Cryptocurrencies are rapidly transforming the landscape of international transactions, offering numerous advantages over traditional banking methods. As global commerce continues to expand, the need for efficient, cost-effective, and secure payment solutions has never been more critical. This article explores the key benefits of using cryptocurrencies for international transactions, delving into market analysis, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Reduced Transaction Costs | Cryptocurrencies eliminate intermediaries, significantly lowering fees associated with cross-border payments. |

| Faster Transactions | Transactions can be completed in minutes rather than days, enhancing cash flow and operational efficiency. |

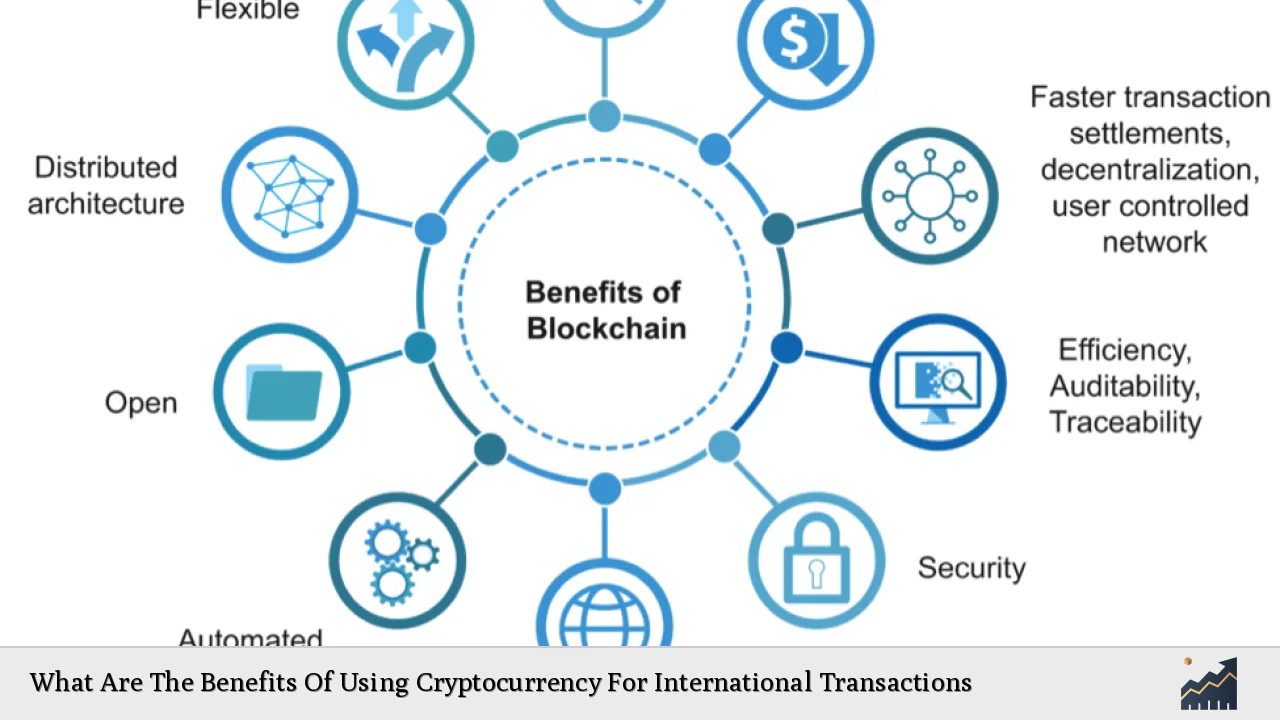

| Enhanced Security | Blockchain technology provides secure and immutable transaction records, reducing fraud risk. |

| Financial Inclusion | Cryptocurrencies offer access to financial services for unbanked populations, facilitating global commerce. |

| Decentralization | Transactions occur directly between parties without central authority interference, streamlining processes. |

| Stablecoins Adoption | Stablecoins mitigate volatility risks associated with traditional cryptocurrencies, making them ideal for international payments. |

| Transparency and Traceability | The public ledger system enhances trust and accountability in transactions. |

| Hedge Against Currency Fluctuations | Using cryptocurrencies can protect against currency devaluation in unstable economies. |

Market Analysis and Trends

The global cryptocurrency market is projected to grow significantly, with estimates suggesting an increase of $34.5 billion from 2024 to 2028 at a compound annual growth rate (CAGR) of 16.64%. This growth is driven by rising acceptance among retailers and increased investment in digital assets. Notably, stablecoins have gained traction as a preferred medium for international transactions due to their stability compared to more volatile cryptocurrencies like Bitcoin.

Recent data indicates that approximately 6.8% of the global population owns cryptocurrency, amounting to over 560 million individuals. This growing user base reflects a shift towards digital currencies as viable alternatives for traditional financial systems.

