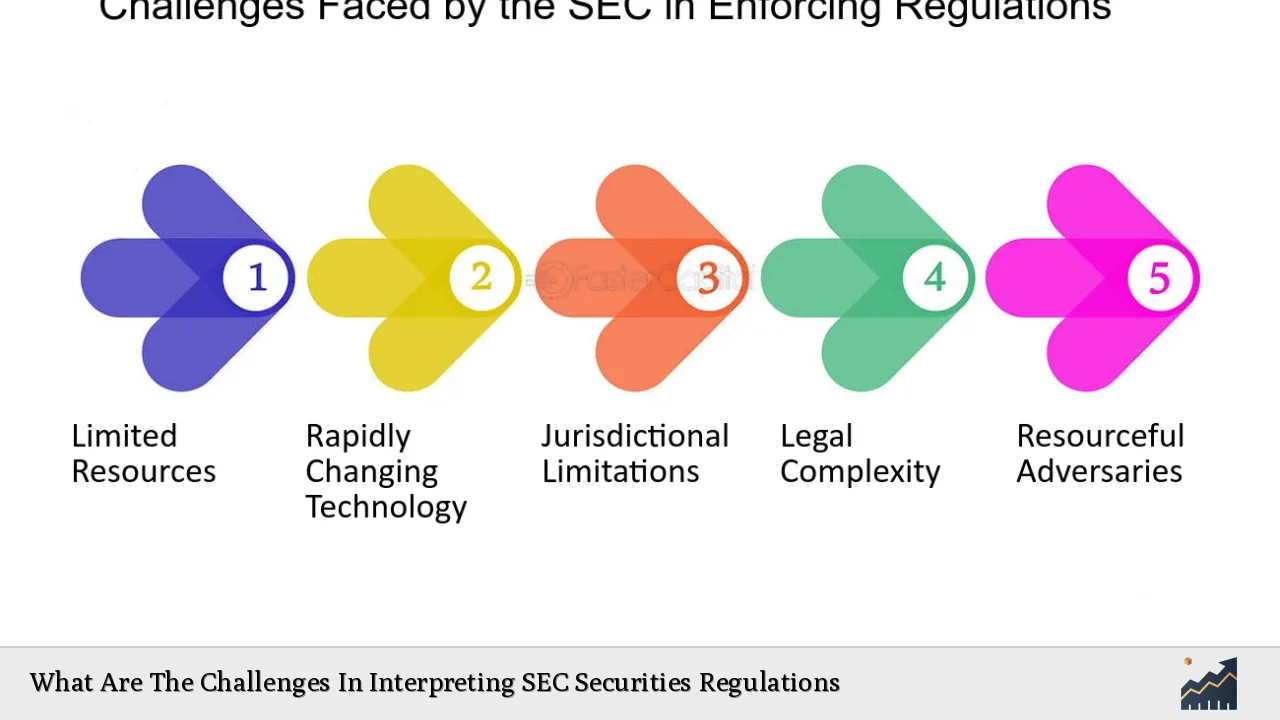

Understanding and interpreting the regulations set forth by the U.S. Securities and Exchange Commission (SEC) presents numerous challenges for investors, finance professionals, and companies alike. The SEC’s regulations are designed to protect investors and maintain fair, orderly, and efficient markets, but their complexity can lead to confusion and misinterpretation. This article delves into the various challenges associated with interpreting SEC securities regulations, supported by current market statistics and trends.

| Key Concept | Description/Impact |

|---|---|

| Complexity of Regulations | The SEC’s rules encompass a wide range of securities laws that require extensive knowledge to navigate effectively. |

| Frequent Changes | Regulations are subject to frequent updates and amendments, making it difficult for stakeholders to stay compliant. |

| Ambiguity in Interpretation | Many regulations contain ambiguous language that can lead to varying interpretations among market participants. |

| Technological Adaptation | The rise of new technologies, such as blockchain and AI, presents challenges in applying existing regulations to novel financial products. |

| International Considerations | Globalization of markets complicates compliance as different jurisdictions have varying regulatory frameworks. |

| Enforcement Discrepancies | The inconsistency in enforcement actions can lead to uncertainty about how regulations are applied in practice. |

| Resource Allocation | Smaller firms may struggle with the resources needed to ensure compliance with complex regulations. |

| Investor Education | Lack of understanding among investors regarding their rights and obligations under SEC regulations can lead to exploitation. |

Market Analysis and Trends

The landscape of securities regulation is continuously evolving, influenced by market dynamics, technological advancements, and regulatory reforms. Recent trends indicate a shift toward greater scrutiny of emerging financial products, particularly in the cryptocurrency space. The SEC has stated that most cryptoassets qualify as securities, which necessitates compliance with established securities laws. This has led to increased enforcement actions against firms that fail to adhere to these regulations.

