Intel Corporation, a cornerstone of the semiconductor industry, has faced significant challenges in recent years, including fierce competition and technological setbacks. However, the company’s potential for recovery and growth has sparked interest among investors. This comprehensive analysis will explore Intel’s current market position, financial health, strategic initiatives, and future outlook to help investors make informed decisions.

| Key Concept | Description/Impact |

|---|---|

| Market Position | Intel remains a dominant player in the semiconductor industry, particularly in CPUs for personal computers and data centers. |

| Financial Performance | Recent financial results show a significant net loss but also indicate operational cash flow generation and ongoing dividend payments. |

| Strategic Initiatives | The company is investing heavily in advanced chip manufacturing and AI technology to regain competitive advantage. |

| Market Trends | The semiconductor sector is expected to grow, driven by demand for AI, cloud computing, and 5G technologies. |

| Risks | Execution risks remain high due to competitive pressures from AMD and NVIDIA, along with challenges in chip manufacturing. |

| Regulatory Environment | Intel must navigate complex regulatory landscapes as it expands its operations globally. |

| Future Outlook | Analysts predict potential price recovery based on strategic execution and market demand shifts. |

Market Analysis and Trends

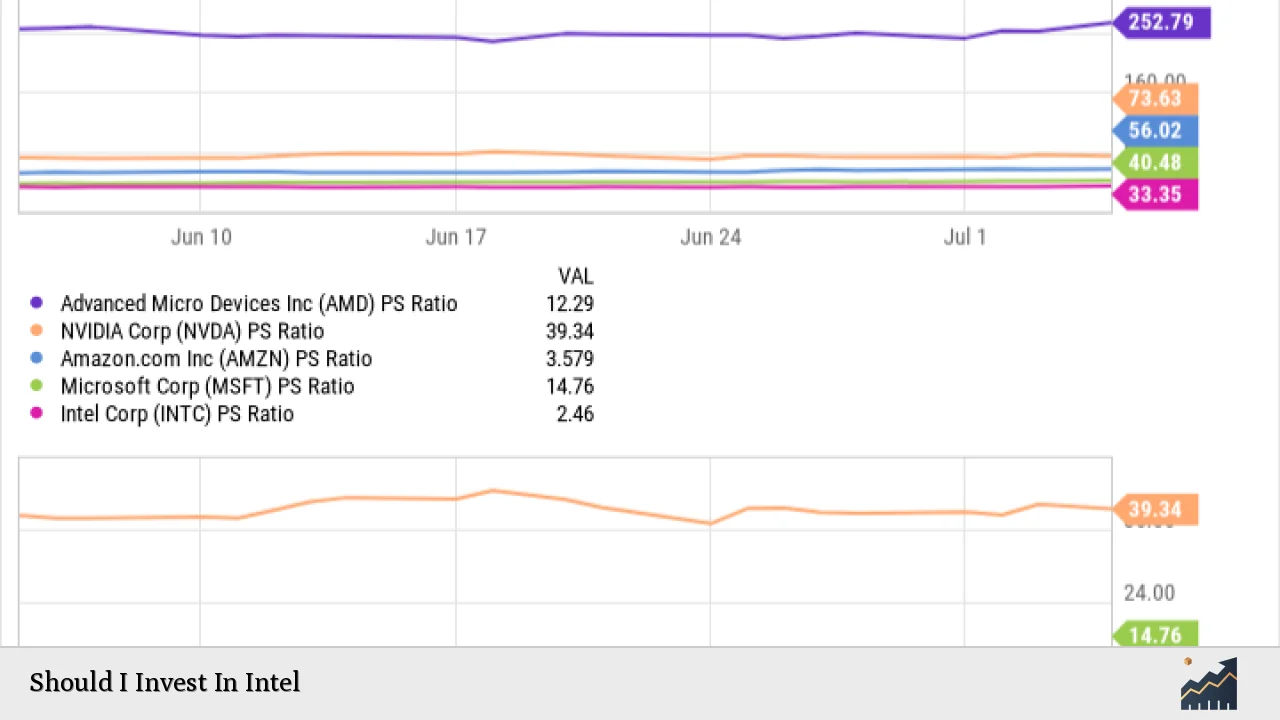

Intel’s market position is currently under scrutiny as it grapples with intense competition from Advanced Micro Devices (AMD) and NVIDIA. Historically, Intel has dominated the CPU market for personal computers and servers; however, recent years have seen a decline in its market share due to slower technological advancements compared to its competitors. As of late 2024, Intel’s stock price stands at approximately $20.83, reflecting a substantial decline from previous highs.

