Investing in equities, or stocks, presents a unique set of opportunities and challenges. While equities can offer substantial returns, they also come with significant risks that investors must understand and manage. The value of stocks can fluctuate dramatically due to various factors, including market conditions, company performance, and broader economic indicators. This volatility can lead to potential losses, making it crucial for investors to be aware of the risks associated with equity investments.

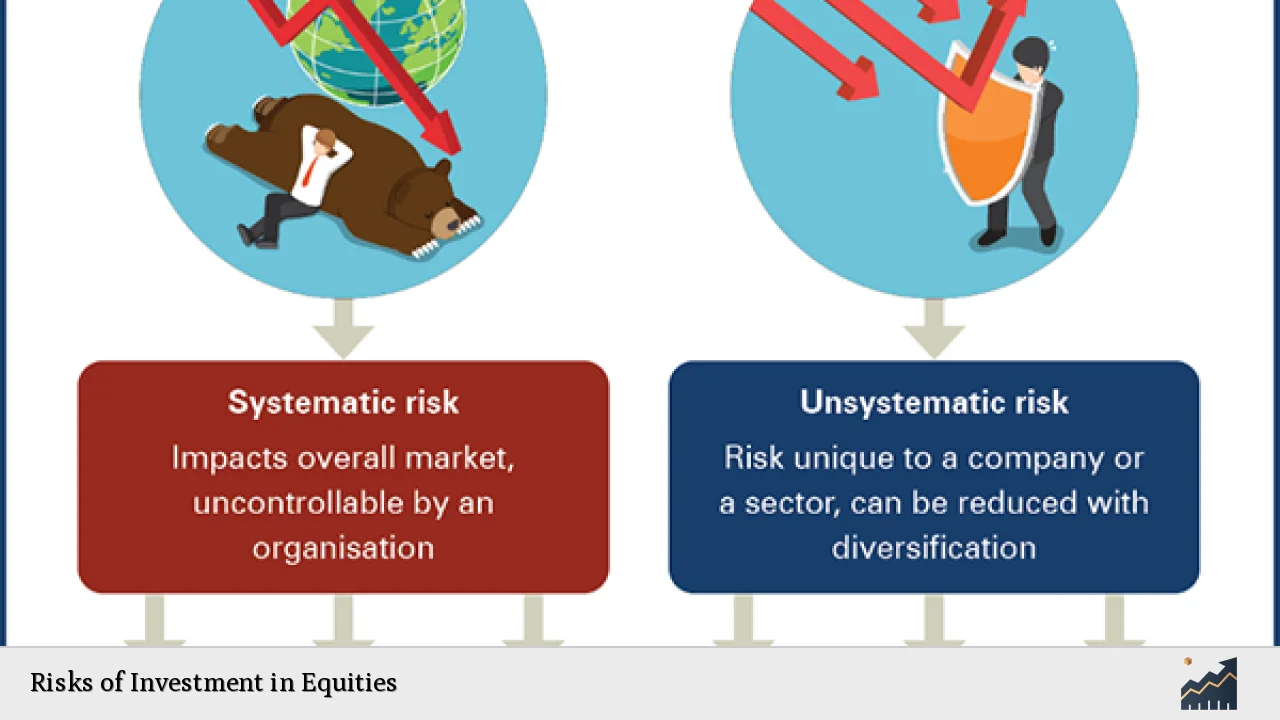

Equity risk is primarily linked to the possibility of losing money due to a decline in stock prices. Investors may face market risk, which is the risk that the overall market will decline, affecting the value of individual stocks. Additionally, there are other risks such as liquidity risk, credit risk, and regulatory risk that can impact equity investments. Understanding these risks is essential for making informed investment decisions and developing effective strategies to mitigate them.

| Type of Risk | Description |

|---|---|

| Market Risk | Risk of loss due to overall market declines. |

| Liquidity Risk | Difficulty in selling shares without affecting their price. |

| Credit Risk | Risk that a company may default on its obligations. |

| Regulatory Risk | Impact of changes in laws and regulations on stock performance. |

Understanding Market Risk

Market risk is one of the most significant risks associated with equity investments. It refers to the potential for an investor to experience losses due to factors that affect the entire market or a specific sector. These factors can include economic downturns, political instability, or changes in interest rates.

When the market declines, it often leads to a decrease in stock prices across the board. This decline can be sudden and unpredictable, making it challenging for investors to react effectively. For instance, during economic recessions, consumer spending typically decreases, leading to lower revenues for companies and consequently lower stock prices.

