Operating investments refer to the financial resources allocated by a business to support its core operations and generate revenue. These investments are crucial for maintaining and enhancing a company’s operational efficiency. They encompass various assets and expenditures that directly contribute to the production and sale of goods or services. Understanding operating investments is essential for business owners, investors, and financial analysts as they provide insights into a company’s operational health and potential for growth.

Operating investments can include a wide range of assets such as machinery, inventory, and working capital. These elements are vital for day-to-day operations and play a significant role in determining the overall profitability of a business. Proper management of operating investments helps businesses optimize their performance, reduce costs, and improve cash flow.

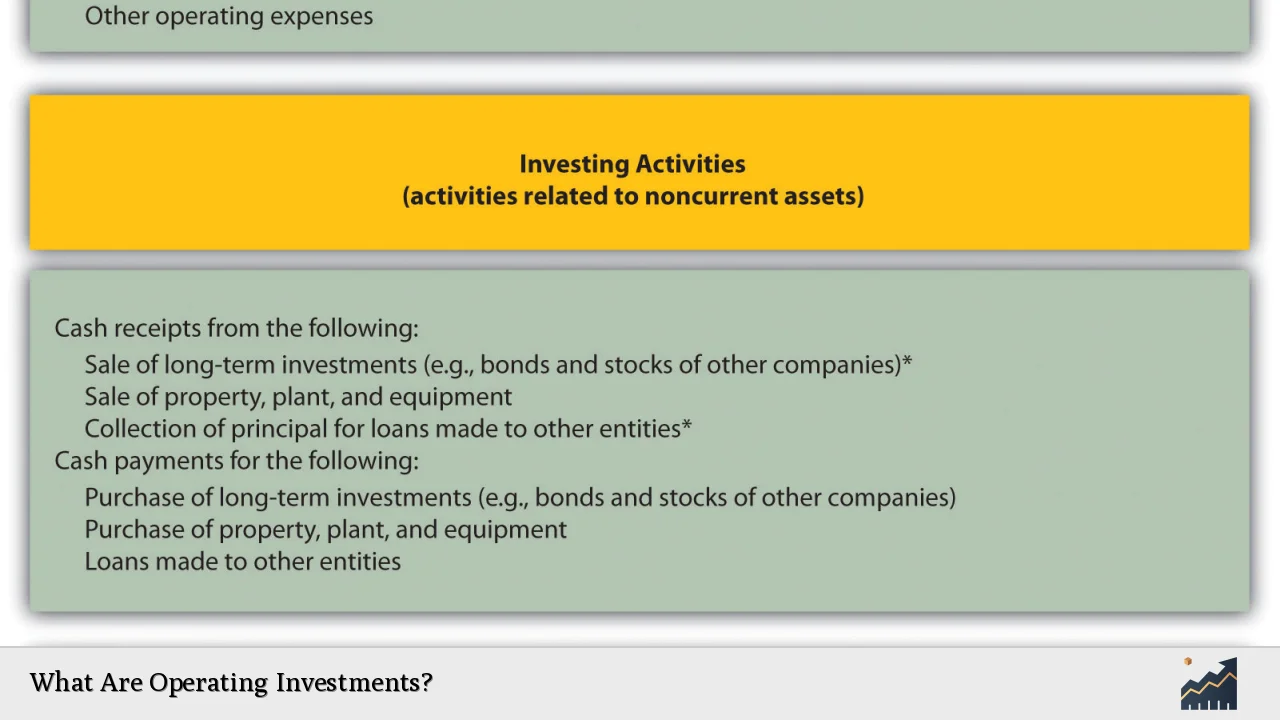

The distinction between operating investments and other types of investments, such as financial or long-term investments, is important. While financial investments may focus on generating returns from market activities, operating investments are primarily concerned with enhancing a company’s operational capabilities.

| Type of Investment | Description |

|---|---|

| Operating Investments | Resources allocated to support core business operations. |

| Financial Investments | Investments in securities or other financial instruments. |

Understanding Operating Investments

Operating investments are essential for businesses to maintain their competitive edge. They include tangible assets like machinery, equipment, and inventory, as well as intangible assets such as software and patents that facilitate operations. By investing in these areas, companies can enhance their productivity and efficiency, leading to increased revenue generation.

Important info: The effectiveness of operating investments can be measured through various financial metrics such as return on investment (ROI) and operating cash flow. These metrics help assess how well the resources are utilized in generating profits.

Managing operating investments involves careful planning and analysis. Companies must evaluate their current operational needs and future growth prospects to determine the appropriate level of investment. This process often includes budgeting for new equipment purchases, upgrading technology systems, or increasing inventory levels to meet customer demand.

Moreover, businesses must consider the lifecycle of their operating assets. Regular maintenance and timely upgrades are necessary to ensure that these assets continue to perform optimally. Neglecting operating investments can lead to inefficiencies, increased costs, and ultimately reduced profitability.

