The integration of decentralized finance (DeFi) within the GameFi sector is revolutionizing how players interact with games and earn real-world value. GameFi, which combines gaming and financial incentives through blockchain technology, allows players to earn cryptocurrencies and non-fungible tokens (NFTs) while engaging in virtual environments. This innovative approach not only enhances the gaming experience but also introduces significant financial opportunities for players, developers, and investors alike.

| Key Concept | Description/Impact |

|---|---|

| Real Ownership of Assets | GameFi allows players to own their in-game assets as NFTs, which can be traded or sold on decentralized marketplaces, providing true ownership and liquidity. |

| Play-to-Earn Model | This model enables players to earn money through gameplay, creating new income streams especially in regions with limited economic opportunities. |

| Decentralized Marketplaces | GameFi facilitates peer-to-peer trading of in-game assets without intermediaries, enhancing market efficiency and reducing costs. |

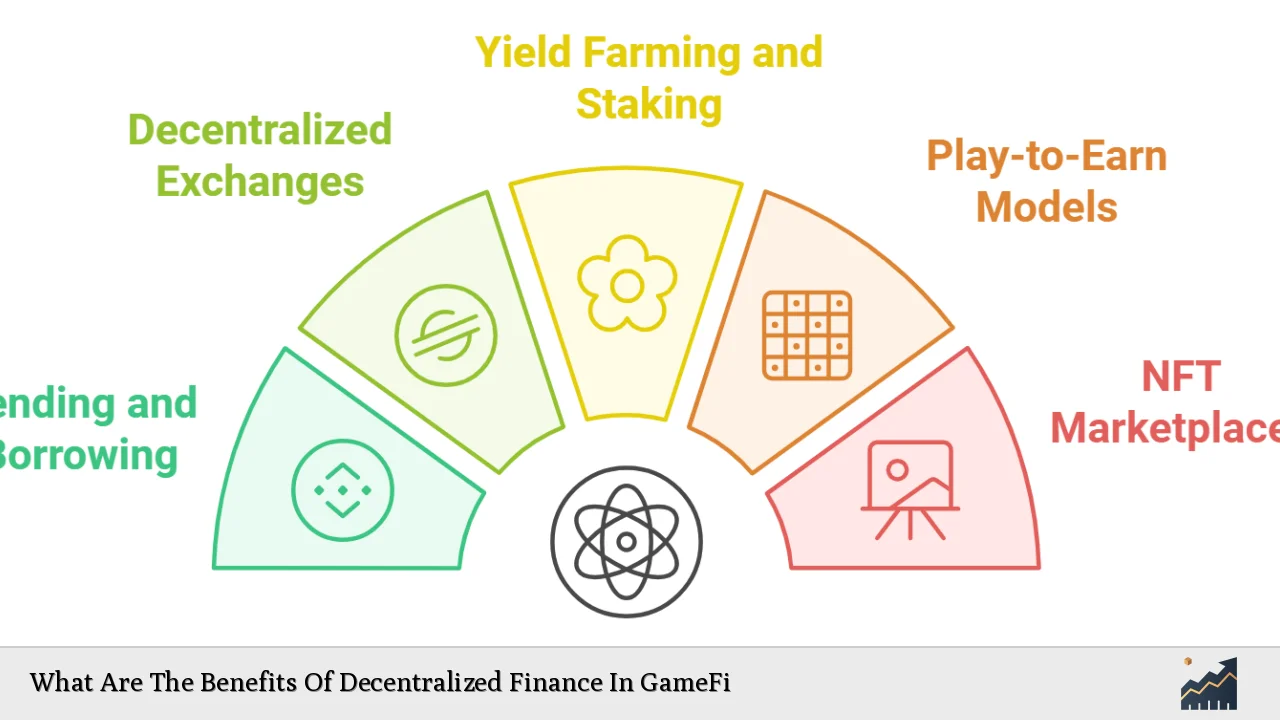

| Integration of DeFi Mechanisms | Players can stake their tokens, lend assets, or participate in yield farming, generating passive income from their gaming activities. |

| Financial Inclusion | DeFi in GameFi opens access to financial services for unbanked populations, enabling them to participate in the global economy. |

| Enhanced Security and Transparency | Blockchain technology ensures secure transactions and transparency in asset ownership, reducing fraud risks associated with traditional gaming. |

| Community Engagement and Governance | Players can participate in governance decisions of the games they play, fostering a sense of community and shared ownership. |

| Market Growth Potential | The GameFi market is projected to grow significantly, with a valuation expected to reach $30 billion by 2024, driven by increasing player engagement and investment. |

Market Analysis and Trends

The GameFi sector is experiencing rapid growth due to the increasing adoption of blockchain technology and cryptocurrencies. As of 2023, the global GameFi market was valued at approximately $9.6 billion and is anticipated to grow at a compound annual growth rate (CAGR) of 25.4% from 2024 to 2033. This growth is fueled by the rising popularity of play-to-earn models, where players can earn real-world value through gameplay.

