Reinvested distributions are a financial strategy where income generated from an investment is automatically used to purchase additional shares or units of the same investment, rather than being paid out in cash. This approach is commonly used with various investment vehicles, including stocks, mutual funds, exchange-traded funds (ETFs), and real estate investment trusts (REITs). The primary goal of reinvesting distributions is to harness the power of compound growth, potentially leading to increased returns over time.

When an investor opts for reinvested distributions, they are essentially choosing to forego immediate cash payouts in favor of growing their investment position. This method can be particularly beneficial for long-term investors who don't require immediate income from their investments and are focused on building wealth over time. By reinvesting distributions, investors can accumulate more shares or units of the investment, which may lead to larger future distributions and potential capital appreciation.

| Aspect | Description |

|---|---|

| Definition | Automatic reinvestment of investment income into additional shares/units |

| Common Types | Dividends, interest, capital gains |

| Primary Benefit | Compound growth potential |

| Typical Investments | Stocks, mutual funds, ETFs, REITs |

How Reinvested Distributions Work

The mechanics of reinvested distributions are relatively straightforward. When an investment generates income, such as dividends from stocks or interest from bonds, instead of receiving this income as cash, it is automatically used to purchase additional shares or units of the same investment. This process typically occurs without any action required from the investor, as long as they have opted into a reinvestment plan.

For stocks, this process is often facilitated through Dividend Reinvestment Plans (DRIPs). Many companies offer DRIPs, allowing shareholders to reinvest their dividends directly into additional shares of the company's stock, often at a discount to the current market price and without paying brokerage fees. This can be an efficient way for investors to gradually increase their stake in a company over time.

In the case of mutual funds and ETFs, reinvested distributions work similarly. When the fund makes a distribution, whether it's from dividends, interest, or capital gains realized within the fund, investors can choose to have these distributions automatically reinvested into additional shares of the fund. This is often the default option for many fund investments unless the investor specifically opts for cash distributions.

Benefits of Reinvested Distributions

- Compound Growth: By reinvesting distributions, investors can take advantage of compound growth. As more shares are acquired, subsequent distributions may be larger, potentially leading to accelerated growth over time.

- Dollar-Cost Averaging: Regular reinvestment of distributions can result in buying more shares when prices are low and fewer when prices are high, potentially reducing the average cost per share over time.

- Convenience: Reinvestment plans are typically automated, requiring no action from the investor once set up.

- Reduced Transaction Costs: Many reinvestment plans, especially DRIPs, offer reduced or eliminated transaction fees for reinvested shares.

- Fractional Shares: Reinvestment often allows for the purchase of fractional shares, enabling investors to fully reinvest their distributions regardless of the share price.

Types of Reinvested Distributions

Reinvested distributions can come in various forms, depending on the type of investment and the income it generates. Understanding these different types can help investors make informed decisions about their reinvestment strategies.

Dividend Reinvestment

Dividend reinvestment is perhaps the most well-known form of reinvested distributions. It involves using cash dividends paid by a company to purchase additional shares of that company's stock. This can be done through a DRIP offered by the company itself or through a brokerage that provides automatic dividend reinvestment services.

Dividend reinvestment is particularly popular with blue-chip stocks and other dividend-paying equities. It allows investors to steadily increase their position in a company without committing additional capital beyond their initial investment.

Interest Reinvestment

Interest reinvestment typically applies to fixed-income investments such as bonds or bond funds. When interest payments are made, instead of receiving them as cash, investors can choose to reinvest this income into additional bonds or bond fund shares. This strategy can be especially effective in a rising interest rate environment, as it allows investors to potentially benefit from higher yields over time.

Capital Gains Reinvestment

Capital gains reinvestment is common with mutual funds and ETFs. When a fund realizes capital gains from selling securities within its portfolio, it must distribute these gains to shareholders. Investors can choose to reinvest these capital gains distributions back into the fund, acquiring additional shares.

