Stablecoins have emerged as a vital component of the cryptocurrency ecosystem, providing a stable alternative to the volatility associated with traditional cryptocurrencies. As their popularity grows, so does the need for secure and efficient storage solutions. This article explores the best wallets for storing stablecoins, analyzing market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Stablecoin Market Growth | The stablecoin market has reached a historic $200 billion in total market capitalization, with Tether (USDT) leading at $139 billion and USD Coin (USDC) following at $41 billion. |

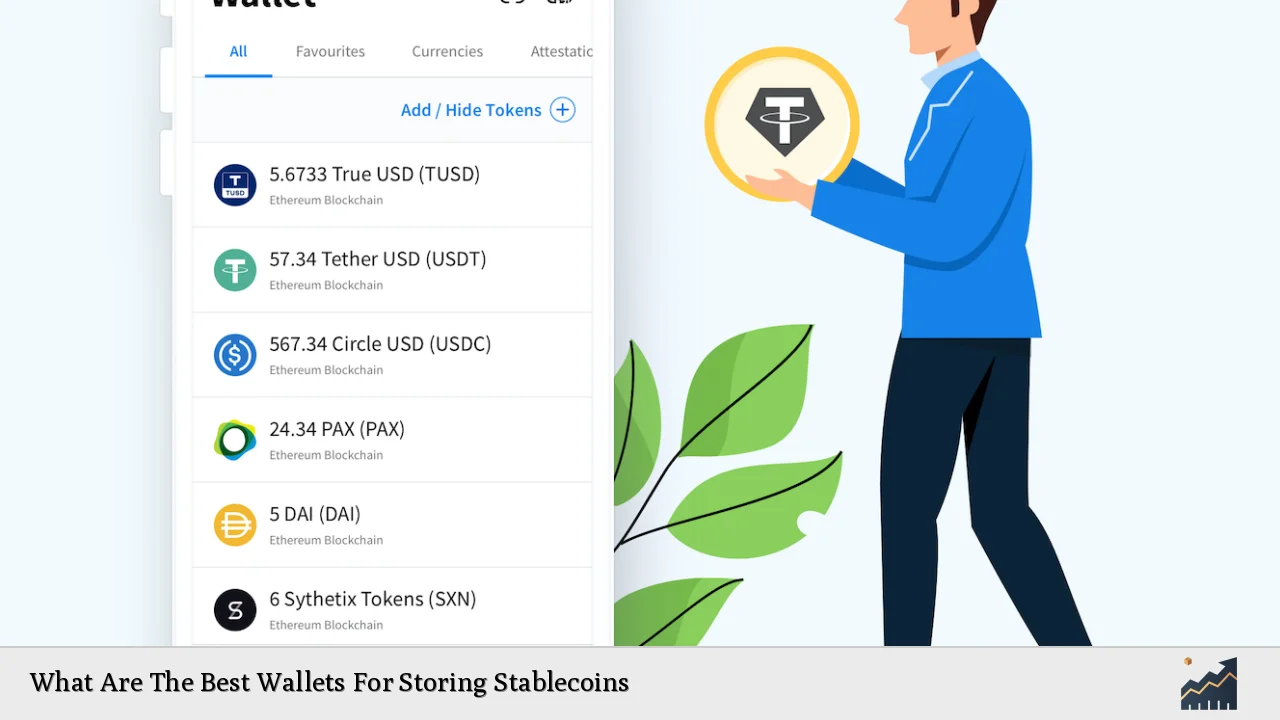

| Wallet Types | Wallets can be categorized into hardware wallets, software wallets, and custodial wallets, each offering different levels of security and accessibility. |

| Security Features | Robust security features such as encryption, multi-factor authentication, and cold storage are essential for protecting stablecoin assets. |

| Regulatory Compliance | Adherence to regulations is crucial for stablecoin issuers and wallet providers to ensure user trust and legal compliance. |

| Future Trends | The adoption of stablecoins is expected to continue growing, particularly in regions with unstable financial systems, as they offer a reliable means of transaction and value preservation. |

Market Analysis and Trends

The stablecoin market has shown remarkable growth over the past few years. By December 2024, the total market capitalization of stablecoins reached approximately $200 billion. This growth is largely driven by increased trading activity in cryptocurrencies and the expanding use cases of stablecoins in payments, remittances, and savings. Tether (USDT) continues to dominate the market with a 70% share, while USD Coin (USDC) holds about 20%.

The demand for stablecoins is particularly strong in regions facing economic instability. For instance:

- In Latin America and Sub-Saharan Africa, stablecoins are increasingly used as a hedge against local currency volatility.

- Businesses are adopting stablecoins for cross-border transactions due to their lower fees and faster settlement times compared to traditional banking systems.

Furthermore, regulatory scrutiny is intensifying as governments seek to establish clear frameworks for stablecoin usage. This could impact how wallets operate and how users interact with these digital assets.