In fiscal year 2024, the SEC filed 583 enforcement actions, recovering $8.2 billion in financial remedies—an all-time high for the agency. This reflects a growing emphasis on compliance and investor protection amid rising market volatility and innovative financial products.

Implementation Strategies

To navigate the complexities of SEC regulations effectively, companies should adopt several strategies:

- Regular Training: Continuous education for compliance teams on regulatory updates is crucial. This ensures that staff are aware of changes in laws and can implement them correctly.

- Utilization of Technology: Implementing compliance software can help automate reporting processes and ensure adherence to filing deadlines.

- Engagement with Legal Experts: Consulting with legal professionals who specialize in securities law can provide clarity on ambiguous regulations.

- Proactive Compliance Culture: Encouraging a culture of compliance within organizations can help identify potential issues before they escalate into violations.

Risk Considerations

Interpreting SEC regulations carries inherent risks that can impact both individual investors and companies:

- Legal Risks: Misinterpretation of regulations may lead to legal penalties or sanctions against firms or individuals.

- Financial Risks: Non-compliance can result in significant financial losses due to fines or loss of investor trust.

- Reputational Risks: Companies found in violation of SEC rules may suffer reputational damage that affects their market position.

- Market Risks: Regulatory changes can impact market dynamics, affecting stock prices and investor sentiment.

Regulatory Aspects

The SEC’s regulatory framework is built on several key laws designed to protect investors:

- Securities Act of 1933: This act mandates disclosure of significant information about securities offered for public sale, aimed at preventing fraud.

- Securities Exchange Act of 1934: It established the SEC and granted it broad authority over the securities industry, including oversight of exchanges and self-regulatory organizations (SROs).

- Investment Company Act of 1940: This act regulates investment companies to minimize conflicts of interest and requires them to disclose their financial condition.

The challenge lies in the interpretation of these laws as they apply to new financial instruments and market practices. For instance, the recent focus on cryptocurrency has highlighted gaps in existing regulatory frameworks that were not designed for digital assets.

Future Outlook

Looking ahead, the SEC is expected to continue refining its approach to regulation as new technologies emerge. The increasing complexity of financial products will necessitate ongoing dialogue between regulators and industry participants.

Key areas for future regulatory focus include:

- Enhanced Disclosure Requirements: As new types of securities emerge, there will likely be calls for more comprehensive disclosure practices tailored to specific asset classes.

- Adaptation to Technological Changes: The SEC will need to develop guidelines addressing the unique risks posed by technologies like blockchain and AI.

- Global Regulatory Coordination: As markets become more interconnected, collaboration between international regulators will be essential for effective oversight.

Frequently Asked Questions About What Are The Challenges In Interpreting SEC Securities Regulations

- What are the main challenges in interpreting SEC regulations?

The main challenges include complexity, frequent changes, ambiguity in language, technological adaptation, international considerations, enforcement discrepancies, resource allocation issues, and investor education. - How often do SEC regulations change?

The SEC frequently updates its regulations in response to market developments and emerging risks; stakeholders must stay informed about these changes. - What should companies do to ensure compliance?

Companies should invest in regular training for staff, utilize compliance technology, engage legal experts for guidance, and foster a proactive compliance culture. - What are the consequences of non-compliance?

Non-compliance can lead to legal penalties, financial losses, reputational damage, and adverse effects on market conditions. - How does globalization affect SEC regulation?

Globalization complicates compliance as different jurisdictions have varying regulatory frameworks that must be navigated by companies operating internationally. - What role does technology play in interpreting SEC regulations?

Technology aids in automating compliance processes but also presents challenges as new financial products may not fit neatly within existing regulatory frameworks. - Why is investor education important regarding SEC regulations?

Lack of understanding among investors can lead to exploitation; educating them about their rights helps protect them from fraud. - What is the future outlook for SEC regulation?

The future will likely see enhanced disclosure requirements tailored for new asset classes, adaptation strategies for technological changes, and increased global regulatory coordination.

In conclusion, while interpreting SEC securities regulations poses significant challenges due to their complexity and evolving nature, proactive strategies can mitigate risks associated with non-compliance. Stakeholders must remain vigilant in adapting to changes while fostering a culture of transparency and education within the investment community.