Bonds are a type of debt instrument used by governments, municipalities, and corporations to raise capital. When you purchase a bond, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity. This makes bonds a popular choice for investors seeking a reliable income stream and capital preservation.

Understanding how bonds work is crucial for making informed investment decisions. Bonds typically pay fixed interest at regular intervals, known as coupon payments, until they mature. At maturity, the issuer repays the principal amount. The predictable nature of bond payments can provide a sense of security for investors compared to more volatile investments like stocks.

Bonds come in various forms, each with unique characteristics and risks. They can be classified into several categories, including government bonds, municipal bonds, and corporate bonds. Each type has its own risk profile and potential returns, making it essential for investors to align their bond choices with their financial goals.

| Bond Type | Description |

|---|---|

| Government Bonds | Issued by national governments; considered low-risk. |

| Municipal Bonds | Issued by states or local governments; often tax-exempt. |

| Corporate Bonds | Issued by companies; higher risk but potentially higher returns. |

How Do Bonds Work?

Bonds operate on a simple premise: when you buy a bond, you are lending money to the issuer. The issuer agrees to pay you interest at specified intervals until the bond matures, at which point they repay the principal amount.

For example, if you purchase a 10-year government bond with a face value of $10,000 and an annual interest rate of 4%, you will receive $400 each year (or $200 semiannually) until maturity. At the end of the ten years, the government will repay your initial investment of $10,000.

The interest payments received from bonds are known as coupon payments, which can be paid annually, semiannually, or even monthly depending on the bond’s terms. The coupon rate is expressed as a percentage of the bond’s face value and determines how much interest you will earn.

Bonds can be traded in secondary markets after their initial issuance. This means that investors can buy or sell bonds before they mature. The price of bonds fluctuates based on market conditions, particularly interest rates. When interest rates rise, existing bonds with lower rates become less attractive, causing their prices to drop. Conversely, when interest rates fall, existing bonds may rise in value because they offer higher returns compared to new issues.

Types of Bonds

There are several types of bonds available to investors:

- Government Bonds: Issued by national governments and considered low-risk investments due to their backing by the government.

- Municipal Bonds: Issued by states or local municipalities to fund public projects; these often come with tax advantages.

- Corporate Bonds: Issued by companies to raise capital for various purposes; these carry higher risks but offer potentially higher returns.

- Zero-Coupon Bonds: Sold at a discount and do not pay periodic interest; instead, they pay the full face value at maturity.

- Convertible Bonds: Can be converted into a predetermined number of shares of the issuing company’s stock.

Each type serves different investment strategies and risk tolerances.

