Exchange-Traded Funds (ETFs) are investment vehicles that combine features of mutual funds and individual stocks. They offer investors a way to gain exposure to a diversified portfolio of assets through a single security that trades on an exchange like a stock. ETFs typically track an underlying index, such as the S&P 500, but can also focus on specific sectors, commodities, or investment strategies.

ETFs have gained significant popularity among investors due to their flexibility, low costs, and potential tax efficiency. They provide an efficient way to diversify investments across various asset classes, including stocks, bonds, commodities, and even cryptocurrencies. Unlike mutual funds, ETFs can be bought and sold throughout the trading day at market prices, offering greater liquidity and trading flexibility.

| ETF Characteristic | Description |

|---|---|

| Trading | Bought and sold on exchanges like stocks |

| Diversification | Typically track an index or basket of assets |

| Costs | Generally lower expense ratios than mutual funds |

| Liquidity | Can be traded throughout the day |

| Transparency | Holdings usually disclosed daily |

How ETFs Work

ETFs operate by pooling investor money to purchase a basket of securities that typically mirror the composition and performance of a specific index or asset class. The fund is divided into shares that investors can buy and sell on the open market. This structure allows ETFs to provide diversification benefits similar to mutual funds while offering the trading flexibility of individual stocks.

One key feature of ETFs is their creation and redemption process, which involves authorized participants (usually large financial institutions) who can create or redeem large blocks of ETF shares called creation units. This mechanism helps keep the ETF’s market price closely aligned with its underlying net asset value (NAV), minimizing the potential for significant price discrepancies.

Most ETFs are passively managed, meaning they aim to replicate the performance of a specific index rather than trying to outperform it. This approach often results in lower operating expenses compared to actively managed funds. However, there are also actively managed ETFs available, which attempt to beat their benchmark indexes through various investment strategies.

Types of ETFs

ETFs come in various forms, catering to different investment objectives and risk appetites:

- Stock ETFs: Track equity indexes or sectors

- Bond ETFs: Provide exposure to fixed-income securities

- Commodity ETFs: Invest in physical commodities or futures contracts

- Currency ETFs: Track foreign exchange rates

- Sector ETFs: Focus on specific industries or sectors

- Style ETFs: Target specific investment styles (e.g., growth, value)

- Factor ETFs: Emphasize specific investment factors (e.g., momentum, quality)

- Inverse ETFs: Aim to profit from market declines

- Leveraged ETFs: Use derivatives to amplify returns (and risks)

Benefits of Investing in ETFs

ETFs offer several advantages that have contributed to their growing popularity among investors:

1. Diversification: ETFs provide instant diversification by holding a basket of securities, helping to spread risk across multiple investments.

2. Low Costs: Many ETFs have lower expense ratios compared to actively managed mutual funds, potentially leading to better long-term returns.

3. Flexibility: Investors can buy and sell ETF shares throughout the trading day at market prices, unlike mutual funds that trade only once daily.

4. Transparency: Most ETFs disclose their holdings daily, allowing investors to know exactly what they own.

5. Tax Efficiency: Due to their structure and creation/redemption process, ETFs often generate fewer capital gains distributions than mutual funds.

6. Accessibility: ETFs allow investors to gain exposure to a wide range of asset classes, including some that may be difficult to access directly.

7. Ease of Use: ETFs can be bought and sold through most brokerage accounts, making them accessible to both individual and institutional investors.

Potential Drawbacks of ETFs

While ETFs offer numerous benefits, investors should also be aware of potential drawbacks:

1. Trading Costs: Frequent trading of ETFs can incur brokerage commissions, potentially eroding returns.

2. Bid-Ask Spreads: Some ETFs, especially those with lower trading volumes, may have wider bid-ask spreads, increasing the cost of buying and selling.

3. Tracking Error: ETFs may not perfectly replicate the performance of their underlying index due to various factors, including fees and trading costs.

4. Complexity: Some specialized ETFs, such as leveraged or inverse ETFs, can be complex and may not be suitable for all investors.

5. Market Risk: Like all investments, ETFs are subject to market risk and can lose value in declining markets.

How to Invest in ETFs

Investing in ETFs is relatively straightforward and can be done through most brokerage accounts. Here’s a step-by-step guide to getting started:

1. Open a Brokerage Account: Choose a reputable broker that offers a wide selection of ETFs and competitive fees.

2. Research ETFs: Identify ETFs that align with your investment goals, risk tolerance, and asset allocation strategy.

3. Analyze ETF Characteristics: Consider factors such as expense ratio, tracking error, liquidity, and underlying holdings.

4. Place an Order: Decide on the number of shares you want to purchase and place a market or limit order through your brokerage platform.

5. Monitor Your Investment: Regularly review your ETF holdings to ensure they continue to meet your investment objectives.

6. Rebalance as Needed: Periodically adjust your portfolio to maintain your desired asset allocation.

Choosing the Right ETFs

When selecting ETFs for your portfolio, consider the following factors:

- Investment Objective: Ensure the ETF aligns with your financial goals and risk tolerance.

