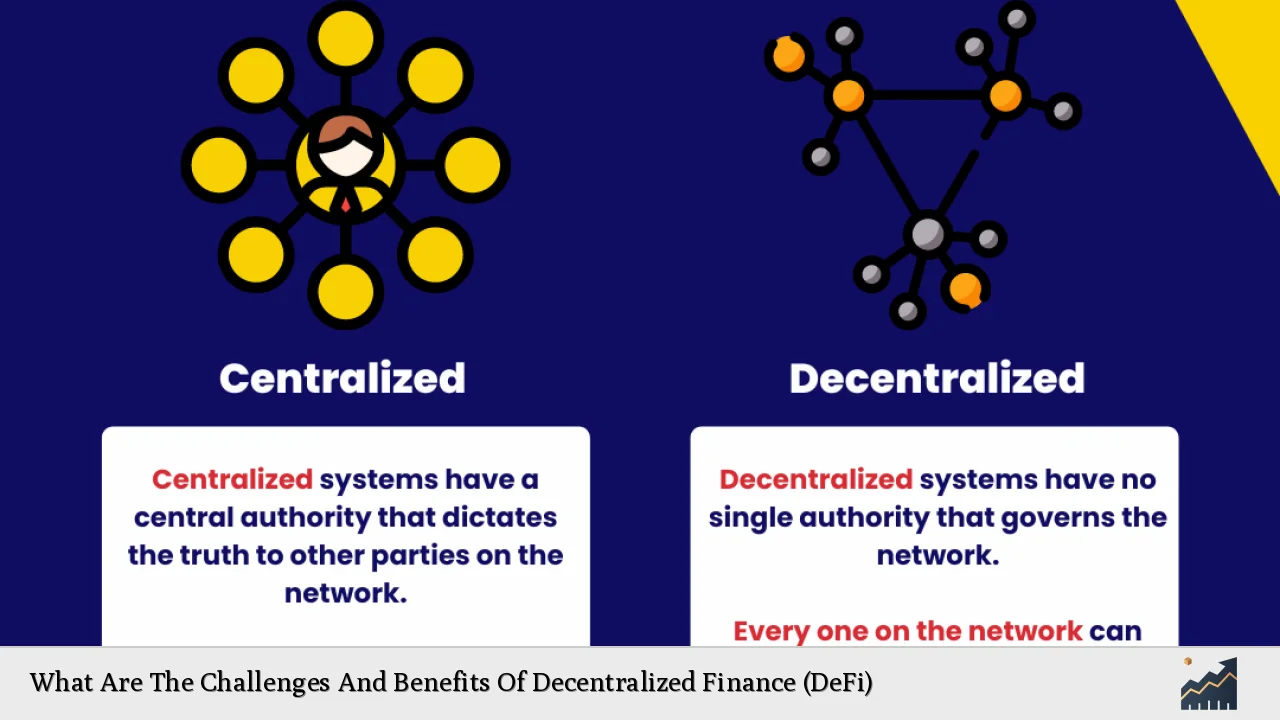

Decentralized Finance (DeFi) represents a revolutionary shift in the financial landscape, leveraging blockchain technology to create financial systems that operate without traditional intermediaries like banks. This innovative approach offers numerous benefits, such as increased accessibility and reduced costs, but it also faces significant challenges, including regulatory uncertainty and security risks. As the DeFi market continues to grow, understanding these dynamics is crucial for investors and finance professionals.

| Key Concept | Description/Impact |

|---|---|

| Financial Inclusion | DeFi provides financial services to individuals who lack access to traditional banking systems, enabling savings, borrowing, and investment opportunities for underserved populations. |

| Elimination of Intermediaries | By removing middlemen, DeFi reduces transaction costs and increases efficiency, allowing users to interact directly with financial services. |

| Transparency | All transactions on DeFi platforms are recorded on public blockchains, enhancing accountability and reducing fraud risks. |

| Regulatory Challenges | The decentralized nature of DeFi complicates regulatory oversight, leading to uncertainty for investors and developers alike. |

| Security Risks | Despite its advantages, DeFi is susceptible to hacking and smart contract vulnerabilities, which can result in significant financial losses. |

| User Experience Issues | The complexity of DeFi platforms can deter new users due to a steep learning curve associated with blockchain technology and decentralized applications. |

| Market Volatility | The value of assets in DeFi can be highly volatile, posing risks for investors who may not be prepared for sudden market shifts. |

| Future Growth Potential | The DeFi market is expected to grow significantly, with projections estimating it will reach USD 78.47 billion by 2029, driven by increased adoption and innovation. |

Market Analysis and Trends

The DeFi market has experienced explosive growth in recent years. As of 2024, the market size is projected to reach approximately USD 46.61 billion and is expected to grow at a compound annual growth rate (CAGR) of 10.98% through 2029. This growth is attributed to several factors:

- Increased Adoption: More users are engaging with DeFi protocols due to their accessibility and the potential for higher returns compared to traditional finance.

