Decentralized Finance (DeFi) has revolutionized the way individuals manage their financial assets, providing unprecedented freedom and control over personal finances. As the DeFi ecosystem continues to expand, the importance of selecting a suitable wallet for managing digital assets becomes increasingly critical. DeFi wallets facilitate interaction with decentralized applications (dApps) and allow users to engage in activities such as yield farming, lending, and trading without relying on traditional financial institutions. This article explores the best DeFi wallets available in 2024, providing insights into their features, market trends, and strategies for effective asset management.

| Key Concept | Description/Impact |

|---|---|

| DeFi Wallets | Wallets specifically designed to interact with DeFi protocols, allowing users to manage assets securely and participate in decentralized finance activities. |

| Self-Custody | Users retain control of their private keys, enhancing security but requiring users to be diligent in safeguarding their credentials. |

| Total Value Locked (TVL) | A key metric in DeFi representing the total capital held within DeFi protocols; as of January 2024, TVL is approximately $55.95 billion. |

| Market Growth | The DeFi market is projected to reach $26 billion in revenue by 2024, driven by increasing adoption and innovation. |

| Regulatory Landscape | Ongoing regulatory developments are shaping the DeFi environment, impacting how wallets operate and ensuring compliance with financial laws. |

Market Analysis and Trends

The DeFi market has experienced significant growth over the past few years. As of January 2024, the Total Value Locked (TVL) in DeFi platforms reached approximately $55.95 billion, a dramatic increase from just $9.1 billion in July 2020. This growth reflects a broader trend towards decentralized financial services that offer greater transparency and accessibility compared to traditional finance.

Key Trends Driving Growth

- Mainstream Adoption: Increased awareness and acceptance of cryptocurrencies among individual investors and institutions are driving demand for DeFi products.

- Tokenization of Real-World Assets (RWAs): The integration of RWAs into DeFi protocols is gaining traction, allowing traditional assets like real estate and commodities to be represented on-chain.

- Institutional Interest: Financial institutions are beginning to explore DeFi solutions, recognizing their potential for high yields and operational efficiency.

- Technological Innovations: Advances in blockchain technology are enhancing user experiences through improved security measures and user-friendly interfaces.

Implementation Strategies

When selecting a DeFi wallet, investors should consider several factors to ensure effective asset management:

Key Considerations

- Security Features: Look for wallets that offer robust security measures such as two-factor authentication (2FA), biometric access, and hardware wallet integration.

- User Experience: A user-friendly interface can significantly enhance the management of assets, especially for those new to DeFi.

- Multi-Chain Support: Choose wallets that support multiple blockchain networks to facilitate interactions across various dApps.

- Integration with dApps: The ability to seamlessly connect with popular decentralized applications enhances functionality.

