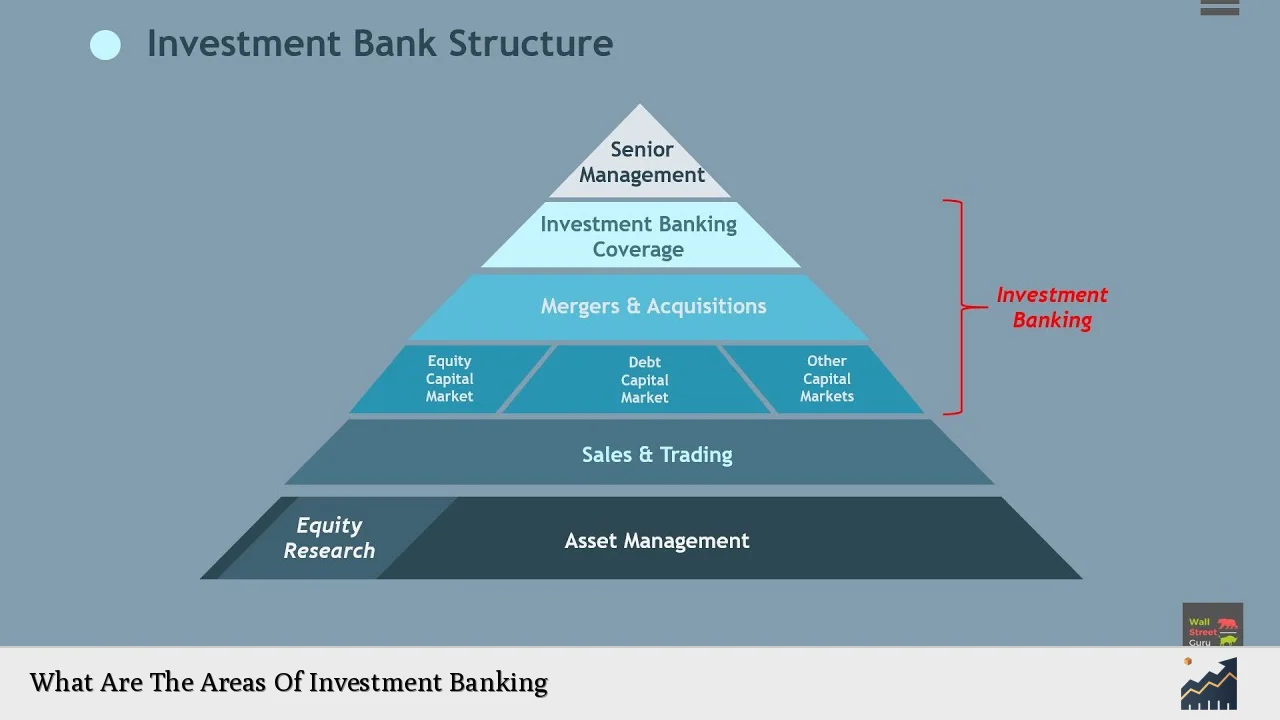

Investment banking is a vital segment of the financial services industry, providing essential services to corporations, governments, and other institutions. It primarily assists clients in raising capital, executing complex financial transactions, and offering strategic advisory services. Investment banks serve as intermediaries between investors and entities seeking funds, facilitating various activities such as mergers and acquisitions (M&A), underwriting, and trading. This article will explore the key areas of investment banking, detailing their functions and significance in the financial landscape.

| Area | Description |

|---|---|

| Capital Raising | Assisting clients in obtaining funds through equity or debt instruments. |

| Mergers & Acquisitions | Advising on corporate mergers and acquisitions to optimize value. |

| Sales & Trading | Facilitating the buying and selling of securities for clients. |

| Asset Management | Managing investment portfolios for various clients. |

| Equity Research | Providing analysis and recommendations on stocks and securities. |

Capital Raising

Capital raising is one of the most critical functions of investment banks. This area focuses on assisting clients in obtaining funds necessary for various purposes, including business expansion, acquisitions, or operational needs. Investment banks facilitate this process through different methods:

- Initial Public Offerings (IPOs): Helping companies go public by issuing shares to raise capital from public investors.

- Debt Issuance: Assisting clients in issuing bonds or other debt instruments to secure funding from institutional investors.

