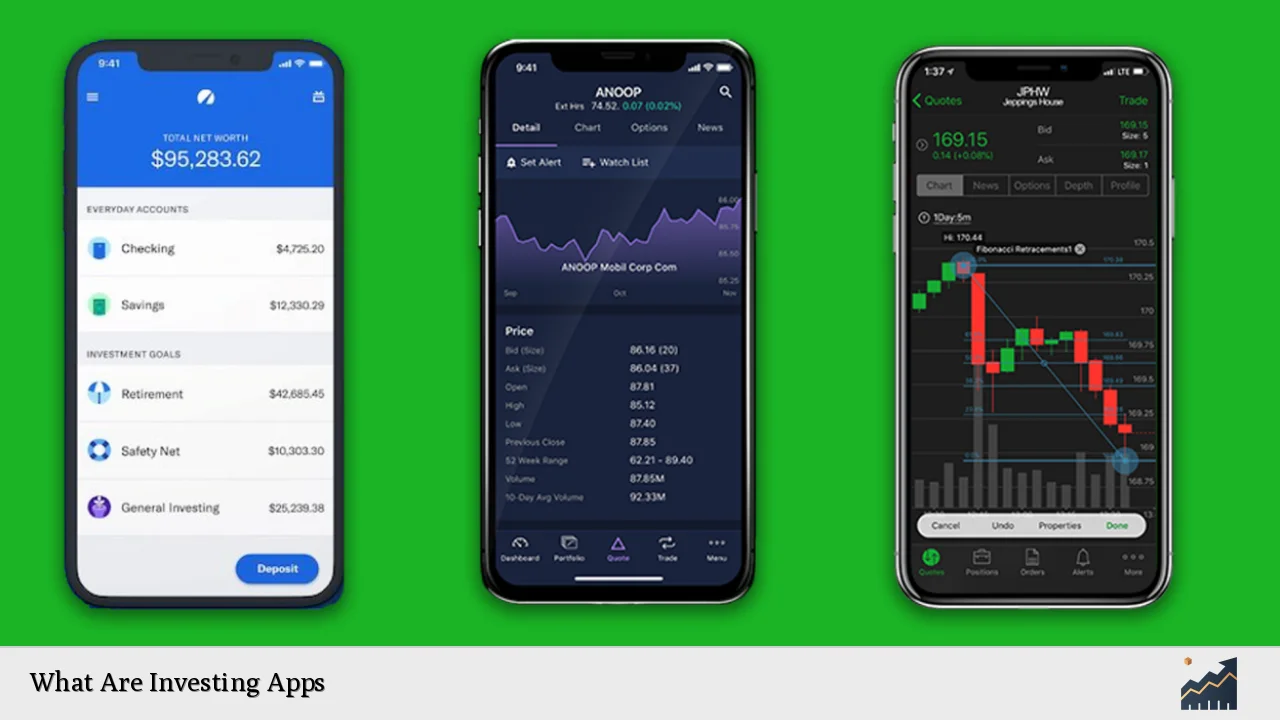

Investing apps are digital platforms that allow users to manage their investments directly from their mobile devices or computers. These applications provide a range of functionalities, including buying and selling stocks, tracking portfolio performance, and accessing market data. They cater to both novice investors looking to start their investment journey and experienced traders seeking advanced tools for market analysis and trading.

Investing apps have gained popularity due to their user-friendly interfaces and the convenience they offer. Users can invest in various assets such as stocks, bonds, cryptocurrencies, and ETFs without needing a traditional brokerage account. Many of these apps also include educational resources, enabling users to make informed decisions about their investments.

| Feature | Description |

|---|---|

| Real-time Market Data | Access to live stock prices and market trends. |

| Portfolio Management | Tools to track and manage investment portfolios. |

| Educational Resources | Articles, videos, and tutorials on investing. |

| Automated Investing | Robo-advisors that manage investments based on user preferences. |

Types of Investing Apps

Investing apps can be categorized into several types based on their features and target audience. Understanding these categories helps users choose the right app for their investment needs.

- Brokerage Apps: These apps allow users to buy and sell securities directly. They typically offer a wide range of investment options, including stocks, bonds, and ETFs. Examples include E*TRADE and Fidelity.