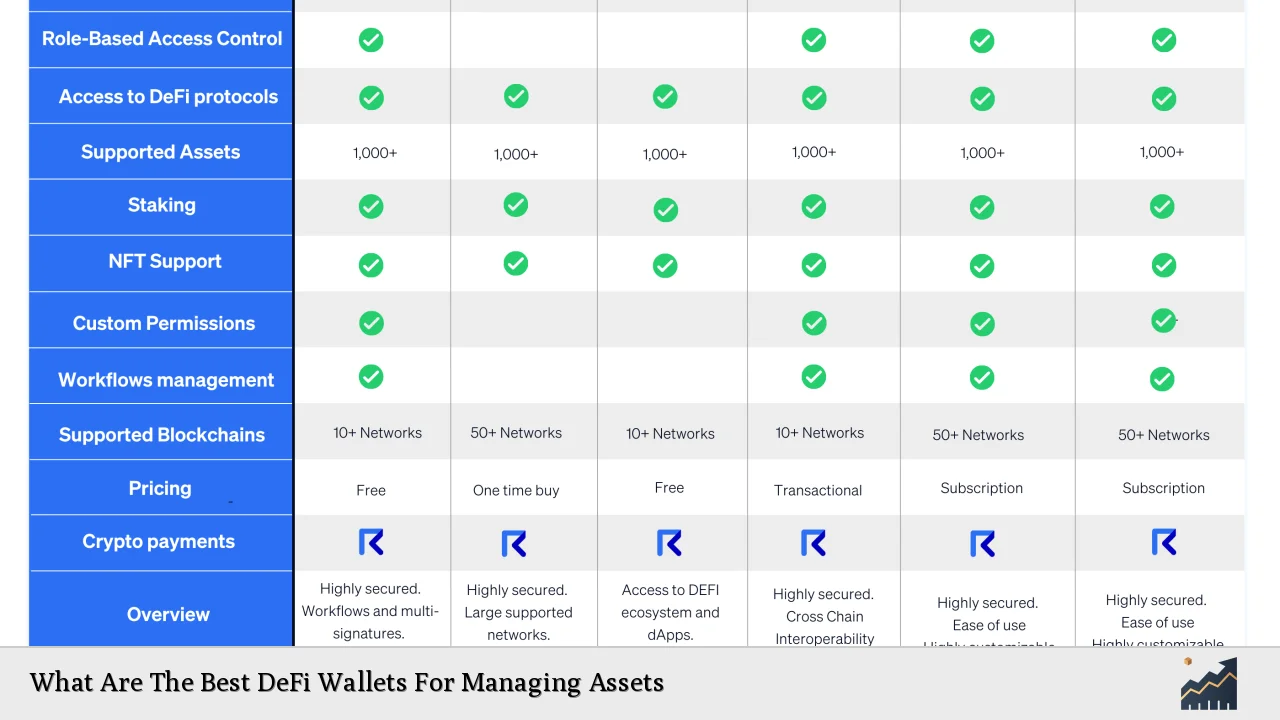

Recommended Wallets

- MetaMask: Widely regarded as one of the best wallets for Ethereum-based dApps. MetaMask supports ERC-20 tokens and offers features like token swapping and hardware wallet integration.

- Phantom Wallet: A leading wallet for Solana users, Phantom provides a simple interface for managing assets across multiple ecosystems including Ethereum and Bitcoin.

- Ledger Stax: A hardware wallet known for its high-security standards. It allows users to manage various cryptocurrencies while keeping them offline.

- Trust Wallet: This mobile wallet supports a wide range of cryptocurrencies and integrates well with Binance’s ecosystem.

- SafePal: A portable wallet that combines security with functionality, supporting over 100 blockchains and offering cross-chain swaps.

Risk Considerations

Investing in DeFi comes with inherent risks that users must navigate carefully:

- Smart Contract Vulnerabilities: Bugs or exploits in smart contracts can lead to significant losses. Users should only interact with well-audited protocols.

- Market Volatility: The cryptocurrency market is highly volatile; prices can fluctuate dramatically within short periods.

- Regulatory Risks: As governments worldwide develop regulations around cryptocurrencies and DeFi, changes could impact how wallets operate or what services they offer.

Regulatory Aspects

The regulatory landscape surrounding DeFi is evolving rapidly. In many jurisdictions, regulators are beginning to scrutinize decentralized platforms more closely:

- Compliance Requirements: Wallet providers may need to implement Know Your Customer (KYC) processes depending on local regulations.

- Tax Implications: Users should be aware of tax obligations related to cryptocurrency transactions in their respective countries.

- Consumer Protection Laws: As DeFi becomes more mainstream, there may be increased pressure on platforms to enhance consumer protections against fraud or loss.

Future Outlook

The future of DeFi wallets appears promising as they continue to evolve alongside the broader cryptocurrency landscape:

- Increased Interoperability: Future wallets will likely focus on enabling seamless interactions across various blockchain networks.

- Enhanced User Experiences: Innovations aimed at simplifying user interactions will make it easier for newcomers to engage with decentralized finance.

- Institutional Adoption Growth: As more institutional players enter the space, we can expect greater liquidity and new products tailored for professional investors.

Frequently Asked Questions About What Are The Best DeFi Wallets For Managing Assets

- What is a DeFi wallet?

A DeFi wallet is a digital wallet designed specifically for managing cryptocurrencies and interacting with decentralized finance protocols. - How do I choose the best DeFi wallet?

Consider security features, user experience, multi-chain support, and integration capabilities with dApps when selecting a wallet. - Are hardware wallets safer than software wallets?

Yes, hardware wallets are generally considered safer as they store private keys offline, reducing exposure to online threats. - Can I use multiple wallets for my assets?

Yes, many users opt for multiple wallets to diversify security measures or manage different types of assets. - What are the risks associated with using a DeFi wallet?

Risks include smart contract vulnerabilities, market volatility, regulatory changes, and potential loss of funds due to user error. - Is it necessary to conduct KYC when using a DeFi wallet?

KYC requirements vary by jurisdiction; some wallets may require it based on local regulations. - How do I recover my funds if I lose access to my wallet?

Most wallets provide a recovery seed phrase; keeping this phrase secure allows you to restore access if needed. - What is Total Value Locked (TVL) in DeFi?

Total Value Locked refers to the total capital held within all DeFi protocols at any given time; it serves as an indicator of market health.

The landscape of decentralized finance continues to evolve rapidly. By staying informed about trends, risks, and regulatory developments while carefully selecting suitable wallets for asset management, investors can effectively navigate this dynamic environment.