Orca (ORCA) is a decentralized exchange (DEX) token built on the Solana blockchain, designed for trading cryptocurrencies in a user-friendly environment. With its growing popularity in the decentralized finance (DeFi) space, understanding the various methods to store ORCA tokens is crucial for investors aiming to maximize security and accessibility. This article explores the different storage options available for ORCA tokens, providing insights into their benefits and risks.

| Key Concept | Description/Impact |

|---|---|

| Hot Wallets | Hot wallets are connected to the internet and provide quick access to funds. They are convenient for frequent trading but are more susceptible to hacks. |

| Cold Wallets | Cold wallets are offline storage solutions that offer enhanced security for long-term holdings. They include hardware wallets and paper wallets. |

| Exchanges’ Wallets | Wallets provided by exchanges allow users to store ORCA tokens directly on the platform. While convenient, they pose risks if the exchange is compromised. |

| Non-Custodial Wallets | These wallets give users full control over their private keys, enhancing security. Examples include software wallets like Trust Wallet and hardware wallets like Ledger. |

| Multi-Signature Wallets | These require multiple signatures to authorize transactions, adding an extra layer of security, especially for larger holdings. |

Market Analysis and Trends

The market for cryptocurrencies continues to evolve rapidly, with Orca emerging as a significant player in the DeFi sector. As of December 2024, ORCA’s price is approximately $5.24, with a market capitalization of around $490.57 million. The token has experienced significant volatility, peaking at an all-time high of $21.67 in October 2021 before undergoing substantial corrections.

Recent trends indicate a growing interest in decentralized exchanges due to their lower fees and user control compared to centralized platforms. Orca’s integration with Solana enhances its appeal by offering high transaction speeds and low costs, making it an attractive option for traders and investors alike.

Implementation Strategies

When considering how to store ORCA tokens, investors should evaluate their individual needs and risk tolerance. Here are some strategies:

- Hot Wallets: Ideal for active traders who require quick access to their funds. Examples include exchange wallets (like Binance or KuCoin) and software wallets (like Trust Wallet). However, users should be aware of the risks associated with keeping funds on exchanges.

- Cold Wallets: Recommended for long-term investors looking to secure their assets against potential hacks. Hardware wallets such as Ledger or Trezor offer robust security features, while paper wallets can be created offline but require careful handling.