Current Market Dynamics

The semiconductor industry is experiencing robust growth driven by several factors:

- AI Integration: The rise of artificial intelligence technologies is creating new demands for advanced chips capable of handling complex computations.

- Cloud Computing: Increased reliance on cloud services necessitates powerful data center processors.

- 5G Expansion: The rollout of 5G networks is generating demand for enhanced processing capabilities.

Despite these growth drivers, Intel faces significant headwinds. Analysts note that while the company has plans to regain its competitive edge through strategic investments—such as a $20 billion commitment to new manufacturing facilities—execution risks remain high. The company’s recent financial performance reflects these challenges; in Q3 2024, Intel reported a net loss of $16.6 billion.

Implementation Strategies

Investors considering Intel should evaluate several key strategies the company is implementing:

- Cost Reduction Initiatives: Intel aims to achieve $10 billion in cost savings by 2025 through operational efficiencies and workforce reductions.

- Technological Advancements: The introduction of new manufacturing nodes (14A) is part of Intel’s roadmap to regain leadership in chip technology.

- Market Diversification: Expanding into AI accelerators and private 5G markets could open new revenue streams.

Investment Considerations

Investors should assess whether these strategies can effectively mitigate risks associated with declining market share and technological lagging. The potential for recovery hinges on successful execution of these initiatives.

Risk Considerations

Investing in Intel carries several risks that potential investors should be aware of:

- Execution Risks: The company’s ambitious turnaround plan may face delays or challenges that could impact profitability.

- Competitive Pressures: AMD and NVIDIA continue to outperform Intel in key segments, particularly in AI and high-performance computing.

- Market Volatility: The semiconductor sector is subject to cyclical fluctuations that can affect stock performance.

Financial Health

As of Q3 2024, Intel’s financial health shows signs of strain with significant losses reported; however, the company continues to generate cash flow from operations. This indicates some resilience despite facing operational challenges. Investors should closely monitor quarterly earnings reports for signs of improvement.

Regulatory Aspects

Intel operates within a complex regulatory environment that affects its global operations. Compliance with international trade regulations, environmental standards, and labor laws is crucial as the company expands its manufacturing capabilities. Investors should consider how regulatory changes could impact Intel’s operational costs and market access.

Future Outlook

Looking ahead, analysts are cautiously optimistic about Intel’s potential for recovery:

- Analyst Predictions: Forecasts suggest that if Intel successfully executes its strategic initiatives, stock prices could rebound to between $30 and $42 by 2025.

- Market Demand: The ongoing demand for semiconductors driven by emerging technologies positions Intel favorably if it can innovate effectively.

Conclusion

In summary, investing in Intel presents both opportunities and risks. While the company has a storied history as a leader in the semiconductor space, recent performance indicates significant challenges ahead. Investors must weigh the potential for recovery against execution risks and competitive pressures. A diversified approach that considers both short-term volatility and long-term growth prospects may be prudent.

Frequently Asked Questions About Should I Invest In Intel

- What are the main risks associated with investing in Intel?

The primary risks include execution challenges related to their turnaround strategy, competitive pressures from AMD and NVIDIA, and market volatility inherent in the semiconductor sector. - How has Intel performed financially recently?

Intel reported a net loss of $16.6 billion in Q3 2024 but generated $4.1 billion in cash from operations during the same period. - What strategies is Intel implementing to regain market share?

Intel is focusing on cost reduction initiatives, technological advancements through new manufacturing nodes, and expanding into AI markets. - Is now a good time to invest in Intel?

This depends on individual risk tolerance; while there are signs of potential recovery, significant risks remain due to competition and execution challenges. - What are analysts saying about Intel’s future stock price?

Analysts project that if Intel successfully executes its plans, stock prices could rise significantly over the next few years. - How does Intel’s dividend policy impact investment decisions?

Intel has a history of dividend payments which may appeal to income-focused investors; however, recent cuts indicate caution moving forward. - What role does regulatory compliance play in Intel’s operations?

Compliance with international regulations is crucial as it affects operational costs and market access across different regions. - Can Intel compete effectively against AMD and NVIDIA?

If Intel successfully implements its strategic initiatives and innovates effectively, it may regain competitive ground against AMD and NVIDIA.

Investors should conduct thorough research or consult financial advisors before making investment decisions regarding Intel Corporation.