The integration of DeFi into GameFi has created new revenue streams for developers while enhancing player engagement. Popular titles like Axie Infinity have demonstrated how players can earn substantial incomes by participating in these ecosystems. Furthermore, the emergence of decentralized marketplaces has allowed for seamless trading of in-game assets, thus providing liquidity that was previously absent in traditional gaming environments.

Implementation Strategies

To effectively integrate DeFi within GameFi platforms, developers should consider the following strategies:

- Incorporating Play-to-Earn Mechanics: Games should design economic models that reward players for their time and effort through tangible financial returns.

- Utilizing NFTs for Asset Ownership: Implementing NFTs allows players to have verifiable ownership of their in-game items, which can be traded or sold on secondary markets.

- Creating Decentralized Marketplaces: Establishing platforms where players can trade assets directly fosters a vibrant economy and enhances user engagement.

- Integrating Financial Services: Incorporating DeFi features such as staking, lending, and yield farming within games encourages players to utilize their digital assets actively.

- Fostering Community Governance: Allowing players to participate in governance decisions enhances community involvement and aligns game development with player interests.

Risk Considerations

While the benefits of integrating DeFi into GameFi are substantial, several risks must be considered:

- Market Volatility: The value of cryptocurrencies and NFTs can be highly volatile, posing risks to player investments.

- Regulatory Uncertainty: As governments worldwide grapple with regulating cryptocurrencies and blockchain technologies, GameFi projects may face compliance challenges.

- Security Vulnerabilities: Despite blockchain's inherent security features, smart contracts can be susceptible to bugs or exploits that may jeopardize user funds.

- High Failure Rate: A significant percentage of GameFi projects fail shortly after launch due to poor utility or lack of engagement. Reports indicate that about 93% of new projects may not survive beyond a few months.

Regulatory Aspects

The regulatory landscape surrounding DeFi and GameFi remains complex and rapidly evolving. Key considerations include:

- Compliance with Financial Regulations: GameFi platforms must navigate regulations related to securities laws if they offer tokens that could be classified as securities.

- Consumer Protection Laws: Ensuring player safety through transparent practices is crucial as regulatory bodies increasingly scrutinize digital asset markets.

- Anti-Money Laundering (AML) Policies: Implementing robust AML measures is essential for maintaining compliance and fostering trust among users.

Developers should stay informed about regulatory changes that may impact their operations and ensure compliance to mitigate risks associated with legal repercussions.

Future Outlook

The future of GameFi integrated with DeFi looks promising as both sectors continue to evolve. Key trends expected to shape this landscape include:

- Increased Interoperability: Future developments will likely focus on creating standards that allow assets to move seamlessly across different games and platforms.

- Expansion into the Metaverse: The convergence of GameFi with metaverse platforms will create immersive experiences where users can earn rewards while engaging in virtual worlds.

- Adoption of AI Technologies: AI-driven analytics will enhance game mechanics and personalize user experiences, optimizing in-game economies.

- Broader Financial Services Integration: As DeFi continues to mature, we can expect more sophisticated financial services tailored specifically for gamers.

As these trends unfold, they will further solidify the role of decentralized finance within the gaming industry.

Frequently Asked Questions About What Are The Benefits Of Decentralized Finance In GameFi

- What is GameFi?

GameFi refers to blockchain-based games that integrate financial elements allowing players to earn cryptocurrency or NFTs through gameplay. - How does DeFi enhance gaming?

DeFi introduces financial incentives such as staking and yield farming within games, enabling players to generate passive income from their digital assets. - What are the risks associated with GameFi?

The primary risks include market volatility, regulatory uncertainty, security vulnerabilities, and high project failure rates. - Can anyone participate in GameFi?

Yes, anyone with an internet connection can engage with GameFi platforms without needing traditional banking services. - What role do NFTs play in GameFi?

NFTs provide verifiable ownership of in-game assets that can be traded or sold on decentralized marketplaces. - How do decentralized marketplaces work?

Decentralized marketplaces enable peer-to-peer trading of digital assets without intermediaries, enhancing market efficiency. - What is the future outlook for GameFi?

The future looks bright with trends like increased interoperability between games, expansion into the metaverse, and greater integration of AI technologies expected to drive growth. - Is there a potential for financial inclusion through GameFi?

Yes, by providing access to financial services via blockchain technology, GameFi can empower unbanked populations globally.

The intersection between decentralized finance and gaming through GameFi presents a transformative opportunity for both industries. By leveraging blockchain technology's benefits—such as transparency, security, and true asset ownership—GameFi not only enhances player experiences but also democratizes access to financial opportunities worldwide. As this sector continues to evolve amidst challenges such as regulatory scrutiny and market volatility, its potential for growth remains significant.