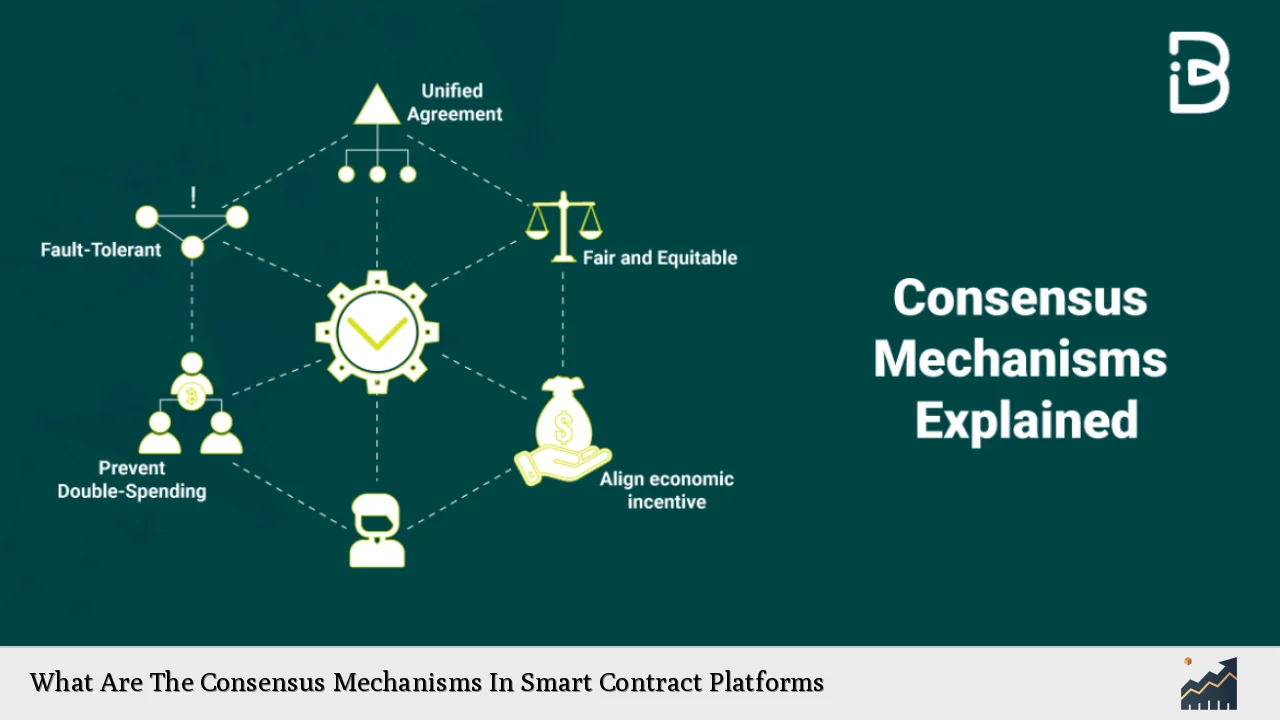

Consensus mechanisms are fundamental protocols that enable multiple participants in a decentralized network to agree on the state of a distributed ledger, ensuring data integrity, security, and trust. In the context of smart contract platforms, these mechanisms play a crucial role in validating transactions and executing contracts autonomously without the need for intermediaries. As blockchain technology evolves, various consensus mechanisms have emerged, each with distinct characteristics, advantages, and challenges.

| Key Concept | Description/Impact |

|---|---|

| Proof of Work (PoW) | A consensus mechanism that requires participants (miners) to solve complex mathematical problems to validate transactions and create new blocks. PoW is energy-intensive but provides strong security. Used by Bitcoin. |

| Proof of Stake (PoS) | Participants (validators) are chosen to create new blocks based on the number of coins they hold and are willing to “stake.” PoS is more energy-efficient than PoW and enhances scalability. Used by Ethereum post-2022. |

| Delegated Proof of Stake (DPoS) | A variation where stakeholders elect delegates to validate transactions on their behalf. This method improves transaction speed and efficiency but may introduce centralization risks. Used by platforms like EOS. |

| Practical Byzantine Fault Tolerance (PBFT) | This mechanism is designed for permissioned blockchains, allowing nodes to reach consensus even when some nodes fail or act maliciously. It enhances security but can be less scalable. Used by Hyperledger Fabric. |

| Proof of Authority (PoA) | In this model, a limited number of nodes are granted the authority to validate transactions based on their identity and reputation. This approach is efficient but sacrifices decentralization. Used in private blockchains. |

| Proof of Capacity (PoC) | This mechanism allows nodes to use their available hard drive space to mine blocks, promoting energy efficiency compared to PoW. It is less common but offers innovative solutions for storage-based networks. |

| Federated Byzantine Agreement (FBA) | This model allows a group of trusted nodes to reach consensus without requiring all nodes in the network to participate, enhancing speed while maintaining some level of decentralization. Used by Stellar. |

| Proof of Burn (PoB) | Participants “burn” coins by sending them to an unspendable address to gain the right to mine or validate transactions. This method encourages investment in the network’s future but can be wasteful. |

Market Analysis and Trends

The global smart contracts market is experiencing rapid growth, driven by increasing adoption across various industries such as finance, healthcare, supply chain management, and real estate. According to recent reports, the smart contracts market was valued at approximately USD 684.3 million in 2022 and is projected to grow at a staggering CAGR of 82.2%, reaching USD 73.8 billion by 2030. This growth is fueled by the demand for automation, transparency, and security in transactions facilitated by blockchain technology.

