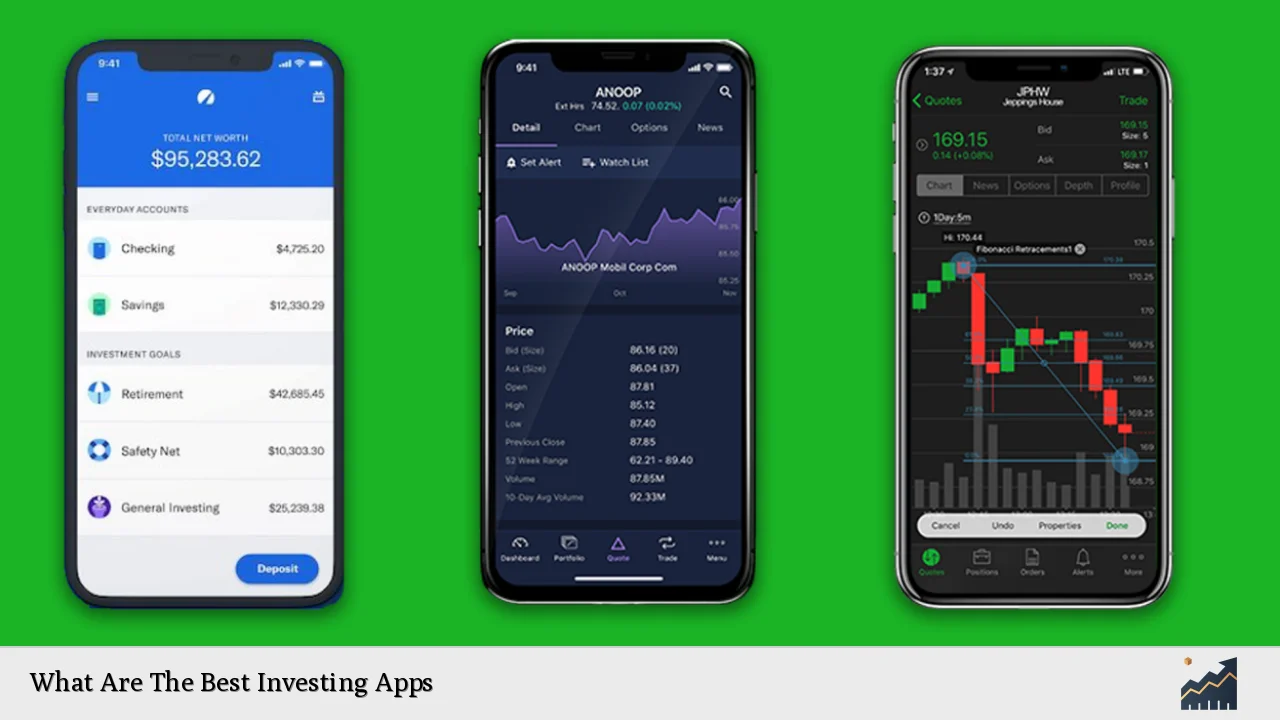

Investing apps have revolutionized the way individuals manage their finances and grow their wealth. With the rise of technology, these platforms offer users the ability to trade stocks, manage portfolios, and access financial advice from the comfort of their smartphones. The best investing apps cater to a variety of user needs, whether for beginners seeking guidance or experienced traders looking for advanced tools. This article explores the top investing apps available in 2025, highlighting their features, benefits, and potential drawbacks.

| App Name | Key Features |

|---|---|

| SoFi Invest | Commission-free trading, financial planning help |

| Betterment | Automated investing, socially responsible portfolios |

| E*TRADE | Robust trading tools, user-friendly interface |

Best Overall Investment App: E*TRADE

E*TRADE stands out as the best overall investment app due to its comprehensive features and user-friendly interface. It offers a seamless experience for both novice and experienced investors. Users can trade stocks, ETFs, and mutual funds without paying commissions. The app also provides advanced trading tools and a wealth of educational resources to help users make informed decisions.

E*TRADE’s mobile platform is designed for convenience, allowing users to manage their accounts on the go. It includes features such as customizable watchlists, real-time market data, and advanced charting capabilities. The app’s intuitive navigation makes it easy for users to execute trades quickly and efficiently.

