Investing is a fundamental financial concept that involves allocating resources, usually money, with the expectation of generating an income or profit. It encompasses various strategies, asset classes, and risk levels. Understanding the basics of investing is crucial for anyone looking to build wealth over time. This guide will cover essential concepts, strategies, and practical steps to help you navigate the investing landscape effectively.

Investing can seem daunting at first, but it is essentially about making informed decisions that align with your financial goals. Whether you’re saving for retirement, a major purchase, or simply looking to grow your wealth, having a solid grasp of investment principles is vital.

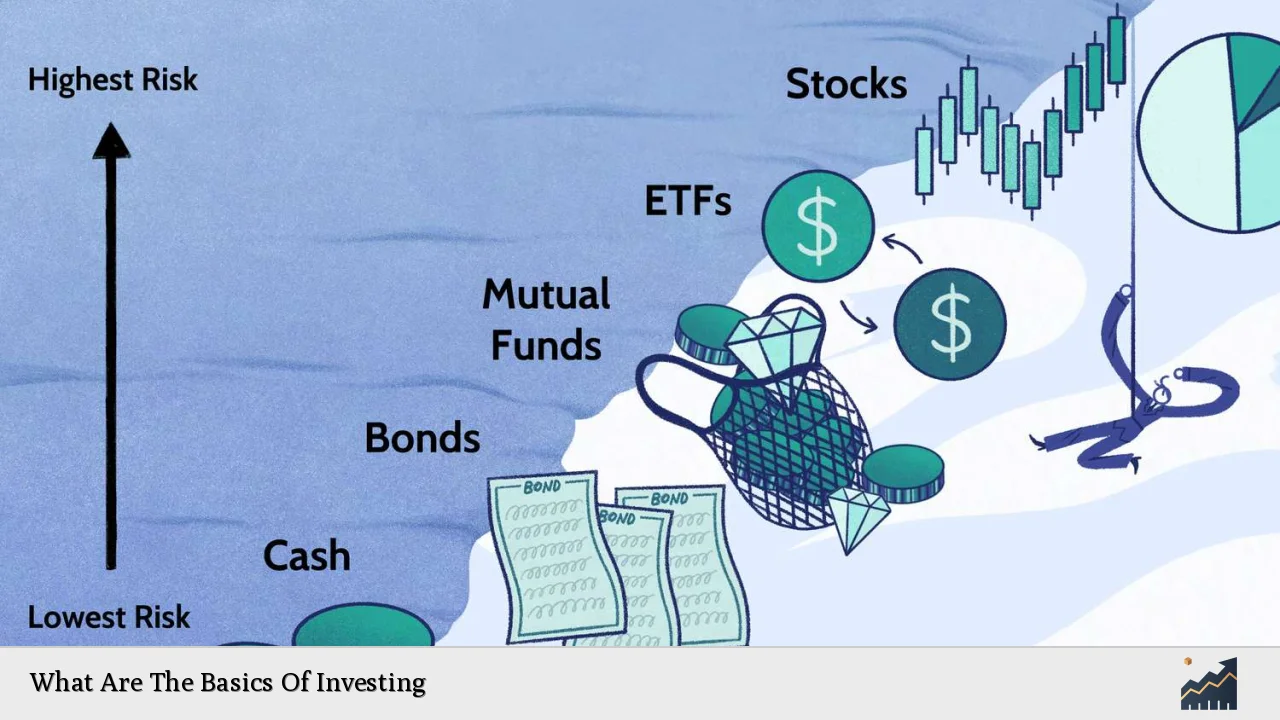

Here’s a concise overview of what investing entails:

| Investment Type | Description |

|---|---|

| Stocks | Ownership in a company with potential for high returns. |

| Bonds | Loans to companies or governments that pay interest. |

| Mutual Funds | Pooled investments managed by professionals. |

| ETFs | Funds that trade on exchanges like stocks. |

| Real Estate | Investing in property for rental income or appreciation. |

Understanding Investment Goals

Setting clear investment goals is the first step in your investing journey. Your goals will dictate your investment strategy and help you determine how much risk you are willing to take. Goals can vary widely and may include:

- Saving for retirement

- Purchasing a home

- Funding education

- Building wealth for future generations

Important info: Be specific about your goals; this will help you choose the right investment vehicles and strategies.

