Exchange-based token loyalty programs are transforming the landscape of customer engagement and retention by leveraging blockchain technology to create innovative, flexible, and secure reward systems. Unlike traditional loyalty programs that often suffer from limitations such as lack of transparency, high operational costs, and inflexible reward structures, tokenized loyalty programs offer a more dynamic approach. They empower customers with greater control over their rewards while providing businesses with valuable insights into consumer behavior.

The integration of blockchain technology enhances security and transparency, allowing for real-time tracking and management of loyalty tokens. This article delves into the benefits of exchange-based token loyalty programs, exploring market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

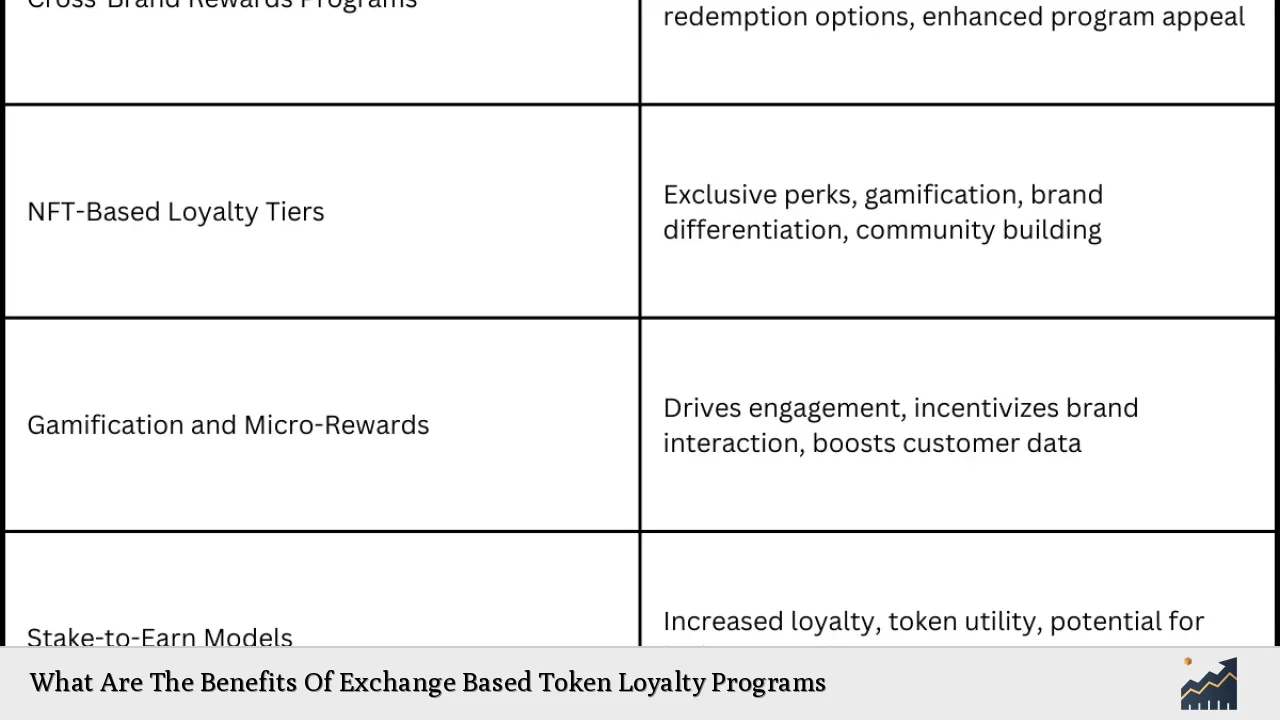

| Key Concept | Description/Impact |

|---|---|

| Transparency | Blockchain provides an immutable record of transactions, ensuring that customers can verify their rewards and fostering trust. |

| Interoperability | Tokens can be used across multiple platforms and brands, increasing their utility compared to traditional loyalty points. |

| Customer Engagement | Gamification and tradable tokens enhance customer interaction and satisfaction, leading to increased brand loyalty. |

| Cost Efficiency | Automation through smart contracts reduces administrative costs and fraud risks associated with traditional systems. |

| Data Insights | Enhanced analytics capabilities allow businesses to tailor offerings based on customer behavior and preferences. |

| Global Reach | Tokens can be redeemed internationally without currency conversion issues, appealing to a broader customer base. |

| Liquidity | Customers can trade or sell their tokens on exchanges, adding real-world value to loyalty rewards. |

| Decentralization | The decentralized nature of blockchain empowers customers with ownership over their tokens, enhancing perceived value. |

Market Analysis and Trends

The market for tokenized loyalty programs is rapidly growing as businesses seek innovative ways to engage customers. According to recent reports, the global market for loyalty management is projected to exceed $11 billion by 2023. The rise of cryptocurrencies and blockchain technology has facilitated the development of these programs, making them more attractive to both consumers and businesses.