Important info: E*TRADE has no minimum balance requirement for standard accounts, making it accessible for new investors. However, options trading incurs a fee of $0.50 to $0.65 per contract based on trading volume.

Best Investment App for Beginners: SoFi Invest

SoFi Invest is an excellent choice for beginners looking to start their investment journey. The app is designed with simplicity in mind, allowing users to begin investing with as little as $1. SoFi offers commission-free trading on stocks and ETFs, eliminating the barriers often associated with starting investments.

In addition to trading, SoFi provides users with access to financial planning resources. Members can receive personalized advice from certified financial planners at no additional cost. This feature is particularly beneficial for those who may feel overwhelmed by the complexities of investing.

Important info: While SoFi does not offer automatic tax-loss harvesting, it compensates with its robust educational resources and support for new investors.

Best Automated Investing App: Betterment

Betterment is recognized as one of the leading robo-advisors in the market. It automates the investment process by creating personalized portfolios based on individual risk tolerance and financial goals. Users can choose from various portfolio options, including socially responsible investments that align with their values.

The app’s automated features include tax-loss harvesting and automatic rebalancing, which help optimize returns over time. Betterment is ideal for those who prefer a hands-off approach to investing while still wanting to achieve long-term growth.

Important info: Betterment requires a minimum balance of $0 for its digital service but charges a management fee ranging from 0.25% to 0.65% annually based on the assets under management.

Best App for Saving: Acorns

Acorns takes a unique approach by combining saving and investing into one platform. The app rounds up users’ purchases to the nearest dollar and invests the spare change into diversified portfolios. This feature makes it easy for individuals to start investing without needing significant upfront capital.

Acorns also offers various account types, including retirement accounts (IRA) and custodial accounts for children. Its user-friendly interface simplifies tracking investments and savings goals.

Important info: Acorns charges a monthly fee ranging from $3 to $12 depending on the selected service tier, but there are no minimum balance requirements for starting an investment account.

Best Investment App for Active Traders: Interactive Brokers

For active traders seeking advanced tools and features, Interactive Brokers is an excellent choice. The app provides access to a wide range of investment products across global markets. It is particularly well-suited for experienced traders who require sophisticated trading capabilities.

Interactive Brokers offers competitive pricing with low commissions on trades and access to margin accounts. The platform includes powerful research tools and real-time data analysis features that cater to traders looking to make quick decisions based on market movements.

Important info: While there is no minimum balance requirement for standard accounts, Interactive Brokers may charge fees based on trading activity levels.

Best Full-Service Investment App: Fidelity

Fidelity is known as one of the top full-service investment apps available today. It combines robust research tools with a comprehensive suite of investment options tailored to meet various investor needs. Fidelity provides commission-free trades on stocks and ETFs while offering extensive educational resources.

The app’s features include personalized investment guidance through its financial advisors and access to retirement planning tools. Fidelity’s commitment to customer service ensures that users receive support whenever needed.

Important info: Fidelity has no minimum balance requirement for standard brokerage accounts, making it accessible for all types of investors.

Best Investment App for Socially Responsible Investing: Ellevest

Ellevest stands out as an investment app focused on socially responsible investing (SRI). It aims primarily at women investors but welcomes anyone interested in ethical investment strategies. Ellevest offers personalized portfolios that align with users’ values while providing comprehensive financial planning services.

The app includes features such as goal-based investing and educational content tailored specifically toward women’s financial needs. This focus helps empower users by providing them with the tools they need to make informed investment decisions.

Important info: Ellevest does not have a minimum balance requirement but charges management fees based on assets under management.

FAQs About Best Investing Apps

- What are investing apps?

Investing apps are mobile platforms that allow users to trade stocks, manage portfolios, and access financial advice. - Are investing apps safe?

Most reputable investing apps use encryption and security measures to protect user data and funds. - Do I need experience to use an investing app?

No, many investing apps cater specifically to beginners with educational resources and automated features. - Can I invest with little money using these apps?

Yes, several apps allow you to start investing with minimal amounts, sometimes as low as $1. - What fees should I expect when using an investing app?

Fees vary by app; some charge monthly fees or commissions per trade while others offer commission-free trading.

Investing apps provide diverse options tailored to different investor needs—from beginners seeking guidance to seasoned traders requiring advanced tools. By understanding each app’s unique features and benefits, you can choose the one that aligns best with your financial goals and investment strategy.