Consider both short-term and long-term objectives. Short-term goals might focus on saving for a vacation, while long-term goals could involve retirement savings or children’s education funds. Understanding your timeline helps in selecting appropriate investments.

Types of Investments

There are several types of investments available, each with its own risk and return profile. Here are some common categories:

- Stocks: Represent ownership in a company and can offer high returns but come with higher risk.

- Bonds: Debt securities issued by corporations or governments that typically provide lower returns than stocks but are generally considered safer.

- Mutual Funds: Investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges like individual stocks.

- Real Estate: Investing in property can provide rental income and capital appreciation over time.

Important info: Diversifying across different types of investments can help mitigate risk.

Risk Tolerance

Understanding your risk tolerance is crucial when investing. Risk tolerance refers to how much volatility you can handle in your investment portfolio without panic selling. Factors influencing risk tolerance include:

- Age

- Financial situation

- Investment goals

- Experience level

Younger investors may have a higher risk tolerance because they have more time to recover from potential losses. In contrast, those nearing retirement typically prefer safer investments that preserve capital.

Important info: Assessing your risk tolerance ensures you choose investments that align with your comfort level.

Investment Strategies

Developing an investment strategy is essential for achieving your financial goals. Here are some popular strategies:

- Buy and Hold: This long-term strategy involves purchasing investments and holding them for an extended period regardless of market fluctuations.

- Dollar-Cost Averaging: This strategy entails investing a fixed amount of money at regular intervals, which helps reduce the impact of market volatility.

- Value Investing: This approach focuses on buying undervalued stocks with strong fundamentals.

- Growth Investing: Investors look for companies expected to grow at an above-average rate compared to their industry peers.

Important info: Each strategy has its pros and cons; choose one that complements your financial objectives.

Starting Your Investment Journey

To start investing effectively, follow these steps:

1. Educate Yourself: Learn about different types of investments and how they work.

2. Set Up an Emergency Fund: Before investing, ensure you have savings set aside for unexpected expenses.

3. Choose an Investment Account: Decide whether you want a brokerage account or tax-advantaged accounts like IRAs or 401(k)s.

4. Determine Your Budget: Decide how much money you can comfortably invest without impacting your daily finances.

5. Select Your Investments: Based on your research and risk tolerance, choose specific investments or funds.

6. Monitor Your Portfolio: Regularly review your investments to ensure they align with your goals and make adjustments as needed.

Important info: Start small if necessary; the key is to begin investing consistently.

Importance of Diversification

Diversification is a crucial principle in investing that involves spreading your investments across various asset classes to reduce risk. By diversifying, you minimize the impact of any single investment’s poor performance on your overall portfolio.

Benefits of Diversification:

- Reduces volatility

- Protects against market downturns

- Enhances potential returns over time

A well-diversified portfolio might include a mix of stocks, bonds, real estate, and other assets tailored to your investment goals and risk tolerance.

Common Mistakes to Avoid

New investors often make several common mistakes that can hinder their success:

- Chasing Performance: Avoid buying into investments solely based on past performance without understanding their fundamentals.

- Timing the Market: Trying to predict market movements can lead to missed opportunities; instead, focus on long-term growth.

- Neglecting Research: Always conduct thorough research before making investment decisions.

- Overreacting to Market Fluctuations: Stay calm during market volatility; remember that investing is a long-term endeavor.

Important info: Learning from mistakes is part of the investing process; stay disciplined and focused on your strategy.

FAQs About Investing

- What is the best way to start investing?

The best way to start investing is by setting clear financial goals and educating yourself about different investment options. - How much money do I need to start investing?

You can start investing with any amount; many platforms allow small contributions through fractional shares. - What are the risks associated with investing?

All investments carry risks, including market volatility and the possibility of losing principal. - Should I invest in stocks or bonds?

Your choice between stocks and bonds should depend on your risk tolerance and investment goals. - How often should I review my investments?

You should review your investments at least annually or whenever there are significant life changes.

Investing requires careful planning and ongoing education. By understanding the basics outlined in this guide, you can make informed decisions that align with your financial objectives while managing risks effectively. Remember that successful investing is often about patience and discipline rather than quick gains.