Key trends influencing this market include:

- Integration with Decentralized Finance (DeFi): Smart contracts are integral to DeFi applications that offer financial services without intermediaries.

- Interoperability Solutions: As multiple blockchains emerge, there is a growing need for cross-chain compatibility, allowing smart contracts to interact seamlessly across different platforms.

- Low-Code Development Platforms: The rise of low-code or no-code platforms is democratizing smart contract development, enabling non-technical users to create contracts easily.

- Focus on Sustainability: With increasing scrutiny over energy consumption in blockchain operations, many platforms are transitioning from PoW to PoS or exploring hybrid models that enhance efficiency.

Implementation Strategies

To effectively implement smart contracts within various consensus mechanisms, organizations must consider several strategic approaches:

- Choosing the Right Consensus Mechanism: Organizations should select a consensus mechanism that aligns with their operational needs—balancing security, scalability, and decentralization.

- Utilizing Layer 2 Solutions: To enhance scalability while maintaining security on primary blockchains like Ethereum, Layer 2 solutions such as rollups can be employed.

- Incorporating Oracles: Smart contracts often require real-world data inputs; integrating decentralized oracles ensures that external data sources are reliable and tamper-proof.

- Regular Audits and Testing: Conducting thorough audits and stress tests on smart contracts helps identify vulnerabilities before deployment.

Risk Considerations

While smart contracts offer numerous benefits, they also come with inherent risks:

- Security Vulnerabilities: Poorly coded smart contracts can lead to exploits resulting in significant financial losses. Historical incidents like the DAO hack highlight these risks.

- Regulatory Uncertainty: As governments worldwide grapple with how to regulate blockchain technologies and cryptocurrencies, compliance risks may arise for organizations utilizing smart contracts.

- Market Volatility: The cryptocurrency market’s inherent volatility can affect the value of assets involved in smart contracts, impacting overall project viability.

- Scalability Challenges: Some consensus mechanisms struggle with scalability under high transaction volumes; organizations must anticipate these issues when designing their systems.

Regulatory Aspects

The regulatory landscape surrounding blockchain technology and smart contracts is evolving rapidly:

- Compliance Requirements: Organizations must ensure that their smart contracts comply with local regulations regarding data protection (e.g., GDPR) and financial transactions.

- Tax Implications: Transactions executed via smart contracts may have tax implications; understanding these requirements is crucial for organizations operating in multiple jurisdictions.

- Licensing Considerations: Depending on the nature of the application (e.g., financial services), certain licenses may be required before deploying smart contract solutions.

Future Outlook

The future of consensus mechanisms in smart contract platforms appears promising:

- Hybrid Consensus Models: The development of hybrid models combining elements from various consensus mechanisms could address scalability and energy efficiency concerns while maintaining security.

- AI Integration: The potential integration of artificial intelligence into consensus algorithms could enhance decision-making processes within decentralized networks.

- Increased Adoption Across Industries: As more sectors recognize the benefits of blockchain technology for automating processes and enhancing transparency, the adoption rate of smart contracts is expected to rise significantly.

- Focus on User Experience: Simplifying user interactions with blockchain technologies will be crucial for broader adoption; this includes developing intuitive interfaces for deploying and managing smart contracts.

Frequently Asked Questions About What Are The Consensus Mechanisms In Smart Contract Platforms

- What is a consensus mechanism?

A consensus mechanism is a protocol used in blockchain networks that enables all participants to agree on a single version of the truth regarding the state of the blockchain. - How does Proof of Work differ from Proof of Stake?

Proof of Work requires miners to solve complex mathematical problems using computational power, while Proof of Stake selects validators based on the number of coins they hold and are willing to lock up as collateral. - What are some advantages of using Delegated Proof of Stake?

Delegated Proof of Stake offers faster transaction processing times and lower costs compared to traditional PoW systems while still maintaining a degree of decentralization through elected delegates. - Why are oracles important for smart contracts?

Oracles provide real-world data inputs necessary for executing conditions within smart contracts accurately; they bridge the gap between on-chain operations and off-chain information. - What risks are associated with implementing smart contracts?

Risks include security vulnerabilities due to coding errors, regulatory uncertainties regarding compliance with laws, market volatility affecting asset values, and scalability challenges during peak usage times. - How do regulatory aspects impact smart contract deployment?

Organizations must navigate compliance requirements related to data protection laws and financial regulations when deploying smart contracts across different jurisdictions. - What trends are shaping the future of consensus mechanisms?

The future trends include hybrid consensus models that improve efficiency while maintaining security, AI integration into decision-making processes within networks, and increasing adoption across various industries. - Can smart contracts be audited?

Yes, auditing smart contracts is essential for identifying vulnerabilities before deployment; it involves reviewing code for security flaws and ensuring compliance with applicable regulations.

The exploration of consensus mechanisms reveals their critical role in shaping the functionality and reliability of smart contract platforms. As technology progresses, ongoing research into innovative solutions will likely enhance these mechanisms’ efficiency while addressing existing challenges.