Stablecoins and traditional cryptocurrencies represent two distinct categories within the digital asset landscape, each serving unique purposes and appealing to different investor needs. While traditional cryptocurrencies like Bitcoin and Ethereum are often viewed as speculative investments due to their price volatility, stablecoins aim to provide a more stable value, making them suitable for transactions and as a store of value. This article explores the key differences between these two types of digital currencies, emphasizing market trends, implementation strategies, regulatory considerations, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

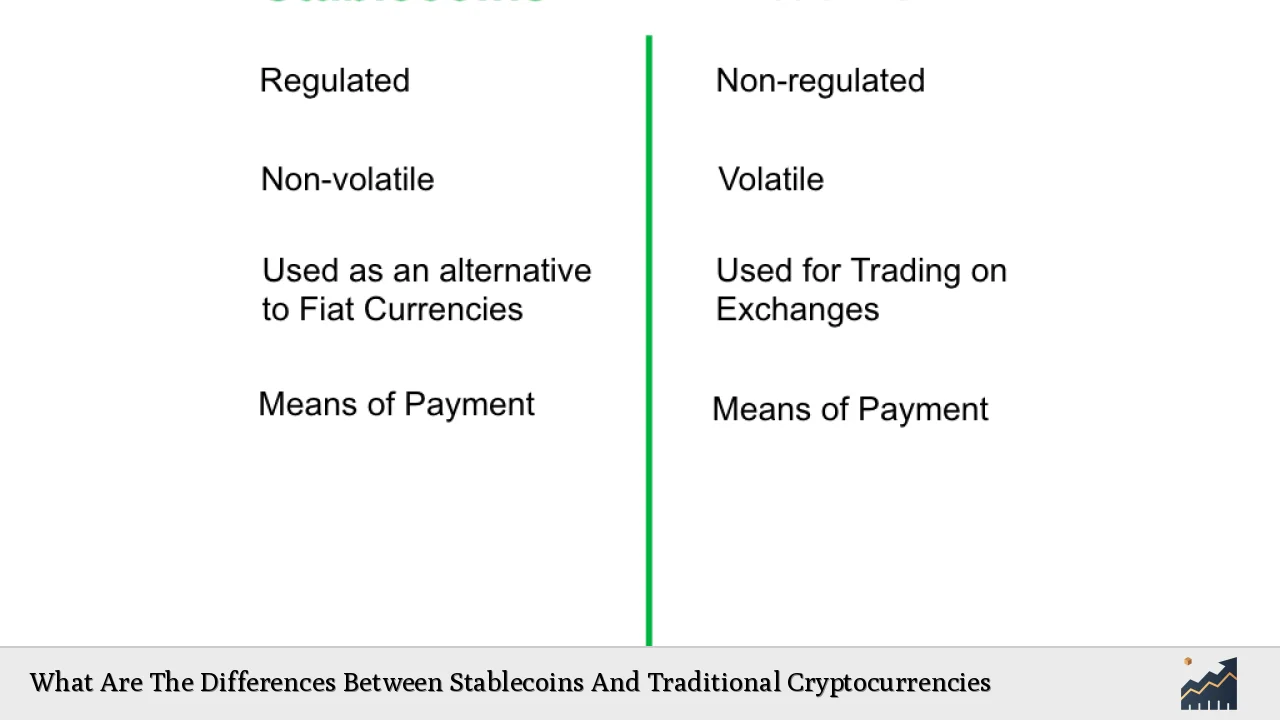

| Value Stability | Stablecoins are pegged to stable assets (e.g., fiat currencies) to maintain a consistent value, while traditional cryptocurrencies experience significant price fluctuations driven by market demand. |

| Use Cases | Stablecoins are primarily used for transactions and remittances due to their stability, whereas traditional cryptocurrencies are often used for investment and speculation. |

| Market Dynamics | The market for stablecoins is influenced by their utility in decentralized finance (DeFi) and cross-border payments, while traditional cryptocurrencies are largely driven by speculative trading. |

| Regulatory Environment | Stablecoins face increasing scrutiny from regulators due to their potential impact on financial stability, whereas traditional cryptocurrencies operate in a more ambiguous regulatory landscape. |

| Technological Infrastructure | Stablecoins often utilize various blockchain technologies for faster transactions and lower fees compared to traditional cryptocurrencies that may rely on slower networks. |

Market Analysis and Trends

The stablecoin market has experienced significant growth, reaching a total market capitalization of approximately $200 billion as of December 2024. Tether (USDT) leads this market with a valuation of around $139 billion, followed by USD Coin (USDC) at approximately $41 billion. This growth is attributed to increasing adoption in payment systems, particularly in regions with unstable financial systems where users seek alternatives to local currencies.

