The rise of stablecoins has transformed the cryptocurrency landscape, providing a bridge between traditional finance and digital assets. Stablecoins, which are pegged to fiat currencies or other assets, offer the stability that many cryptocurrencies lack, making them ideal for trading and investment. As their popularity grows, so does the need for reliable platforms to trade these digital currencies. This article explores the best platforms for trading stablecoins, analyzing market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Stablecoin Market Growth | The total market capitalization of stablecoins reached approximately $172.8 billion as of September 2024, representing 7.89% of the overall cryptocurrency market. |

| Transaction Volume | Stablecoin transaction volumes surged to $20.1 trillion in 2024, indicating their increasing adoption for payments and trading. |

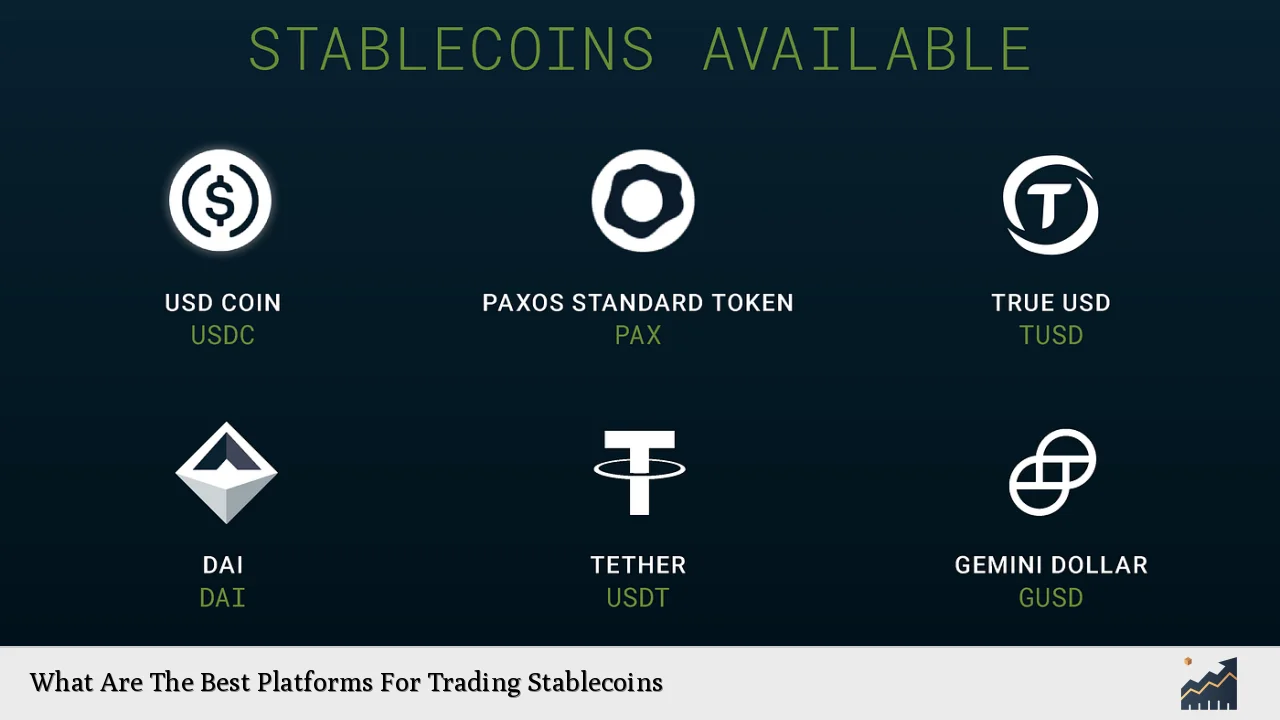

| Leading Stablecoins | Tether (USDT) dominates the market with a share of over 66%, followed by USD Coin (USDC) and Dai (DAI). |

| Platform Features | Top platforms offer low fees, high liquidity, and advanced trading tools tailored for stablecoin transactions. |

| Security Measures | Robust security protocols including two-factor authentication (2FA), cold storage, and insurance policies are critical for protecting user assets. |

Market Analysis and Trends

The stablecoin market has experienced significant growth over the past few years. As of 2024, the total market capitalization of stablecoins has reached approximately $172.8 billion, reflecting a 17.55% increase since early 2024. This surge is primarily driven by increased adoption in various sectors, including e-commerce and cross-border transactions. Notably, stablecoins now facilitate about 30% of global remittances, showcasing their utility in international payments.

