Investing in dividend-paying stocks has become a popular strategy for individual investors seeking stable income and potential capital appreciation. Dividend stocks are shares in companies that return a portion of their profits to shareholders in the form of dividends, which can provide a reliable income stream, particularly appealing during volatile market conditions. As of December 2024, several companies stand out due to their strong dividend yields, consistent payment histories, and robust financial health.

| Key Concept | Description/Impact |

|---|---|

| Dividend Yield | The annual dividend payment divided by the stock price, expressed as a percentage. A higher yield indicates a better return on investment. |

| Dividend Aristocrats | Companies that have increased their dividends for at least 25 consecutive years, reflecting financial stability and commitment to returning value to shareholders. |

| Payout Ratio | The proportion of earnings paid out as dividends to shareholders. A lower ratio suggests that the company retains enough earnings for growth. |

| Dividend Coverage Ratio | A measure of how well a company can pay its dividends with its net income. A ratio above 2 is generally considered safe. |

| Market Capitalization | The total market value of a company’s outstanding shares, indicating its size and stability within the market. |

Market Analysis and Trends

The current landscape for dividend-paying stocks is shaped by several macroeconomic factors, including interest rates, inflation, and overall market volatility. As central banks maintain low-interest rates to stimulate economic growth, dividend stocks have become increasingly attractive compared to fixed-income investments like bonds.

Current Market Statistics

- Average Dividend Yield: As of December 2024, the average yield for S&P 500 dividend stocks is approximately 3.5%.

- Top Performing Sectors: Energy, utilities, and consumer staples are leading sectors with high dividend yields. For instance, energy companies such as Exxon Mobil and Chevron have consistently offered attractive yields due to their strong cash flow from operations.

- Dividend Growth Trends: Companies like PepsiCo and Johnson & Johnson have shown resilience by increasing their dividends annually, even during economic downturns.

Implementation Strategies

Investors looking to incorporate dividend stocks into their portfolios should consider the following strategies:

- Diversification: Spread investments across various sectors to mitigate risks associated with market fluctuations.

- Reinvestment Plans: Utilize Dividend Reinvestment Plans (DRIPs) to automatically reinvest dividends into additional shares, compounding growth over time.

- Focus on Quality: Prioritize companies with strong balance sheets and consistent earnings growth to ensure sustainable dividend payments.

