Evaluating the performance of Pocket Network (POKT) requires an understanding of various metrics that reflect its operational efficiency, market position, and overall health as a decentralized protocol. Pocket Network serves as a decentralized API for blockchain applications, enabling developers to access data from multiple blockchains efficiently. The following metrics are crucial in assessing its performance:

| Key Concept | Description/Impact |

|---|---|

| Data Relays | The number of data relays serviced by the network is a primary metric. It indicates the volume of API requests processed, reflecting user engagement and network utilization. |

| Market Capitalization | Calculated by multiplying the current price of POKT by its circulating supply, this metric helps gauge the overall value and market position of Pocket Network. |

| Token Price Volatility | Monitoring fluctuations in POKT’s price over different time frames (24h, 7d, 30d) provides insights into market sentiment and investor confidence. |

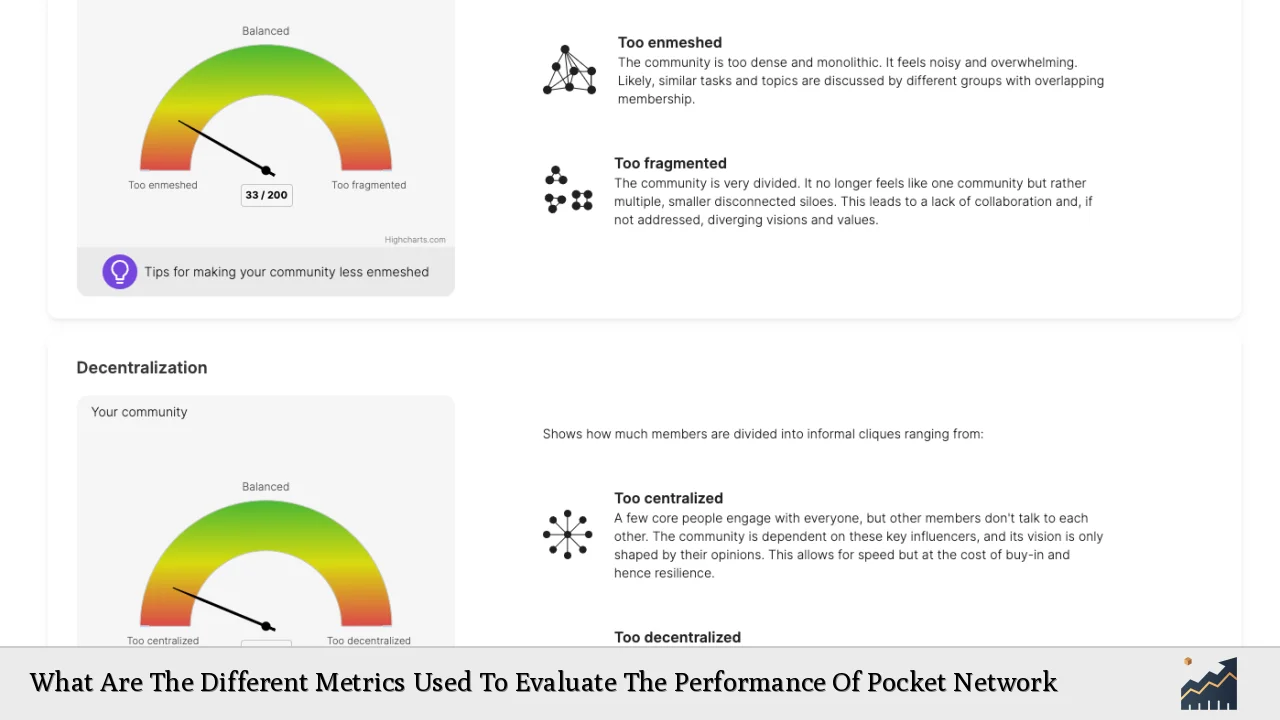

| Node Activity | The number of active nodes in the network is vital for assessing decentralization and reliability. A higher number of nodes typically indicates better service availability. |

| Revenue Generation | Pocket Network’s revenue from relays and staking rewards is a key indicator of its economic sustainability and growth potential. |

| Staking Metrics | The amount of POKT staked by node operators reflects their commitment to the network and can influence network security and performance. |

| Network Uptime | This metric measures the reliability of the service provided by Pocket Network, with higher uptime indicating better performance and user satisfaction. |

| Geographic Distribution of Nodes | The distribution of nodes across different regions can impact latency and service quality for users worldwide. |

| Chain Performance Metrics | Performance across different blockchains supported by Pocket Network helps identify which chains are most utilized and how well they perform within the ecosystem. |

| User Growth Rate | The rate at which new applications and developers are adopting Pocket Network indicates its market acceptance and future growth potential. |

Market Analysis and Trends

The cryptocurrency market is highly dynamic, with trends influenced by technological advancements, regulatory changes, and shifts in investor sentiment.