Key Trends

- Increased Adoption: The number of active users engaging with stablecoins has grown significantly, with over 27.5 million active users reported as of mid-2024.

- Diverse Use Cases: Beyond trading, stablecoins are increasingly used in decentralized finance (DeFi) applications for yield farming and liquidity provision.

- Regulatory Developments: Stricter regulations are being implemented globally, influencing how stablecoins are issued and traded.

Implementation Strategies

When trading stablecoins, investors can adopt several strategies to optimize their returns:

- Arbitrage Trading: Traders can exploit price discrepancies across different exchanges to secure profits.

- Yield Farming: By providing liquidity to DeFi platforms using stablecoins, traders can earn interest on their holdings.

- Hedging Against Volatility: Stablecoins serve as a safe haven during periods of high volatility in the broader cryptocurrency market.

Recommended Platforms

- Binance: Known for its extensive selection of cryptocurrencies and trading pairs, Binance offers low fees and high liquidity for stablecoin transactions.

- Coinbase: With a user-friendly interface and robust security features, Coinbase is ideal for both beginners and experienced traders.

- Kraken: Offers advanced trading tools and a strong reputation for security.

- Bitget: Focuses on derivative markets with competitive fees and innovative features like copy trading.

- OKX: Provides a wide range of tokens and advanced trading options including margin trading.

Risk Considerations

While trading stablecoins may seem less risky compared to other cryptocurrencies due to their price stability, several risks still need to be considered:

- Counterparty Risk: The stability of a stablecoin depends on its underlying assets; thus, issues with asset backing can lead to devaluation.

- Regulatory Risks: Changes in regulations can impact the availability and legality of certain stablecoins.

- Market Liquidity Risks: In times of market stress, liquidity can dry up quickly, affecting the ability to execute trades at desired prices.

Regulatory Aspects

The regulatory landscape for stablecoins is evolving rapidly:

- In the United States and Europe, regulators are increasingly scrutinizing stablecoin issuers to ensure compliance with financial regulations.

- The introduction of frameworks such as the EU’s Markets in Crypto-Assets (MiCA) regulation aims to provide clarity on how stablecoins should be managed and traded.

- Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations is becoming standard practice among reputable exchanges.

Future Outlook

The future of stablecoins appears promising as they continue to gain traction across various sectors:

- Innovative Financial Products: The integration of stablecoins into traditional finance could lead to new financial products that leverage their stability.

- Local Stablecoins: There is potential growth in region-specific stablecoins that cater to local economic conditions.

- Increased Institutional Adoption: As more institutions recognize the benefits of using stablecoins for transactions and investments, demand is expected to rise further.

Frequently Asked Questions About What Are The Best Platforms For Trading Stablecoins

- What are stablecoins?

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging them to a reserve asset like fiat currency or commodities. - Why trade stablecoins?

Traders use stablecoins for their price stability compared to other cryptocurrencies, making them ideal for hedging against volatility. - Which platforms are best for trading stablecoins?

The best platforms include Binance, Coinbase, Kraken, Bitget, and OKX due to their low fees and high liquidity. - What risks are associated with trading stablecoins?

Risks include counterparty risk related to asset backing, regulatory risks from changing laws, and liquidity risks during market downturns. - How do I choose a platform for trading?

Consider factors such as security measures, fees, available trading pairs, user experience, and regulatory compliance when selecting a platform. - Can I earn interest on my stablecoin holdings?

Yes, many DeFi platforms offer yield farming opportunities where you can earn interest by providing liquidity with your stablecoin holdings. - Are there tax implications when trading stablecoins?

Yes, tax regulations vary by jurisdiction; it’s advisable to consult a tax professional regarding your specific situation. - How do I ensure my funds are secure on an exchange?

Select exchanges that implement robust security measures such as two-factor authentication (2FA), cold storage for assets, and insurance policies against breaches.

In conclusion, choosing the right platform for trading stablecoins involves careful consideration of various factors including security features, fees structure, liquidity options, regulatory compliance, and personal investment strategies. With the growing adoption of these digital assets in various sectors of finance and commerce, traders have more opportunities than ever before to leverage their benefits while managing associated risks effectively.