Investing in the stock market requires a keen understanding of various sectors and their potential for long-term growth. As economic conditions fluctuate, certain sectors tend to outperform others, driven by technological advancements, demographic shifts, and changing consumer preferences. This analysis aims to identify the best stock market sectors for long-term growth, supported by current market statistics and trends.

| Key Concept | Description/Impact |

|---|---|

| Healthcare | The healthcare sector is projected to yield the highest long-term returns due to advancements in medical technology and pharmaceuticals, particularly with innovations in obesity treatments and chronic disease management. |

| Information Technology | This sector is at the forefront of growth, driven by cloud computing, artificial intelligence (AI), and cybersecurity. The demand for tech solutions continues to grow, making it a cornerstone for future investments. |

| Financials | The financial sector is benefiting from rising interest rates and increased consumer spending. Companies involved in asset management and insurance are particularly well-positioned for growth. |

| Energy | While traditional energy sources face challenges, renewable energy is gaining traction. Investments in clean technology and infrastructure are expected to drive long-term growth in this sector. |

| Consumer Discretionary | This sector thrives during economic expansion as consumer spending increases. E-commerce and luxury goods are key areas within this sector that show promise for growth. |

| Industrials | As economies recover post-pandemic, industrials related to infrastructure development and defense are expected to see significant growth due to government spending initiatives. |

| Utilities | This defensive sector offers stability but is generally slower-growing. However, advancements in technology may enhance efficiency and profitability in the long term. |

Market Analysis and Trends

The stock market is influenced by various macroeconomic factors that affect different sectors differently. As of 2024, several trends are shaping the investment landscape:

- Technological Advancements: The rapid evolution of technology continues to create opportunities in sectors like information technology and healthcare. Companies that leverage AI and machine learning are expected to outperform.

- Demographic Changes: An aging population is driving demand for healthcare services and products. This trend is particularly evident in pharmaceuticals and biotechnology.

- Sustainability Focus: There is a growing emphasis on sustainability, pushing investments towards renewable energy sources. The shift towards electric vehicles (EVs) and clean energy solutions presents significant growth potential.

- Economic Recovery: Following disruptions caused by the pandemic, sectors like industrials and consumer discretionary are poised for recovery as consumer confidence improves.

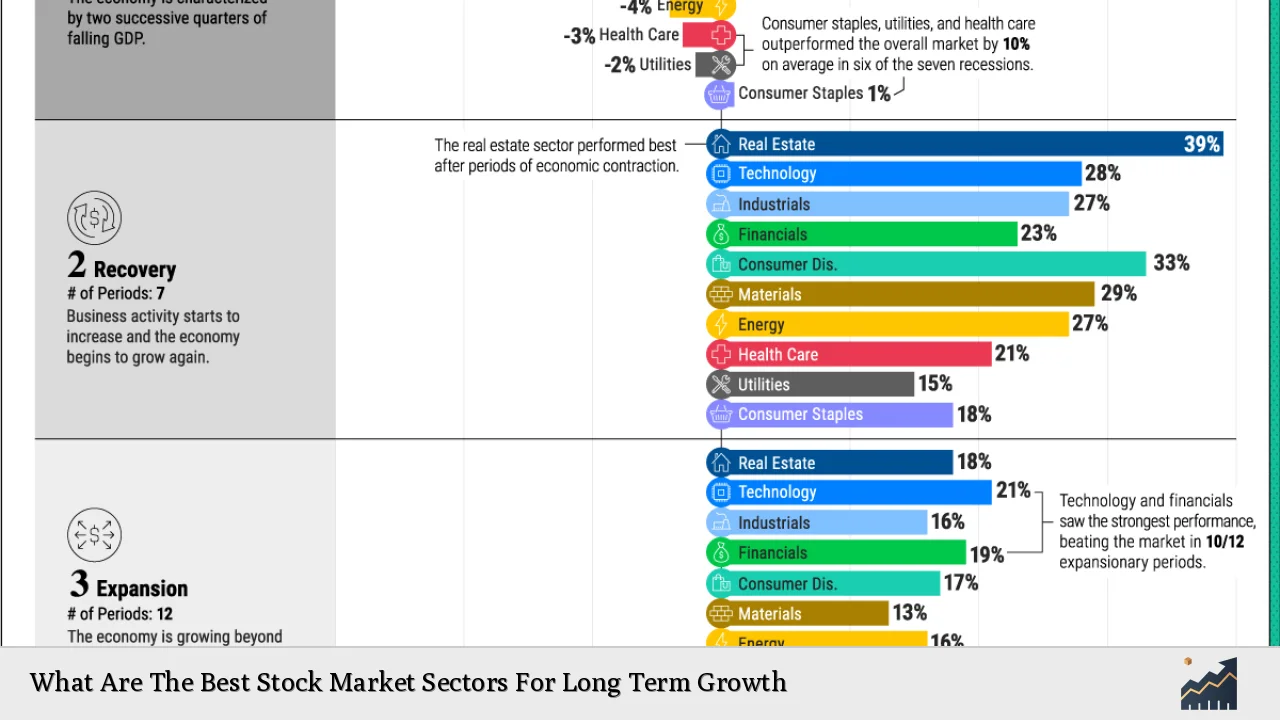

Current statistics highlight these trends; for instance, the information technology sector has led the market with a cumulative gain of 28% as of mid-2024, driven by optimism surrounding AI technologies. Additionally, healthcare innovations have positioned it as a top performer due to breakthroughs in treatments that cater to chronic conditions.