Types of Operating Investments

Operating investments can be categorized into several types based on their nature and purpose:

- Tangible Assets: These include physical items such as machinery, vehicles, buildings, and equipment that are essential for production processes.

- Inventory: This refers to the goods available for sale or raw materials used in production. Effective inventory management is crucial for meeting customer demand without incurring excess costs.

- Working Capital: This encompasses short-term assets like cash, accounts receivable, and accounts payable that are necessary for daily operations. Maintaining adequate working capital ensures that a company can meet its short-term obligations.

- Intangible Assets: These include non-physical items such as patents, trademarks, and software that contribute to operational efficiency. Investing in technology can significantly enhance productivity.

- Research and Development (R&D): Allocating funds towards R&D is vital for innovation and improving existing products or services. This type of investment helps businesses stay competitive in rapidly changing markets.

Understanding these categories allows businesses to make informed decisions about where to allocate their resources most effectively.

Importance of Operating Investments

Operating investments play a critical role in a company’s success. They directly impact operational efficiency, product quality, and customer satisfaction. Here are some key reasons why managing operating investments is essential:

1. Enhances Productivity: By investing in modern equipment and technology, companies can streamline their processes, reduce downtime, and increase output.

2. Improves Quality: High-quality machinery and materials lead to better product quality, which enhances customer satisfaction and brand reputation.

3. Supports Growth: Adequate operating investments enable businesses to scale operations quickly in response to market demand or new opportunities.

4. Reduces Costs: Investing in efficient systems can lower operational costs over time by minimizing waste and improving resource utilization.

5. Increases Competitiveness: Companies that continuously invest in their operations can adapt more swiftly to market changes than those that do not.

In summary, effective management of operating investments is vital for sustaining business growth and achieving long-term success.

Measuring the Effectiveness of Operating Investments

To assess the effectiveness of operating investments, businesses utilize various financial metrics:

- Return on Investment (ROI): This metric measures the profitability of an investment relative to its cost. A higher ROI indicates more efficient use of capital.

- Operating Cash Flow: This reflects the cash generated from normal business operations after accounting for operational expenses. Positive cash flow indicates healthy operating performance.

- Asset Turnover Ratio: This ratio measures how efficiently a company uses its assets to generate sales revenue. A higher ratio signifies better asset utilization.

- Gross Margin: This metric indicates the difference between sales revenue and the cost of goods sold (COGS). A higher gross margin suggests effective cost management related to operating investments.

By regularly analyzing these metrics, companies can identify areas for improvement in their operating investments strategy.

Challenges in Managing Operating Investments

While managing operating investments is crucial for success, it also presents several challenges:

- Capital Constraints: Limited access to funding can hinder a company’s ability to invest adequately in necessary assets or upgrades.

- Rapid Technological Changes: Keeping up with technological advancements requires continuous investment in new tools and training programs for staff.

- Market Volatility: Economic fluctuations can impact demand forecasts, making it difficult to determine optimal inventory levels or investment needs.

- Balancing Short-term vs Long-term Goals: Companies must find a balance between immediate operational needs and long-term strategic objectives when making investment decisions.

Addressing these challenges requires careful planning and strategic decision-making at all levels of management.

Best Practices for Managing Operating Investments

To effectively manage operating investments, companies should adopt several best practices:

- Conduct Regular Assessments: Periodically evaluate existing assets’ performance against business objectives to identify areas needing improvement or replacement.

- Prioritize Investments Based on ROI: Focus on projects with the highest potential returns when allocating resources for new investments.

- Implement Technology Solutions: Utilize software tools for inventory management, asset tracking, and financial analysis to streamline operations.

- Engage Employees in Decision-Making: Involve staff in discussions about potential improvements or needed resources; they often have valuable insights into operational challenges.

- Monitor Industry Trends: Stay informed about market developments that may impact investment strategies or operational needs over time.

By following these practices, companies can enhance their ability to manage operating investments effectively while maximizing returns on those investments.

FAQs About Operating Investments

- What are examples of operating investments?

Examples include machinery purchases, inventory acquisition, working capital allocation, and technology upgrades. - How do operating investments affect profitability?

Effective management of operating investments leads to increased productivity and reduced costs, enhancing overall profitability. - What is the difference between operating investments and financial investments?

Operating investments support day-to-day business activities while financial investments focus on generating returns from securities. - How can businesses measure the success of their operating investments?

Businesses can measure success through metrics like ROI, operating cash flow, asset turnover ratio, and gross margin. - What challenges do companies face when managing operating investments?

Challenges include capital constraints, rapid technological changes, market volatility, and balancing short-term versus long-term goals.

In conclusion, understanding what operating investments are is fundamental for any business aiming for sustainable growth. By effectively managing these resources through strategic planning and regular assessment practices while overcoming challenges through best practices outlined above will ensure long-term success within competitive markets.