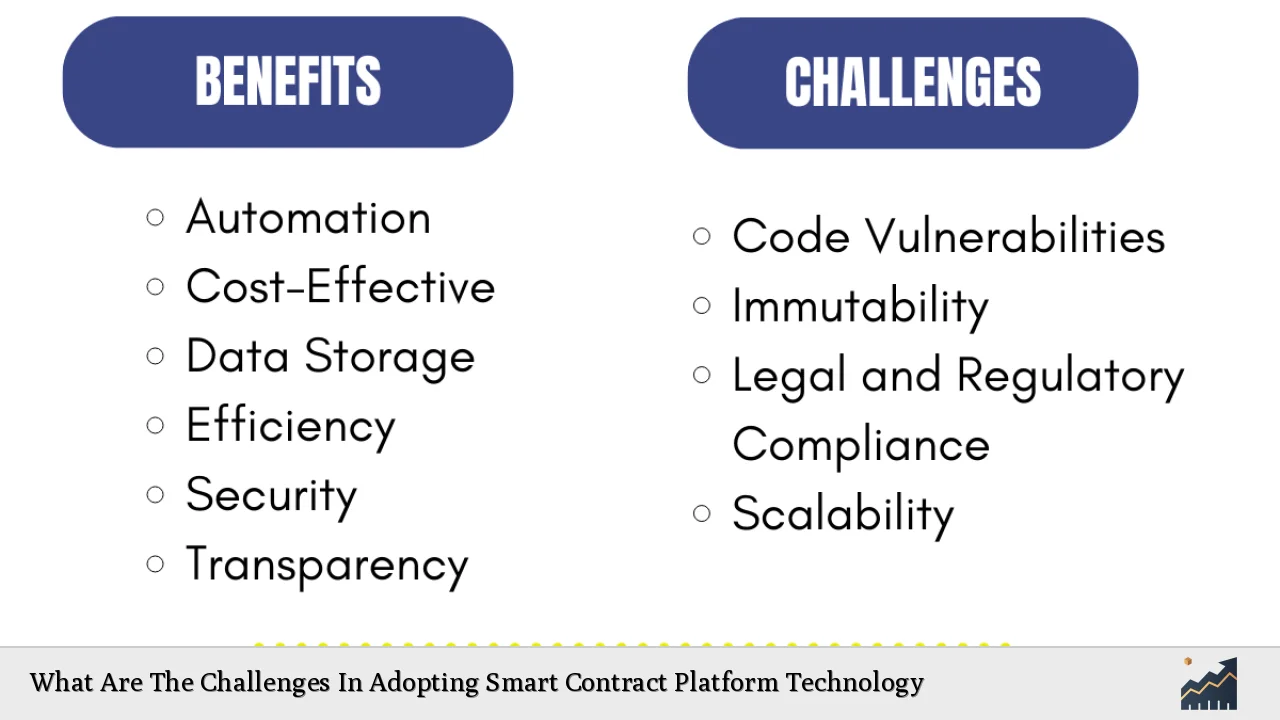

Smart contract platforms have emerged as a revolutionary technology in the financial sector, promising to automate and streamline various processes across industries. However, the adoption of this technology is not without its challenges. As organizations and investors consider integrating smart contracts into their operations, it’s crucial to understand the hurdles they may face. This comprehensive analysis delves into the key challenges in adopting smart contract platform technology, providing insights for both individual investors and finance professionals.

| Key Concept | Description/Impact |

|---|---|

| Technical Complexity | Requires specialized knowledge, potentially limiting widespread adoption |

| Scalability Issues | Current platforms struggle with high transaction volumes, impacting efficiency |

| Security Concerns | Vulnerabilities in smart contract code can lead to significant financial losses |

| Regulatory Uncertainty | Lack of clear legal frameworks creates compliance risks for businesses |

| Integration Challenges | Difficulty in incorporating smart contracts with existing systems and processes |

Market Analysis and Trends

The smart contract market is experiencing rapid growth, with projections indicating significant expansion in the coming years. According to recent market research, the global smart contracts market is expected to reach $1,460.3 million by 2030, growing at a CAGR of 24.2% from 2024 to 2030. This growth is driven by increasing adoption across various sectors, including finance, supply chain management, and real estate.

Despite this positive outlook, the market faces several challenges that could impact its growth trajectory. One of the primary concerns is the technical complexity associated with smart contract development and implementation. This complexity often requires specialized knowledge and skills, which can be a barrier for many organizations looking to adopt the technology.

Another significant trend is the ongoing development of more user-friendly platforms and tools to simplify smart contract creation and management. This trend aims to address the technical barriers and make the technology more accessible to a broader range of users and businesses.

Implementation Strategies

Successful adoption of smart contract platforms requires careful planning and execution. Organizations considering this technology should focus on the following strategies:

Education and Training

Investing in comprehensive education and training programs for staff is crucial. This includes not only technical training for developers but also general awareness programs for management and other stakeholders. Understanding the fundamentals of blockchain technology and smart contracts is essential for effective implementation and risk management.

Phased Approach

Rather than attempting a full-scale implementation, organizations should consider a phased approach. This could involve:

- Identifying low-risk, high-impact use cases for initial implementation

- Developing proof-of-concept projects to demonstrate value and gain stakeholder buy-in

- Gradually expanding the use of smart contracts across different departments or processes

Collaboration and Partnerships

Partnering with experienced blockchain and smart contract developers can help overcome technical challenges. Additionally, collaborating with industry peers and joining blockchain consortiums can provide valuable insights and shared resources for tackling common adoption challenges.