Benefits of Investing in Bonds

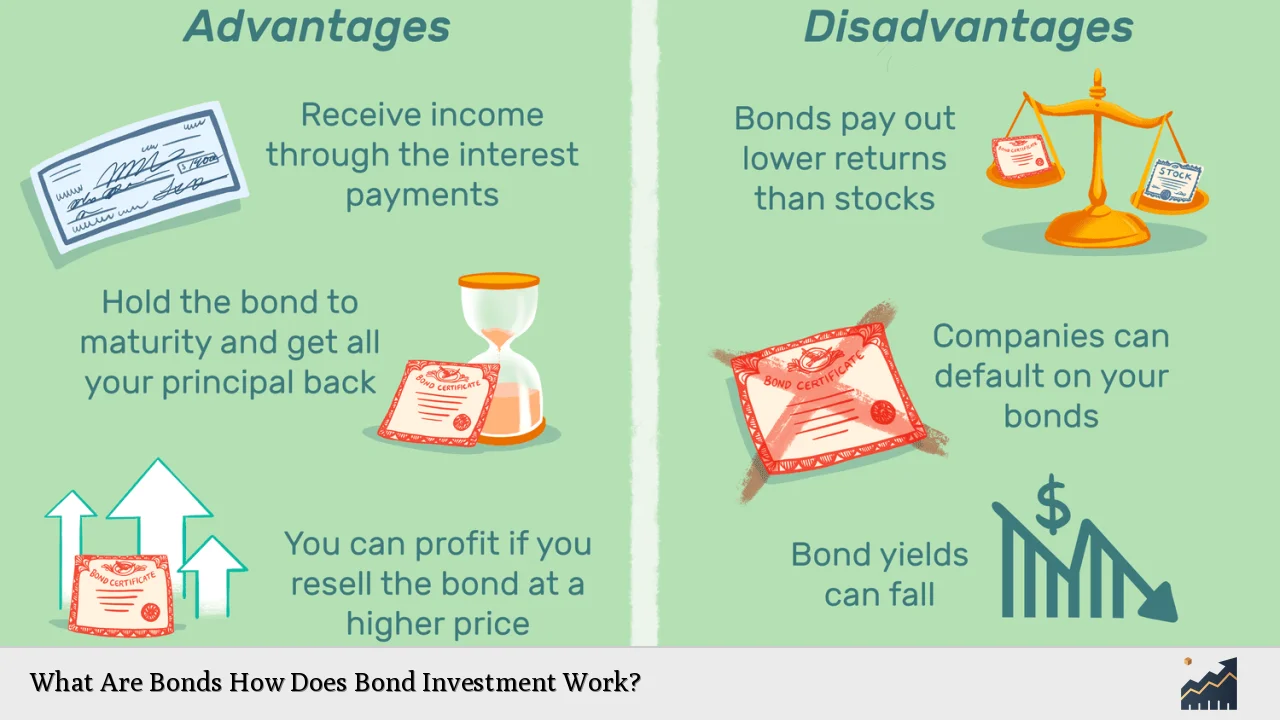

Investing in bonds offers several advantages:

- Predictable Income: Bonds provide regular interest payments that can help ensure steady cash flow.

- Capital Preservation: If held to maturity, bonds return the full principal amount, making them less risky than stocks.

- Diversification: Including bonds in an investment portfolio can help reduce overall risk since they often behave differently than stocks.

- Tax Benefits: Certain types of bonds, like municipal bonds, may offer tax-exempt interest income.

These benefits make bonds an appealing option for conservative investors or those nearing retirement who prioritize income stability over aggressive growth.

Risks Associated with Bond Investments

While bonds are generally considered safer than stocks, they are not without risks:

- Interest Rate Risk: When interest rates rise, bond prices typically fall. This can lead to losses if an investor sells before maturity.

- Credit Risk: The risk that the issuer may default on its payments. Corporate bonds carry higher credit risks than government bonds.

- Inflation Risk: If inflation rises significantly, it can erode the purchasing power of fixed coupon payments received from bonds.

Understanding these risks is crucial for managing a bond portfolio effectively and aligning it with your investment goals.

How to Invest in Bonds

Investing in bonds involves several steps:

1. Determine Your Investment Goals: Assess your financial objectives and risk tolerance before investing in bonds.

2. Choose Bond Types: Select from government, municipal, or corporate bonds based on your investment strategy.

3. Research Issuers and Ratings: Investigate potential issuers’ credit ratings through agencies like Moody’s or Standard & Poor’s to gauge their creditworthiness.

4. Consider Maturity Dates: Understand when each bond matures and how that fits into your financial timeline.

5. Monitor Interest Rates: Keep an eye on prevailing interest rates as they directly impact bond prices and yields.

6. Diversify Your Portfolio: Spread investments across different types and maturities of bonds to mitigate risks.

By following these steps, you can build a well-rounded bond portfolio that aligns with your financial goals while managing associated risks effectively.

Managing Bond Investments

Once you’ve invested in bonds, effective management is crucial:

- Regularly Review Your Portfolio: Keep track of your investments’ performance and make adjustments as needed based on changes in market conditions or personal financial situations.

- Understand Duration: Duration measures a bond’s sensitivity to changes in interest rates; knowing this helps manage interest rate risk effectively.

- Reinvest Interest Payments: Consider reinvesting coupon payments into new bond purchases or other investments to maximize returns over time.

- Stay Informed About Economic Conditions: Economic indicators can influence interest rates; staying informed helps anticipate changes that may affect your bond investments.

Through diligent management and monitoring, investors can optimize their bond portfolios for better performance over time.

FAQs About Bonds

- What is a bond?

A bond is essentially a loan made by an investor to an issuer who promises to pay back the principal along with periodic interest. - How do I earn money from bonds?

You earn money through regular coupon payments until maturity when you receive back your initial investment. - What types of risks do bonds have?

Bonds carry risks such as interest rate risk, credit risk, and inflation risk that can affect their value. - Can I sell my bonds before they mature?

Yes, most bonds can be sold on secondary markets before maturity; however, prices may fluctuate based on current market conditions. - Are all bonds safe investments?

No investment is entirely safe; while government bonds are generally low-risk, corporate bonds carry higher risks depending on the issuer’s creditworthiness.

By understanding what bonds are and how they work within the broader financial landscape, investors can make informed decisions that align with their financial goals while effectively managing associated risks.