Reinvestment Strategies

Developing an effective reinvestment strategy requires careful consideration of an investor's financial goals, risk tolerance, and overall investment portfolio. Here are some key strategies to consider:

- Full Reinvestment: This involves reinvesting all distributions back into the investment. It's often favored by investors focused on long-term growth who don't need immediate income from their investments.

- Partial Reinvestment: Some investors choose to reinvest a portion of their distributions while taking the rest as cash. This can provide a balance between growth and income.

- Selective Reinvestment: Investors may choose to reinvest distributions from certain investments while taking cash from others, based on their assessment of each investment's growth potential.

- Cross-Investment Reinvestment: Some brokerages allow investors to reinvest distributions from one investment into a different security, providing flexibility in portfolio management.

Considerations for Reinvestment

When implementing a reinvestment strategy, investors should consider several factors:

- Tax Implications: Reinvested distributions are typically still taxable in the year they are received, even if not taken as cash. This can create a tax liability without providing immediate cash flow.

- Portfolio Rebalancing: Consistent reinvestment in a single security or fund can potentially skew portfolio allocations over time. Regular portfolio reviews and rebalancing may be necessary.

- Investment Goals: Reinvestment strategies should align with overall investment objectives, whether they're focused on growth, income, or a combination of both.

- Market Conditions: In some cases, it may be more advantageous to take distributions in cash and reinvest them strategically based on market conditions or opportunities in other investments.

