Layer 1 (L1) blockchains serve as the foundational layer of blockchain networks, providing the essential infrastructure upon which decentralized finance (DeFi) applications are built. These blockchains, such as Bitcoin and Ethereum, enable secure, transparent, and efficient transactions without the need for intermediaries. Their unique characteristics and capabilities make them particularly advantageous for DeFi, which aims to recreate and improve upon traditional financial services through decentralized technologies. This article explores the advantages of using Layer 1 blockchains for DeFi, supported by current market trends and analysis.

| Key Concept | Description/Impact |

|---|---|

| Decentralization | L1 blockchains operate on a decentralized network, ensuring no single entity controls the system. This enhances trust among users and reduces the risk of censorship or manipulation. |

| Security | Utilizing robust consensus mechanisms (e.g., Proof of Work, Proof of Stake), L1 blockchains provide high security standards that protect against fraud and cyber-attacks, making them suitable for high-value transactions. |

| Immutability | Once transactions are recorded on L1 blockchains, they cannot be altered or deleted. This feature ensures data integrity and transparency, which are crucial for financial applications. |

| Smart Contract Functionality | L1 blockchains like Ethereum support smart contracts that automate complex transactions and processes, enabling a wide range of DeFi applications such as lending, borrowing, and trading. |

| Scalability Solutions | While L1 blockchains face scalability challenges, innovations such as sharding and layer-2 solutions are being developed to enhance transaction throughput without compromising security. |

Market Analysis and Trends

The DeFi sector has witnessed exponential growth over recent years, with total value locked (TVL) in DeFi protocols reaching approximately $100 billion in late 2024. Layer 1 blockchains have played a central role in this expansion. As of December 2024, Layer 1 blockchains collectively hold a market capitalization exceeding $2.8 trillion, with Bitcoin accounting for about 70% of this value. This surge is attributed to increased adoption of cryptocurrencies and DeFi applications driven by market dynamics and regulatory developments.

Current Trends

- Increased Adoption: More users are engaging with DeFi platforms due to their accessibility and potential for higher returns compared to traditional financial systems.

- Institutional Interest: Traditional financial institutions are beginning to explore partnerships with DeFi projects, enhancing credibility and stability in the sector.

- Regulatory Developments: Regulatory clarity is evolving, which could lead to more widespread adoption of DeFi solutions on L1 blockchains.

Implementation Strategies

To effectively leverage Layer 1 blockchains for DeFi applications, developers must consider several strategic approaches:

- Choosing the Right Blockchain: Depending on the specific needs of the application (e.g., transaction speed vs. security), selecting an appropriate L1 blockchain is crucial. Ethereum remains popular due to its established ecosystem, while newer entrants like Solana offer high throughput.