Recommended Stocks

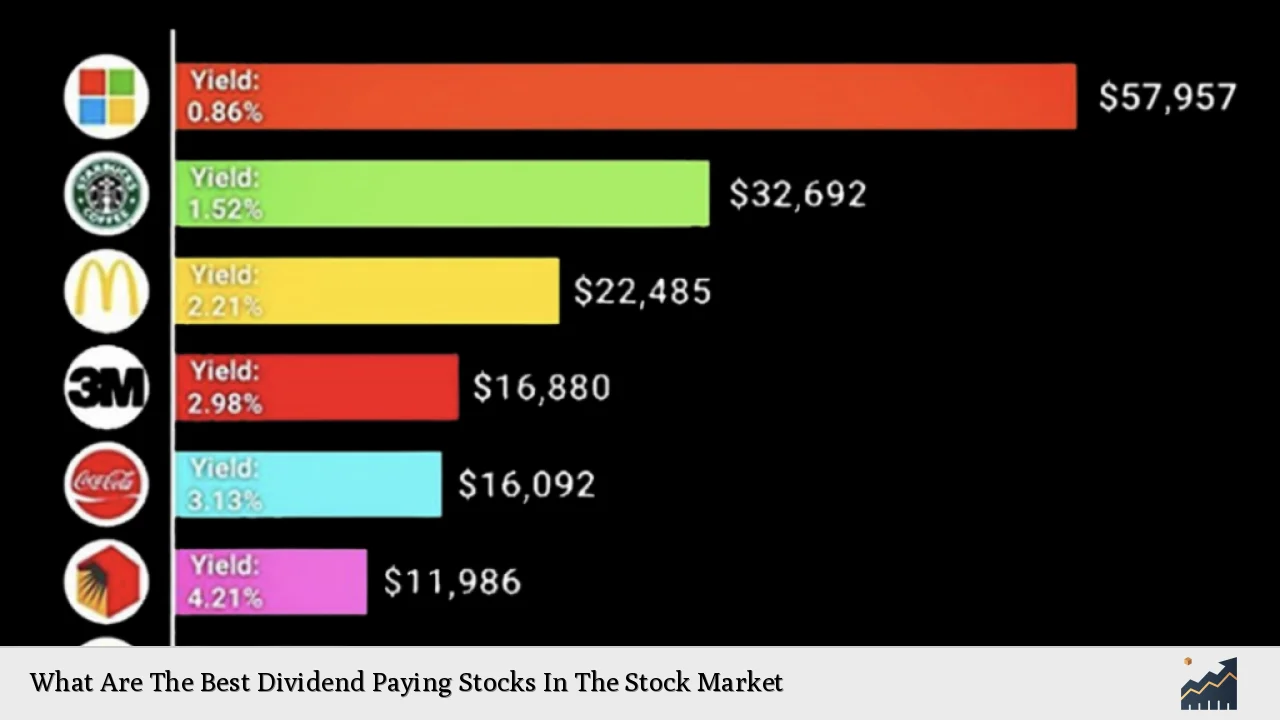

Here are some of the best dividend-paying stocks as of December 2024:

| Ticker | Company Name | Sector | Market Cap ($B) | Dividend Yield (%) | Payout Ratio (%) |

|---|---|---|---|---|---|

| XOM | Exxon Mobil | Energy | 450 | 5.10 | 40 |

| CVX | Chevron | Energy | 300 | 4.80 | 38 |

| PEP | PepsiCo | Consumer Staples | 240 | 3.16 | 60 |

| JNJ | Johnson & Johnson | Healthcare | 400 | 2.90 | 50 |

| MO | Altria Group | Tobacco | 90 | 7.35 | 80 |

Risk Considerations

While dividend stocks can offer attractive returns, they also come with inherent risks:

- Market Risk: Economic downturns can lead to decreased profits and potential cuts in dividends.

- Sector-Specific Risks: Certain sectors may be more vulnerable to regulatory changes or shifts in consumer behavior (e.g., tobacco or energy).

- Interest Rate Risk: Rising interest rates can make fixed-income investments more attractive compared to dividend stocks.

Mitigation Strategies

To manage these risks, investors should:

- Conduct thorough research on companies’ financial health and market conditions.

- Monitor economic indicators such as inflation rates and interest rate changes.

- Maintain a diversified portfolio that includes both high-yield and growth-oriented stocks.

Regulatory Aspects

Investors must be aware of regulatory requirements affecting dividend payments:

- SEC Regulations: The Securities and Exchange Commission mandates that companies disclose their financial performance and any changes in dividend policies.

- Tax Implications: Qualified dividends are taxed at a lower rate than ordinary income; understanding these implications is crucial for maximizing returns.

Future Outlook

The outlook for dividend-paying stocks remains positive as companies continue to seek ways to reward shareholders amidst economic recovery efforts. Analysts predict that sectors like technology may begin adopting more aggressive dividend policies as they generate substantial cash flows.

Key Trends to Watch

- Increased Focus on Sustainability: Companies are increasingly aligning their business models with sustainable practices, which may influence long-term profitability and dividend stability.

- Rising Interest Rates Impact: As central banks adjust interest rates in response to inflationary pressures, the attractiveness of dividend stocks relative to bonds will fluctuate.

Frequently Asked Questions About What Are The Best Dividend Paying Stocks In The Stock Market

- What is a good dividend yield?

A good dividend yield typically ranges from 3% to 6%, depending on the sector and market conditions. - How often do companies pay dividends?

Most companies pay dividends quarterly; however, some may pay monthly or annually. - Are high-yield stocks riskier?

Yes, high-yield stocks can be riskier as they may indicate underlying financial issues if the yield is significantly above average. - What are Dividend Aristocrats?

Dividend Aristocrats are companies that have increased their dividends for at least 25 consecutive years. - How can I find reliable dividend stocks?

You can use financial news websites, stock screeners, and investment platforms that filter based on yield and payout history. - Is it safe to rely solely on dividends for income?

No, relying solely on dividends can be risky; it’s advisable to have a diversified investment strategy. - How do I reinvest my dividends?

You can enroll in a Dividend Reinvestment Plan (DRIP) offered by many companies or brokerage firms. - What should I consider before investing in dividend stocks?

Consider factors such as the company’s payout ratio, financial health, industry trends, and your own investment goals.

Investing in dividend-paying stocks requires careful analysis and consideration of both current market conditions and individual company performance. By understanding the key metrics associated with dividends—such as yield, payout ratio, and coverage ratio—investors can make informed decisions that align with their financial goals while managing risks effectively.