Layer 1 (L1) blockchains form the foundational layer of blockchain technology, providing the necessary infrastructure for executing smart contracts and supporting decentralized applications (dApps). As the blockchain ecosystem evolves, several L1 platforms have emerged as leaders in enabling smart contracts, each with unique features and capabilities. This article explores the best L1 blockchain platforms for smart contracts, analyzing their market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

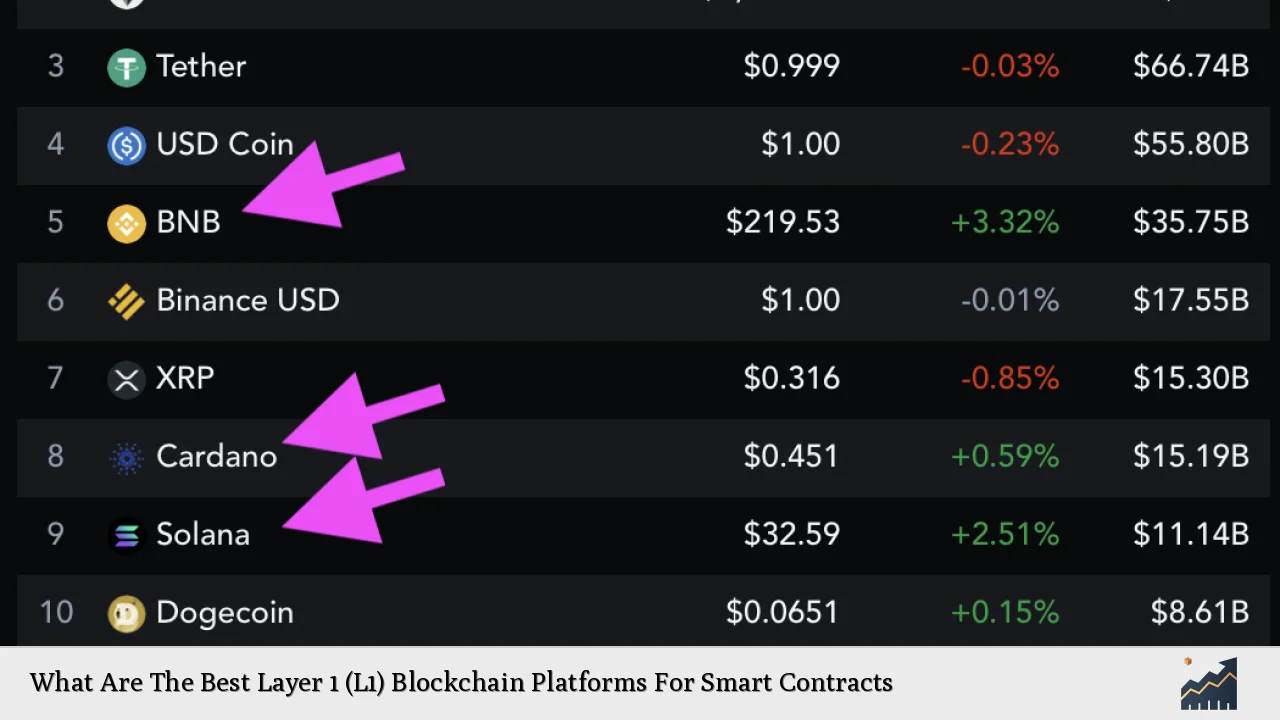

| Ethereum | The first and most widely used platform for smart contracts, boasting a large developer community and extensive dApp ecosystem. |

| Solana | Known for its high throughput and low transaction costs, making it attractive for developers looking to build scalable applications. |

| Cardano | Focuses on security and sustainability through a research-driven approach and a unique proof-of-stake consensus mechanism. |

| BNB Chain | A key player in the DeFi space, offering low transaction fees and a robust environment for dApp development. |

| Avalanche | Offers high scalability and customizable blockchain networks, appealing to enterprises looking for tailored solutions. |

| Tezos | Features on-chain governance and self-amendment capabilities, allowing it to evolve without hard forks. |

| Kadena | Combines scalability with security through its unique braided blockchain architecture, supporting smart contracts at high speeds. |

| Cosmos | Enables interoperability between different blockchains, allowing for seamless communication and data exchange. |

Market Analysis and Trends

The market for Layer 1 blockchains has witnessed substantial growth in recent years. According to recent reports, Layer 1 blockchains collectively surpassed a market capitalization of $2.8 trillion as of late 2024. This surge is attributed to the increasing adoption of decentralized finance (DeFi) applications and non-fungible tokens (NFTs), which heavily rely on robust smart contract functionality.

Key Trends:

- Increased Adoption: The demand for L1 blockchains has surged due to their ability to facilitate complex transactions without intermediaries.