Key Trends

- Increased Adoption: More companies are adopting blockchain-based loyalty solutions. For instance, major retailers are integrating tokenized rewards into their existing systems.

- Consumer Preference: Surveys indicate a strong preference among consumers for blockchain-enabled loyalty programs due to their flexibility and transparency.

- Gamification: Many businesses are incorporating gamification elements into their loyalty programs to enhance user engagement.

- Cross-Brand Collaborations: Token interoperability allows customers to accumulate rewards across different brands, increasing the appeal of these programs.

Implementation Strategies

To successfully implement an exchange-based token loyalty program, businesses should consider the following strategies:

- Choose the Right Blockchain: Select a blockchain platform that aligns with business needs in terms of scalability, security, and transaction speed.

- Design User-Friendly Interfaces: Ensure that the user experience is seamless for customers managing their tokens through digital wallets or mobile applications.

- Incorporate Gamification: Engage customers by introducing gamified elements such as challenges or tiered rewards based on token accumulation.

- Educate Customers: Provide clear information on how the program works, including how tokens can be earned, traded, or redeemed.

- Establish Partnerships: Collaborate with other brands or platforms to enhance token interoperability and expand redemption options for customers.

Risk Considerations

While exchange-based token loyalty programs present numerous benefits, they also come with inherent risks:

- Volatility: The value of tokens can fluctuate significantly due to market conditions. Businesses may need to implement measures to stabilize token value.

- Regulatory Compliance: Companies must navigate complex regulatory environments that govern cryptocurrency and digital assets.

- Cybersecurity Threats: As with any digital platform, there is a risk of cyberattacks. Robust security measures must be in place to protect customer data and assets.

- Customer Education: Misunderstanding how tokens work may deter participation. Continuous education efforts are essential.

Regulatory Aspects

The regulatory landscape for blockchain technology and cryptocurrency is evolving. Businesses must stay informed about compliance requirements in their jurisdictions. Key considerations include:

- Securities Regulations: Depending on how tokens are classified (as securities or utility tokens), different regulations may apply.

- Data Privacy Laws: Compliance with data protection regulations such as GDPR is crucial when handling customer information within loyalty programs.

- Anti-Money Laundering (AML) Regulations: Companies should implement AML practices when dealing with cryptocurrency transactions related to loyalty tokens.

Future Outlook

The future of exchange-based token loyalty programs looks promising as technology advances and consumer expectations evolve. Key developments expected in the coming years include:

- Enhanced Interoperability: Increased collaboration between brands will lead to more integrated reward systems that allow for seamless token usage across platforms.

- Innovative Reward Structures: Businesses will continue to explore creative ways to reward customers beyond traditional discounts—think exclusive experiences or ownership stakes in products.

- Greater Consumer Control: As decentralization becomes more prevalent, consumers will likely demand more control over how they manage their loyalty tokens.

- Broader Market Acceptance: As awareness grows about the benefits of tokenized loyalty programs, adoption rates among businesses will increase significantly.

Frequently Asked Questions About Exchange Based Token Loyalty Programs

- What are exchange-based token loyalty programs?

These are reward systems that utilize blockchain technology to create tradable digital tokens as incentives for customer engagement across various platforms. - How do these programs enhance customer engagement?

The flexibility of using tokens across multiple brands increases their perceived value while gamification elements encourage active participation. - What are the main risks associated with these programs?

Main risks include market volatility of tokens, regulatory compliance challenges, cybersecurity threats, and the need for ongoing customer education. - How do businesses benefit from implementing tokenized loyalty programs?

Businesses can reduce operational costs through automation, gain valuable insights from enhanced data analytics, and foster stronger relationships with customers through transparent systems. - Are there any regulatory concerns?

Yes, businesses must comply with securities regulations depending on how tokens are classified and adhere to data privacy laws when managing customer information. - Can tokens be traded or sold?

Yes, one of the significant advantages is that customers can trade or sell their tokens on exchanges or within peer-to-peer networks. - What industries are adopting these programs?

The retail sector is leading adoption; however, industries such as travel (airlines) and hospitality are also exploring tokenized solutions. - What does the future hold for these programs?

The future includes enhanced interoperability between brands’ loyalty systems, innovative reward structures beyond discounts, and increased consumer control over their rewards.

Exchange-based token loyalty programs represent a significant shift in how businesses approach customer retention strategies. By harnessing the power of blockchain technology, companies can create more engaging experiences that resonate with modern consumers while navigating the complexities of today’s digital economy.