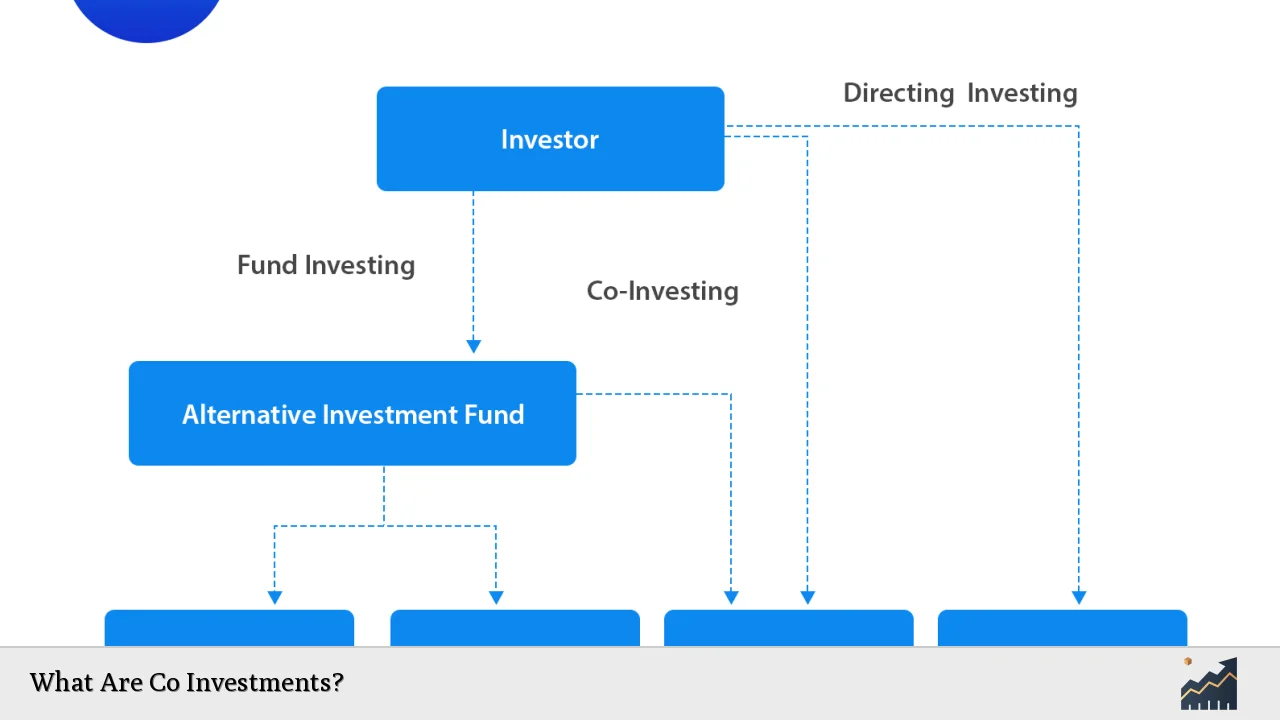

Co-investments are a strategic investment approach where investors, typically limited partners (LPs), invest directly alongside a fund manager in specific deals, rather than through a pooled investment fund. This method allows investors to participate in individual transactions, often with lower fees and greater transparency compared to traditional private equity investments. Co-investments can enhance returns and provide investors with direct access to high-potential companies or projects.

The co-investment structure is particularly prevalent in private equity, where it enables fund managers to raise additional capital for larger investments without over-concentrating their existing funds. Investors who engage in co-investments generally receive more detailed insights into the underlying investments, allowing for better-informed decision-making. This arrangement not only benefits the investors by potentially increasing their returns but also aids fund managers in executing larger deals without diluting their capital.

| Aspect | Description |

|---|---|

| Definition | Direct investment alongside a fund manager in a specific deal. |

| Typical Structure | Minority stakes in private equity or real estate. |

| Benefits | Lower fees, higher transparency, and potential for improved returns. |

| Risks | Less diversification compared to traditional funds. |

Understanding Co-Investments

Co-investments primarily arise when general partners (GPs) invite select LPs to invest alongside them in specific deals. This opportunity often comes after a GP has identified an attractive investment but requires additional capital beyond what is available in the main fund. By allowing LPs to co-invest, GPs can secure the necessary funding while providing their investors with exclusive access to promising opportunities.

The co-investment process generally involves several steps:

- Invitation: GPs extend invitations to select LPs based on prior interest or established relationships.