Furthermore, the 2024 Global Crypto Adoption Index highlights that countries in Central & Southern Asia and Oceania are leading in crypto adoption, indicating a trend towards greater utilization of cryptocurrencies in regions previously underserved by conventional banking.

Implementation Strategies

To effectively utilize cryptocurrencies for international transactions, businesses can adopt several strategies:

- Integrate Payment Gateways: Companies should implement cryptocurrency payment processors that facilitate transactions in various digital currencies. These gateways can convert crypto payments into local fiat currencies if needed.

- Educate Stakeholders: Providing training for employees on cryptocurrency usage and its benefits can enhance operational efficiency.

- Utilize Stablecoins: Businesses should consider using stablecoins for international transactions to minimize the risks associated with price volatility.

- Leverage Blockchain Technology: Adopting blockchain solutions can streamline transaction processes and enhance security through decentralized verification.

- Partner with Fintech Firms: Collaborating with fintech companies specializing in crypto payments can help businesses navigate regulatory challenges and optimize transaction processes.

Risk Considerations

While the benefits of using cryptocurrencies for international transactions are compelling, several risks must be considered:

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving. Businesses must stay informed about compliance requirements to avoid legal repercussions.

- Volatility: Although stablecoins mitigate some volatility risks, other cryptocurrencies can experience significant price fluctuations that may affect transaction values.

- Cybersecurity Threats: The digital nature of cryptocurrencies makes them susceptible to hacking and fraud. Implementing robust security measures is essential to protect assets.

- Limited Acceptance: Despite growing adoption, not all merchants accept cryptocurrencies as payment. This limitation can hinder their practical use in everyday transactions.

Regulatory Aspects

The regulatory environment for cryptocurrencies varies widely across jurisdictions. In many regions, authorities are still developing frameworks to govern crypto transactions. Key considerations include:

- Compliance with Anti-Money Laundering (AML) Laws: Businesses must ensure that their cryptocurrency operations comply with AML regulations to prevent illicit activities.

- Tax Implications: Understanding the tax treatment of cryptocurrency transactions is crucial for businesses to avoid unexpected liabilities.

- International Coordination: Given the borderless nature of cryptocurrencies, international cooperation among regulators is necessary to create cohesive guidelines that facilitate cross-border transactions while ensuring security and compliance.

Future Outlook

The future of cryptocurrency in international transactions appears promising as technological advancements continue to drive adoption. Key trends expected to shape this landscape include:

- Increased Merchant Acceptance: As more businesses recognize the benefits of accepting cryptocurrencies, their use as a payment method will likely expand.

- Technological Innovations: Developments in blockchain technology will enhance transaction speed, security, and scalability.

- Central Bank Digital Currencies (CBDCs): The emergence of CBDCs may complement existing cryptocurrencies by providing regulated digital currencies that maintain stability while offering similar benefits.

- Enhanced Financial Inclusion: Cryptocurrencies will continue to provide access to financial services for underserved populations globally, contributing to economic growth.

Frequently Asked Questions About What Are The Benefits Of Using Cryptocurrency For International Transactions

- What are the main benefits of using cryptocurrency for international transactions?

The primary benefits include reduced transaction costs, faster transaction speeds, enhanced security through blockchain technology, financial inclusion for unbanked populations, and transparency in record-keeping. - How do cryptocurrencies reduce transaction costs?

Cryptocurrencies eliminate intermediaries like banks and payment processors, which typically charge high fees for cross-border transfers. - What role do stablecoins play in international transactions?

Stablecoins provide a stable medium of exchange that mitigates volatility risks associated with traditional cryptocurrencies, making them suitable for business payments. - Are there any risks associated with using cryptocurrencies?

Yes, risks include regulatory uncertainty, price volatility (for non-stablecoins), cybersecurity threats, and limited merchant acceptance. - How does blockchain technology enhance security?

Blockchain technology ensures secure transaction records through cryptographic techniques that make alterations nearly impossible and provide transparency through public ledgers. - What is the future outlook for cryptocurrency in international payments?

The future looks promising with increased merchant acceptance, technological innovations enhancing efficiency and security, and growing interest from central banks in issuing digital currencies. - How can businesses implement cryptocurrency payment solutions?

Businesses can integrate crypto payment gateways, educate stakeholders on usage benefits, utilize stablecoins for transactions, leverage blockchain technology for efficiency, and partner with fintech firms. - What should businesses consider regarding regulatory compliance?

Businesses must stay informed about AML laws, tax implications of crypto transactions, and ensure they comply with local regulations governing digital currencies.

In conclusion, the adoption of cryptocurrency for international transactions presents significant advantages over traditional banking methods. By reducing costs and transaction times while enhancing security and accessibility, cryptocurrencies are poised to play a pivotal role in shaping the future of global finance. As businesses navigate this evolving landscape, staying informed about market trends and regulatory developments will be crucial for leveraging these innovative financial tools effectively.