Impact of Reinvested Distributions on Investment Performance

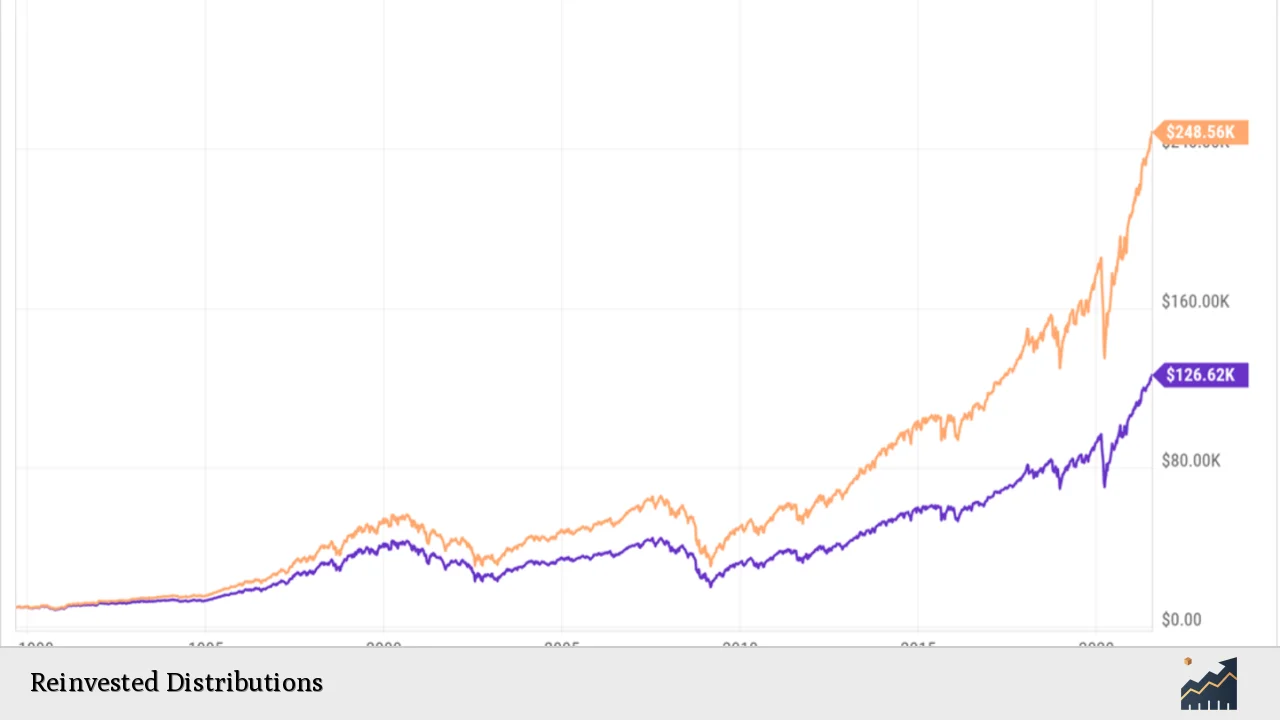

Reinvested distributions can have a significant impact on long-term investment performance, primarily through the power of compounding. By continually reinvesting income back into an investment, investors can potentially accelerate growth over time.

For example, consider two investors who each invest $10,000 in a stock that pays a 3% annual dividend and grows at 5% per year. Investor A reinvests all dividends, while Investor B takes the dividends as cash. After 20 years, assuming consistent growth and dividend rates:

| Investor | Final Investment Value |

|---|---|

| Investor A (Reinvesting) | $43,219 |

| Investor B (Not Reinvesting) | $26,533 |

This simplified example illustrates the potential long-term benefit of reinvesting distributions. However, it's important to note that actual investment performance can vary significantly based on market conditions, changes in dividend policies, and other factors.

Measuring Performance with Reinvested Distributions

When evaluating investment performance, it's crucial to consider whether distributions are being reinvested. Many performance metrics, such as total return, assume that all distributions are reinvested. This can provide a more accurate picture of an investment's true performance over time.

Investors should be aware of whether performance figures they're reviewing include reinvested distributions. For instance, a stock's price chart alone doesn't reflect the impact of reinvested dividends, which can significantly affect total returns over long periods.

Risks and Limitations of Reinvested Distributions

While reinvesting distributions can be a powerful strategy for long-term wealth accumulation, it's not without risks and limitations:

- Market Risk: Reinvesting in a declining market means buying more shares at lower prices, which can amplify losses in the short term.

- Overconcentration: Consistently reinvesting in a single security or fund can lead to an overconcentration in that investment, potentially increasing portfolio risk.

- Tax Considerations: As mentioned earlier, reinvested distributions are typically still taxable, which can create a tax liability without providing cash flow to cover it.

- Opportunity Cost: By automatically reinvesting, investors may miss opportunities to invest in other potentially more attractive investments.

- Fees: Some reinvestment plans may involve fees, which can erode returns over time, especially for smaller investments.

Conclusion

Reinvested distributions can be a powerful tool for long-term investors looking to harness the power of compound growth. By automatically reinvesting income back into an investment, investors can potentially accelerate their wealth accumulation over time. However, like any investment strategy, it's important to carefully consider how reinvestment fits into your overall financial plan, taking into account factors such as tax implications, portfolio diversification, and individual financial goals.

Ultimately, the decision to reinvest distributions should be based on a thorough understanding of the strategy's benefits and limitations, as well as how it aligns with your personal investment objectives. As with any significant financial decision, consulting with a qualified financial advisor can help ensure that your reinvestment strategy is optimized for your unique circumstances.

FAQs About Reinvested Distributions

- Are reinvested distributions taxable?

Yes, reinvested distributions are typically taxable in the year they are received, even if not taken as cash. - Can I reinvest distributions from any type of investment?

Most stocks, mutual funds, and ETFs offer reinvestment options, but availability may vary by investment and brokerage. - How do reinvested distributions affect my cost basis?

Reinvested distributions increase your cost basis, which can impact capital gains calculations when you eventually sell the investment. - Can I change my reinvestment preferences?

Yes, most brokerages allow you to change your reinvestment preferences at any time, though changes may not apply to imminent distributions. - Do reinvested distributions guarantee better returns?

While reinvestment can potentially enhance returns through compounding, it does not guarantee better performance and still carries investment risks.