As we transition into 2025, investors are increasingly focusing on a variety of asset classes and investment themes that reflect current economic conditions and future growth potential. The landscape is marked by significant shifts towards alternative investments, technology, and sustainable practices. These trends are driven by a combination of factors including market volatility, technological advancements, and a growing awareness of environmental, social, and governance (ESG) issues.

Investors are looking for opportunities that not only promise financial returns but also align with their values and the evolving market dynamics. This article explores the major investment themes emerging as we enter 2025, providing insights into where individuals and institutions are placing their money.

| Investment Theme | Description |

|---|---|

| Alternative Investments | Investments outside traditional stocks and bonds, including private equity and hedge funds. |

| Technology Stocks | Focus on companies in AI, biotech, and renewable energy sectors. |

| Sustainable Investments | Investments prioritizing ESG factors and impact investing. |

Alternative Investments on the Rise

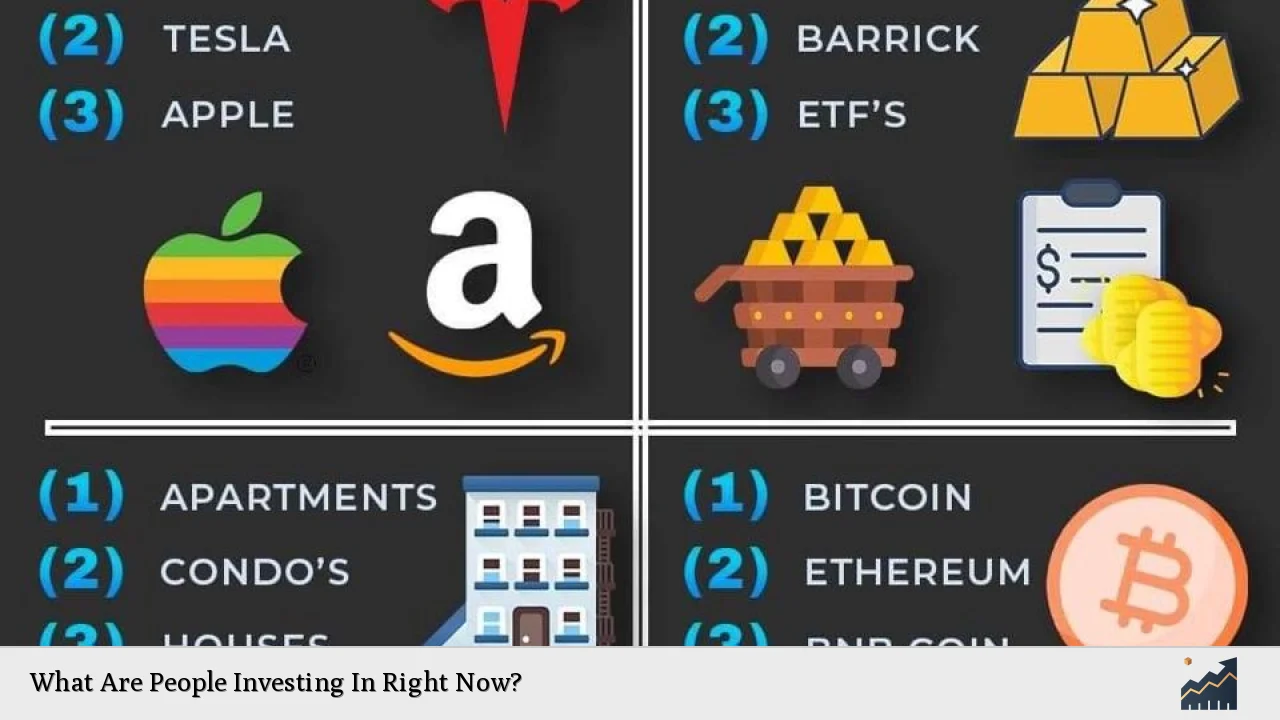

One of the most notable trends in the investment world is the increasing interest in alternative investments. This category includes assets such as private equity, hedge funds, real estate, and commodities. Investors are drawn to these options due to their potential for higher returns and lower correlation with traditional markets.

- Private Equity: This sector is experiencing significant growth as investors seek opportunities that can provide substantial returns over time. Private equity firms are capitalizing on market inefficiencies and undervalued assets.

- Hedge Funds: Hedge funds are becoming more popular due to their ability to navigate market volatility. They offer diverse strategies that can include long/short equity, global macroeconomic trends, and event-driven investing.

- Real Estate: With rising interest rates impacting traditional financing options, real estate investments are seen as a hedge against inflation. Investors are particularly interested in sectors like logistics and healthcare real estate.