- Technological Advancements: Innovations such as layer-2 scaling solutions are improving transaction speeds and reducing costs.

- Institutional Participation: Financial institutions are beginning to explore DeFi products, integrating them into their operations or developing their own solutions.

The fastest growing regions for DeFi include North America and Asia Pacific, where a tech-savvy population is eager to embrace new financial technologies. The Asia Pacific region is particularly notable for its rapid adoption rates in countries like China, Japan, and India.

Implementation Strategies

For individuals and businesses looking to engage with DeFi, several strategies can enhance their experience:

- Education: Understanding the underlying technology of blockchain and smart contracts is crucial. Resources such as online courses and tutorials can help demystify these concepts.

- Diversification: Investors should consider diversifying their portfolios across various DeFi protocols to mitigate risks associated with individual projects.

- Security Practices: Utilizing hardware wallets and enabling two-factor authentication can protect assets from potential hacks.

- Engagement with Communities: Participating in community forums and discussions can provide insights into emerging trends and best practices within the DeFi space.

Risk Considerations

While DeFi offers compelling opportunities, it also presents several risks that investors must consider:

- Regulatory Uncertainty: The lack of clear regulations can expose investors to legal risks. As governments worldwide grapple with how to regulate this new sector, changes in policy could impact the viability of certain platforms.

- Smart Contract Vulnerabilities: Bugs or exploits in smart contracts can lead to significant financial losses. Investors should conduct thorough research on the security audits of platforms before investing.

- Market Volatility: The prices of cryptocurrencies used in DeFi can fluctuate wildly. Investors should be prepared for the possibility of losing a substantial portion of their investments.

Regulatory Aspects

The regulatory landscape surrounding DeFi remains complex and evolving. Key considerations include:

- Consumer Protection: Regulators aim to protect consumers from fraud while fostering innovation. Striking this balance is essential for the sustainable growth of DeFi.

- Tax Implications: Investors must understand how transactions within DeFi are taxed in their jurisdictions. This includes reporting requirements for capital gains from trades or earnings from yield farming.

- Compliance Requirements: As more institutional players enter the space, there may be increased pressure on DeFi platforms to comply with anti-money laundering (AML) and know your customer (KYC) regulations.

Future Outlook

The future of DeFi appears promising but will depend on several factors:

- Technological Innovation: Continued advancements in blockchain technology will likely enhance scalability and security within the ecosystem.

- Mainstream Adoption: As more individuals become familiar with cryptocurrencies and blockchain technology, adoption rates are expected to rise further.

- Regulatory Clarity: Clearer regulations will provide a framework that encourages innovation while protecting consumers, fostering a safer environment for investment.

Overall, as the industry matures, we may see an integration between traditional finance and DeFi systems that could redefine how financial services are delivered globally.

Frequently Asked Questions About Decentralized Finance (DeFi)

- What is Decentralized Finance (DeFi)?

DeFi refers to a financial system built on blockchain technology that operates without traditional intermediaries like banks. It allows users to lend, borrow, trade, and earn interest on their assets through decentralized applications (dApps). - What are the main benefits of using DeFi?

The primary benefits include increased accessibility for unbanked populations, reduced transaction costs by eliminating middlemen, enhanced transparency through blockchain records, and the potential for higher returns compared to traditional finance. - What risks should I be aware of when investing in DeFi?

Investors should consider regulatory uncertainty, smart contract vulnerabilities that could lead to hacks or losses, market volatility that affects asset prices significantly, and user experience challenges due to complex interfaces. - How does regulation affect DeFi?

The decentralized nature of DeFi complicates regulatory oversight. While some regulations aim at consumer protection and preventing fraud, excessive regulation could stifle innovation within the sector. - What trends are shaping the future of DeFi?

Key trends include increased institutional participation in DeFi products, technological advancements improving scalability and security measures, and a growing focus on regulatory clarity that fosters a safer investment environment. - How can I get started with investing in DeFi?

Begin by educating yourself about blockchain technology and different DeFi protocols. Consider diversifying your investments across multiple platforms while implementing strong security practices like using hardware wallets. - What role do smart contracts play in DeFi?

Smart contracts automate transactions within DeFi platforms without intermediaries. They execute predefined conditions automatically when certain criteria are met, ensuring transparency and efficiency. - Is it safe to invest in DeFi?

The safety of investing in DeFi largely depends on understanding the associated risks. Conduct thorough research on platforms’ security measures before investing; however, all investments carry inherent risks.

Decentralized Finance holds immense potential but also presents unique challenges that require careful navigation by investors. By understanding both sides—its benefits and risks—individuals can make informed decisions as they explore this innovative financial landscape.