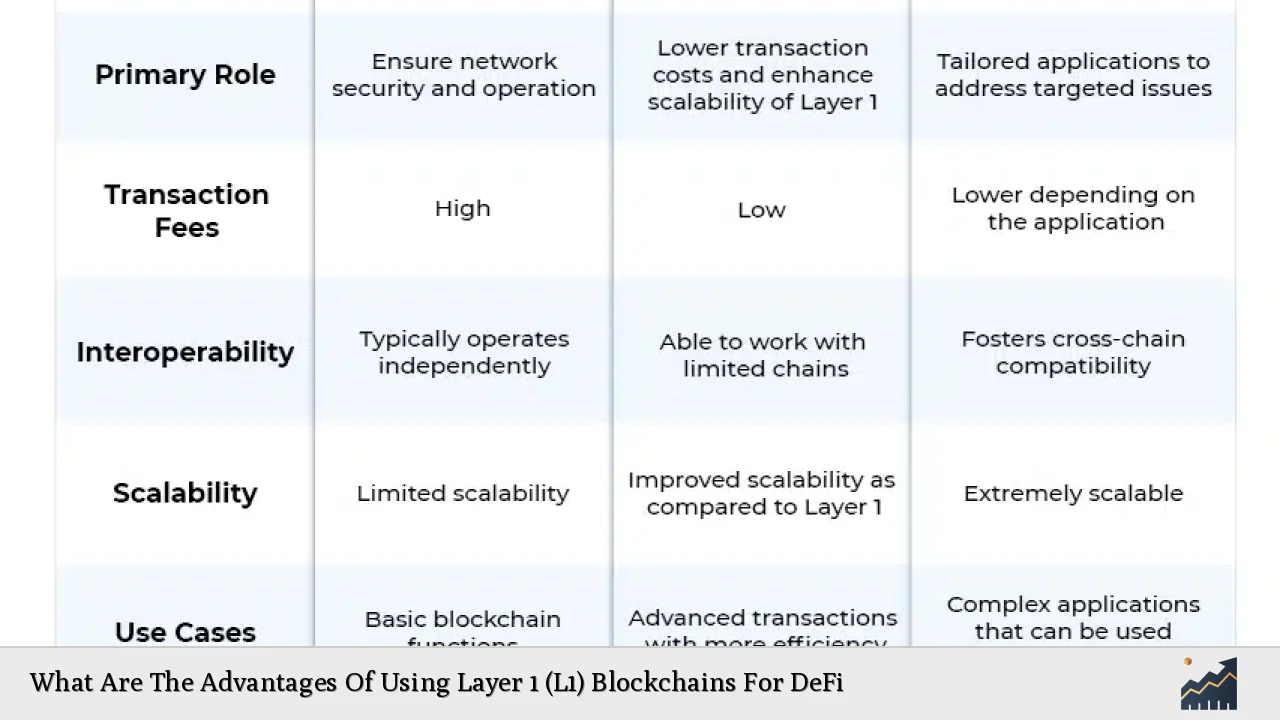

- Integrating Layer-2 Solutions: To address scalability issues inherent in L1 blockchains, integrating layer-2 solutions can enhance performance by offloading some transaction processing from the main chain.

- Utilizing Smart Contracts: Developers should focus on creating efficient smart contracts that minimize gas fees while ensuring robust functionality.

Risk Considerations

While Layer 1 blockchains offer numerous advantages for DeFi applications, they also come with inherent risks:

- Scalability Challenges: High demand can lead to network congestion, resulting in slower transaction times and increased costs during peak usage periods.

- Regulatory Risks: As governments worldwide begin to regulate cryptocurrencies more strictly, DeFi projects may face compliance challenges that could impact their operations.

- Smart Contract Vulnerabilities: Bugs or exploits in smart contracts can lead to significant financial losses; thus, rigorous testing and audits are essential before deployment.

Regulatory Aspects

The regulatory environment surrounding cryptocurrencies and DeFi is rapidly evolving. Key considerations include:

- Compliance Requirements: Many jurisdictions are implementing regulations that require DeFi platforms to adhere to anti-money laundering (AML) and know-your-customer (KYC) guidelines.

- Tax Implications: Investors must be aware of tax obligations related to cryptocurrency transactions and gains from DeFi activities.

- Potential for Centralized Control: Increased regulation could lead to a shift towards more centralized models within what is fundamentally a decentralized space.

Future Outlook

The future of Layer 1 blockchains in the context of DeFi appears promising but will depend on several factors:

- Technological Innovations: Continued advancements in blockchain technology will enhance scalability and security features critical for supporting complex financial applications.

- Market Dynamics: The ongoing evolution of user preferences towards decentralized solutions will drive further investment into Layer 1 projects.

- Global Adoption: As more regions embrace blockchain technology, Layer 1 solutions will likely see increased integration into traditional financial systems.

Frequently Asked Questions About What Are The Advantages Of Using Layer 1 (L1) Blockchains For DeFi

- What is a Layer 1 blockchain?

A Layer 1 blockchain is the base level of a blockchain network that handles all transactions independently without relying on other networks. - How do Layer 1 blockchains ensure security?

Layer 1 blockchains use consensus mechanisms like Proof of Work or Proof of Stake to validate transactions securely across a decentralized network. - What role do smart contracts play in DeFi?

Smart contracts automate processes within DeFi applications, enabling functionalities such as lending and trading without intermediaries. - What are the scalability issues faced by Layer 1 blockchains?

L1 blockchains may experience congestion during high transaction volumes, leading to slower processing times and higher fees. - How does regulation affect DeFi?

Regulatory developments can impose compliance requirements on DeFi platforms but can also enhance legitimacy and user trust. - What is the future outlook for Layer 1 blockchains?

The future looks bright as technological advancements continue to improve scalability and security while user adoption grows. - Why is decentralization important in finance?

Decentralization reduces reliance on single entities or intermediaries, enhancing trust among users and mitigating risks associated with centralized control. - Can Layer 2 solutions help with L1 scalability?

Yes, layer-2 solutions can alleviate congestion by processing transactions off-chain while still leveraging the security of the underlying L1 blockchain.

Layer 1 blockchains are integral to the development of decentralized finance applications. Their advantages—decentralization, security, immutability, smart contract functionality—position them as foundational elements driving innovation in finance. As market conditions evolve and technology advances, these platforms will continue to shape the future landscape of global finance.