Risk Considerations

Adopting smart contract platforms comes with several risks that organizations must carefully consider and mitigate:

Security Vulnerabilities

Smart contracts are susceptible to coding errors and vulnerabilities that can be exploited by malicious actors. High-profile incidents, such as the DAO hack in 2016, have highlighted the potential for significant financial losses due to smart contract vulnerabilities. To mitigate this risk, organizations should:

- Conduct thorough code audits and security testing before deployment

- Implement formal verification processes to mathematically prove the correctness of smart contract code

- Consider using established smart contract templates and libraries to reduce the risk of custom coding errors

Operational Risks

The immutable nature of smart contracts can pose operational challenges. Once deployed, smart contracts cannot be easily modified, which can be problematic if there are errors or changes in business requirements. To address this:

- Implement rigorous testing and simulation processes before deployment

- Design smart contracts with upgrade mechanisms where appropriate

- Maintain comprehensive documentation and version control for all smart contract code

Legal and Compliance Risks

The regulatory landscape for smart contracts is still evolving, creating uncertainty and potential compliance risks. Organizations must stay informed about regulatory developments and ensure their smart contract implementations comply with relevant laws and regulations.

Regulatory Aspects

The regulatory environment for smart contracts varies significantly across jurisdictions, presenting a complex landscape for organizations operating globally. Key regulatory considerations include:

Legal Recognition

While some jurisdictions have begun to recognize smart contracts as legally binding agreements, many are still grappling with how to integrate them into existing legal frameworks. This lack of clarity can create uncertainty around the enforceability of smart contracts in legal disputes.

Data Protection and Privacy

Smart contracts often involve the processing and storage of personal or sensitive data. Organizations must ensure their implementations comply with data protection regulations such as GDPR in the EU or CCPA in California. This may require implementing privacy-enhancing technologies or designing smart contracts with data minimization principles in mind.

Financial Regulations

For financial institutions and fintech companies, compliance with existing financial regulations is crucial. This includes anti-money laundering (AML) and know-your-customer (KYC) requirements, which can be challenging to implement in the context of decentralized smart contract platforms.

Future Outlook

Despite the challenges, the future of smart contract platforms looks promising. Several trends and developments are likely to shape the adoption landscape in the coming years:

Interoperability Solutions

The development of cross-chain interoperability solutions will likely address some of the scalability and integration challenges currently facing smart contract platforms. This could lead to more seamless integration of smart contracts across different blockchain networks and with existing systems.

Regulatory Clarity

As regulators gain a better understanding of smart contract technology, we can expect more comprehensive and clear regulatory frameworks to emerge. This will provide greater certainty for businesses looking to adopt smart contracts and potentially accelerate adoption in regulated industries.

Advancements in Security and Auditing Tools

Ongoing research and development in smart contract security are likely to produce more sophisticated tools for detecting vulnerabilities and ensuring the integrity of smart contract code. This could help address some of the security concerns that currently hinder adoption.

Integration with Emerging Technologies

The convergence of smart contracts with other emerging technologies such as artificial intelligence and the Internet of Things (IoT) could open up new use cases and drive further adoption. For example, AI could be used to optimize smart contract terms, while IoT devices could trigger smart contract executions based on real-world events.

In conclusion, while the adoption of smart contract platform technology presents significant challenges, the potential benefits in terms of efficiency, transparency, and automation make it an attractive proposition for many organizations. By carefully considering the risks, implementing robust strategies, and staying informed about regulatory developments, businesses can navigate these challenges and position themselves to leverage the full potential of smart contracts in the future.

Frequently Asked Questions About What Are The Challenges In Adopting Smart Contract Platform Technology

- What is the biggest technical challenge in implementing smart contracts?

The biggest technical challenge is often ensuring the security and correctness of smart contract code. Due to their immutable nature, errors in smart contracts can have severe consequences, making thorough testing and auditing crucial. - How can organizations address the scalability issues of smart contract platforms?

Organizations can address scalability by considering layer-2 solutions, sidechains, or more scalable blockchain platforms. Additionally, optimizing smart contract code and implementing off-chain computations where possible can help improve performance. - What legal considerations should be taken into account when adopting smart contracts?

Key legal considerations include ensuring the enforceability of smart contracts in relevant jurisdictions, compliance with data protection regulations, and addressing potential conflicts between smart contract execution and traditional legal processes. - How can businesses mitigate the risks associated with the immutability of smart contracts?

To mitigate risks, businesses can implement upgrade mechanisms in their smart contracts, use thorough testing and simulation processes, and maintain comprehensive documentation. It’s also advisable to start with low-risk use cases before scaling to more critical applications. - What skills are needed in an organization to successfully implement smart contract technology?

Organizations need a mix of skills including blockchain development, smart contract programming (e.g., Solidity for Ethereum), cybersecurity expertise, legal knowledge of digital contracts, and business process analysis to identify suitable use cases. - How does the adoption of smart contracts impact traditional business processes?

Smart contracts can automate and streamline many traditional business processes, potentially reducing intermediaries, lowering costs, and increasing transparency. However, this may require significant changes to existing workflows and systems, necessitating careful change management.