The collapse of FTX, once a leading cryptocurrency exchange, has left a trail of disillusioned customers and investors. Following its bankruptcy in November 2022, numerous testimonials have emerged from former users detailing their experiences with the platform. These accounts provide insight into the operational failures, customer service issues, and the emotional toll on individuals who trusted FTX with their funds. This article aims to analyze these testimonials while providing a broader context of the market dynamics and regulatory landscape surrounding FTX.

| Key Concept | Description/Impact |

|---|---|

| Customer Trust Erosion | Many users reported feeling deceived by FTX’s marketing promises of security and high returns, leading to a significant erosion of trust in cryptocurrency exchanges. |

| Withdrawal Difficulties | Numerous testimonials highlight challenges in withdrawing funds, with some users claiming they were unable to access their accounts for extended periods. |

| Emotional Distress | The financial losses experienced by customers have led to significant emotional distress, with many describing feelings of anxiety and betrayal. |

| Recovery Efforts | Some users have sought assistance from third-party services to recover their funds, often at additional costs or risks. |

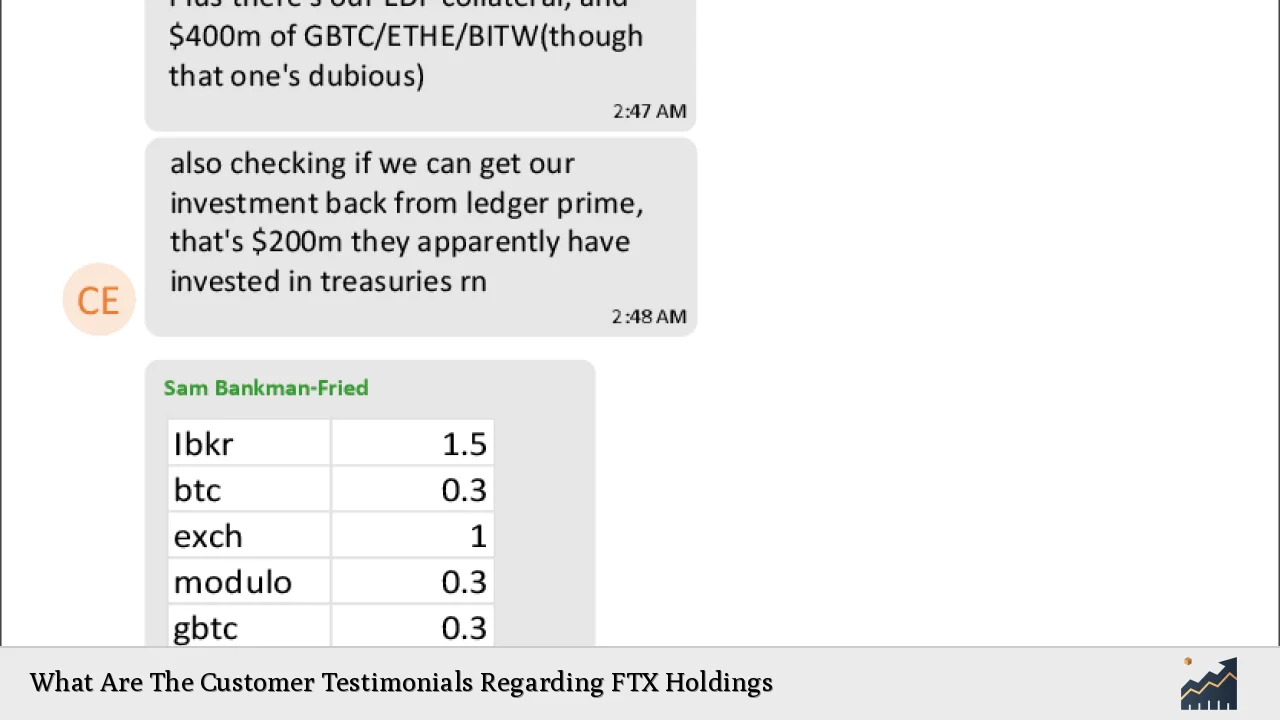

| Lack of Transparency | Users frequently pointed out FTX’s lack of transparency regarding its operations and financial health, contributing to a sense of insecurity. |

Market Analysis and Trends

FTX’s rapid rise and subsequent fall reflect broader trends within the cryptocurrency market. Initially, FTX gained traction through aggressive marketing strategies, including celebrity endorsements and partnerships with major sports teams. However, its downfall was precipitated by a combination of mismanagement, regulatory scrutiny, and market volatility.