Implementation Strategies

Investing in these sectors requires a strategic approach:

- Diversification: Spread investments across multiple sectors to mitigate risks associated with market volatility. For example, combining high-growth sectors like technology with more stable sectors like utilities can balance potential returns.

- Sector ETFs: Consider exchange-traded funds (ETFs) that focus on specific sectors. These funds provide exposure to a basket of stocks within a sector, reducing individual stock risk while capitalizing on sector growth.

- Long-Term Perspective: Focus on long-term trends rather than short-term fluctuations. Sectors such as healthcare may experience volatility but offer substantial returns over time due to continuous demand.

- Regular Monitoring: Stay informed about economic indicators that impact sector performance. Adjust investment strategies based on macroeconomic conditions such as interest rates and inflation trends.

Risk Considerations

While investing in high-growth sectors can yield significant returns, it also comes with inherent risks:

- Market Volatility: High-growth sectors like technology can be subject to sharp price fluctuations based on market sentiment or regulatory changes.

- Sector-Specific Risks: Each sector faces unique challenges; for instance, healthcare companies may deal with regulatory hurdles while energy companies might face commodity price fluctuations.

- Economic Sensitivity: Sectors such as consumer discretionary are sensitive to economic downturns. A recession can lead to reduced consumer spending, negatively impacting these investments.

Investors should conduct thorough research and consider their risk tolerance before allocating funds into these sectors.

Regulatory Aspects

Understanding the regulatory environment is crucial for investing:

- Healthcare Regulations: The pharmaceutical industry faces stringent regulations regarding drug approvals and pricing policies. Investors should monitor changes in healthcare laws that could impact profitability.

- Financial Sector Oversight: Regulatory bodies like the SEC oversee financial institutions. Changes in regulations can affect operational costs and profit margins within this sector.

- Environmental Regulations: The energy sector is increasingly influenced by environmental laws aimed at reducing carbon emissions. Investments in renewable energy may benefit from government incentives while traditional energy sources could face stricter regulations.

Staying informed about regulatory developments can help investors anticipate changes that may affect their investments.

Future Outlook

The future outlook for these sectors appears promising:

- Healthcare: Continued innovation in medical treatments and technologies will likely sustain growth in this sector. The global healthcare market is projected to reach $11 trillion by 2027.

- Technology: As businesses increasingly adopt digital solutions, the demand for IT services will continue to rise. Analysts predict that AI-related stocks will dominate market performance over the next decade.

- Financials: With rising interest rates benefiting banks and financial services firms, this sector is expected to maintain robust performance as economic conditions improve.

- Energy: The transition towards renewable energy sources presents both challenges and opportunities. Companies investing in sustainable practices are likely to see long-term benefits as global energy demands evolve.

In summary, individual investors should carefully consider these trends when evaluating potential investments across various sectors.

Frequently Asked Questions About What Are The Best Stock Market Sectors For Long Term Growth

- Which stock market sectors are best for long-term investment?

The best sectors include healthcare, information technology, financials, energy (particularly renewables), consumer discretionary, and industrials due to their strong growth potential. - How do I choose which sector to invest in?

Consider macroeconomic trends, your risk tolerance, investment horizon, and current market conditions when selecting a sector. - Are there risks associated with investing in high-growth sectors?

Yes, high-growth sectors often experience volatility and are sensitive to economic downturns or regulatory changes. - What role does diversification play in investing?

Diversification helps mitigate risks by spreading investments across different sectors or asset classes. - How can I stay informed about market trends?

Follow financial news outlets, subscribe to investment newsletters, or use market analysis platforms for regular updates. - What impact do interest rates have on stock market sectors?

Rising interest rates generally benefit financials but can negatively impact high-growth sectors like technology due to increased borrowing costs. - Should I invest more heavily in defensive or growth sectors?

This depends on your investment strategy; defensive sectors provide stability during downturns while growth sectors offer higher potential returns during expansions. - Is it advisable to seek professional investment advice?

If you’re unsure about your investment strategy or need personalized guidance based on your financial situation, consulting a financial advisor is recommended.

This comprehensive analysis highlights not only the best stock market sectors for long-term growth but also provides insights into implementation strategies, risks involved, regulatory aspects, and future outlooks essential for informed investment decisions.