In contrast, the traditional cryptocurrency market remains dominated by Bitcoin and Ethereum, which together account for over half of the total crypto market cap. While these assets continue to attract speculative investors, their volatility limits their use as everyday transactional currencies.

Current Trends

- Increased Adoption: Stablecoins are being increasingly integrated into payment systems by fintech companies like PayPal, enhancing their utility for cross-border transactions.

- Regulatory Developments: Regulatory bodies are focusing on stablecoins due to their rapid growth and potential risks to financial stability. This scrutiny may lead to stricter regulations in the near future.

- Technological Advancements: Innovations in blockchain technology are enabling faster transaction times and lower costs for stablecoin transfers compared to traditional cryptocurrency transactions.

Implementation Strategies

Investors and businesses looking to leverage stablecoins can consider several strategies:

- Utilizing Stablecoins for Transactions: Businesses can accept stablecoins as payment methods to reduce transaction costs and enhance speed compared to traditional banking systems.

- Hedging Against Volatility: Investors can use stablecoins as a hedge against the volatility of traditional cryptocurrencies, allowing them to maintain liquidity while minimizing risk.

- Integration into Financial Services: Financial institutions can integrate stablecoin solutions into their offerings for remittances and international payments, capitalizing on the growing demand for efficient transaction methods.

Risk Considerations

While stablecoins offer several advantages over traditional cryptocurrencies, they are not without risks:

- Pegging Risks: The mechanisms used to maintain the peg can fail. For instance, algorithmic stablecoins have shown vulnerabilities during market downturns, leading to significant losses in value.

- Regulatory Risks: As governments worldwide examine the implications of stablecoins on monetary policy and financial stability, changes in regulation could impact their use.

- Market Confidence: The reliance on reserves or algorithms means that any loss of confidence among users can lead to rapid sell-offs and de-pegging events.

Regulatory Aspects

The regulatory environment surrounding stablecoins is evolving rapidly:

- Increased Scrutiny: Regulatory bodies like the SEC are focusing on how stablecoins operate within the broader financial system. There is concern about their potential impact on monetary policy and financial stability.

- Proposed Regulations: Some jurisdictions are proposing regulations that would require stablecoin issuers to hold sufficient reserves or comply with banking standards. This could enhance consumer protection but may also stifle innovation.

- Global Perspectives: Different countries are approaching stablecoin regulation differently; for example, some nations promote innovation while others impose strict guidelines aimed at protecting financial systems from risks associated with digital currencies.

Future Outlook

The future of both stablecoins and traditional cryptocurrencies appears promising yet uncertain:

- Continued Growth of Stablecoins: Analysts project that the market for stablecoins could grow significantly, potentially reaching $400 billion by 2025 if favorable regulatory conditions prevail.

- Integration with Traditional Finance: As more financial institutions begin adopting stablecoin solutions, we may see increased interoperability between traditional finance (TradFi) and decentralized finance (DeFi), creating new opportunities for users.

- Technological Evolution: Advances in blockchain technology will likely enhance the efficiency of both types of digital assets, making them more accessible and functional for everyday use.

Frequently Asked Questions About What Are The Differences Between Stablecoins And Traditional Cryptocurrencies

- What is a stablecoin?

A stablecoin is a type of cryptocurrency designed to maintain a stable value by pegging its price to a reserve asset such as a fiat currency or commodity. - How do traditional cryptocurrencies differ from stablecoins?

Traditional cryptocurrencies like Bitcoin are highly volatile and primarily driven by market speculation, whereas stablecoins aim for price stability. - What are the main types of stablecoins?

Stablecoins can be categorized into fiat-collateralized (backed by fiat currency), crypto-collateralized (backed by other cryptocurrencies), and algorithmic (maintaining stability through algorithms). - Are stablecoins safe?

While they offer more stability than traditional cryptocurrencies, risks exist related to pegging mechanisms and regulatory scrutiny. - How are stablecoins used in everyday transactions?

Stablecoins facilitate faster and cheaper transactions compared to traditional banking systems, making them popular for remittances and cross-border payments. - What is the regulatory outlook for stablecoins?

The regulatory environment is evolving with increased scrutiny from authorities aiming to mitigate risks associated with financial stability. - Can I invest in stablecoins?

Yes, investors can buy stablecoins as part of their portfolio strategy but should be aware of the associated risks. - How do I choose between using a stablecoin or a traditional cryptocurrency?

Your choice should depend on your investment goals; choose stablecoins for stability in transactions or traditional cryptocurrencies for potential high returns through speculation.

In conclusion, understanding the differences between stablecoins and traditional cryptocurrencies is crucial for investors navigating the evolving digital asset landscape. Each type serves distinct purposes—stablecoins provide stability suitable for transactions while traditional cryptocurrencies offer opportunities for speculative investment. As both markets develop further under increasing regulatory scrutiny, investors should remain informed about trends and risks associated with each category.