FTX Holdings, once a leading cryptocurrency exchange, faced numerous challenges during its attempts to expand into new markets. The collapse of the firm in late 2022 highlighted significant operational, regulatory, and market-related issues that not only affected its growth trajectory but also had broader implications for the cryptocurrency industry. This analysis delves into the multifaceted challenges FTX encountered while trying to broaden its market presence, providing insights into the lessons learned from its tumultuous journey.

| Key Concept | Description/Impact |

|---|---|

| Regulatory Compliance | FTX struggled with varying regulations across jurisdictions, leading to legal disputes and fines that eroded investor confidence. |

| Security Vulnerabilities | High-profile security breaches raised concerns about the platform’s ability to protect user assets, impacting its reputation and user trust. |

| Operational Inefficiencies | The rapid growth of FTX outpaced its organizational capacity, resulting in management issues and operational inefficiencies. |

| Market Volatility | The inherent volatility in cryptocurrency markets complicated FTX’s expansion strategies and risk management practices. |

| Reputation Damage | The collapse of FTX severely damaged its brand reputation, making it difficult to regain trust from users and investors. |

Market Analysis and Trends

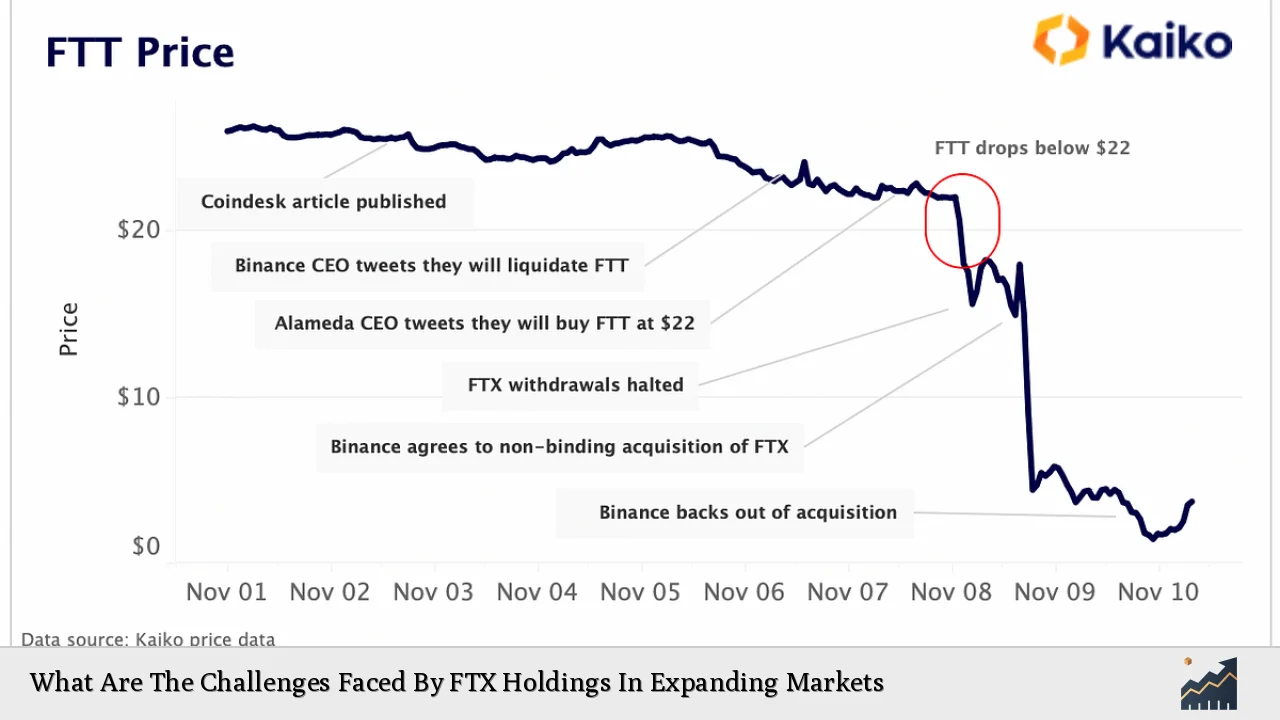

The cryptocurrency market has experienced significant fluctuations over the past few years, characterized by rapid growth followed by sharp declines. In 2021, FTX capitalized on this volatility, achieving a peak trading volume of $21 billion in a single day, which contributed to its valuation soaring to $18 billion. However, as the market began to stabilize and regulatory scrutiny increased, FTX faced challenges that highlighted the risks associated with aggressive expansion strategies.