- Evaluation: Interested LPs review the investment details and conduct due diligence.

- Commitment: After evaluating the opportunity, LPs commit capital to the deal.

- Execution: The investment is executed, with LPs participating alongside the GP.

This collaborative approach enables both parties to share risks and rewards while maintaining a level of control over individual investments.

Benefits of Co-Investments

Co-investments offer numerous advantages that can enhance an investor’s portfolio and overall investment strategy:

- Lower Fees: Since co-investments are often structured outside a traditional fund, they typically incur lower management fees and carried interest costs.

- Increased Transparency: Investors gain direct insight into specific companies or projects they are investing in, allowing for more informed decision-making.

- Improved Returns: Many studies indicate that co-investments can outperform traditional private equity funds due to reduced fees and targeted investment strategies.

- Enhanced Control: Investors have greater control over their capital allocation and can choose investments that align closely with their objectives.

These benefits make co-investments an attractive option for sophisticated investors looking to maximize their returns while maintaining a degree of involvement in their investments.

Risks and Considerations

While co-investments present many opportunities, they also come with inherent risks that investors must consider:

- Limited Diversification: Co-investors may concentrate their capital in fewer deals compared to diversified funds, increasing exposure to specific risks associated with those investments.

- Resource Intensive: Conducting thorough due diligence on potential co-investment opportunities requires significant time and expertise. Investors may need dedicated teams to manage this process effectively.

- Dependency on GPs: The success of co-investments often hinges on the capabilities of the GP managing the deal. Poor decision-making or execution by the GP can adversely affect returns for co-investors.

Understanding these risks is crucial for investors considering co-investment opportunities as part of their overall strategy.

Types of Co-Investment Structures

Co-investments can be structured in various ways depending on the preferences of the investors and the nature of the deals:

- Direct Co-Investment: Investors participate directly alongside GPs in specific transactions, often negotiating terms that align with their interests.

- Sidecar Funds: These are separate funds created specifically for co-investing alongside a primary fund, allowing investors to pool resources for larger investments while still retaining some control over individual allocations.

- Separately Managed Accounts (SMAs): Some investors opt for SMAs where they work with a manager who sources and executes co-investment opportunities tailored to their specific objectives.

Each structure has its own set of advantages and disadvantages, making it essential for investors to choose one that aligns with their investment strategy and risk tolerance.

The Role of Limited Partners

Limited partners play a critical role in the co-investment landscape. They are typically institutional investors such as pension funds, endowments, or family offices that seek higher returns through direct participation in deals. Their involvement can provide several benefits:

- Access to Exclusive Deals: Many GPs offer co-investment opportunities only to select LPs, giving them access to high-potential investments that may not be available through traditional funds.

- Strengthened Relationships: Engaging in co-investments can enhance relationships between LPs and GPs, leading to better communication and collaboration on future opportunities.

- Performance Insights: By participating directly in deals, LPs can gain valuable insights into the operational capabilities of GPs, helping them make more informed decisions about future commitments.

Overall, LPs benefit from enhanced engagement and potential returns by actively participating in co-investment opportunities.

Evaluating Co-Investment Opportunities

Investors must approach co-investment opportunities with careful evaluation and due diligence. Here are key considerations:

- Investment Thesis: Understand the rationale behind the investment and how it fits within broader market trends or sector dynamics.

- GP Track Record: Assess the historical performance of the GP managing the deal. A strong track record can indicate better chances of success.

- Deal Structure: Analyze the terms of the investment, including fees, exit rights, and any potential conflicts of interest.

By conducting thorough evaluations, investors can mitigate risks associated with co-investing while maximizing their potential for returns.

FAQs About Co Investments

- What is a co-investment?

A co-investment is a direct investment made by an investor alongside a fund manager in a specific deal. - How do co-investments differ from traditional private equity funds?

Co-investments allow investors direct access to individual deals with lower fees compared to traditional pooled funds. - What are the main benefits of participating in co-investments?

Benefits include lower fees, increased transparency, improved returns, and greater control over capital allocation. - What risks should investors consider with co-investments?

Risks include limited diversification, resource intensity for due diligence, and dependency on GP performance. - How can I evaluate potential co-investment opportunities?

Investors should assess the investment thesis, GP track record, and deal structure before committing capital.

Co-investments represent a compelling opportunity for sophisticated investors seeking higher returns and greater involvement in their investment strategies. By understanding their structure, benefits, risks, and evaluation methods, investors can effectively navigate this dynamic landscape.