- Robo-Advisors: These platforms use algorithms to create and manage investment portfolios for users based on their risk tolerance and financial goals. They are ideal for beginners who prefer a hands-off approach. Popular robo-advisors include Wealthfront and Betterment.

- Social Trading Apps: These apps enable users to follow and copy the trades of experienced investors. This feature is beneficial for those who want to learn from others while investing. eToro is a well-known example.

- Cryptocurrency Apps: Designed specifically for trading digital currencies, these apps allow users to buy, sell, and store cryptocurrencies like Bitcoin and Ethereum. Coinbase is a leading cryptocurrency app.

- Investment Research Apps: These applications provide tools for analyzing stocks and other investments, offering insights into market trends and company performance. Examples include Seeking Alpha and Morningstar.

Key Features of Investing Apps

Investing apps come equipped with various features designed to enhance the user experience and facilitate effective investing. Here are some essential features:

- User-Friendly Interface: A clean, intuitive design makes it easy for users to navigate the app and access different functionalities.

- Real-Time Data: Access to live market data allows investors to make timely decisions based on current trends.

- Portfolio Tracking: Users can monitor the performance of their investments over time, helping them adjust their strategies as needed.

- Educational Resources: Many apps offer articles, videos, webinars, and tutorials that help users understand investing concepts better.

- Security Features: Robust security measures protect user data and funds, including two-factor authentication (2FA) and encryption technologies.

- Push Notifications: Alerts about significant market changes or personal portfolio updates keep users informed in real-time.

- Customer Support: Access to customer service through chat or phone ensures that users can get help when needed.

Benefits of Using Investing Apps

Investing apps provide numerous advantages that make them appealing to a wide range of investors:

- Accessibility: Users can invest anytime and anywhere using their smartphones or tablets, making it convenient for busy individuals.

- Low Fees: Many investing apps have lower fees compared to traditional brokerages, allowing users to keep more of their profits.

- Fractional Shares: Some apps allow users to purchase fractional shares of stocks, making it easier for those with limited capital to invest in high-value companies.

- Automation: Robo-advisors automate the investment process by managing portfolios based on user-defined criteria, reducing the time spent on manual trading.

- Community Features: Social trading apps foster a sense of community where investors can share insights and strategies with each other.

Choosing the Right Investing App

Selecting the right investing app depends on individual preferences and investment goals. Here are some factors to consider:

- Investment Goals: Determine whether you want active trading or a more passive approach through automated investing.

- Fees: Compare the fee structures of different apps to find one that aligns with your budget. Look for commission-free trading options if possible.

- Available Assets: Ensure the app offers access to the types of investments you are interested in, such as stocks, ETFs, or cryptocurrencies.

- User Experience: Test out the app’s interface through demo accounts if available; a user-friendly experience can significantly enhance your investing journey.

- Educational Resources: If you’re a beginner, look for an app that provides ample educational materials to help you learn about investing strategies.

Common Challenges with Investing Apps

While investing apps offer many benefits, there are also challenges that users may encounter:

- Market Volatility: Rapid changes in market conditions can lead to impulsive decisions if users do not have a solid strategy in place.

- Overtrading: The ease of trading through an app may lead some investors to trade too frequently, resulting in higher transaction costs and potential losses.

- Security Risks: As with any online platform, there is always a risk of cyberattacks or data breaches; thus, choosing an app with strong security measures is crucial.

- Limited Personalization: Some robo-advisors may not offer enough customization options for experienced investors looking for tailored strategies.

FAQs About Investing Apps

- What is an investing app?

An investing app is a mobile platform that allows users to buy, sell, and manage investments directly from their devices. - Are investing apps safe?

Most reputable investing apps implement strong security measures; however, it’s essential to choose one with robust protections. - Can I trade cryptocurrencies on investing apps?

Yes, many investing apps support cryptocurrency trading alongside traditional assets. - Do I need a lot of money to start using an investing app?

No, many apps allow you to start with small amounts or even fractional shares. - What features should I look for in an investing app?

Look for real-time data access, portfolio tracking tools, educational resources, low fees, and strong security features.

Investing apps have revolutionized how individuals approach financial markets by making investment opportunities more accessible than ever before. Whether you’re just starting out or looking for advanced trading tools, there’s likely an app tailored to meet your needs. With careful consideration of features and personal goals, you can leverage these platforms effectively for your financial growth.