Understanding your investments is crucial for achieving financial security and growth. Investments can encompass a wide range of assets, including stocks, bonds, real estate, mutual funds, and more. Each type of investment has its own risk profile, potential returns, and liquidity characteristics. As an investor, knowing what you own and how these assets fit into your overall financial strategy is essential.

Investments are typically categorized based on various factors such as risk tolerance, investment goals, and time horizon. For example, younger investors may prefer growth-oriented assets like stocks, while those nearing retirement might focus on income-generating investments like bonds or dividend-paying stocks.

To help you understand the landscape of your investments better, here’s a concise overview of different investment types and their characteristics:

| Investment Type | Description |

|---|---|

| Stocks | Equity ownership in a company with potential for high returns. |

| Bonds | Debt securities issued by governments or corporations with fixed interest payments. |

| Real Estate | Property investments that can provide rental income and appreciation. |

| Mutual Funds | Pooled investment vehicles managed by professionals across various assets. |

| ETFs | Exchange-traded funds that offer diversification and trade like stocks. |

Understanding Different Types of Investments

Investments can be broadly categorized into several types based on their nature and structure. Each type serves different purposes and comes with its own set of risks and rewards.

Stocks

Stocks represent ownership in a company. When you buy stocks, you become a shareholder and have a claim on the company’s assets and earnings. Stocks are known for their potential for high returns but also come with higher volatility compared to other investment types. Investors often buy stocks to achieve capital appreciation over time.

Bonds

Bonds are debt instruments where you lend money to an issuer (government or corporation) in exchange for periodic interest payments plus the return of the bond’s face value at maturity. Bonds are generally considered safer than stocks but typically offer lower returns. They can be an essential part of a diversified investment portfolio.

Real Estate

Real estate investments involve purchasing property for rental income or capital appreciation. Real estate can provide steady cash flow through rent and potential tax benefits. However, it also requires significant capital upfront and ongoing management.

Mutual Funds

Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who aim to achieve specific investment objectives. While mutual funds offer diversification, they also come with management fees that can impact overall returns.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They typically have lower expense ratios than mutual funds and provide instant diversification across various asset classes. ETFs can be an excellent choice for investors looking for flexibility in trading.

Assessing Your Investment Goals

Before diving deeper into your investments, it is crucial to define your investment goals. Understanding what you want to achieve will guide your investment decisions and help you select the appropriate asset classes.

Short-term vs Long-term Goals

Your goals can be classified as short-term or long-term:

- Short-term goals: These may include saving for a vacation or purchasing a car within the next few years. Investments aimed at short-term goals should prioritize liquidity and capital preservation.

- Long-term goals: These typically involve saving for retirement or funding a child’s education over several decades. Long-term investments can afford to take on more risk in exchange for potentially higher returns.

Risk Tolerance

Your risk tolerance plays a significant role in determining your investment strategy. It reflects how much risk you are willing to take with your investments:

- Conservative investors: Prefer low-risk investments that offer stable returns.

- Moderate investors: Are willing to accept some risk for potentially higher returns.

- Aggressive investors: Seek high-growth opportunities and are comfortable with significant market fluctuations.

