The rapid rise of stablecoins as a cornerstone of the cryptocurrency ecosystem has prompted significant scrutiny regarding the integrity and transparency of their reserves. As digital currencies pegged to fiat assets, stablecoins are designed to maintain a stable value, yet the mechanisms for auditing and verifying the reserves backing these coins present unique challenges. These challenges stem from regulatory gaps, transparency issues, and the inherent complexities of decentralized finance (DeFi) systems. This article delves into the multifaceted challenges associated with auditing and verifying stablecoin reserves, providing a comprehensive analysis for investors and finance professionals.

| Key Concept | Description/Impact |

|---|---|

| Lack of Regulatory Frameworks | The absence of standardized regulations complicates the auditing process, leading to inconsistencies in how reserves are reported and verified. |

| Transparency Issues | Many stablecoin issuers do not provide sufficient transparency regarding their reserve holdings, making it difficult to trust the reported figures. |

| Verification Difficulties | Auditors face challenges in verifying the existence and value of reserves due to decentralized structures and lack of access to necessary data. |

| Operational Risks | Inadequate risk management practices can lead to potential fraud or misrepresentation of reserve assets. |

| Technological Limitations | The reliance on traditional auditing methods may not be sufficient in a blockchain context, necessitating innovative solutions for effective verification. |

| Market Volatility | The fluctuating nature of underlying assets can impact the stability of stablecoins, complicating reserve verification efforts. |

Market Analysis and Trends

The stablecoin market has seen exponential growth, with a total market capitalization exceeding $156 billion as of late 2024. Tether (USDT) leads this market with a supply of approximately $114.4 billion, followed by USD Coin (USDC) at $33.3 billion and DAI at $5.3 billion. This growth reflects an increasing demand for stable digital assets in both retail and institutional sectors, particularly as businesses seek efficient cross-border payment solutions.

Recent trends indicate:

- Increased Adoption: Stablecoins are becoming more integrated into payment systems, with projections suggesting that cross-border stablecoin payments could reach $2.8 trillion by 2024.

- Diversity in Collateralization: There is a notable shift towards using diverse collateral assets beyond fiat currencies, including commodities like gold and other financial instruments.

- Regulatory Developments: Stricter regulations are anticipated globally as authorities aim to enhance oversight and protect investors amidst rising concerns over transparency.

Implementation Strategies

To address the challenges in auditing stablecoin reserves effectively, several strategies can be implemented:

- Third-Party Audits: Engaging reputable third-party auditors can provide independent verification of reserve holdings. Regular audits should be mandated to ensure ongoing compliance with transparency standards.

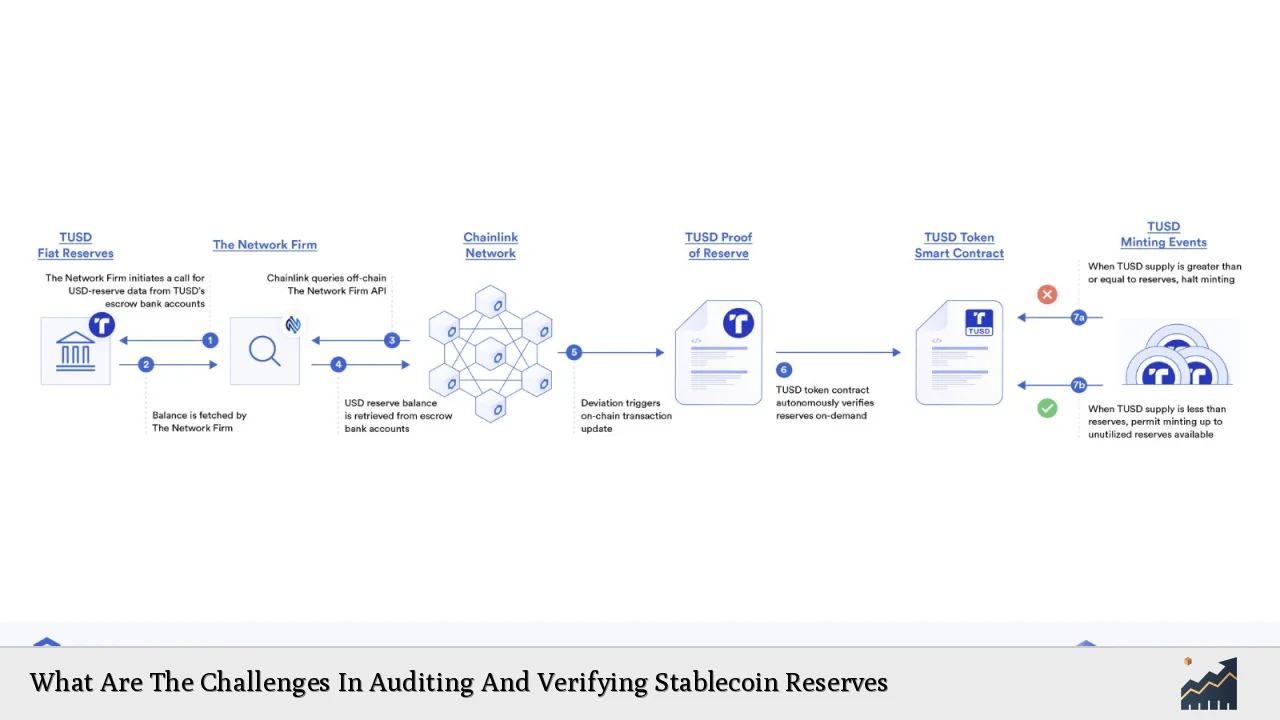

- On-Chain Reporting: Utilizing blockchain technology for real-time reporting can enhance transparency. By recording reserve data directly on-chain, stakeholders can access up-to-date information about asset backing.