The shift towards alternative investments reflects a broader trend of portfolio diversification. Investors are increasingly recognizing the importance of having a mix of asset classes to mitigate risks associated with economic fluctuations.

Technology Stocks Leading the Charge

In today’s market, technology stocks continue to dominate investor interest. The rapid advancement of technology has created new opportunities across various sectors, particularly in artificial intelligence (AI), biotechnology, and renewable energy.

- Artificial Intelligence: Companies specializing in AI technologies are attracting significant investments due to their potential to revolutionize industries. Firms like Nvidia and Google are at the forefront of this trend, showcasing robust earnings growth.

- Biotechnology: As the global population ages, there is an increasing demand for innovative healthcare solutions. Pharmaceutical companies developing treatments for chronic diseases are gaining traction among investors.

- Renewable Energy: The shift towards sustainable energy sources is driving investments in solar, wind, and other green technologies. With governments worldwide committing to reducing carbon emissions, renewable energy stocks are poised for growth.

Investors see technology as a critical driver of future economic growth. As such, they are willing to allocate substantial portions of their portfolios to tech-focused companies that demonstrate strong potential for innovation and profitability.

Sustainable Investing Gains Momentum

Sustainable investing is no longer just a niche market; it has become a mainstream investment strategy. Investors are increasingly looking for opportunities that align with their values while also delivering financial returns.

- ESG Investments: Environmental, social, and governance (ESG) criteria are becoming essential components of investment decisions. Funds focused on ESG factors have seen significant inflows as investors seek to support companies that prioritize sustainability.

- Impact Investing: This approach focuses on generating positive social or environmental impacts alongside financial returns. Investors are keen on projects that address global challenges such as climate change, poverty alleviation, and healthcare access.

- Green Bonds: The issuance of green bonds is expected to exceed $1 trillion in 2025 as companies seek funding for environmentally friendly projects. These bonds provide investors with a way to support sustainable initiatives while earning interest.

The growing emphasis on sustainability reflects a broader societal shift towards responsible investing. Investors recognize that aligning their portfolios with sustainable practices can lead to long-term benefits not only for themselves but also for future generations.

Cryptocurrencies Remain Popular

Despite regulatory uncertainties and market volatility, cryptocurrencies continue to attract attention from both retail and institutional investors. The rise of digital currencies is reshaping traditional finance and investment strategies.

- Bitcoin and Ethereum: These leading cryptocurrencies have established themselves as digital gold and utility tokens respectively. Their adoption continues to grow as more individuals view them as viable alternatives to traditional currencies.

- Crypto ETFs: Exchange-traded funds (ETFs) focused on cryptocurrencies offer investors an easier way to gain exposure without directly purchasing digital assets. These funds have gained popularity amid increasing acceptance of cryptocurrencies by mainstream financial institutions.

- Market Sentiment: Geopolitical tensions and economic instability often drive interest in cryptocurrencies as investors look for alternative stores of value. The potential for high returns continues to attract speculative investments in this volatile market.

While cryptocurrencies present unique risks, their potential rewards keep them on the radar for many investors seeking diversification beyond traditional asset classes.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) have gained traction among investors looking for income-generating assets with potential for capital appreciation. REITs offer an accessible way to invest in real estate without directly owning properties.

- Income Generation: REITs typically pay dividends derived from rental income or property sales, making them attractive for income-focused investors seeking regular cash flow.

- Diversification Benefits: Investing in REITs allows individuals to diversify their portfolios by adding real estate exposure without the complexities of direct property ownership.

- Sector-Specific Opportunities: Different types of REITs focus on various sectors such as residential, commercial, healthcare, or data centers. This specialization allows investors to target specific areas of growth within the real estate market.

As interest rates fluctuate and economic conditions evolve, REITs remain an appealing option for those looking to balance risk while capturing potential upside in the real estate sector.

FAQs About What Are People Investing In Right Now

- What are the top investment themes for 2025?

Top themes include alternative investments, technology stocks, sustainable investing, cryptocurrencies, and real estate. - Why is there increased interest in alternative investments?

Alternative investments offer higher returns and diversification benefits compared to traditional asset classes. - How are technology stocks performing?

Technology stocks continue to show strong performance due to advancements in AI, biotech, and renewable energy. - What role does ESG play in investing today?

ESG factors are critical as investors seek alignment between their values and financial goals. - Are cryptocurrencies still a viable investment option?

Yes, despite volatility; cryptocurrencies remain popular among investors seeking diversification.

As we move further into 2025, these trends will likely evolve based on economic conditions and investor sentiment. By staying informed about emerging themes and opportunities across various asset classes, investors can better position themselves for success in an ever-changing financial landscape.