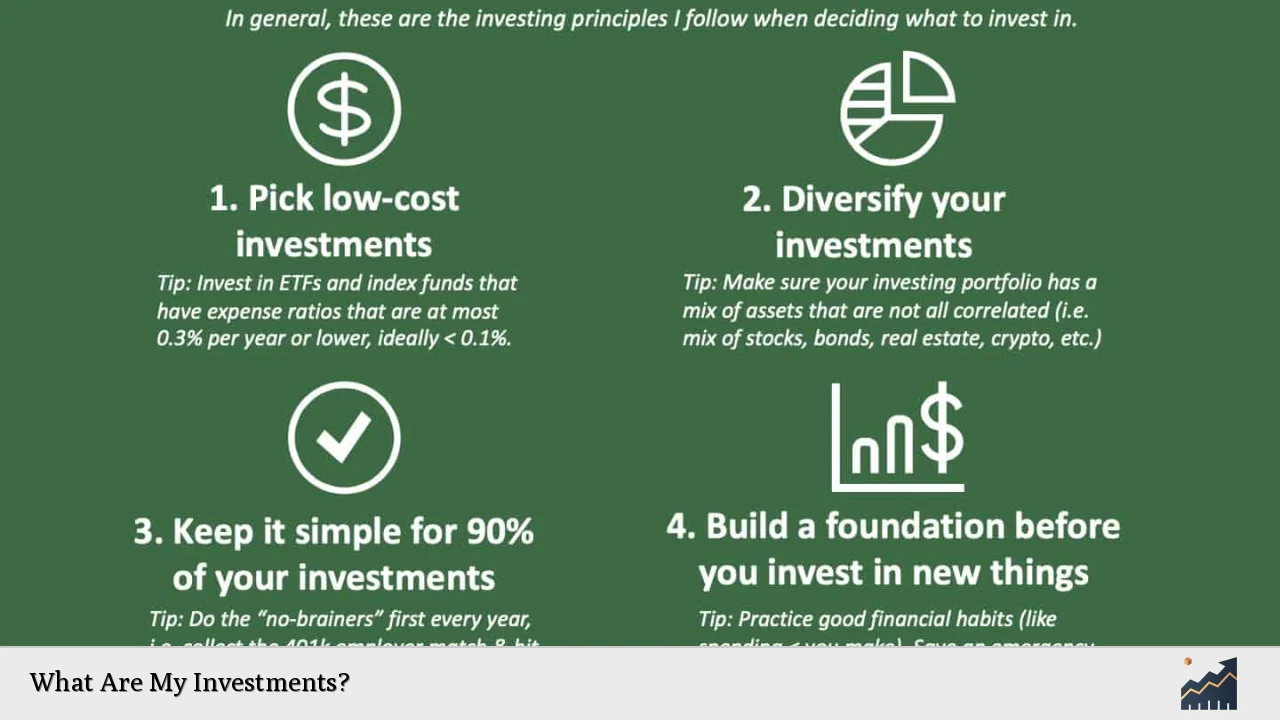

Building a Diversified Portfolio

A well-diversified portfolio is essential for managing risk while maximizing potential returns. Diversification involves spreading your investments across various asset classes to reduce exposure to any single asset’s performance.

Asset Allocation

Asset allocation refers to how you distribute your investments among different asset categories:

- Equities (stocks): Generally offer higher growth potential but come with higher volatility.

- Fixed income (bonds): Provide stability and income but lower growth potential.

- Real assets (real estate): Can add diversification and hedge against inflation.

- Cash equivalents: Offer liquidity but minimal returns.

The right asset allocation depends on your individual financial situation, investment goals, and risk tolerance.

Rebalancing Your Portfolio

Over time, market fluctuations can cause your asset allocation to drift from its original target. Regularly rebalancing your portfolio helps maintain your desired risk level:

- Review your portfolio periodically (e.g., annually).

- Adjust holdings back to target allocations by selling overperforming assets and buying underperforming ones.

Monitoring Your Investments

Once you’ve established your investment portfolio, continuous monitoring is vital to ensure alignment with your financial goals:

Performance Tracking

Regularly assess the performance of your investments against benchmarks or indices relevant to each asset class. This will help identify areas needing adjustment or reallocation.

Market Trends

Stay informed about market trends that could impact your investments:

- Economic indicators (e.g., interest rates, inflation).

- Industry developments (e.g., technological advancements).

Being aware of these factors can help you make informed decisions about when to buy or sell assets.

Seeking Professional Guidance

If navigating the complexities of investing feels overwhelming, consider seeking professional advice:

Financial Advisors

A financial advisor can provide personalized guidance tailored to your financial situation:

- Help define investment goals.

- Create a diversified portfolio aligned with those goals.

- Offer ongoing support in monitoring and adjusting investments as needed.

Robo-Advisors

For those who prefer a more automated approach, robo-advisors offer algorithm-driven financial planning services with minimal human intervention:

- Typically lower fees than traditional advisors.

- Provide automated portfolio management based on individual risk profiles.

FAQs About What Are My Investments

- What types of investments should I consider?

Consider stocks, bonds, real estate, mutual funds, and ETFs based on your financial goals. - How do I determine my risk tolerance?

Your risk tolerance depends on factors like age, financial situation, and investment objectives. - What is diversification?

Diversification involves spreading investments across various asset classes to reduce risk. - How often should I rebalance my portfolio?

You should review and rebalance your portfolio at least annually or after significant market changes. - Should I hire a financial advisor?

A financial advisor can help tailor an investment strategy suited to your needs if you’re unsure how to proceed.

Understanding what you own is crucial for making informed decisions about your financial future. By defining your goals, assessing your risk tolerance, building a diversified portfolio, monitoring performance regularly, and seeking professional guidance when necessary, you can navigate the world of investing more effectively.