Reinvestment needs refer to the requirements and considerations a business or investor must address when deciding how to allocate profits, dividends, or other forms of income back into their operations or investments. This practice is crucial for sustaining growth, enhancing competitiveness, and ensuring long-term viability. Reinvestment can take various forms, including upgrading technology, expanding product lines, or increasing marketing efforts. Understanding reinvestment needs involves recognizing the potential benefits and risks associated with reinvesting funds rather than distributing them as profits.

Reinvestment is a strategic approach that allows businesses to leverage their earnings to foster growth and innovation. It is essential for companies aiming to maintain a competitive edge in their respective markets. By reinvesting profits, businesses can improve operational efficiency, develop new products, and enhance customer experiences. Additionally, reinvestment can attract investors by demonstrating confidence in the company’s future prospects.

The decision to reinvest often hinges on several factors, including market conditions, business goals, and available opportunities for growth. Companies must evaluate their current financial status and future potential before committing to specific reinvestment strategies. This process can involve analyzing cash flow, identifying areas for improvement, and determining the most effective use of available funds.

| Aspect | Description |

|---|---|

| Definition | Reinvestment needs pertain to the allocation of profits back into a business or investment. |

| Purpose | To foster growth, enhance competitiveness, and ensure long-term viability. |

Understanding Reinvestment Needs

Reinvestment needs are influenced by various factors that businesses must consider when planning their financial strategies. These factors include market dynamics, competition, technological advancements, and customer preferences. Companies that fail to recognize their reinvestment needs may struggle to keep pace with industry changes or miss out on growth opportunities.

One of the primary reasons for reinvesting is to support business growth. By allocating profits toward expansion initiatives such as new product development or market entry strategies, companies can increase their market share and revenue potential. Additionally, reinvestment allows businesses to enhance operational efficiency through technology upgrades or process improvements.

Another critical aspect of reinvestment needs is attracting investment. Investors are more likely to support companies that demonstrate a commitment to growth through strategic reinvestment. This confidence can lead to increased funding opportunities and partnerships that further bolster a company’s position in the market.

Furthermore, reinvesting profits can help businesses maintain control over their operations. By choosing to reinvest rather than distribute dividends or profits, owners can avoid diluting their ownership stakes or relying on external funding sources. This autonomy enables them to make decisions aligned with their long-term vision for the company.

Types of Reinvestment Strategies

Businesses can adopt various reinvestment strategies based on their unique circumstances and goals. Understanding these strategies is essential for effectively addressing reinvestment needs.

- Technology Upgrades: Investing in new technologies can streamline operations and improve productivity. This may include software updates, hardware purchases, or automation tools that enhance efficiency.

- Employee Development: Training programs and skill development initiatives are crucial for fostering a knowledgeable workforce. Investing in employees not only boosts morale but also increases overall productivity.

- Marketing Expansion: Allocating funds toward marketing efforts helps businesses reach new customers and strengthen brand awareness. This may involve digital advertising campaigns, social media initiatives, or content marketing strategies.

- Product Development: Reinvesting in research and development enables companies to innovate and create new products that meet evolving customer demands. This strategy is vital for maintaining relevance in competitive markets.

- Infrastructure Improvements: Enhancing physical or digital infrastructure supports better customer service and operational efficiency. Investments in logistics systems or office renovations can significantly impact overall performance.

Each of these strategies plays a pivotal role in addressing a company’s reinvestment needs while contributing to its long-term success.