- Proof of Reserves Mechanisms: Implementing proof-of-reserve protocols allows users to verify that stablecoins are fully backed by adequate reserves at any given time. This approach can significantly bolster user confidence.

- Enhanced Disclosure Standards: Regulatory bodies should establish clear guidelines for disclosure requirements related to reserve assets, including detailed breakdowns of holdings and custodian information.

Risk Considerations

The risks associated with inadequate auditing practices in stablecoin reserves are significant:

- Fraud Risk: Without stringent auditing processes, there is a heightened risk of fraudulent activities such as misrepresentation of asset values or inadequate backing for issued tokens.

- Market Confidence Erosion: If investors perceive that stablecoins lack sufficient backing or transparency, it could lead to a loss of confidence, triggering sell-offs or “runs” on these assets.

- Operational Risks: Poorly managed reserves may expose issuers to liquidity crises or insolvency risks if they cannot meet redemption requests during periods of high demand.

- Technological Vulnerabilities: Reliance on outdated auditing methods may not capture the complexities associated with smart contracts and decentralized finance platforms, leaving room for exploitation.

Regulatory Aspects

The regulatory landscape surrounding stablecoins is rapidly evolving. Key points include:

- Emerging Standards: Organizations like the American Institute of CPAs (AICPA) are proposing new criteria for stablecoin issuers regarding proof of reserves. These criteria aim to enhance transparency but currently lack enforceability.

- Global Variability: Different jurisdictions are adopting varied approaches to regulation; for instance, the European Union’s Markets in Crypto-Assets (MiCA) regulation seeks to create a unified framework while U.S. regulations remain fragmented.

- Increased Scrutiny Post-Crisis: Following incidents like the collapse of FTX, regulatory bodies have intensified their focus on ensuring that stablecoin issuers maintain adequate reserves and transparent practices.

Future Outlook

The future of stablecoin auditing hinges on several factors:

- Technological Advancements: Innovations in blockchain technology and decentralized finance could lead to more robust auditing solutions that enhance trustworthiness without compromising efficiency.

- Stronger Regulatory Frameworks: As governments worldwide recognize the importance of regulating digital assets, clearer guidelines will likely emerge, fostering greater stability within the market.

- Market Evolution: The continued evolution of financial technologies will influence how stablecoins operate and are audited. The integration of advanced analytics and AI could streamline verification processes while improving accuracy.

In conclusion, while stablecoins offer significant advantages in terms of stability and usability within digital finance ecosystems, their success hinges on overcoming substantial challenges related to auditing and verifying reserves. By implementing robust strategies that prioritize transparency and regulatory compliance, stakeholders can enhance trust in these digital assets while paving the way for sustainable growth in this burgeoning market.

Frequently Asked Questions About Challenges In Auditing And Verifying Stablecoin Reserves

- What are stablecoins?

Stablecoins are cryptocurrencies designed to maintain a fixed value by pegging them to traditional assets like fiat currencies or commodities. - Why is auditing important for stablecoins?

Auditing ensures that the reserves backing stablecoins are accurately reported and maintained, which is crucial for maintaining investor trust. - What challenges do auditors face when verifying stablecoin reserves?

Auditors encounter difficulties such as lack of regulatory frameworks, transparency issues regarding reserve holdings, and technological limitations in traditional audit methods. - How can proof-of-reserve mechanisms improve trust?

Proof-of-reserve mechanisms allow users to independently verify that a stablecoin is fully backed by its claimed reserves at any time. - What role do regulators play in stabilizing the market?

Regulators aim to establish guidelines that promote transparency and accountability among stablecoin issuers while protecting investors from potential risks. - How does market volatility affect stablecoins?

The value fluctuations of underlying assets can impact the perceived stability of a stablecoin, complicating efforts to verify its reserves accurately. - What future trends might influence stablecoin auditing?

Technological advancements in blockchain reporting and stronger regulatory frameworks are expected to shape future practices in auditing stablecoin reserves. - Should individual investors be concerned about investing in stablecoins?

Investors should conduct thorough research into the audit practices and regulatory compliance of specific stablecoins before investing.

This comprehensive analysis highlights both the current landscape and future considerations for auditing and verifying stablecoin reserves. By addressing these challenges head-on through innovative solutions and regulatory advancements, stakeholders can foster greater confidence in this essential component of modern finance.