Current trends indicate a shift towards more regulated environments for cryptocurrency exchanges. As governments worldwide implement stricter regulations to protect consumers and ensure market stability, companies like FTX must adapt their business models accordingly. This regulatory evolution presents both challenges and opportunities for firms looking to expand into new markets.

Key Market Trends Influencing FTX’s Expansion

- Increased Regulatory Scrutiny: Governments are tightening regulations around cryptocurrency trading platforms, necessitating compliance adaptations.

- Market Maturity: As the cryptocurrency market matures, user expectations regarding security and transparency are rising.

- Technological Advancements: Innovations in blockchain technology present opportunities for improved security and operational efficiency.

Implementation Strategies

To address the challenges faced during its expansion efforts, FTX could have adopted several strategic approaches:

- Enhanced Compliance Framework: Developing a robust compliance framework that aligns with international regulations would have mitigated legal risks associated with operating in multiple jurisdictions.

- Investment in Security Infrastructure: Strengthening cybersecurity measures would have helped protect user assets and maintain trust.

- Scalable Operations: Implementing scalable operational processes could have supported growth without compromising efficiency or service quality.

- Transparent Communication: Maintaining open lines of communication with stakeholders regarding risks and operational changes would have fostered trust and loyalty.

Risk Considerations

FTX’s expansion was fraught with various risks that ultimately contributed to its downfall:

- Liquidity Risks: The reliance on illiquid assets for collateral placed significant pressure on FTX during market downturns.

- Reputational Risks: High-profile incidents of mismanagement and security breaches severely impacted user trust.

- Market Risks: The volatile nature of cryptocurrencies made it challenging for FTX to maintain stable operations amid fluctuating prices.

- Operational Risks: Internal management issues led to inefficiencies that hampered decision-making processes during critical times.

Regulatory Aspects

The regulatory landscape for cryptocurrency exchanges is evolving rapidly. FTX’s struggles underscore the importance of compliance with local laws and international standards. Key regulatory challenges include:

- Diverse Regulatory Environments: Operating across multiple jurisdictions requires navigating complex regulatory frameworks that can differ significantly from one region to another.

- Consumer Protection Laws: Increasing focus on consumer protection mandates exchanges to implement stringent measures to safeguard user funds.

- Anti-Money Laundering (AML) Regulations: Compliance with AML regulations is essential for maintaining legitimacy in global markets.

Future Outlook

The future of cryptocurrency exchanges like FTX hinges on their ability to adapt to an increasingly regulated environment while addressing past mistakes. As the market continues to evolve, several factors will shape the landscape:

- Increased Regulation: Stricter regulations will likely lead to a consolidation of smaller players in the market as compliance costs rise.

- Technological Integration: Advances in technology will provide opportunities for innovation in security and user experience, which can enhance competitiveness.

- Market Recovery Potential: Despite recent downturns, there is potential for recovery as institutional interest in cryptocurrencies grows alongside advancements in blockchain technology.

Frequently Asked Questions About What Are The Challenges Faced By FTX Holdings In Expanding Markets

- What led to the collapse of FTX?

The collapse was primarily due to liquidity issues stemming from mismanagement of customer funds and reliance on illiquid assets. - How did regulatory challenges impact FTX?

FTX faced significant legal disputes due to non-compliance with various jurisdictions’ regulations, which eroded investor confidence. - What security measures could have prevented breaches?

Investing in advanced cybersecurity infrastructure and regular audits could have mitigated security vulnerabilities. - Can FTX recover from its reputation damage?

While recovery is challenging, rebuilding trust through transparency and compliance is essential for any future endeavors. - What lessons can other companies learn from FTX’s experience?

The importance of robust compliance frameworks, effective risk management strategies, and transparent communication cannot be overstated. - How does market volatility affect cryptocurrency exchanges?

Market volatility creates both opportunities and risks; exchanges must manage liquidity effectively during downturns. - What is the future outlook for cryptocurrency exchanges?

The future will likely see increased regulation but also opportunities for innovation as technology evolves. - How important is consumer trust for cryptocurrency platforms?

Consumer trust is critical; without it, platforms struggle to retain users amidst competition.

The challenges faced by FTX Holdings serve as a cautionary tale within the rapidly evolving cryptocurrency landscape. By analyzing these obstacles through a comprehensive lens—considering market dynamics, regulatory environments, operational strategies, and risk management—investors can gain valuable insights into navigating this complex sector.