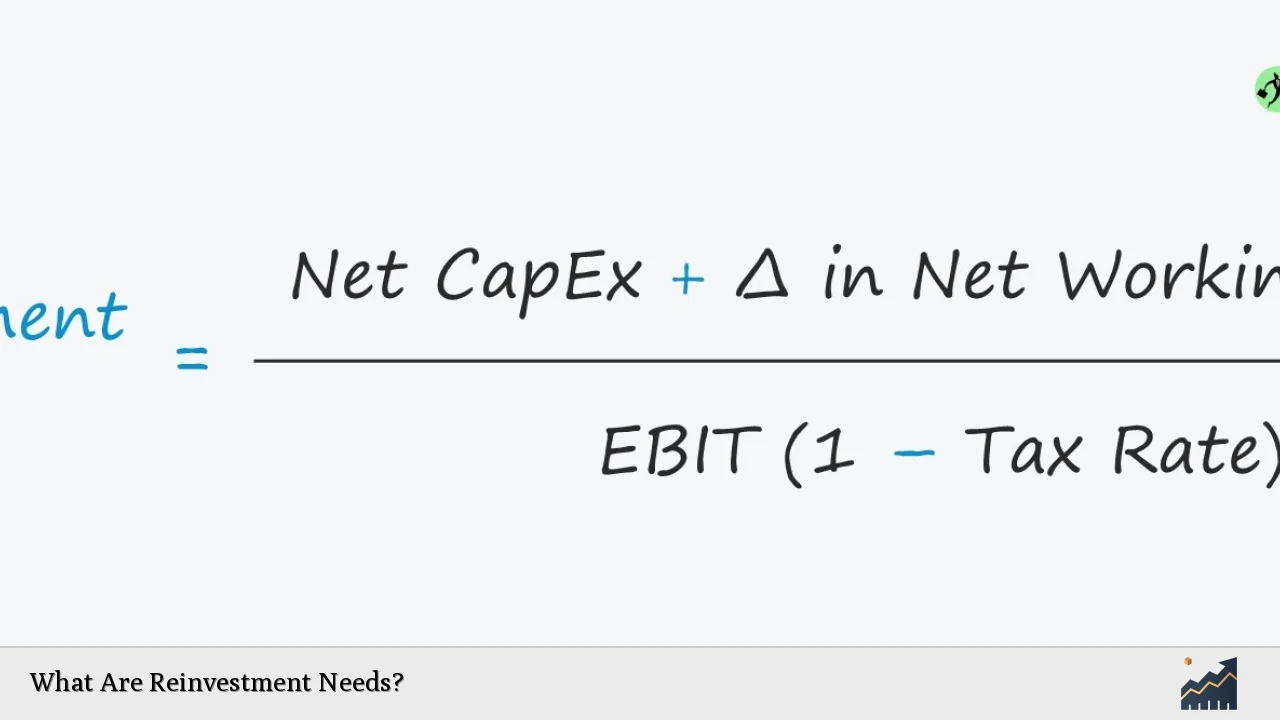

Assessing Reinvestment Needs

To effectively manage reinvestment needs, businesses must conduct thorough assessments of their current financial situation and future goals. This process typically involves several key steps:

1. Understand Business Goals: Clearly define short-term and long-term objectives to guide reinvestment decisions.

2. Identify Areas for Improvement: Analyze existing operations to pinpoint inefficiencies or gaps that require attention.

3. Evaluate Financial Health: Assess cash flow statements, profit margins, and overall financial stability to determine available funds for reinvestment.

4. Prioritize Investments: Create a list of potential investments ranked by urgency and expected return on investment (ROI).

5. Develop a Timeline: Establish realistic timelines for implementing reinvestment strategies based on available resources and market conditions.

By following these steps, businesses can ensure they are making informed decisions regarding their reinvestment needs while maximizing the potential benefits of allocated funds.

Benefits of Reinvestment

Reinvestment offers numerous advantages that contribute to a company’s growth trajectory:

- Enhanced Growth Potential: Companies that reinvest are better positioned to expand their operations and increase revenue streams over time.

- Improved Operational Efficiency: Investing in technology or infrastructure upgrades leads to streamlined processes that reduce costs and improve productivity.

- Increased Market Competitiveness: By continuously innovating and adapting through reinvestment, businesses can maintain a competitive edge in their industry.

- Attracting Talent: Companies committed to employee development through training programs are more likely to attract skilled professionals who seek opportunities for growth.

- Long-Term Sustainability: Strategic reinvestment fosters resilience against market fluctuations by ensuring companies remain agile and responsive to changing conditions.

These benefits highlight why understanding and addressing reinvestment needs is critical for any organization aiming for sustained success.

Risks Associated with Reinvestment

While the benefits of reinvesting are significant, there are also inherent risks that businesses must consider:

- Market Uncertainty: Economic downturns or shifts in consumer behavior can impact the effectiveness of reinvestment strategies.

- Opportunity Cost: Funds allocated toward one investment may prevent businesses from pursuing other potentially lucrative opportunities.

- Execution Challenges: Poorly executed reinvestment strategies can lead to wasted resources and diminished returns on investment.

- Overextension: Rapid expansion without adequate planning may strain resources and hinder overall performance.

Understanding these risks allows businesses to make more informed decisions regarding their reinvestment needs while developing contingency plans for potential challenges.

FAQs About Reinvestment Needs

- What are the main reasons for reinvesting profits?

Reinvesting profits supports business growth, enhances competitiveness, attracts investors, and maintains control over operations. - How do I determine my company’s reinvestment needs?

Assess your financial health, identify areas for improvement, prioritize investments based on goals, and develop a timeline. - What types of investments should I consider for reinvesting?

Consider technology upgrades, employee development programs, marketing expansion efforts, product development initiatives, and infrastructure improvements. - What are the risks associated with reinvesting?

Risks include market uncertainty, opportunity costs from missed chances elsewhere, execution challenges leading to wasted resources, and potential overextension. - How does reinvesting affect investor confidence?

Demonstrating a commitment to growth through strategic reinvestment can enhance investor confidence in a company’s future prospects.

In conclusion, understanding what constitutes *reinvestment needs* is vital for any business aiming for sustainable growth. By carefully assessing these needs through strategic planning and execution while being mindful of associated risks, organizations can leverage their earnings effectively for long-term success.