The cryptocurrency market has seen significant growth and evolution over the past few years, with exchange-based tokens emerging as key players in this landscape. These tokens, often linked to specific cryptocurrency exchanges, provide users with various benefits such as reduced trading fees, staking rewards, and governance rights. As individual investors and finance professionals look for viable long-term investment opportunities, understanding the best exchange-based tokens becomes crucial. This article delves into the current market analysis, implementation strategies, risk considerations, regulatory aspects, and future outlook of exchange-based tokens.

| Key Concept | Description/Impact |

|---|---|

| Exchange Token Utility | Exchange tokens often provide benefits like fee discounts, staking rewards, and exclusive access to platform features. |

| Market Performance | The performance of exchange tokens is closely tied to the success and reputation of their parent exchanges. |

| Regulatory Environment | Increasing regulatory scrutiny can impact token value and exchange operations. |

| Market Volatility | Exchange tokens are subject to high volatility, presenting both risks and opportunities for investors. |

| Tokenomics | The economic structure of a token (supply limits, burn mechanisms) influences its long-term value. |

Market Analysis and Trends

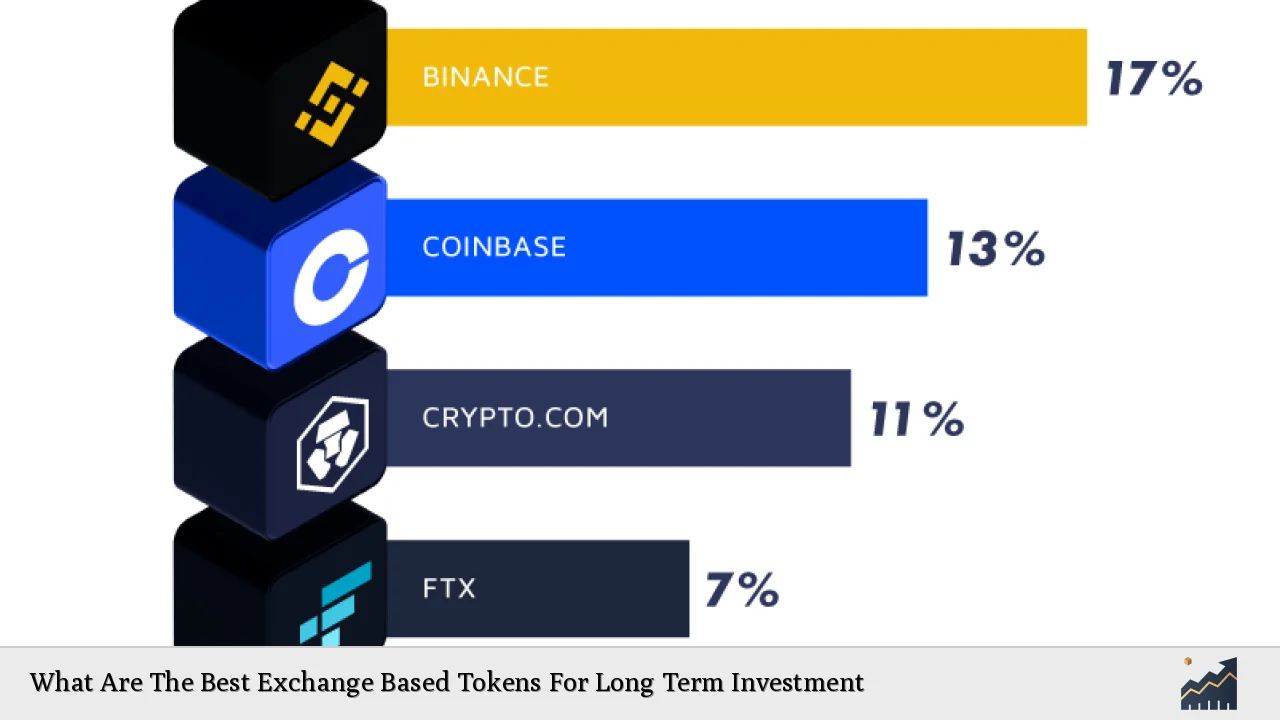

As of late 2024, the cryptocurrency market capitalization has surpassed $3.38 trillion, with Bitcoin leading at new all-time highs. Exchange-based tokens like Binance Coin (BNB), FTX Token (FTT), and others have shown resilience despite broader market fluctuations.

Current Trends

- Increased Adoption: More users are engaging with cryptocurrency exchanges for trading and investment purposes, boosting demand for exchange tokens.

- Integration of DeFi: Many exchanges are incorporating decentralized finance (DeFi) features, enhancing the utility of their native tokens.

- Institutional Interest: Institutional investors are increasingly entering the crypto space, leading to more robust trading volumes and interest in exchange tokens.