- Technological Innovations: Many L1 platforms are implementing advanced technologies such as sharding and layer-2 solutions to enhance scalability.

- Regulatory Developments: As governments worldwide begin to establish clearer regulations around cryptocurrencies, compliant L1 platforms are gaining traction among institutional investors.

- Market Volatility: Despite the overall growth, individual L1 tokens have experienced significant volatility. For instance, Mantra’s token surged over 7,000% YTD in 2024 due to strategic partnerships that enhanced its utility in real-world asset tokenization.

Implementation Strategies

Investors and developers looking to leverage L1 blockchain platforms should consider several implementation strategies:

- Choosing the Right Platform: Evaluate each platform’s transaction speed, fees, security features, and community support. Ethereum remains a top choice for its extensive ecosystem but may face challenges related to scalability.

- Utilizing Layer-2 Solutions: For platforms like Ethereum that face congestion issues, integrating layer-2 solutions can significantly enhance transaction speeds while reducing costs.

- Security Practices: Implementing rigorous security audits is essential when developing smart contracts to mitigate vulnerabilities that could lead to exploits.

- Community Engagement: Engaging with developer communities can provide valuable insights into best practices and emerging trends within specific ecosystems.

Risk Considerations

While investing in or developing on L1 blockchains offers significant opportunities, it also comes with inherent risks:

- Smart Contract Vulnerabilities: Bugs in smart contract code can lead to substantial financial losses. The infamous DAO hack on Ethereum serves as a cautionary tale regarding the importance of thorough testing.

- Regulatory Risks: As governments tighten regulations around cryptocurrencies, projects that fail to comply may face legal challenges or operational restrictions.

- Market Volatility: The cryptocurrency market is notoriously volatile. Investors should be prepared for significant price fluctuations that can impact their holdings.

- Technological Limitations: Scalability issues remain a challenge for many L1 blockchains. As user adoption increases, networks may struggle to maintain performance levels without significant upgrades.

Regulatory Aspects

The regulatory landscape surrounding Layer 1 blockchains is evolving rapidly. Key considerations include:

- Compliance Requirements: Many jurisdictions require blockchain projects to adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Platforms that integrate these requirements will likely gain favor with regulators.

- International Standards: Organizations like the International Organization for Standardization (ISO) are developing standards for blockchain technology that could facilitate cross-border operations.

- Legal Frameworks: Countries such as Malta have established comprehensive regulatory frameworks that support blockchain innovation while ensuring consumer protection.

Future Outlook

The future of Layer 1 blockchains appears promising as technological advancements continue to drive innovation:

- Enhanced Interoperability: Future developments will likely focus on creating more sophisticated cross-chain protocols that allow different blockchains to communicate seamlessly.

- Sustainability Initiatives: With growing concerns about energy consumption associated with proof-of-work systems, many L1 platforms are transitioning towards more eco-friendly consensus mechanisms like proof-of-stake.

- Mainstream Adoption: As traditional financial institutions explore blockchain technology’s potential, L1 platforms will play a crucial role in facilitating this integration.

- Evolving Governance Models: On-chain governance mechanisms will become increasingly important as communities seek ways to manage upgrades and changes without fracturing networks through hard forks.

Frequently Asked Questions About What Are The Best Layer 1 (L1) Blockchain Platforms For Smart Contracts

- What is a Layer 1 blockchain?

A Layer 1 blockchain is the base layer of a blockchain network where transactions are processed directly on the main chain. Examples include Bitcoin and Ethereum. - Why are smart contracts important?

Smart contracts automate processes by executing predefined conditions without intermediaries, enhancing efficiency and reducing costs. - Which Layer 1 platform is best for developers?

Ethereum remains popular due to its extensive documentation and large community; however, Solana is gaining traction due to its speed and low fees. - What are the risks associated with investing in Layer 1 blockchains?

Risks include market volatility, regulatory changes, technological limitations, and potential vulnerabilities in smart contract code. - How do regulatory changes impact Layer 1 blockchains?

Regulatory changes can affect compliance requirements for projects operating on these platforms, influencing their operational viability. - What trends should investors watch in the Layer 1 space?

Investors should monitor developments in scalability solutions, regulatory frameworks, interoperability advancements, and sustainability initiatives. - Can Layer 1 blockchains support multiple applications?

Yes, many L1 platforms support various applications ranging from DeFi protocols to NFT marketplaces. - What is the future of Layer 1 blockchains?

The future looks bright with ongoing innovations aimed at enhancing scalability, interoperability, security measures, and mainstream adoption across industries.

Layer 1 blockchains serve as the backbone of decentralized ecosystems by enabling smart contracts that facilitate complex transactions efficiently. Understanding their capabilities and challenges is crucial for investors looking to navigate this dynamic landscape effectively.