Implementation Strategies

When selecting a wallet for storing stablecoins, investors should consider several factors:

- Security: Opt for wallets that provide robust security features such as hardware storage or multi-signature options.

- User Experience: A user-friendly interface enhances accessibility for both novice and experienced users.

- Compatibility: Ensure the wallet supports multiple types of stablecoins (e.g., USDT, USDC, DAI) and integrates with various platforms.

- Backup Options: Look for wallets that offer secure backup features to protect against data loss.

Recommended Wallets

- Ledger Nano X

- Type: Hardware wallet

- Pros: High security through cold storage; supports over 1,500 cryptocurrencies; Bluetooth connectivity.

- Cons: Higher price point; complex setup process.

- Trust Wallet

- Type: Software wallet

- Pros: User-friendly interface; supports a wide range of cryptocurrencies; integrates with DeFi applications.

- Cons: Limited to mobile devices; less secure than hardware wallets.

- Coinbase Wallet

- Type: Custodial wallet

- Pros: Easy integration with Coinbase exchange; strong security features; backup options available.

- Cons: Custodial risks associated with reliance on Coinbase.

- Exodus Wallet

- Type: Software wallet

- Pros: Intuitive design; built-in exchange feature; supports multiple cryptocurrencies.

- Cons: Some custodial elements; less secure than hardware alternatives.

- MyEtherWallet (MEW)

- Type: Web-based wallet

- Pros: Non-custodial; integrates with hardware wallets; open-source.

- Cons: Complexity may deter beginners; susceptible to phishing attacks.

Risk Considerations

Investing in stablecoins comes with its own set of risks:

- Counterparty Risk: Users must trust that the issuer maintains adequate reserves to back the stablecoin’s value.

- Regulatory Risks: Changes in regulations could affect the usability of certain wallets or even the stability of some stablecoins.

- Security Risks: Even with robust security measures in place, there is always a risk of hacks or breaches that could lead to loss of assets.

To mitigate these risks:

- Diversify holdings across multiple wallets and issuers.

- Use hardware wallets for significant amounts to ensure maximum security.

- Stay informed about regulatory developments affecting stablecoins.

Regulatory Aspects

Regulatory frameworks surrounding stablecoins are evolving rapidly. In many jurisdictions, regulators are focusing on ensuring transparency and consumer protection while promoting innovation within the financial sector. Key points include:

- Compliance Requirements: Stablecoin issuers are increasingly required to undergo regular audits and maintain reserves that match their circulating supply.

- Licensing: Some countries are introducing licensing requirements for entities involved in issuing or managing stablecoins.

- Consumer Protection: Regulations aim to protect consumers from potential losses due to issuer insolvency or fraud.

As regulations become clearer, it is likely that institutional adoption will increase, leading to further growth in the stablecoin market.

Future Outlook

The future of stablecoins appears promising as they continue to gain traction across various sectors:

- Increased Adoption: With businesses recognizing the benefits of using stablecoins for transactions—such as lower fees and faster processing times—their adoption is expected to rise significantly.

- Technological Advancements: Innovations in blockchain technology will likely enhance the functionality and security of wallets used for storing stablecoins.

- Global Integration: As more financial institutions explore integrating stablecoins into their services, we may see them become a more common medium of exchange globally.

Market experts project that by 2025, the total market capitalization of stablecoins could reach $400 billion if favorable regulatory conditions persist.

Frequently Asked Questions About What Are The Best Wallets For Storing Stablecoins

- What types of wallets are available for storing stablecoins?

There are three main types of wallets: hardware wallets (for maximum security), software wallets (for ease of use), and custodial wallets (managed by third parties). - How do I choose the best wallet for my needs?

Consider factors like security features, user experience, compatibility with different cryptocurrencies, and backup options when selecting a wallet. - Are hardware wallets worth the investment?

Yes, hardware wallets provide superior security by keeping private keys offline, making them ideal for storing significant amounts of cryptocurrency. - What are the risks associated with using custodial wallets?

Custodial wallets require trust in third-party providers which could lead to potential losses if the provider faces issues or breaches. - Can I use multiple wallets for different types of stablecoins?

Yes, using multiple wallets can enhance security and allow you to manage different assets more effectively. - How can I ensure my wallet remains secure?

Use strong passwords, enable two-factor authentication (2FA), regularly update software, and keep backups of your recovery phrases. - What should I do if I lose access to my wallet?

If you have backed up your recovery phrase securely, you can restore access using that phrase. If not, recovery may be impossible. - Are there any fees associated with using these wallets?

Fees vary by wallet type; hardware wallets may have upfront costs while software wallets might charge transaction fees depending on network activity.

Stablecoins represent a significant evolution in digital finance by providing stability amidst volatility. Selecting an appropriate wallet is crucial for safeguarding these assets while taking advantage of their unique benefits in today’s dynamic financial landscape.