Investors can manage market risk through diversification—spreading investments across various sectors and asset classes to reduce exposure to any single investment’s poor performance. However, it is essential to note that while diversification can mitigate risks, it cannot eliminate them entirely.

Performance Risk

Performance risk relates specifically to the individual companies in which investors choose to invest. Even in a favorable market environment, specific companies may fail to meet performance expectations due to poor management decisions, competitive pressures, or operational challenges.

For example, if a company fails to innovate or adapt to changing market conditions, its stock price may suffer regardless of overall market trends. This risk is particularly pronounced in industries characterized by rapid technological change or intense competition.

Investors should conduct thorough research before investing in any company. Analyzing financial statements, understanding industry trends, and evaluating management effectiveness are crucial steps in assessing performance risk.

Liquidity Risk

Liquidity risk is the possibility that an investor may not be able to sell their shares quickly without incurring a significant loss in value. This situation often arises with stocks that have low trading volumes or are part of niche markets.

In times of market stress or economic downturns, liquidity can dry up quickly. Investors may find themselves unable to sell their shares at desired prices or at all. This risk emphasizes the importance of investing in liquid assets—those that can be easily bought or sold without significantly impacting their price.

To mitigate liquidity risk, investors should consider investing in larger companies with higher trading volumes or exchange-traded funds (ETFs) that offer greater liquidity compared to individual stocks.

Credit Risk

Credit risk refers to the potential for loss when a company defaults on its debt obligations. If a company faces financial difficulties and cannot meet its debt payments, its stock price may plummet as investors lose confidence in its ability to generate profits.

This type of risk is particularly relevant for companies with high levels of debt relative to their earnings. Investors should assess a company’s creditworthiness by reviewing its credit ratings and financial health before investing.

To minimize credit risk exposure, investors might diversify their portfolios by including stocks from various sectors and industries with varying levels of debt.

Regulatory Risk

Regulatory risk involves the potential for changes in laws or regulations that could negatively impact a company’s operations or profitability. This type of risk can arise from new legislation affecting taxation, environmental regulations, labor laws, or trade policies.

For instance, if new regulations significantly increase compliance costs for a specific industry, companies within that sector may see their profit margins shrink. Investors should stay informed about regulatory changes that could affect their investments and consider these factors when making investment decisions.

Economic Concentration Risk

Economic concentration risk occurs when an investor’s portfolio is heavily weighted toward a single industry or sector. If that sector experiences a downturn—due to factors like changing consumer preferences or technological advancements—the investor’s portfolio could suffer significant losses.

To mitigate this risk, investors should aim for a diversified portfolio that includes stocks from various sectors. This approach helps ensure that poor performance in one area does not disproportionately impact overall portfolio performance.

Inflation Risk

Inflation risk refers to the possibility that rising inflation will erode the purchasing power of returns from equity investments. If inflation rises significantly while stock returns remain stagnant or decline, investors may find their real returns diminished.

Investors can hedge against inflation by including assets like commodities or real estate in their portfolios alongside equities. These assets often perform better during periods of rising inflation compared to traditional stocks.

Volatility Risk

Volatility risk is associated with the fluctuations in stock prices over time. Stocks are inherently volatile investments; they can experience sharp price swings based on news events or changes in investor sentiment.

High volatility can lead to substantial gains but also significant losses within short periods. Investors who are uncomfortable with this level of uncertainty might consider more stable investments like bonds or dividend-paying stocks.

Strategies for Mitigating Equity Investment Risks

Investors can employ several strategies to mitigate risks associated with equity investments:

- Diversify your portfolio across different sectors and asset classes.

- Invest for the long term rather than attempting short-term trades.

- Stay informed about market trends and economic indicators.

- Avoid making impulsive decisions based on short-term market movements.

- Regularly review and adjust your investment strategy based on performance and changing market conditions.

These strategies help create a balanced approach toward equity investing while minimizing potential risks.

FAQs About Risks of Investment in Equities

- What is equity risk?

Equity risk refers to the financial risk involved in holding stocks due to fluctuations in share prices. - How can I manage liquidity risk?

You can manage liquidity risk by investing in larger companies with higher trading volumes. - What is market risk?

Market risk is the possibility of losing money due to overall declines in the stock market. - What role does diversification play?

Diversification helps spread investment risks across various sectors and asset classes. - Why is regulatory risk important?

Regulatory risk is important because changes in laws can significantly impact a company’s profitability.

In conclusion, while investing in equities offers opportunities for substantial returns, it also carries inherent risks that must be carefully considered. By understanding these risks—market risk, performance risk, liquidity risk, credit risk, regulatory risk—and implementing effective strategies for mitigation, investors can navigate the complexities of equity investing more successfully.