- Current Market Position: As of December 2024, Pocket Network has a market capitalization of approximately $85 million, with a circulating supply of 1.63 billion POKT tokens. The current price is around $0.05033, reflecting significant volatility in recent months.

- Growth in Data Relays: In 2021 alone, Pocket Network serviced over 13 billion relays, showcasing a remarkable increase in usage. This growth trend has continued into 2024, with analysts predicting further increases as more decentralized applications (dApps) seek reliable data access solutions.

- User Adoption: The network has seen a surge in developer interest due to its cost-effective solutions compared to traditional centralized APIs. This trend is expected to continue as blockchain technology becomes more mainstream.

Implementation Strategies

To leverage Pocket Network’s capabilities effectively, investors and developers should consider several strategies:

- Staking POKT: Node operators should stake their tokens to enhance their earning potential through relay rewards while contributing to network security.

- Monitoring Performance Metrics: Regularly analyzing metrics such as data relays and node activity can help operators optimize their operations and identify areas for improvement.

- Diversifying Applications: Developers should explore integrating multiple blockchains through Pocket Network to enhance their applications’ functionality and reach.

Risk Considerations

Investing in Pocket Network entails several risks:

- Market Volatility: The cryptocurrency market is known for its price fluctuations. Investors should be prepared for potential losses due to sudden market changes.

- Regulatory Risks: As governments around the world develop regulations for cryptocurrencies, there could be impacts on how Pocket Network operates or how its token is utilized.

- Technical Risks: As with any decentralized network, technical issues such as downtime or vulnerabilities can affect performance and user trust.

Regulatory Aspects

Understanding the regulatory landscape is crucial for both investors and developers involved with Pocket Network:

- Compliance Requirements: As a cryptocurrency project, Pocket Network must adhere to local regulations concerning digital assets. This includes KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols depending on jurisdiction.

- Impact on Token Utility: Regulatory changes can influence how POKT is used within the ecosystem, particularly regarding staking and rewards mechanisms.

Future Outlook

The future of Pocket Network appears promising based on current trends:

- Increased Adoption: With more developers seeking decentralized solutions for data access, demand for Pocket Network’s services is likely to grow.

- Technological Advancements: Continuous improvements in blockchain technology will enhance the efficiency and scalability of networks like Pocket.

- Market Expansion: As more blockchains integrate with Pocket Network, its utility will increase, potentially driving up demand for POKT tokens.

Frequently Asked Questions About What Are The Different Metrics Used To Evaluate The Performance Of Pocket Network

- What are data relays in Pocket Network?

Data relays refer to API requests processed by the network. They are a key performance metric indicating how much traffic the network handles. - How is market capitalization calculated?

Market capitalization is calculated by multiplying the current price of POKT by its circulating supply. - What does staking mean?

Staking involves locking up POKT tokens to support network operations while earning rewards based on the amount staked. - Why is node activity important?

A higher number of active nodes enhances network reliability and decentralization, crucial for maintaining service quality. - What risks should investors consider?

Investors should be aware of market volatility, regulatory changes, and potential technical issues affecting network performance. - How can I monitor my investment in Pocket Network?

You can track metrics such as token price fluctuations, market cap changes, and data relay volumes through various crypto analytics platforms. - What are chain performance metrics?

These metrics evaluate how well different blockchains perform within the Pocket ecosystem regarding usage and reliability. - What does future growth look like for Pocket Network?

The future seems positive due to increasing adoption rates among developers seeking decentralized solutions for accessing blockchain data.

In conclusion, assessing the performance of Pocket Network involves analyzing various metrics that provide insights into its operational health and market position. By understanding these metrics, investors can make informed decisions while navigating this evolving landscape.