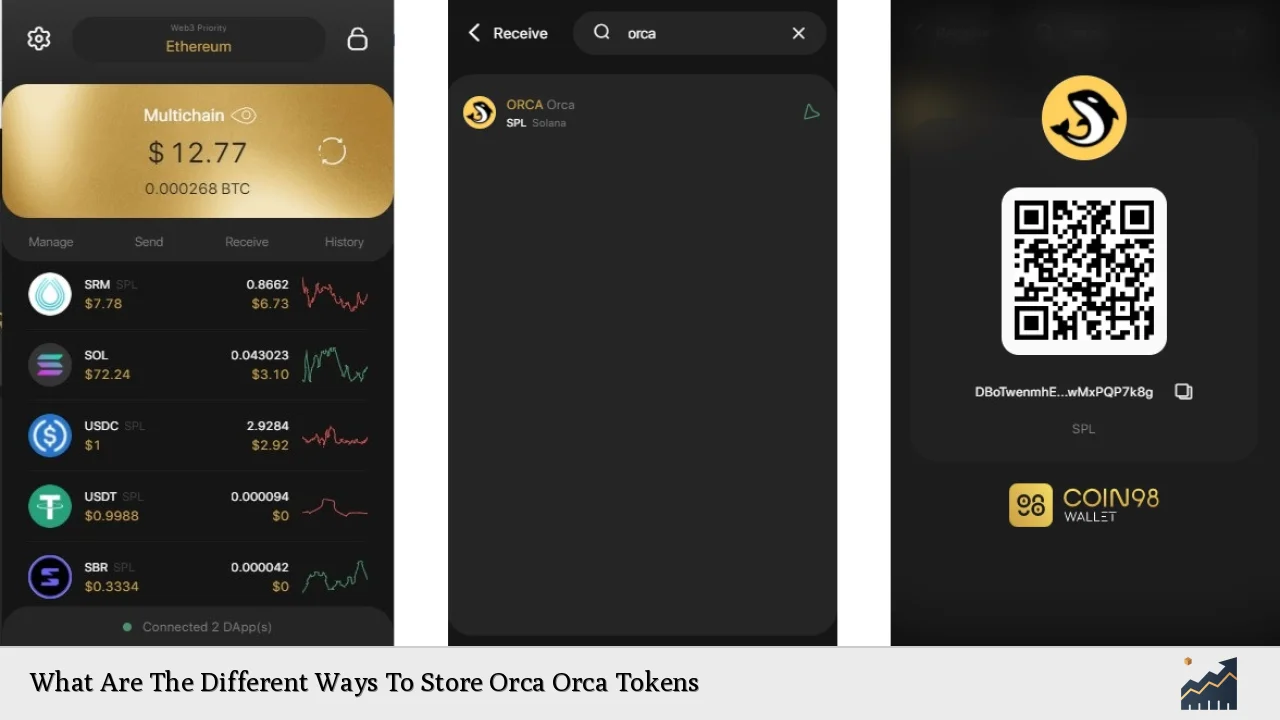

- Non-Custodial Wallets: These allow users full control over their private keys. Software options like Phantom or Sollet are popular among Orca users due to their compatibility with Solana-based tokens.

- Multi-Signature Wallets: For those managing larger amounts of ORCA or operating within a team, multi-signature wallets can provide additional security by requiring multiple approvals for transactions.

Risk Considerations

Storing ORCA tokens comes with inherent risks that investors must consider:

- Security Risks: Hot wallets are more vulnerable to cyberattacks due to their online nature. Users should implement strong security measures such as two-factor authentication and regular password updates.

- Exchange Risks: Storing tokens on exchanges exposes users to risks associated with hacking or insolvency of the exchange. It is advisable not to keep large amounts of cryptocurrency on exchanges long-term.

- Loss of Access: With non-custodial wallets, losing access to private keys can result in permanent loss of tokens. Investors should back up their keys securely.

Regulatory Aspects

The regulatory landscape surrounding cryptocurrencies continues to evolve globally. In many jurisdictions, holding and trading cryptocurrencies like ORCA may require compliance with local laws regarding taxation and reporting. Investors should stay informed about regulations that may affect their holdings or trading activities.

In the United States, for example, the SEC has indicated that certain cryptocurrencies may be classified as securities, which could impact how they are traded and stored. Investors should consult legal advice if unsure about their obligations under local laws.

Future Outlook

The future of Orca appears promising as decentralized finance continues to gain traction among investors seeking alternatives to traditional financial systems. Analysts predict that ORCA could see renewed growth in 2024, potentially reaching values around $10-$12 as institutional interest increases and technological advancements continue.

Investors should keep an eye on Orca’s developments within the DeFi space, especially regarding its liquidity pools and yield farming opportunities which enhance user engagement and reward participation.

Frequently Asked Questions About What Are The Different Ways To Store Orca Orca Tokens

- What is the safest way to store ORCA tokens?

The safest way is using a hardware wallet or a cold wallet since these options are offline and less susceptible to hacking. - Can I store ORCA tokens on exchanges?

Yes, you can store them on exchanges like Binance or KuCoin; however, this poses higher risks due to online vulnerabilities. - What are hot wallets?

Hot wallets are online storage solutions that allow easy access but come with increased security risks. - What are cold wallets?

Cold wallets are offline storage methods that offer enhanced security for long-term cryptocurrency holdings. - How do I create a paper wallet for ORCA?

A paper wallet can be created using an offline program that generates public and private keys which you then print out securely. - What is a multi-signature wallet?

A multi-signature wallet requires multiple private keys to authorize transactions, adding an extra layer of security. - Should I use a non-custodial wallet?

If you prioritize control over your private keys and enhanced security, a non-custodial wallet is recommended. - Are there any regulatory concerns when storing ORCA?

Yes, it’s essential to comply with local regulations regarding cryptocurrency holdings and trading.

In conclusion, understanding the various methods for storing Orca tokens is essential for any investor looking to secure their assets effectively while navigating the evolving landscape of decentralized finance. Each storage method has its advantages and disadvantages; therefore, careful consideration based on individual needs is crucial for optimal asset management.