Key Market Trends

- Volatility in Cryptocurrency Prices: The cryptocurrency market is characterized by extreme price fluctuations. For example, Bitcoin peaked at around $64,000 in April 2021 before plummeting to below $20,000 in late 2022. This volatility can lead to panic selling among investors.

- Increased Regulatory Oversight: In the wake of FTX’s collapse, regulatory bodies are intensifying scrutiny over cryptocurrency exchanges. This includes calls for more stringent regulations regarding transparency and customer protection.

- Shift Towards Decentralized Finance (DeFi): As trust in centralized exchanges wanes, there is a growing interest in DeFi platforms that offer more control over personal assets without intermediaries.

Implementation Strategies

For investors considering engagement with cryptocurrency platforms post-FTX, several strategies can mitigate risks:

- Diversification: Avoid placing all assets on a single platform. Utilize multiple exchanges or wallets to spread risk.

- Due Diligence: Conduct thorough research on any platform before investing. Look for user reviews, regulatory compliance history, and security measures.

- Use of Cold Wallets: Store cryptocurrencies in cold wallets rather than leaving them on exchanges. This practice significantly reduces the risk of loss due to hacks or insolvency.

Risk Considerations

Investing in cryptocurrencies remains inherently risky due to several factors:

- Market Volatility: Prices can fluctuate wildly within short periods, leading to potential losses.

- Regulatory Risks: Changes in regulations can impact the viability of certain platforms or cryptocurrencies.

- Operational Risks: Issues such as poor management practices or inadequate security measures can lead to significant losses for users.

Regulatory Aspects

The fallout from FTX has prompted discussions about the need for comprehensive regulatory frameworks governing cryptocurrency exchanges. Key considerations include:

- Licensing Requirements: Regulatory bodies may require exchanges to obtain licenses to operate legally, ensuring they meet certain standards for transparency and security.

- Consumer Protection Measures: Implementing measures that protect consumers from fraud and ensure the safeguarding of their assets is essential for rebuilding trust in the industry.

- Reporting Obligations: Exchanges could be mandated to provide regular reports on their financial health and operational practices to regulators.

Future Outlook

The future of cryptocurrency exchanges will likely be shaped by the lessons learned from the FTX debacle. As trust is rebuilt within the industry, several trends may emerge:

- Increased Adoption of Regulations: Expect more robust regulations aimed at protecting consumers and ensuring fair trading practices.

- Growth of Decentralized Platforms: With increasing skepticism towards centralized exchanges like FTX, decentralized platforms may see greater adoption as users seek more control over their assets.

- Enhanced Security Protocols: Exchanges will likely invest more in cybersecurity measures to prevent breaches and protect customer funds.

Frequently Asked Questions About Customer Testimonials Regarding FTX Holdings

- What were common complaints from FTX customers?

Customers frequently reported issues with withdrawals, lack of responsive customer service, and feelings of betrayal due to misleading marketing claims. - How did customers feel about the safety of their funds?

Many customers expressed concerns about the safety of their funds after discovering that FTX had mismanaged customer deposits. - What steps are being taken for fund recovery?

Some customers have turned to third-party services for assistance in recovering lost funds, although these services may come with additional costs. - How has FTX’s collapse affected investor confidence?

Investor confidence has significantly declined across the cryptocurrency market as users become more cautious about where they store their assets. - What should investors look for in a cryptocurrency exchange now?

Investors should prioritize transparency, regulatory compliance, security measures, and user reviews when selecting an exchange. - Are there any legal actions being taken against FTX?

Yes, ongoing legal proceedings involve claims against FTX’s management for misappropriation of funds and other fraudulent activities. - How can investors protect themselves from similar situations?

Investors can protect themselves by diversifying their holdings across multiple platforms and utilizing cold storage solutions for cryptocurrencies. - What is the outlook for cryptocurrency regulation post-FTX?

Regulatory bodies are expected to implement stricter regulations aimed at enhancing consumer protection and ensuring operational transparency among exchanges.

The testimonials surrounding FTX Holdings serve as a stark reminder of the importance of due diligence in investment practices. As the cryptocurrency landscape evolves post-FTX, both investors and regulators must adapt to ensure greater security and trust within this dynamic market.