policy changes affecting market dynamics.

Frequently Asked Questions About What Are The Effects Of Government Policies On The Stock Market

- How do interest rate changes affect stock prices?

Interest rate changes directly impact borrowing costs for companies; lower rates generally boost stock prices by increasing consumer spending and corporate profits. - What role do fiscal policies play in stock market performance?

Fiscal policies like government spending and tax cuts stimulate economic activity which can lead to higher corporate earnings and subsequently higher stock prices. - How do trade policies impact specific industries?

Trade policies such as tariffs can protect domestic industries from foreign competition but may also increase costs for consumers and disrupt supply chains. - What is the effect of political stability on the stock market?

Political stability fosters investor confidence; instability often leads to increased volatility as investors react to uncertainties regarding future policies. - How do regulations influence investor behavior?

Regulations designed to protect investors can enhance confidence in markets; however, excessive regulation may deter investment due to increased compliance costs. - What are some risks associated with investing based on government policy changes?

The primary risks include policy uncertainty, interest rate fluctuations, irrational market reactions, and global economic factors. - How should investors prepare for potential regulatory changes?

Investors should stay informed about proposed regulations that could impact their investments and consider diversifying their portfolios accordingly. - What indicators should investors monitor regarding government policy impacts?

Key indicators include unemployment rates, inflation data, GDP growth forecasts, and major legislative developments impacting fiscal or monetary policy.

The interplay between government policies and the stock market is complex yet vital for understanding investment landscapes. By staying informed about current trends and potential future developments, investors can better navigate this dynamic environment.