- Expense Ratio: Compare costs among similar ETFs to minimize fees.

- Tracking Error: Look for ETFs that closely track their underlying index.

- Liquidity: Consider trading volume and bid-ask spreads, especially for less popular ETFs.

- Assets Under Management: Larger ETFs may offer better liquidity and lower risk of closure.

- Tax Efficiency: Consider the potential tax implications, especially for taxable accounts.

- Provider Reputation: Choose ETFs from reputable issuers with a track record of good management.

ETFs vs. Other Investment Vehicles

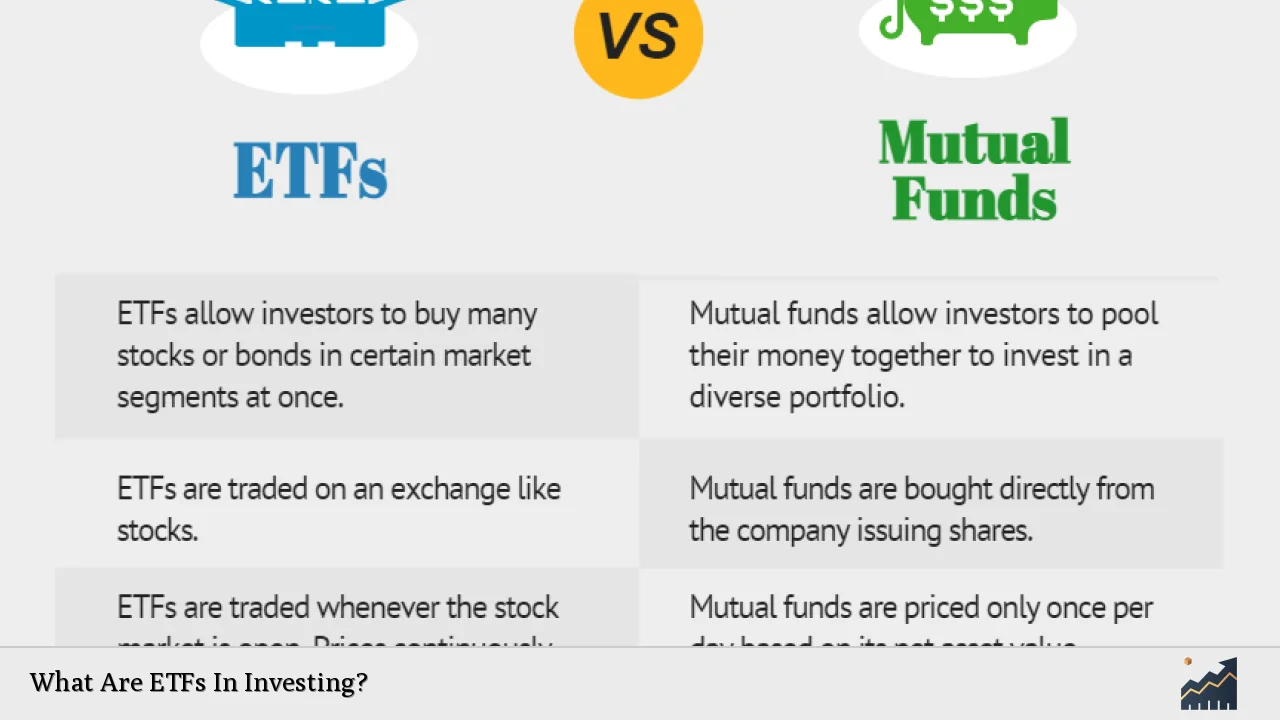

ETFs share similarities with other investment vehicles but also have distinct characteristics:

| Feature | ETFs | Mutual Funds |

|---|---|---|

| Trading | Throughout the day | Once daily |

| Minimum Investment | One share | Often higher |

| Expense Ratios | Generally lower | Often higher |

| Tax Efficiency | Usually more tax-efficient | May generate more capital gains |

| Management Style | Mostly passive | Active and passive options |

Compared to individual stocks, ETFs offer built-in diversification and often lower risk. However, they may not provide the potential for outsized returns that individual stock picking can offer. ETFs also differ from closed-end funds, which have a fixed number of shares and can trade at significant premiums or discounts to their NAV.

FAQs About ETFs In Investing

- Are ETFs suitable for beginner investors?

Yes, ETFs can be excellent for beginners due to their simplicity, diversification, and low costs. - How do ETF dividends work?

ETFs that hold dividend-paying securities typically pass those dividends on to shareholders, either as cash or reinvested shares. - Can I lose all my money in an ETF?

While it’s unlikely to lose all your money, ETFs can decline in value, especially during market downturns. - What’s the difference between ETFs and index funds?

ETFs trade throughout the day on exchanges, while index funds are priced once daily after market close. - How many ETFs should I own in my portfolio?

The number varies based on your goals, but a well-diversified portfolio can often be achieved with just a few broad-market ETFs.