- Private Placements: Offering securities directly to a select group of investors rather than through a public offering.

Investment banks leverage their extensive networks and market knowledge to connect clients with potential investors, ensuring they secure the best possible terms for their capital needs. This area is crucial for companies looking to grow or restructure their finances effectively.

Mergers & Acquisitions (M&A)

Mergers and acquisitions represent another significant area within investment banking. Investment banks provide advisory services throughout the entire M&A process, which includes:

- Target Identification: Assisting clients in identifying potential acquisition targets or buyers.

- Valuation Services: Conducting thorough analyses to determine the fair value of companies involved in a transaction.

- Negotiation Support: Facilitating negotiations between parties to ensure favorable terms are reached.

- Due Diligence: Conducting comprehensive assessments of financial, legal, and operational aspects of target companies.

The expertise provided by investment banks in M&A transactions is invaluable, as these deals often involve substantial sums of money and complex regulatory considerations. Their role ensures that clients navigate this intricate landscape successfully.

Sales & Trading

The sales and trading division of investment banks focuses on facilitating transactions in financial markets. This area involves two primary functions:

- Sales: Engaging with clients to understand their investment needs and offering suitable securities or trading strategies.

- Trading: Executing buy and sell orders for various financial instruments, including stocks, bonds, derivatives, and commodities.

Investment banks act as intermediaries between buyers and sellers in the market, providing liquidity and ensuring efficient price discovery. They may also engage in proprietary trading, where they trade using their own capital to generate profits. This division is essential for maintaining market efficiency and providing clients with timely access to investment opportunities.

Asset Management

Asset management is another critical area within investment banking that focuses on managing investments on behalf of clients. This can include:

- Portfolio Management: Developing tailored investment strategies based on individual client goals and risk tolerance.

- Investment Advisory: Providing expert advice on asset allocation, security selection, and market trends.

- Performance Monitoring: Regularly reviewing client portfolios to ensure alignment with investment objectives.

Investment banks typically serve a diverse clientele in asset management, including institutional investors such as pension funds, endowments, and high-net-worth individuals. The expertise offered in this area helps clients achieve their financial goals while managing risks effectively.

Equity Research

Equity research is a specialized area within investment banking that involves analyzing publicly traded companies to provide insights into their performance and potential for growth. Key activities include:

- Company Analysis: Evaluating financial statements, market position, competitive landscape, and growth prospects.

- Industry Research: Assessing broader industry trends that may impact individual companies or sectors.

- Investment Recommendations: Providing buy/sell/hold recommendations based on thorough analysis.

Equity research plays a crucial role in informing both institutional and retail investors about potential investment opportunities. Investment banks leverage their research capabilities to support trading activities and enhance client decision-making processes.

Other Specialized Areas

In addition to the core functions outlined above, investment banking encompasses several specialized areas that cater to specific client needs:

- Corporate Restructuring: Advising distressed companies on strategies to optimize capital structures or navigate bankruptcy proceedings.

- Risk Management Services: Offering solutions to identify, assess, and mitigate financial risks through derivatives or other instruments.

- Structured Finance: Designing complex financial products tailored to meet specific client requirements or regulatory standards.

These specialized areas require unique expertise and are often critical during periods of economic uncertainty or market volatility. Investment banks provide essential support in these situations by leveraging their knowledge and resources.

FAQs About Areas Of Investment Banking

- What are the main areas of investment banking?

The main areas include capital raising, mergers & acquisitions (M&A), sales & trading, asset management, and equity research. - How do investment banks assist with mergers?

Investment banks provide advisory services throughout the M&A process including valuation, negotiation support, and due diligence. - What is the role of sales & trading in investment banking?

This area facilitates transactions by connecting buyers and sellers while providing liquidity in financial markets. - What services do asset management divisions offer?

Asset management divisions manage investments for clients through portfolio management and advisory services. - How does equity research benefit investors?

Equity research provides analysis and recommendations that help investors make informed decisions about securities.

Investment banking plays a significant role in the global economy by facilitating capital flows between investors and entities seeking funds. Understanding its various areas helps stakeholders appreciate how these institutions contribute to economic growth and stability. Each function within investment banking requires specialized knowledge and skills, making it a complex yet rewarding field for professionals involved.