Notable Exchange Tokens for Long-Term Investment

- Binance Coin (BNB): As the native token of Binance, BNB offers reduced trading fees and access to various services within the Binance ecosystem. Its price has shown significant growth alongside Binance's expansion.

- FTX Token (FTT): Although FTX faced challenges in 2022, it remains a compelling option due to its innovative features and potential for recovery as the exchange rebuilds its reputation.

- Huobi Token (HT): Huobi’s extensive global presence and commitment to user security make HT a solid choice for long-term investors.

- KuCoin Token (KCS): KuCoin offers benefits like fee discounts and staking rewards, making KCS attractive for users who frequently trade on the platform.

- Bitfinex Token (LEO): Despite past controversies surrounding Bitfinex, LEO remains relevant due to its unique features such as fee discounts and token burning mechanisms.

Implementation Strategies

Investing in exchange-based tokens requires a strategic approach:

- Diversification: Consider holding multiple exchange tokens to mitigate risks associated with platform-specific issues.

- Staking Opportunities: Utilize staking features offered by exchanges to earn passive income while holding your tokens.

- Market Timing: Monitor market trends and price movements to identify optimal entry points for investment.

- Long-Term Perspective: Focus on the underlying fundamentals of each token rather than short-term price fluctuations.

Risk Considerations

Investing in exchange-based tokens is not without risks:

- Platform Dependency: The value of an exchange token is heavily reliant on the success of its parent platform. Legal issues or security breaches can severely impact token value.

- Regulatory Scrutiny: Increasing regulation could classify some tokens as securities, potentially leading to restrictions that affect their usability and value.

- Market Volatility: Cryptocurrencies are known for their price volatility; thus, investors should be prepared for significant price swings.

- Liquidity Risks: Some lesser-known exchange tokens may face liquidity issues, making it difficult to sell holdings without impacting the market price.

Regulatory Aspects

The regulatory landscape for cryptocurrencies is evolving rapidly:

- MiCA Regulation: The Markets in Crypto-Assets (MiCA) regulation introduced by the European Union aims to create a harmonized framework for crypto-assets. This regulation will impact how many exchange tokens operate within Europe starting from December 2024.

- SEC Oversight: In the United States, the Securities and Exchange Commission (SEC) continues to scrutinize cryptocurrencies and may impose stricter regulations on exchange tokens classified as securities.

Investors must stay informed about these developments as they can significantly affect the viability of exchange-based tokens as long-term investments.

Future Outlook

The outlook for exchange-based tokens appears promising given several factors:

- Technological Advancements: Innovations in blockchain technology will likely enhance the functionality and appeal of exchange platforms and their respective tokens.

- Increased Institutional Participation: As institutional interest grows in cryptocurrencies, demand for reliable exchange platforms—and by extension their native tokens—is expected to rise.

- Global Market Expansion: Emerging markets are beginning to embrace cryptocurrencies more readily, which could lead to increased user bases for exchanges worldwide.

In conclusion, while investing in exchange-based tokens presents unique opportunities for growth within the cryptocurrency space, it is essential for investors to conduct thorough research and consider both market conditions and regulatory developments before making investment decisions.

Frequently Asked Questions About What Are The Best Exchange Based Tokens For Long Term Investment

- What are exchange-based tokens?

Exchange-based tokens are cryptocurrencies that are issued by cryptocurrency exchanges. They typically provide users with benefits such as reduced trading fees, staking rewards, and governance rights. - Why should I invest in exchange-based tokens?

Investing in these tokens can offer advantages such as lower transaction costs on their respective platforms, potential appreciation in value tied to platform success, and opportunities for passive income through staking. - What risks are associated with investing in these tokens?

The primary risks include platform dependency on the success of the underlying exchange, regulatory scrutiny that may classify them as securities, market volatility affecting prices significantly, and liquidity risks associated with trading lesser-known tokens. - How do I choose which exchange token to invest in?

Consider factors such as the reputation of the exchange, tokenomics (supply limits and burn mechanisms), utility within the ecosystem (like fee discounts), and overall market trends. - Are there any regulatory concerns I should be aware of?

Yes, regulations like MiCA in Europe aim to establish a legal framework for crypto-assets that could impact how these tokens operate. Additionally, U.S. regulations from bodies like the SEC could also affect their classification. - What is the future outlook for exchange-based tokens?

The future looks optimistic due to technological advancements in blockchain technology, increased institutional participation in cryptocurrencies, and expanding global markets embracing digital assets. - Can I earn passive income from exchange-based tokens?

Yes! Many exchanges offer staking opportunities where you can lock up your tokens in return for rewards or interest payments. - How do market trends affect my investment?

Market trends can significantly influence token prices; therefore, staying informed about overall cryptocurrency market conditions is crucial when investing in these assets.

This comprehensive overview provides insights into selecting suitable exchange-based tokens for long-term investment while considering current trends and potential risks involved.